Good morning, it's Paul here.

Just to clarify, for any new subscribers who may not be aware, this is was a placeholder article, which is posted early every weekday, so that readers can add your comments from 7am on RNSs. Then I update the article section by section throughout the morning. Official finish time is 1pm, when the SCVR email goes out, by which time the bulk of the report is usually done. If I have spare time, I then add more sections on some days in the afternoons, which is bonus content that I'm doing in my own time.

Many thanks for the smashing positive feedback yesterday, I really appreciate it!

Today's report will focus initially on Revolution Bars (LON:RBG) because this is one of my big 4 personal holdings. Once I've got my head around that, then I'll look at other companies reporting on trading.

Estimated time of completion today is 2 pm

Update at 14:05 - today's report is now finished.

Revolution Bars (LON:RBG)

Share price: 88.8p (up c. 7% today, at 09:25)

No. shares: 50.0m

Market cap: £44.4m

(at the time of writing, I hold a long position in this share)

Revolution Bars Group plc ("the Group"), the leading operator of premium bars trading across the UK under the Revolution and Revolucion de Cuba brands, is today providing a trading update for the 26 weeks ended 28 December 2019 ("H1 FY20") and also for the important Christmas trading period through to and including New Year's Eve.

Background - this is a turnaround situation under new-ish (18 months), operationally focused management. The share price lost two thirds of its value, after the aborted 203p cash takeover bid from Stonegate, as investors clearly didn't believe the turnaround was likely to work.

What went wrong?

- Old management too focused on expansion roll-out of new sites, took their eyes off the ball on existing sites

- Brain drain of key site managers & area managers - led to demotivated staff, high staff turnover, and hence deteriorating performance

- Distraction of protracted bid process from Stonegate at 203p per share, and interference from nightclubs operator Deltic

- Older sites became tatty, as refurbishment cycle delayed

- Competition intensified

- Cost headwinds

Action taken

- Expansion halted

- Dividends stopped for the time being to focus on debt reduction

- Numerous "work streams" initiated to improve operational performance

- Refurbishment programme started, to bring old sites back up to scratch

Quoted share prices - the market is currently showing the prices of RBG shares as - Bid: 85.2p, Offer: 91.0p, an apparently wide spread. However, the published prices on small caps are not the real prices. The whole system is appalling actually, and something needs to be done about this.

The real prices are currently;

Bid: 87.29p (size: 35k shares, with a 40k bid just behind at 87.18p)

Offer: 90.3p (size: 6k shares. next offer price is 5k shares at 90.42p)

As you can see, the share is well bid, and the spread is not 5.8p, it's actually 3.01p

How long can the LSE allow this rigged system to continue, where the genuine prices (on RSPs) are hidden from view? It wastes so much time having to find out the real prices by enquiring with a broker, or putting a dummy trade into an online dealing platform. We need proper price transparency, with the quoted prices being the real prices on RSPs. Everyone should have free access to all the pricing information, in real time. That would level the playing field between professionals and everyone else.

Generally speaking, when a share is well bid, and thinly offered (as in this case), then it's usually going higher. Although remember that there can also be hidden orders working in the background - e.g. a market maker might be bidding for stock because he's working a big buy order for a broker. If for example, I wanted to buy 100k shares in RBG, I would ring my broker, and say something like "buy 100k RBG, at 88p or better, good for the day". He would then ring a market maker, and give them the order. The market maker then accumulates stock on the bid at (say) 87.5p, and at the end of the day passes that stock over to my broker, who rings me up and says typically, "You've been part-filled, you buy 35k shares at 88p. Shall I continue the order tomorrow?"

Orders that are working in the background like that don't get printed until the end of the day, or in some cases may not be printed for some time later, until the order has completed. There are rules on when trades have to be reported.

This is why sometimes a share price will rise or fall apparently out of kilter with the printed trades - that's because there's a large buyer or seller in the background.

Today's update - this is a good (but not blow-out) announcement . I'm pleased with it, because I think it confirms that the turnaround is working, and should gather further momentum in 2020, driven by refurbs of under-performing sites.

Xmas/NYE trading - peak trading, which RBG generally does well in (7th consecutive year of LFL increases). Sure enough, we have an excellent performance, with LFL sales up +4.0%

H1 trading - covering the 26 weeks to 28 Dec 2019.

