Hi, it's Paul here.

Estimated timings - I awoke today feeling uncharacteristically perky (not being a morning person). Therefore I'm hoping to have this report finished before 1pm.

Update at 12:59 - sorry, I got so bogged down in FUL that am running a couple of hours behind schedule. Revised finish time of 3pm - it has to be done by then, as I have to walk into town to get an Xmas present for my nephew, and have a beard trim.

Update at 14:33 - today's report is now finished.

Remit of the SCVRs here

I thought it might be helpful for new subscribers here, if I explain our remit.

Graham and I review typically the 4 or 5 most interesting trading updates & interim/final results statements, announced on the day, from small caps [which we define here as c.£10-400m mkt caps]. Sometimes we stray outside of that size range if we see something interesting (e.g. being an ex-CFO for a ladieswear retailer, I like to look at my 2 favourite retail sector picks, Boohoo (LON:BOO) and Next (LON:NXT) results statements).

We cover about 500 companies in total, excluding these sectors: natural resources, pharmaceutical/biotechs, insurance, anything wildly speculative/blue sky, and anything else we don't like the look of. Also, I don't tend to cover financials but Graham does. I might start covering financials in 2020, to eliminate that anomaly.

Since we cover so many shares, please understand that we're just reviewing the figures & commentary. The idea is that readers might then like to do your own more detailed research on anything that catches your eye. The idea is very much that readers DYOR (Do Your Own Research).

We are NOT share tipping! Hence you will never find buying advice, or buy/sell instructions here. Graham and I are both professional investors, sharing our research & views with you. We disclose if we have a position in a share.

We're independent! We never accept money from companies to give a more positive view on them.

Like all other investors, we make plenty of investing mistakes - missing opportunities, and sometimes buying shares that do really badly (that's been my personal speciality in the last 18 months!).

I think our main achievement here over the last 6 years, has been to steer our readers away from frauds & semi-frauds. Notable successes have included these;

- A blanket negative view on all Chinese AIM floats (sure enough, they nearly all turned out to be frauds).

- Nearly 30 extremely bearish articles on Globo over several years (which turned out to be a fraud).

- Similarly with Quindell - although Tom Winnifrith deserves a hat tip for his detailed investigative work on it.

- Plus numerous other junk stocks that we've been bearish on here, which turned out to be disasters (the most recent one, that we've been extremely bearish on for 5 years, being Koovs, which went bust recently).

There have been plenty of successes here too (readers have collectively made multiple millions from BOO), but I'm most proud of saving people money by pointing out dodgy companies with dodgy accounts.

Also, we focus on trying to explain accounting concepts to non-accountants, hence enabling readers to more confidently do your own research.

Last but not least, we have a super community here, where together we help answer each others' queries, and put our heads together to share information & views, in a friendly environment.

Fulham Shore (LON:FUL)

Share price: 11.25p (price unchanged at 08:40)

No. shares: 573.6m

Market cap: £64.5m

(for the avoidance of doubt, I do not currently have any position in this share)

The Directors of The Fulham Shore PLC ("Fulham Shore" or the "Group") are pleased to announce unaudited interim results for the six months ended 29 September 2019.

This is a chain of casual dining restaurants, concentrated mainly in London, with 2 formats;

Franco Manca - 51 restaurants offering everyday good value (i.e. no discounting) sourdough pizzas. Limited number of menu options, non-branded drinks (e.g. excellent "No Logo" bottled beer for £3.50), and focus on ingredients with good or interesting provenance.

The Real Greek - 18 restaurants - nicely presented Greek-style food.

I've mystery shopped both brands, and they're very good - worth trying if you haven't done so yet.

