Good morning!

Some announcements I've noticed today:

- Ted Baker (LON:TED)

- Somero Enterprises Inc (LON:SOM)

- Victoria (LON:VCP)

- Air Partner (LON:AIR)

Putting the pen down at 11.20 AM, as I have to go and look at the house I'm about to buy. I didn't cover Sumo (LON:SUMO) or Burberry (LON:BRBY) (in which I have a long position). If I'm not back too late, I may add an extra section or two. Thanks for your understanding!

Ted Baker (LON:TED)

- Share price: 319p (pre-market)

- No. of shares: 44.6 million

- Market cap: £142 million

Update on independent review of inventory

Shocking news, although less shocking for those who run a mile at the first sight of accounting problems:

The Deloitte review has now largely concluded and Ted Baker expects to report that the value of inventory held on the Group's balance sheet at 26th January 2019 was overstated by £58m. This is materially higher than the £20-25m preliminary assessment announced on 2nd December 2019.

We've covered this share on numerous occasions in recent months - see the archives.

Both Paul and I tend to dramatically write down our valuation of companies as soon as accounting problems are revealed.

For me, it's a matter of trust: I can either trust the accounts, or I can't. If I can't trust them, I don't bother going any further. This lesson was learned during the period of Chinese frauds on AIM.

Paul wrote on December 10 in relation to TED:

I suspect that more, possibly deeper, inventories write-downs could be in the pipeline.

On December 2, when the inventory issues were revealed for the first time, I wrote;

Investors need to be wary of:

- Early estimates being too optimistic.

- Other accounting problems being discovered, after a more thorough investigation ("there's never just one cockroach in the kitchen").

- Accounting problems being indicative of wider ethical problems in a company.

- The company being unable to generate the expected level of profitability, when it starts telling the truth about its finances.

It wouldn't surprise me if all of the above four issues apply to TED.

Adding it up

I've gone back to look at the Final Results for FY January 2019, which are the focus of investigation (remember that final results are audited, whereas interim results are unaudited).

Cost of goods sold increased by £27 million during the year, and inventories increased by £24.5 million. On its face, that doesn't sound unreasonable. But inventories as a proportion of COGS had been increasing for some time, and by this stage had increased to an enormous ratio.

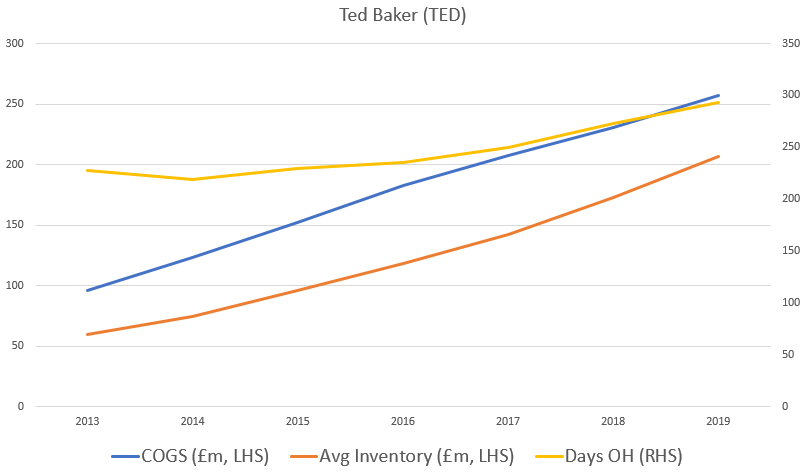

I've quickly put the numbers into Excel to demonstrate this for you, visually. I'm using the "Days of Inventory On Hand" metric, to show how long, on average, it took TED to sell its inventory:

The blue line is COGS - the value of the goods sold by TED each year.

The red line is Average Inventory - how much inventory TED had on its balance sheet.

The yellow line is a sort of ratio between the two, giving us "Days of Inventory On Hand" - how long it took TED to shift a piece of an inventory, on average.

As you can see, since 2013, TED has had rising COGS and rising Average Inventory.

The two numbers have been rising in lockstep. Which again doesn't sound so bad, except that it means the ratio between them approaches 1:1.