Positive LFLs, with an improving trend, but not as good as Xmas;

H1 LY (Jul-Dec 2018): LFL -4.0%

H2 LY (Jan-Jun 2019): LFL -2.9%

H1 TY (Jul-Dec 2019): LFL +1.2%

Within the +1.2% for H1 TY there is an improving trend, as follows;

Q1 TY (Jul-Sep 2019): LFL +0.7%

Q2 TY (Oct-Dec 2019): not disclosed

Q1+Q2 TY (Jul-Dec 2019): LFL +1.2%

Looking at it simplistically, by assuming that Q1 and Q2 sales are roughly the same, then this implies Q2 LFL growth of +1.7%

Future LFL sales should continue improving, because of;

- Operational improvements across many workstreams

- Refurbs (the main driver of the turnaround) - 15 planned for this year

- Soft comparatives

- 3 under-performing sites closed in H1

As you can see, hopes for further improved performance are not just on a wing & a prayer, there are specific actions driving improved performance.

Profitability - measured at the adjusted EBITDA level, which I'm fine with, as it's a good proxy for cash generation. This is absolutely key, and again is reassuring;

The Board expects the Group's Interim results to be published on 26 February 2020 with underlying earnings, as measured by adjusted EBITDA** on a pre-IFRS16 basis, to have improved in line with market expectations.

** Adjusted EBITDA excludes exceptional items, bar opening costs and share-based payments.

It's a pity the company didn't add another footnote specifying what the market expectations are. However, the house broker has issued a one-pager today, available on Research Tree, which is well worth taking a look at.

Forecast is for £12.3m adj EBITDA in FY 06/2020, which is a lot of cashflow for a company with a market cap of just £44m. This is really important, as it confirms to me that the company is generating plenty of cashflow to both self-fund its site refurbs (about £200k apiece), and pay down debt. My understanding is that there's no corp tax to pay this year either. Mgt previously indicated that net debt should reduce by c.£5-6m this year, although I think the property deal (see below) might roughly halve that reduction.

Adj EPS is forecast to rise from 3.4p LY to 6.6p TY - a PER of 13.5

Property deal - this is very interesting;

The Board is also pleased to announce that since the end of the interim reporting period, it has exchanged contracts with real estate investment company Aprirose, landlord of nine of the Group's properties, to surrender five leases of loss-making sites and re-gear a further four leases with a small net rent reduction but with a 25 year term.

The transaction is expected to complete in March on payment by the Group of a premium equivalent to less than three times the annual trading losses of the five lease surrenders.

The net effect of these transactions is to improve the Group's on-going full year operational cash flows by c£1.2m per annum.

The background to this, is that in 2007 RBG did a sale & leaseback of either 9 or 11 freehold sites (my notes are confused on this), in a transaction with a landlord called Aprirose. It looks to have been a bum deal, as some of the 25 year leases (so 12 years left to run) turned out to be millstones, with heavy trading losses due to uneconomically high rents. As I've said before, re IFRS 16, leases are only a liability in the real world if trading from that site is loss-making.

The problem with this, is that landlords really don't care if the tenant is trading at a loss, providing the tenant is solvent & can keep paying the (inflated) rent. RBG even closed 2 of these sites, since it was cheaper to pay the rent on an empty site, than trade at an even bigger loss.

I discussed this issue with management a while ago, in some detail, and the upshot is that it was a roughly £1m p.a. drain on cashflow. RBG had made provisions on the balance sheet for this issue.

Today's news is really positive - the issue has been fixed. The landlord would require a substantial payment from RBG to allow it to surrender uneconomic leases. This seems to have been agreed at a payment due of about £3.5m, combined with agreeing new 25 year leases on the 4 other sites. This will enable the landlord to revalue its own freeholds upwards, on the 4 sites that RBG is keeping. RBG must be trading profitably from those 4 sites, or they wouldn't have signed new 25 year leases on them. There is some risk here though, if those 4 sites subsequently become loss-making, so ideally I'd like a bit more colour on this.

The upshot is that, after paying the c.£3.5m premium to surrender the 5 loss-making sites' leases, then RBG's cashflow will improve by £1.2m p.a. - NB this is not in the existing forecasts, so it's great news.