Sector - the restaurant sector has well-known problems at the moment, so this share has to be viewed in this context;

Over-capacity - far too many new restaurant sites were created in the last 10-15 years - I recall hearing a figure of +40% sector capacity increase since 2006. Whilst many restaurants are going bust now, sector experts Langton Capital (subscribe for their outstanding, free, daily email here - highly recommended) made a very important point recently, which hadn't occurred to me. Namely that excess capacity is not disappearing fast. What's happening instead, is that when a restaurant operator goes bust, the landlord is likely to simply re-let the restaurant to another, probably inferior operator, at a lower rent possibly. Who may operate the site for say a year, and then they too go bust. The fixtures & fittings possibly cost £0.5 -1.0m originally, most of which is left behind by the tenant that goes bust, as it has little resale value secondhand. Therefore, the landlord can offer all the existing F&F to a new tenant as a major inducement. In other words, as Langton points out, a restaurant site that goes bust is most likely to re-open as another restaurant. Thus capacity is likely to take a long time to finally leave this sector.

Discounting - struggling competitors are resorting to almost permanent discounting, in order to just get bums on seats. I prefer FUL's every day good value pricing model, but if a competitor nearby is offering permanent 50% off (e.g. Wildwood operated by Tasty (LON:TAST) does that) then it's bound to take some business away from FUL.

Staffing costs - again, a well-known factor that is hurting labour-intensive businesses, particularly in the retailing & hospitality sectors. Minimum wage is rising above inflation, plus pension contributions, and the apprenticeship levy are putting additional pressure on this sector.

Business rates - seems to have particularly hurt London properties, which is mainly where Fulham Shore operates.

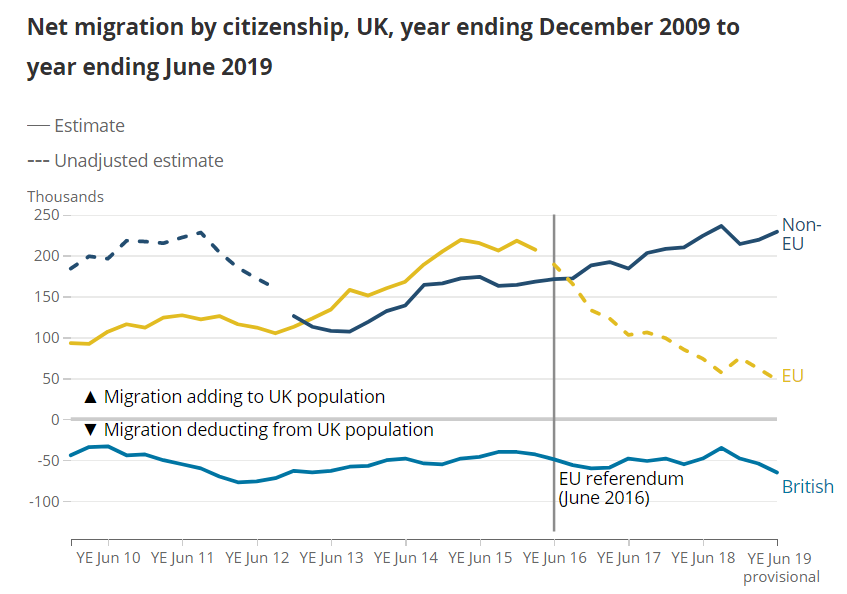

EU migration - I hate to raise this topic, as it risks lighting the blue touch paper on an unwanted political argument here - please resist the temptation to post a scathing remainy reply (that means you, purpleski! ;-) ) please remember we're only talking about markets & economics here, not politics - you have Twitter for that!

Anyway, Franco Manca in particular employs a lot of Italian staff. You can tell that by how noisy it is, mainly staff shouting at each other in good-natured banter. I sometimes feel that I've crashed a rather boisterous Italian house party, when having a pizza in Franco Manca. Therefore, investors in FUL should be asking the question about whether it can retain those staff?

To my mind, the bottom line is that it doesn't particularly matter if the staff are Italian, Polish, Romanian, Croatian, or even British. Does it really matter? Not to me, and probably most people, I imagine. Although it does give a bit more authenticity to the whole Italian experience if the staff are Italian. So maybe it does matter, actually, thinking about it!

