Good morning!

Graham here with the placeholder for today's SCVR.

I'm planning to make a few macro observations before commenting on the latest company news.

Contrary to popular belief, I didn't quit finance to go into gardening - I'll have to use my Twitter more carefully in future.

Cheers

Graham

Small-caps of interest today (final list):

- Motorpoint (LON:MOTR)

- Countrywide (LON:CWD)

- Begbies Traynor (LON:BEG)

- TP (LON:TPG)

- Pendragon (LON:PDG)

Finished at 13.20pm.

Macro Latest - Strange Events

There have been some very unusual events in recent days, related to the pandemic, which I think are worth a mention.

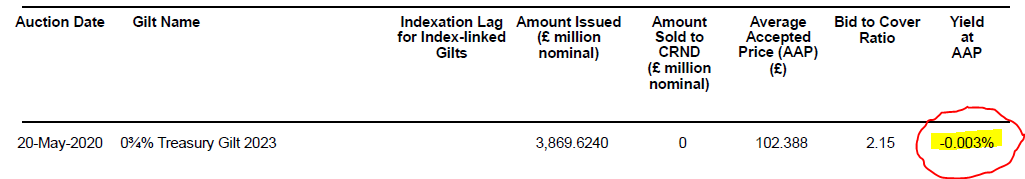

1. UK Sells a Negative Bond

The Debt Management Office yesterday sold a bond with a negative interest rate for the first time.

It was about £4 billion in value and matures in 2024.

The yield was only very fractionally negative - minus 0.003%.

So does it really matter? I think so, even if it's a mostly symbolic event.

It shows that the zero bound can be broken in the UK.

We've already seen negative yields in many other countries in recent years. Now that the zero bound has been breached for the first time in the UK, the institutions buying these bonds might start to think of it as normal, and will reset their expectations for where yields might go in future.

Why did it happen?

The effect of quantitative easing is of course very important - the Bank of England owns c. 25% of UK government debt.

The emergency low 0.1% base rate is also a big factor, because it depresses interest rates generally. It's not as if High Street banks offer great alternatives for yield.

To the extent that the negative bond yield is not purely driven by existing policy, it's also a reflection of pessimism for the years ahead - it reflects extreme risk aversion, and perhaps a belief that UK interest rates are about to turn negative.

On that point...

2. BoE won't rule out negative base rate

New governor of the Bank of England, Andrew Bailey, has refused to rule out imposing a negative base rate in the UK.

There were mixed messages last week, with Bailey appearing to dismiss the suggestion, while others in the Bank were more favourable.

The BoE's Chief Economist said:

"The economy is weaker than a year ago and we are now at the effective lower bound, so in that sense it's something we'll need to look at - are looking at - with somewhat greater immediacy,"

Strange times and I think investors do need to worry about this. Topsy-turvy monetary policy will have real-world and financial effects, e.g. on inflation, consumer behaviour, and stock market valuations.

For what it's worth, I do think it is a sign of tremendous failure by central bankers (thinking in particular about Mark Carney for the UK) that interest rates failed to normalise after the global financial crisis of 2008.

We've had just over a decade in which the economy has been quite strong and there was plenty of opportunity to wean the financial markets, companies and individuals off ultra-low interest rates.

Yes, it would have caused equity markets to rebase at a lower level and required a small number of unsustainable companies and households to restructure. That would be the price to pay to go back to a "normal" economy where ordinary savers, pensioners and other investors could achieve retirement and other financial goals without taking unnecessary risk.

For now, ultra-easy monetary policy is excused by weak consumer price inflation...

3. Inflation falls to the lowest level since 2016

The latest CPI bulletin is a lot more interesting than usual (these things are usually sleep-inducing).

Key points and other things I noticed:

- CPIH (CPI + household costs) fell to just 0.9% in April, year-on-year, significantly below the 2% target

- 16% of the usual basket was "unavailable". Literally impossible to buy 16% of goods!

- Many other price quotes were not collected for one reason or another. Makes me wonder how useful the April number is!

- Fuel pump prices saw their largest monthly fall ever.

- Lower transport prices were a big factor in the declining CPI and CPIH. So were lower clothing and footwear prices as retailers dumped stock.

- Inflation in housing/household services was at the lowest level in 10 years. Big oversupply in natural gas. Electricity and water prices down too.

Low inflation is seen by some to justify lower or negative interests, since the target level of inflation is 2%.