Debt - I like this bit;

Whilst external cost pressures persist, we will continue to manage cautiously, using excess cash to reduce indebtedness below one times EBTIDA before we will consider further expansion opportunities"

That's very prudent. Bars are highly operationally geared, so frequently get into (sometimes terminal) trouble in recessions, when sales can drop sharply. Therefore it's much safer to have a low level of debt, or net cash.

My opinion - so far so good! For me this share was a success (cash bid at 203p) that went badly wrong, because like a fool I didn't sell at the time. I met new management several times, and decided to back their logical & thorough turnaround plan.

I think the share way overshot on the downside, and with the turnaround clearly now starting to work, then there should be decent upside here, as more old, tatty sites are refurbished.

Will it get back to 203p? Probably not, but by my calculations & estimates, I see recovery to c.120-150p being possible. The likelihood of recession in the UK seems to have dramatically receded in recent weeks, which is great news for bar operators. Plus the c.6% rise in minimum wage in April will be both a cost headwind for RBG, but will also put a lot more money in the pockets of its customers. It's likely to thin out the competition too. Therefore, I think we could see LFL sales accelerate to maybe 2-5% in 2020, which would be great if it happens. Fingers crossed!

I don't want to hold this share forever, but my reason for continuing to hold is that I think it's the wrong price - too cheap. There could be another takeover bid at any time also. So a nice each-way bet.

Here's the 3-year chart, showing the profit warning in 2017, then the takeover bid (which fell through). It's been agony holding all the way down, but I never imagined it would go down to anything like this low. Anyway, things are starting to look up now.

EDIT at 11:48 - something else that just occurred to me, this is why RBG would make an attractive target for a takeover bid;

- An acquirer could increase profits by removing duplicated costs, e.g. bolting it onto their existing systems (accounts, admin, area managers, etc)

- Opportunity to add a few million to profits through bulk buying power of a much larger drinks/pubs group. It's sometimes said that RBG is sub-scale

- Legacy property problems fixed, which might have put off acquirers

- Revolution bars are mainly late night bars, and make their profits on Fri & Sat nights. Hence would make a nice bolt-on acquisition for a more traditional pub operator, because it's targeting a different section of the market

This is probably why Stonegate were prepared to pay about 7x EBITDA a couple of years ago. With EBITDA currently £12.3m, 7 times is £86.1m, or 172p per share ballpark takeover price? i.e. a bidder would value RBG differently to private investors, hence it's worth more to them than it is to us. End of edit.

Edit at 19:47 - Additional points which have occurred to me since posting the above;

Expansion - once the basics of the business have been sorted out, and debt reduced, then the roll-out of new sites could resume. This presents an opportunity, in that in future this share could re-rate back to being a growth company.

Property deal - some of us baulked at RBG signing new 25 leases (announced today) on 4 of the sites that it is retaining with landlord called Aprirose. It's just dawned on me that RBG already occupies these sites (hence knows them inside out, and what level of rent is affordable), and RBG is already committed to occupying these sites for another 12 years from now, on the existing 25 year leases signed in 2007. Therefore it is actually only committing to another 13 years on these sites, over and above what it was already committed to. And the rents have come down, albeit described as only by a small amount.

End of edit.

QUIZ (LON:QUIZ)

Share price: 16.3p (down c.12% today, at 12:06)

No. shares: 124.2m

Market cap: £20.2m

QUIZ, the omni-channel fashion brand, announces a trading update for the seven-week period from24 November 201917 November 2019 to 4 January 2020 ("the Period").

[dates corrected in a replacement RNS at 17:11]

- Revenues down 9.3% - looks like some sales were pulled from Xmas towards Black Friday (effectively a mid-season sale)

- The only bright spot is own website sales, up 5.9% and a higher proportion at full price, so presumably higher gross margin

- Unprofitable sales through third party websites have been terminated - makes sense, but will depress the sales figures

- Total online sales declined by 14.8%

- Standalone stores (i.e. not concessions in Debenhams & other dept stores) down 7.0%

- Gross margins OK - broadly in line

- Inventories carefully managed, and down on last year

- Net cash of £10.7m at seasonal peak of 4 Jan 2020 - expect this to fall though

- Cost-cutting has "largely offset" impact of lower sales

Overall - broadly in line with Board's expectations.