Anyway, when I mystery shop, I always ask the staff about the business. Franco Manca staff (and I accept the sample size is small) that I've met look & sound happy, and always answer positively when I ask them about how they are treated, and if they like working at FM. Are they all rushing off back home to Italy, since the referendum, etc? In a word, no.

Anecdotal evidence is often rubbish. So what do the statistics say? Net immigration from the EU is still positive, although numbers have fallen considerably. So talk of a mass exodus is, so far, simply untrue. More people are coming in from the EU, than are leaving.

[Source: ONS]

We don't yet know how things might change in the future. Everyone seems to be inventing their own scenario of the outcome they envisage might happen, and then labelling it as a "fact". Hint: adding "(fact)" after stating your opinion, does not necessarily make it a fact! In fact (haha!) seeing as it's a prediction of what might happen in future, then it definitely is not a fact.

Probably the key statistics to look at now, are the number of EU citizens applying for settled, or pre-settled status in the UK. I've heard stories of EU citizens who have lived in the UK for decades, being mightily angry and upset at having to apply to stay here. And I very much sympathise with them. If I reverse things, and imagine myself in that situation, then I would feel angry and upset too.

Getting back to facts though, doing a bit of googling reveals that the application process for EU citizens to apply to remain in the UK, looks simple, online, and free.

This article says that 2 million EU citizens have already applied to remain in the UK after Brexit, despite the deadline being some time away;

The deadline for applying will be 30 June 2021, or 31 December 2020 if the UK leaves the EU without a deal.

[source: gov.uk website]

Therefore, it looks to me as if a mass exodus of EU workers, from the UK, looks unlikely. A smaller scale exodus is still possible though, which might push up wages further for companies like FUL. So for investors, this is an area of possible concern, which needs monitoring, in my view.

Just to reiterate, whatever your political views, please don't post them here. I'm only interested in the economics of how this issue might affect companies which employ a lot of EU labour. Grazie mille!

