Good morning, it's Paul here with Tuesday's SCVR.

Estimated completion time - 1pm

Update at 13:05 - today's report is now finished.

I've got a few minutes to kill before the 7am RNS starts beeping into life.

I'm delighted to see that we're coming to the end of that part of the year when it's still dark at getting up time. The first glimmer of dawn is appearing to the east.

I woke up with a start, very early this morning, wondering why the listed company D4T4 decided to call itself D4T4. Then it dawned on me - D4T4 looks a bit like the word "DATA" in capital letters, but with the letter A replaced with the number 4. The company's slogan of "All about the data" hadn't previously been obvious enough to enlighten me! Which made me realise that I'd been rather thick.

In fact, I've got form on this. When the Ceefax teletext service was introduced in 1974, I just thought it was a modern-sounding name. It was only when Ceefax was finally discontinued, in 2012, that I realised the name was a pun of "see facts". For 38 years I'd been blissfully unaware of this strikingly obvious fact.

Right here we go, the 7am rush hour in RNS-ville has started!

Initial list

This is what has caught my eye on the first scan of the RNS;

Zytronic (LON:ZYT) - Trading update

NMC Health (LON:NMC) - response to 20% share price fall yesterday

XLMedia (LON:XLM) - business & trading update

Other companies I cover in less detail are: Petards, K3 Capital, Alumasc, and Escape Hunt

Zytronic (LON:ZYT)

Share price: 192.5p (down c.4% today, at 09:41)

No. shares: 16.0m

Market cap: £30.8m

(I don't currently hold this share)

Zytronic is a world renowned developer and manufacturer of a unique range of internationally award winning optically transparent interactive touch sensor overlay products for use with electronic displays in industrial, self-service and public access equipment.

Background - as you can see from the chart below, the share price here is already bombed out, following lacklustre results, and cautious outlook comments, which I reported about here on 10 Dec 2019.

The problem seems to be lumpy contracts, and a gap created by some big projects reaching their end of life. There's a promising sales pipeline, but converting that into actual sales seems to be an issue. Lots of small caps experience this problem.

Today's update - is a bit of a mixed bag;

We explained at the time of our Preliminary announcement in December, that based on current trading we were cautious about the short term. The position is unchanged as revenues during December and January have continued to be considerably behind last year, however, on a more positive note the order intake during January has shown a significant increase.

These orders are not likely to benefit the first half results but are an encouraging sign of the prospects for an improvement in the second half that we were expecting and is normally the case.

Here at the SCVR we don't like second-half weightings in trading updates, as it often turns out to be a deferred profit warning. However, in this case;

- Management has a great track record of telling it like it is. Hence Zytronic's updates can be relied upon to be truthful, and with a refreshing lack of PR spin

- The H2 weighting is based on a significant increase in orders. Hence is not just wishful thinking.

There's also the matter of Zytronic's very strong balance sheet, full of cash. At the last count, this was 82p per share, so even if the company has a bad patch of trading, it is solidly supported by plenty of cash. Hence the lower the share price goes, the more attractive it becomes as an asset play. At some point Zytronic might even attract an activist investor, with the agenda of bullying management into giving the cash to shareholders - which makes sense as management clearly has no use for the surplus cash, other than as a comfort blanket, earning no return.

My opinion - the cash pile has meant generous divis continued in the past, when it had difficult trading periods, although it has said divi policy is under review (which usually means it's likely to be cut in future). The company needs to distribute the cash to shareholders through a special divi, in my view, then rebase the regular divis at a lower, sustainable level.

I imagine today's update might cause a small downward move in share price. You never can tell though, because poor liquidity leads to small volumes moving the price a lot. I imagine that existing holders are probably likely to sit tight, given the upbeat comments about order intake, and that soft short term trading had previously been announced, so theoretically should not be price sensitive.

It's possible that broker forecasts might be lowered again today, but I've not seen anything yet.

EDIT at 11:17 - an update has come through to my inbox. No change to broker forecast profit/EPS today, which is good news. Note that the divi is forecast to be halved this year to 11.4p, yielding c.6%, so still excellent, but no final decision has been made as yet. End of edit.