Think about that for a moment: if your average inventory balance starts to approach the value of the goods you sell during an entire year, then it must be taking you about a year to sell each item, on average! (Edit: this is particularly dangerous if the goods you sell are seasonal, such as fashion items!)

TED's Days on Hand metric starts off in the low-200s, and climbs steadily to 292 days before the inventory problems are announced to the market.

The quantum of the overstatement is enormous. £58 million is:

- 25% of the inventory balance in January 2019

- 11% of TED's total assets

- 24% of TED's equity

- larger than the company's profit in 2019.

How could this have happened? It could just be an honest mistake. Perhaps a writedown was badly needed, but management didn't want to accept this. Maybe they were hoping that the problem would be resolved some other way.

The sinking ship has been deserted: founder Ray Kelvin is gone, the CEO who was appointed last year to replace him is gone, and the long-standing Chairman is gone. Needless to say, the long-standing CFO is gone, too (he's now at Mulberry (LON:MUL) !)

Where do we go from here?

As reported by Sky News, TED's lending banks hired expensive advisors to review the company's prospects. This will be money well spent: TED had net borrowings of £141 million as of last August.

At the time, TED said that it expected to meet all covenants associated with this debt.

Perhaps this is still the case - I can't tell. But if equity holders are nervous about what's going on, then you can be sure that the banks are nervous. The ultimate withdrawal of borrowings or changing of the terms on which banks lend to TED is what I would bet on. Stricter covenants and/or a smaller facility would require the debt load to be replaced by equity, i.e. an equity fundraise.

I also wouldn't rule out the possibility that the losses in the retail side of business might be too large for the profits in wholesale and licensing to swallow. We've seen this before with French Connection (LON:FCCN).

TED's retail revenues are c. 2/3 of total, and only about a quarter of retail sales are online.

Occasionally, value hunters will be right and they will get a real bargain with a share like this. But more often than not, in my view, this sort of situation turns into a nightmare for shareholders. I therefore would not extend my bargepole to TED.

Somero Enterprises Inc (LON:SOM)

- Share price: 284.3p (+9%)

- No. of shares: 56 million

- Market cap: £160 million

Great news from this US-based maker of concrete levelling equipment.

The Board is pleased to report that with strong, profitable trading in the fourth quarter which was ahead of the Board's previous expectations, revenues for the six-month period ended 31 December 2019 significantly increased from H1 2019 as weather conditions improved in the US.

I recommend the comment in the thread below from davidjhill, in which he discusses a method of valuing Somero on the basis of its earnings throughout the entire economic cycle.

What investors perhaps got blindsided by was the effect of persistent rainy weather, which wrecked the company's US sales back in H1.

Additionally, sales in Europe and the Middle East faltered, due to the timing of contracts and "wider macro pressures".

But thankfully, the sales warning in September turned out to be a false alarm. Full-year sales will be modestly ahead of the top end of the guidance, which was $87 million. For context, sales in 2018 were $94 million and in 2017 were $85.6 million.

Thanks to high gross margins (c. 57%) and operational gearing, "the majority of the additional revenue flows through to profits". So the top end of adjusted EBITDA guidance, $28 million, should also be beaten. And just for good measure, year-end net cash will be $5 million ahead of target, at $23 million.

Regional breakdown

The backlog of work in the US, delayed by rainy weather in H1, led to a huge rebound in H2. This seemed extremely unlikely six months ago, but it turns out that US revenue has increased, year-on-year!

Europe and the Middle East declined due to economic/geo-political uncertainty. I guess there are some real macro problems at play.

China showed "slight growth" - and I maintain the view that the opportunity for Somero in China should be viewed as speculative.

Product development

Despite a history of being conservatively managed, Somero does try to develop new products every year. Its latest product, the SkyScreed 25 (for high-rise buildings) has hit its initial sales target and:

"more importantly... we dramatically advanced our knowledge and experience in this attractive new market segment that positions the Company well for future growth."

I don't believe every company which talks up its prospects like this, but Somero deserves the benefit of the doubt, in my view.

Investment in the Skyscreed sales and support teams will be increased, and this will "temper our overall profitability in FY 2020". But again, I would trust Somero that it is going to direct funds wisely and for the long-term benefit of shareholders.