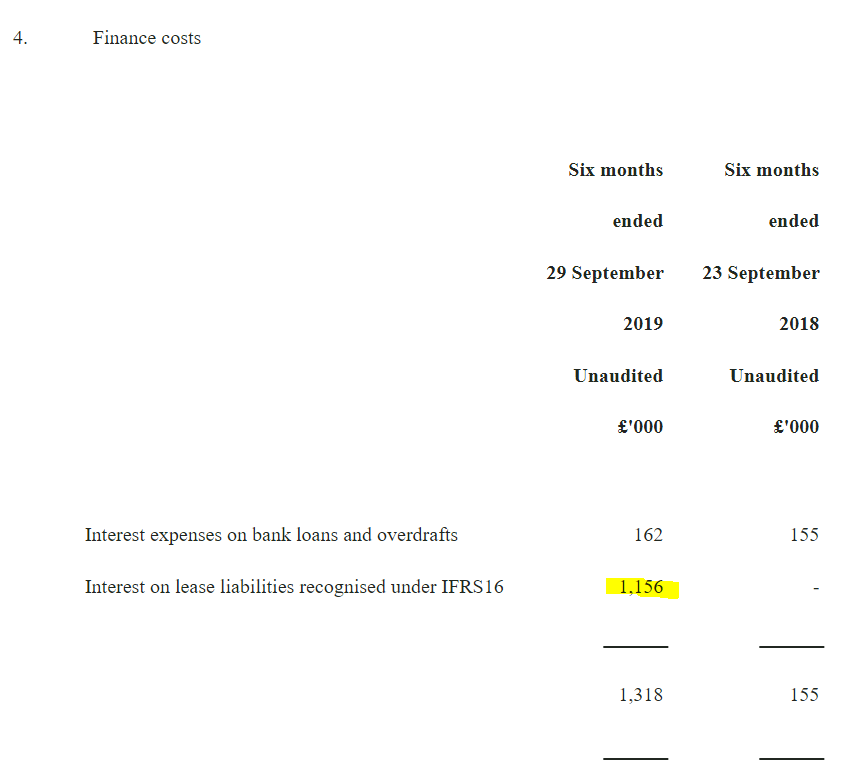

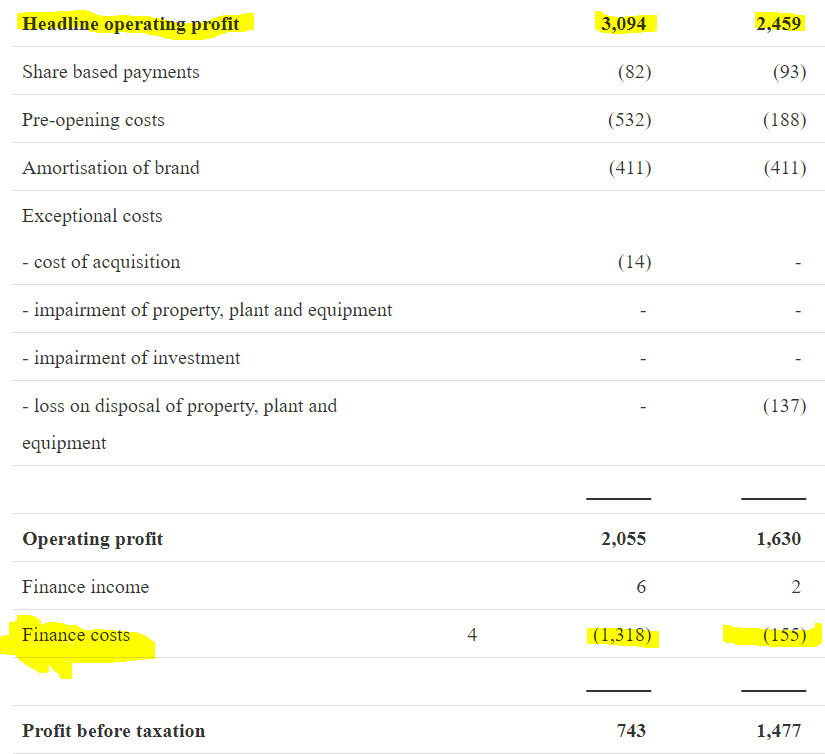

Interim results - looking at the numbers, they are really messed up by IFRS 16, because the prior year comparatives have not been restated, so are not really comparable. This particularly applies to EBITDA.

At first glance, it looks as if profit has gone up on H1 LY. However, note 4 shows that the IFRS 16 nonsense has created a large distortion to finance charges on the P&L, for an invented, unreal finance cost;

The other complication, in addition to IFRS 16, it that the company has its own definition of adjusted profit, which it calls headline operating profit. This adjusts out pre-opening costs for new sites, brand amortisation, etc. But it's stated before the newly increased (due to IFRS 16) finance charges. Therefore I don't think the year-on-year comparison at that level is meaningful.

If I'm reading the numbers correctly, then I would want to take the £3,094k and £2,304k headline operating profit numbers above at the top of the table, and deduct finance charges. Doing that arrives at my adjusted profit before tax of £1,776k vs £2,304k LY H1 - i.e. on a comparable basis, it looks like profit has actually fallen 23%, not risen, as the company claims in the narrative. What do readers think? Does my logic make sense to you?

Like-for-like sales - an investor friend pointed out to me recently that FUL doesn't disclose its LFL sales. This is a key number, which investors need to know. As Graham pointed out recently, retail/hospitality companies generally need to be increasing LFL sales by say 2-3% p.a., to offset rising costs.

Note that its smaller chain, The Real Greek struggled a bit in the period;

As previously reported, trading at The Real Greek proved difficult during summer 2019. A number of terraces were not consistently useable during this period and this softer trading was compounded by particularly strong revenue comparatives against the glorious summer of 2018. The Real Greek opened one new restaurant in the Strand, London at the end of the Half Year, which is trading well. Since the Summer, we have seen improving trends across our Real Greek restaurants.