NMC Health (LON:NMC)

Share price: 1058p (up 2.2% at 11:21)

No. shares: 208.7m

Market cap: £2,208.0m

Response to share price movement

Too big for a full section here, but this one is topical, so raises my curiosity.

NMC is a group of hospitals in the Middle East, with a full listing in London.

It's been savaged by short sellers, who've managed to smash its market cap down by two thirds - which is a massive impact, reducing it from £6bn, to £2bn market cap.

NMC tries to reassure today with an in line update;

NMC Health PLC ("NMC" or the "Company") notes the decline in the Company's share price yesterday [Paul: it dropped 20%] and confirms that it knows of no specific reason for the fall.

The independent review being undertaken by Freeh Group International Solutions LLC, announced on 17 January 2020, is proceeding.

The Company's operations continue to perform strongly and the Company expects to report full-year 2019 results in-line with management's expectations.

It's tricky in shorting situations. If a target company responds to the short-seller attacks, then it's a case of damned if you do, damned if you don't. Last year, Burford Capital (LON:BUR) was pole-axed by a shorting attack, and its shares haven't recovered as yet - indeed they've drifted back down to the lows. Management perhaps spent too long rebutting allegations against them, and made a big mistake in threatening to sue the short sellers, which I think back-fired.

These shorting attacks do often seem to shatter confidence in the shares of target companies, doing lasting damage. Graham discussed this issue yesterday, making some interesting points.

It all reinforces my aversion to companies which are mainly operating overseas, listing in the UK. There does seem to be a very clear pattern, that an extremely high proportion of overseas companies that list in the UK go disastrously wrong in some way. So why on earth do people keep buying shares in them?

EDIT at 13:43 - this share price is extremely volatile today. In the first hour today, it was up at around 1130p, but has since plunged, being down heavily at 894p at 13:46. End of edit.

Talking of which, let's stay on this theme of disappointing overseas companies listed in the UK...

XLMedia (LON:XLM)

Share price: 24.0p (down 29% today, at 08:35)

No. shares: 206.8m

Market cap: £49.6m

XLMedia (AIM: XLM) provides the following update further to its announcement of 20 January 2020 relating to the reduction in ranking of a number of the Group's websites. The update addresses further developments, immediate actions being taken and the impact on the Group's future strategy.

Graham covered this problem previously, and rightly highlighted how important Google rankings are for online businesses. Any changes can have a major impact on ad revenues, if traffic is diverted away from websites by Google.

I never liked the flurry of ad tech businesses which floated a few years ago. Some of them were remarkably profitable, but it turned out that profits were not sustainable. Hence owners were taking advantage of the stock market, to cash out, and dumping their shares on punters who didn't realise that the profits would not be sustained.

If it's not clear to me how a company makes its profits, and whether that is sustainable, then I steer clear of the shares.

XLM paid out big divis in the past, so there's no doubt its profits were real. The question mark is whether those profits are sustainable?

Today's update - I've tried to understand this by summarising it;

- Trying to resolve the problem with Google

- 23 important websites have been impacted - mainly online casino-related websites

- XLM is getting rid of some of its low quality sites, to hopefully improve Google's perception of its overall business

- Company intends to "allocate significant resources to improving & expanding" its best websites, and creating new websites. (Increased costs & lower profit margin maybe?)

- Unable to determine full financial impact

- Loss of revenue $3-5m p.a. for lower quality sites (presumably won't have much profit impact, as low margin)

- Some additional costs already budgeted for

- Expect impairment charge (goodwill write-offs)

- Dividends scrapped until further notice (this is devastating news for shareholders, as cashflow & divis where what this share was all about)

- Management wants to create a "much stronger and more transparent platform". Hmmm.

Can you make sense of this bit? I'm struggling;

Management expects this to represent a monthly reduction in Group revenues of between c$1 million and c$2 million (assuming only a minor fall in its repeat revenues) [Paul: no idea what this means!].

In addition, management expects that any lengthy period of demotion could impact the rankings once restored and that it may take a period of time to re-establish the former high rankings.

My opinion - I'm no expert on this company or sector, so take my views with a pinch of salt.