It's tempting to have a little punt on this, for a recovery, but I can't get away from the perception that this is a pretty rubbish brand, and not aspirational at all.

At £20m market cap, and £10m cash in the bank, it could have some value. The leases are short, so shouldn't pull down the whole company. Danger is that at any sign of a recovery, mgt could take it private, snatching away the upside.

On balance, I'll probably steer clear. It could go either way, I don't know what's the more likely outcome.

Briefer sections now, as time is running short (due to me spending 5 hours on RBG)

Michelmersh Brick Holdings (LON:MBH) - trading update for FY 12/2019 reassures - in line with expectations for profits, and strong cash generation means net debt is better than expected.

The shares have had a great run, like so many other things, so maybe people will want to start banking profits at some point? That's my worry about so many shares right now. I wouldn't want to chase up a price, if it's already risen substantially, and trading is only in line.

Forecast for 2020 shows negligible earnings growth, so there might be an opportunity there for the company to beat expectations?

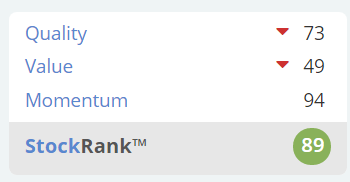

Very good StockRank, so might be worth a closer look? The outlook for UK housebuilders seems a lot brighter, and it makes sense that should read across to brick makers.

Rosslyn Data Technologies (LON:RDT) - I had a quick look at this last night, after a bullish note came through from Equity Development, trumpeting contract wins. However, on looking at the figures, it's clearly going to need refinancing due to a ropey balance sheet. Cashflow looks poor too.

Potentially interesting products, but I'd want to see it on a much firmer footing financially before considering a punt on this.

INCE (LON:INCE)

Share price: 48p (down 46% today, at 12:38)

No. shares: 37.0m

Market cap: £17.8m

The Ince Group plc (AIM: INCE), the international legal and professional services company...

Several readers have asked me to look at this, as the share price has almost halved today. The reason is that it's announced a bombshell fundraising at 45p, which is a huge discount of 50% to last night's close. Although the share price started to plunge on 6 Jan 2020, when it was 115p, falling to 89p in the week before this placing announcement. Funny that. There had been no news from the company since 28 Nov 2019, so this looks like there might possibly have been some illegal insider dealing going on just before the placing, by someone who knew that a deeply discounted placing was imminent.

Management stretched the balance sheet too far, and it looks as if they've been forced into doing a fundraising by the bank. This is complete incompetence, and I see the CFO is leaving. Isn't it weird how so many professional services companies can't manage their own finances?

All this was easily predictable, because it was obvious that the balance sheet was shot to bits. I pointed that out here in the SCVR from 25 July 2019, after the group posted apparently strong results and modest net debt, but there was a massive problem, as I commented in July 2019;

Is there a catch, yes of course! If it looks too good to be true...

The main catch is that there's a ton of deferred consideration, around £29m, plus more since the year end, which is payable in c.3 years.

Balance sheet - is terrible. -£21.7m NTAV even after recent fundraising.

[excerpt from SCVR 25 July 2019]

It seems a bit conceited, quoting my own report, but it's relevant in demonstrating that emergency, discounted fundraisings can be easily avoided by never investing in companies with diabolical balance sheets.

Edit at 20:00 - Several readers have contacted me today to say thanks for steering them away from buying what would have been a disastrous investment. I'm delighted to have helped protect you from a heavy loss. End of edit.

Ten Entertainment (LON:TEG) - full year trading update. Several readers have commented on this, so I'll have a quick look. I wrote a positive piece about it here on 2 Oct 2019, thinking it looked good value at 239p. Like so many other shares, it's soared in recent months, so have we missed the boat at 314p now?

Today's update reads really well, but the bottom line is that it's only in line with expectations, so shouldn't move the share price particularly.

The valuation still looks reasonable, forward PER of 13.4, and a decent yield of 4.38%.

High StockRank of 90.

I think this could have further to run, if markets remain in exuberant mood. I think it's a good idea to buy leisure, rather than retail, because there's evidence we may have reached "peak stuff", and that people want to spend more on experiences rather than more physical possessions.

Time's up for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.