Property leases - if leases expire, then some tenants will be getting the benefit from re-negotiating falling rents, but that depends on the timing of lease expiry, which are often not disclosed. As a theoretical example, a company might have an average lease expiry of say 3 years, which sounds fairly harmless. But that could hide a reality that a company has say 3 or 4 massively loss-making sites with leases that don't expire for 10 years, but the more numerous sites trading profitably or at breakeven might have leases that expire on average in 2 years (and in some cases might even see rent increases). Therefore current disclosures leave investors largely in the dark as to whether lease liabilities are a problem, or not. I'm very unhappy about the new IFRS 16 system, as you might have gathered.

Even if you had access to data of what all the sites rents are (which e.g. a chartered surveyor would have access to), you still don't know whether a site is trading profitably or not. Hence the rent data per site, on its own, is pretty useless.

Balance sheet - is also groaning with IFRS 16 entries, which don't help me at all. So I just cross them out.

NAV is £40.7m. Eliminating intangible assets, arrives at NTAV of £15.3m.

Net debt of £8.8m looks OK to me, given the cash generative nature of the business.

Overall, I would describe the balance sheet as just about OK, but not strong by my standards.

The roll-out (i.e. opening new sites) has resumed, after a pause last year. Hence capex is rising again, considerably. This must be a great time to be opening new sites, as I imagine landlords must be offering a quality operator like this stunningly good deals on new sites.

Cashflow statement - this also seems to have been messed up by IFRS 16 (grrrrr, I need a lie down in a darkened room, with a wet flannel over my head, after spending all morning on this). Rather than wasting more time trying to untangle that, it's easier to just draw the broadbrush conclusion that net cash is about the same as it was a year earlier, after absorbing the cost of opening a decent number of new sites. Therefore the key takeaway is that this is a self-funding roll-out. Hence patient shareholders are likely to own shares in a much bigger business, if they sit back and wait 5 years. Hence the shares might look expensive now, but when you factor in the roll-out, they may not be expensive after all. Possibly.

Outlook comments - the key bit says this;

Current trading remains satisfactory but the sector's outlook is not helped by poor consumer confidence.

I'll be keeping a close eye on consumer confidence figures, as I think the recent, decisive election outcome, and promises of considerable increases in Govt spending, could turn the tide somewhat, although I've no idea how much.

It removes one of the two major uncertainties anyway.

My opinion - I had no intention of spending so long on this!

Bull case - this business has 2 successful restaurant formats, which generate decent cashflows to fund expansion without diluting shareholders. So it's a self-funding roll-out, which tend to attract premium valuations as investors price-in future growth.

Bear case - it looks like underlying profit is going down, so the new sites might be obscuring profit declines at older sites maybe? The company doesn't give us any information about LFL sales, so we don't know. Arguably if LFL sales were strong, then the company would tell us! Or, the new sites might take time to reach strong profitability, therefore the new sites could be diluting good performance from older, maturing sites? We don't have enough information on this.

Overall, I like the business, and think it has potential for a national roll out across the UK. Therefore, long term, this could be maybe 5-10 times its current size, perhaps? That is possible.

Personally, I held a small long position here for some time, but got rid of it earlier this year, on a general portfolio tidy up (given political uncertainty, I decided to have a cull of my small positions that wouldn't move the dial if they went up a lot).

At some point in the next few years, I might go back into this share.

Its current market cap is just under £1m per restaurant. That strikes me as a bit over-valued for the existing sites, but it's pricing in the self-funding roll-out. Therefore, in that context, I'd say the share price looks about right, to me, based on current information.

K3 Capital (LON:K3C)

Share price: 212p (up 21% today, at 12:13)

No. shares: 42.2m

Market cap: £89.5m

K3 Capital Group plc, a leading business and company sales specialist in the UK, is pleased to announce a trading update ahead of its interim results for the six-month period ended 30 November 2019 (the "Period") (the "Interim Results"), which will be announced on 4 February 2020.