Outlook

The Board recognizes that while market conditions and activity levels remain generally positive in non-US regions, there are factors impacting each market that slightly temper underlying growth expectations for 2020. With this combined view, the Board expects 2020 will be a profitable year with healthy cash generation, revenues comparable to 2019 and EBITDA broadly in line with 2019 and in line with current market expectations due to the aforementioned planned increase in investment for future growth.

My view

Despite the unchanged profit expectations for FY 2020, I think this is a really positive update for Somero shareholders.

The company has made it clear that it could choose to let profits rip higher in 2020, but that it prefers not to - because it wants to invest in the SkyScreed.

You can see the launch video for the SkyScreed here. It looks like a useful iinvention, and if Somero thinks that it offers an attractive growth opportunity, then I'd be happy to trust it on that.

Somero offers high quality return metrics, plenty of cash generation and a conservative management style. There is a lot to like here. The current valuation, at perhaps 7x EBITDA, also looks very reasonable to me.

Victoria (LON:VCP)

- Share price: 445p (+7.5%)

- No. of shares: 125 million

- Market cap: £558 million

Intention to refinance term loan

This company's debt has been a source of controversy in the past.

It's an international group of flooring businesses (including but certainly not limited to Victoria Carpets).

As noted by Paul following his discussion with the Chairman in August, it consists of about 10 business units which have a great deal of independence. So the whole thing is a a sort of debt-fuelled Berkshire Hathaway, focused only on carpets, underlay, etc!

It is no secret that the company prefers bond financing to bank debt. Today, it announces the fulfilment of the desire to get rid of its bank debt entirely:

Following continued strong operating performance and favourable market conditions, Victoria PLC (LSE: VCP) today announces that it intends to offer €170 million in aggregate principal amount of senior secured notes due 2024 (the "Notes"). Net proceeds will be used to repay the Group's outstanding senior bank debt in full and, as such, the refinancing will not increase net debt (subject to fees and expenses)

It was back in October 2018 when VCP first announced its desire to issue bonds.

That time, it failed to offer the above reassurances (i.e. that trading was good and that the proposed bond issuance was a positive strategic decision, not something it was being forced into). The lack of explanation led to some private investors speculating that all was not well.

This time, with these reassurances now in place, the market is (correctly) responding positively to today's news. Bonds are a more secure form of debt and in general only available to healthier companies, relative to those companies that have to rely on bank overdrafts and credit facilities.

Current trading is good, too:

In the period following H1 FY20 the Group has continued to achieve positive revenue performance alongside an increase in underlying EBITDA margin of more than 200bps versus the comparable period in FY19, each on a like-for-like basis.

My view

I remain intrigued as to whether the grand plans of the Chairman, a former investment banker, will ultimately create a sustainable business.

Including net debt, the company's enterprise value (EV) is c. £920 million. EV/forecast EBIT is therefore in the region of 11x. That sounds fair to me.

Air Partner (LON:AIR)

- Share price: 77.6p (-19%)

- No. of shares: 53.5 million

- Market cap: £41.5 million

Bad news here:

The Group's UK Charter division has been impacted by slower than expected Q4 trading and as a result the Board expects to announce underlying profit before tax of not less than £4.3 million for the 12 months to 31 January 2020, which is lower than previously expected.

I can see an existing forecast for PBT of £5.7 million. So that's a significant miss.

Reasons given:

- a customer suspending an order (indefinitely, it seems)

- a "soft" private jet market

- revenue from another job falling into the subsequent period.

The US charter market is ok, and other divisions at Air Partner are doing ok, too.

UK outlook

While the visibility around Charter orders is always limited, it has been further impacted by the political uncertainty in the UK and headwinds in the global economy. From the UK perspective, the General Election result on 13 December 2019 delivered a clear majority, which we believe over time will help to build business and consumer confidence.

My view

I'm not an expert in this stock or sector, but on the face of it, this doesn't sound like a very serious profit warning. It sounds more like a company whose revenues are a bit lumpy and order-driven, and where macro conditions can have an impact. Hopefully, it can recover before too long.

That's all for now - cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.