Reading between the lines, it strikes me that the party's over - XLM has clearly been making fantastic profits by working the system, the system has realised, and changed the rules.

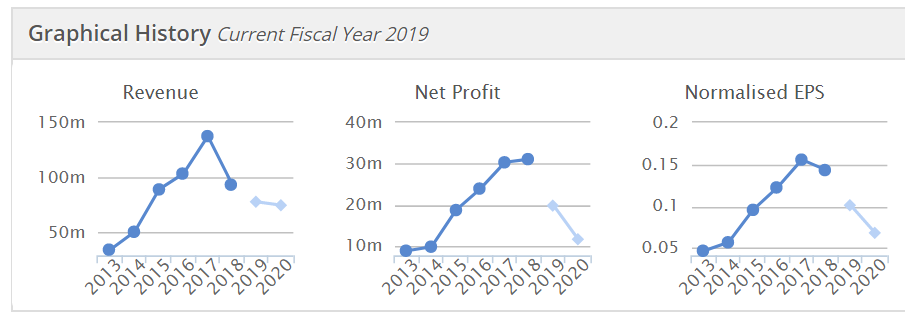

Existing forecasts (prior to today's news) show forecast profit going all the way back down again to 2013-14 levels (see below). What's the chance that forecasts are slashed again? Pretty high I imagine.

Since XLM has suspended divis until further notice, that suggests to me that it might not be generating any meaningful cashflow for the time being. Or it doesn't know, so is playing it safe maybe?

It's another overseas (Israel again) stock where the business model turned out to be flaky. It doesn't interest me at any price, as I cannot work out if there's a sustainable business model here or not.

The last balance sheet showed a decent cash pile, so that should buy the company time to sort out its problems perhaps. Therefore, if you understand the sector & the company, it might be worth spending some time to assess the recovery potential. It doesn't interest me at all though.

The high quality & value scores beguiled the StockRank system I'm afraid. Therefore, I think it's worth applying a manual filter to eliminate overseas small-mid caps, listed in London, from our stock screening, given that so many of them go badly wrong.

I wonder what read-across there might be for other shares? I think it's important to distinguish between online businesses that sell real products & services (less risky), from online businesses that milk the system for ad revenues (more risky).

As always, the most important question for every share, is to ask: Are profits sustainable? Large scale Director selling at IPO, and subsequently, is a very bad sign to look out for. As is an unexpected change in CFO. Put those things together, and there's probably something badly wrong below the surface.

Quick fire sections now, due to time constraints.

Petards (LON:PEG)

Down 22% to 9.75p, so market cap only £5.6m - too small to be bothering with, as the de-listing risk is too high - making risk:reward unattractive. It sells security & surveillance systems.

Two rail projects have gone a bit wrong, and another one is deferred.

Revenues of £15.8m for 2019, below forecast of £17.3m.

Loss-making overall for 2019, but not stated how much.

Outlook comments, and order book of £15m look positive.

Why is a company this small stock market listed? It might help the company win big projects possibly, as being listed is often seen as a prestige thing by customers. Maybe they wouldn't take that view if they knew how much junk there is on AIM!

Petards doesn't pay divis, so owning the shares just looks like dead money.

K3 Capital (LON:K3C)

This one caught my eye as looking potentially interesting due to a positive trading update here on 16 Dec 2019.

It seems to have a disruptive business model earning fees for selling businesses.

Interim results today look good, which is expected, following the strong update announced on 16 Dec 2019.