I wouldn't normally look at this type of company, but the 21% share price rise has intrigued me.

The other thing is that conventional brokers are saying that business (for IPOs, fundraisings, and company sales) is tough. Yet this company (which seems to specialise in company sales) is doing well. It looks a more specialised business model than traditional brokers - and things are going well - so it sounds like K3 could be on to something.

The key bit of today's announcement says;

... the Company is pleased with the growth that has been achieved during H1 and can confirm that it remains confident in achieving market expectations.

Which I presume means full year market expectations. What else would it mean, yes of course that's what it means.

John Rigby, CEO of K3, commented:

"We are pleased to report another very solid H1 performance with more transactions completed during the first half than ever before, a particularly encouraging performance in the context of the difficult market backdrop of political and economic uncertainty.

This growth is further backed up by a record number of deals in the pipeline that underpins our confidence of continued growth in the second half of FY20 and beyond."

It's probably the strong outlook comments, more than being in line with expectations, that triggered the excitement in the share price today.

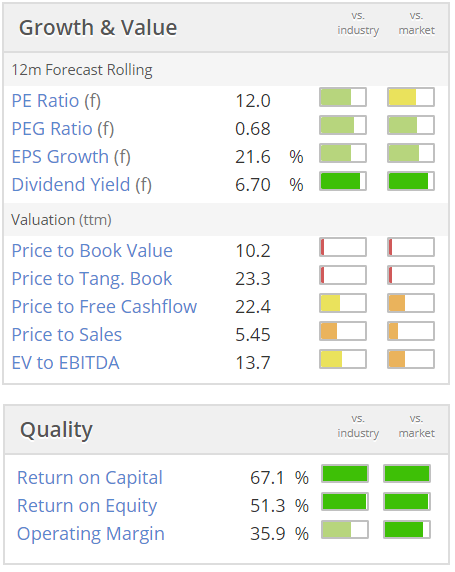

Plus a lowly valuation - here are the Stockopedia stats from last night (so before today's big rise in share price, which will obviously change the valuation stats considerably);

Dividend yield - looks excellent. Although that may not necessarily be sustainable, if the deal pipeline were to dry up in future. I'm having a quick look through its results for FY 05/2019, and note that PBT fell by 33%, and the dividend was also reduced by 33%. So it looks like the company has a policy to pay out a fixed percentage of profits, which is likely to make divis volatile.

Shareholdings - management seem to own a big chunk of the equity, which is good for a business that relies on "rainmakers" to get deals done. Also note the quality institutions on board, so management clearly are credible in the City.

My opinion - this is my first ever, and rather brief, look at this company. It floated in April 2017, on AIM. I think it looks potentially interesting, and would like to find out more about it.

It seems to have carved out a niche in broking & managing the sale of smallish businesses. So if you're thinking about selling your business, this looks like the company to approach.

Fees seem to be lumpy, as dependent on deal volume & size. It seems to be doing well, when competitors are struggling - so they're either better than the competition, or got lucky with some big deals. It looks like revenues & hence profits come from one-off deals, rather than recurring revenue, which is a potential downside.

It's a capital light business model, being a people business. Hence cash generated is paid out in divis. Management have decent shareholdings, so hopefully should stick around.

Overall, I'll add this one to my watch list, as potentially interesting, and will report on it again in future. If time permits, I'll have a look through its AIM Admission Document, which is here. The purpose of the float on AIM was to allow the founder, Tony Ford & wife, to sell some of their stake, for health reasons. It's unusual to see that specifically mentioned in a float.

It floated at 95p, then spiked up to c.400p within a year of joining AIM. So the selling Directors must have been kicking themselves at selling too cheaply. It's since fallen back, but looks to be regaining its poise after today's bullish update.

Here's the chart since it floated at 95p - very volatile, but an undeniably successful float, being over double the IPO price now;

Van Elle Holdings (LON:VANL)

Share price: 41.5p (up 5% today, at 13:06)

No. shares: 80.0m

Market cap: £33.2m

Van Elle, the UK's largest ground engineering contractor, is issuing the following trading update ahead of the announcement of its results for the six months to 31 October 2019 ("H12020").

(sorry, I couldn't get rid of the bolding in the original)

A poor H1 performance, well down on H1 LY, as expected;

... As a result, the Group expects, subject to completion of the interim audit review, to report first half revenues of circa £48m (H12019; £42.9m) and adjusted PBT of circa £1.0m (H12019; £2.8m), reflecting both work mix and the adverse impact of the quiet first quarter.

I say as expected, but given that the share price is up 5%, it must be not quite as bad as expected.

Outlook comments sound reassuring;

Notwithstanding continued short term uncertainty in several of the Group's markets, including the commercial building sector and subdued activity levels in year one of Network Rail's Control Period 6, the Board anticipates modest market improvement during the second half and believes the diversity of the Group's operations and continued delivery of its transition plan initiatives will allow it to maintain the current momentum.

Consequently, the Board believes that the Group is on-track to deliver a result for the current year within the range of market expectations.

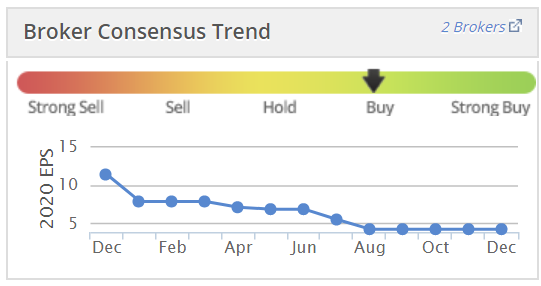

Bear in mind that earnings expectations have more than halved in the last year;

That puts this share on a PER of about 10 for the current year. Why would you want to pay more, for a contracting business, that has disappointed considerably since its float in Oct 2016?

This reminds me of a conversation I had recently, with a friend who does deals for a City broker, including floating things on AIM. I was good-naturedly haranguing him on various matters. The conversation went something like this: "Me, can I give you my wishlist for 2020? No.1 on the list, is will you please stop floating crap companies! Please just float some decent companies!". His reply gave me pause for thought: "If you own a decent private company, why would you want to float it?".

He's got a point, hasn't he? Why take on all the hassle of a stock market listing? Good reasons might include major shareholders/founders wanting to retire, and cash out. Or a private equity owner just wanting an exit, to recycle funds. Or funds for expansion. So there are good reasons to float, but I think we need to look more sceptically, and ask tougher questions about why companies are listing their shares, and maybe not just meekly accept generalised answers?

My opinion - I'm not interested in owning shares in any contracting companies.

Having said that, the surge in Govt infrastructure spending that is now expected (see today's papers) could mean a decent macro backdrop for this sector. So although I wouldn't want to own this share, or others like it, long-term, there could possibly be a decent shorter-term, speculative trade to be had, maybe?

Studio Retail (LON:STU) (formerly Findel)

I've had a quick look through these interim figures, and decided not to dig any deeper, as there are too many complicating factors - e.g. disposal post period end, lots of debt, pension deficit, IFRS 16, PPI claims. So it would take hours to unpick it all, and I'm too tired. Plus this share has never really interested me.

Although just to flag up that its current trading comments today sound good, so it might be worth readers taking a closer look at it, possibly?

We saw more customers waiting for Black Friday and Christmas than in previous years but when they arrived, post period-end they did so in record numbers. Record levels of online sessions in a single day (781k on Black Friday), daily dispatches exceeding 100k parcels for the first time ever, and product sales in the last 11 weeks up 10% on prior year underlines Studio's digital growth trajectory.

Time's up for today, so I'll leave it there.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.