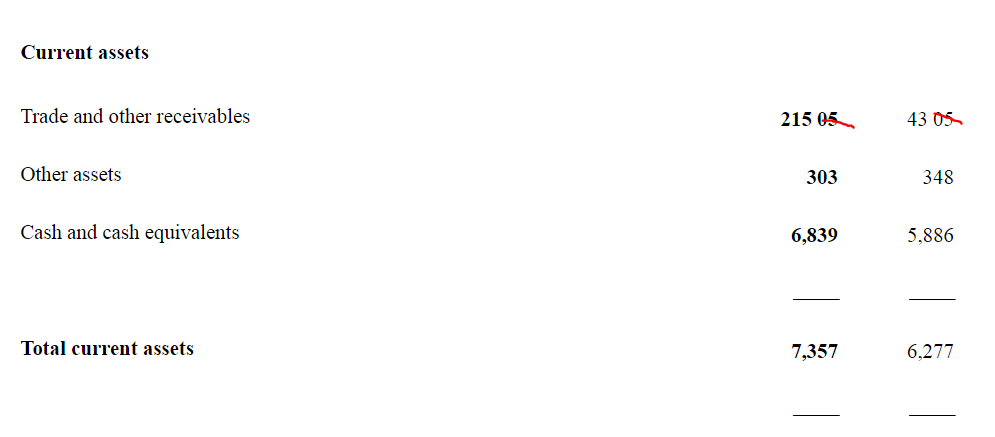

There's a formatting problem on the balance sheet, as you can see here. I've crossed out the superfluous numbers "05". It's easy enough to work out what the correct numbers for Trade and other receivables are, by deducting the Other assets and Cash figures from the subtotal of Total current assets;

Apart from that, the other numbers look fine to me.

Outlook - positive noises about the improved business environment, highest ever WIP pipeline, and December 2019 trading having been strong.

Management says it is confident of meeting full year market expectations. Possibility of a beat here, I wonder?

My opinion - looks an interesting share, and worthy of a closer look.

Alumasc (LON:ALU)

H1 results (6 months to 31 Dec 2019) are out today.

H1 underlying profit is flat vs H1 LY at £2.3m.

That's been achieved despite revenues being down 7% - due to improved gross margin, and cost control.

This share is cheap because there's a big pension deficit. There is some good news there, because deficit recovery payments have fallen from a massive £3.2m pa to a still large (relative to profits) £2.3m.

Outlook - good order book, and makes other positive noises.

My opinion - potentially interesting, given that it operates in a fashionable area of recyclable/recycled products, for managing water & energy consumption.

Make sure you properly factor in the pension deficit, when valuing this, as the PER is artificially low due to that point.

Tesla (NSQ:TSLA)

The mother of all short squeezes is still underway here. This electric car maker seemed to turn a corner with its latest trading update. The share price rose about 20% yesterday, and pre-opening today is indicated at $852 per share - giving it a market cap of wait for it, $153bn!

To put that into perspective, Tesla is now valued at almost the same as (98% of) the market caps of Ford, General Motors, Fiat Chrysler, and BMW put together! Complete lunacy!

Tesla shares are more a cult than an investment and so far the cult leader, Elon Musk, is winning! It's not going to end well though, is it? Fascinating to watch from the sidelines though.

Escape Hunt (LON:ESC)

I imagine its the shareholders who are likely to be hunting for the escape route. This share has now lost about 90% of its value since floating in 2016.

Today's update sounds upbeat, and flags strong LFL sales in Dec 2019. However, it's light on profitability numbers, which is what I need to value the shares.

The section headed "Full year numbers" doesn't have any numbers in it, presumably the irony was unintentional?

Whilst applications both for R&D credits and a Scottish Enterprise grant have been lodged and are progressing, no income from these potential claims is being accrued in the accounts. Management had originally anticipated recognising a contribution from these sources in 2019.

Taking the absence of such credits into account, Escape Hunt expects that the underlying Group EBITDA for FY19 will be modestly ahead of management's expectations.

We're not told what those expectations are, and I cannot find any broker research.

The words "cash" and "debt" do not appear at all in the announcement.

My opinion - overall, this trading update is completely useless, in not giving me any of the information I need. We'll have to wait until the full year numbers are published. For now, I wouldn't go near it, given that it's a tiny company which is proving coy at providing numbers to the market - which usually means the figures are not good.

DX (Group) (LON:DX.)

Issues an in line update.

I'm delighted to see that there's a footnote giving a link to finncap's research portal, where investors can read today's morning note. This note also covers Alumasc, and K3 Capital, as well as DX.

It's incredibly helpful making house broker research notes available to investors, so hats off to finncap for showing the way forward on this.

I'm not interested in buying shares in a low margin freight business, so this one doesn't interest me.

That's it for today, thanks for reading & commenting.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.