But there are good reasons for inflation to be low right now, and they are (hopefully) temporary. They are all to do with the Covid-induced lockdown.

People have been ordered to stay at home, so of course the demand for fuel has collapsed.

Clothing stores are shut and people have no good reason to buy new clothes (except out of necessity), so of course the demand for clothing has collapsed and retailers have been forced to dump their existing stocks onto the market.

These are temporary factors. When inventory levels have been reset, and/or when the economy starts moving again, I think it's safe to assume that pricing in these sectors will go back to normal.

But by the time that happens, interest rates might have become even more abnormal.

I have more to say on the macro front but it's time to get on and cover some companies.

Motorpoint (LON:MOTR)

- Share price: 202p (+1%)

- No. of shares: 90.2 million

- Market cap: £182 million

We used to cover this company regularly. It sells two year old cars with up to 15,000 miles on the clock, from 13 locations.

Today we learn that it has launched "an entirely contactless purchase process, with customers able to choose between free nationwide home delivery or contactless collection at any of its 13 branches."

According to its website, the Glasgow branch is currently closed but all other branches have daily collection slots for customers to pick up their purchase. It's too early to tell what sort of sales this new strategy might achieve.

And Motorpoint is "confident that it is well placed to recommence full operations as soon as UK Government advice allows".

The wider car dealership sector wants to reopen on June 1st. It's not clear if this is actually going to happen.

As for Motorpoint, all I will say is that at least it's not in the new car segment. New car sales fell 97% in April and a ruined economy is not a place where new car sales are going to flourish.

MOTR shares have a high StockRank of 83. If the nearly-new market is back to normal soon, this entry point looks potentially interesting.

The September 2019 balance sheet was fine - there was no overdraft/RCF being used, just a stocking facility to finance its inventories.

Countrywide (LON:CWD)

- Share price: 63.1p (+2%)

- No. of shares: 33 million

- Market cap: £21 million

Final Results and Covid-19 Update

Results to December 2019 aren't very relevant, are they?

Countrywide records an adjusted EBITDA of £24 million, before taking into account £58 million of exceptional items.

Sales volumes were down, and sales/lettings income were both down 5%.

Net debt is still uncomfortable at £83 million.

Covid-19 update - Countrywide has "begun phased re-opening for business across all of our operating channels, including physical branches and valuation visits in addition to the continuation of web-chat and telephony contact."

The first four months of the year were positive, thanks to a strong Q1. Adjusted EBITDA for continuing operations was "significantly ahead".

Liquidity is plentiful - £60 million.

Outlook - no guidance for the year.

My view - I am not able to value this. The track record is so erratic, it's still highly leveraged, and it's not clear to me that the equity is worth anything. Does not pass my quality filters.

Begbies Traynor (LON:BEG)

- Share price: 105p (-4%)

- No. of shares: 128 million

- Market cap: £134 million

Results to April 2020 are "broadly" in line with expectations at this insolvency practitioner and professional services group.

Broadly means "almost" in stock market parlance.

Revenue is a small beat at £70 million, but adjusted PBT is a small miss at £9.2 million.

Net debt is less than £3 million - close enough to zero that it doesn't matter too much at this stage. Cash of £7 million vs. drawn borrowing facilities of £10 million.

Lockdown impact - PBT took a £0.6 million hit from lockdown's effects on some property-related services in the last six weeks of the year. Less work was available in commercial property valuations and business sales.

Business recovery (insolvencies) - this division should be doing very well, and it is. Profit growth of 30% for the year and it was growing even before the lockdown-induced disaster.

Outlook - expects insolvency appointments to keep rising and more disruption to property services, until economic conditions return to normal.

My view - has great momentum and very benign economic conditions, given the nature of what it does. The tailwinds might be priced in at a high-teens P/E multiple.

TP (LON:TPG)

- Share price: 5.51p (+0.2%)

- No. of shares: 779 million

- Market cap: £43 million

Final Results for the year ending 31 December 2019

This is a new one for me. Reader comments have prodded me into taking a look.

TP Group (AIM: TPG), the providers of mission-critical consulting, software and bespoke engineering solutions for a more secure world, announces its audited results for the year ended 31 December 2019.

This sort of thing is outside of my very small circle of competence. It's definitely not a sector that I would normally look at.

I'm happy to write up a few notes for readers anyway.

FY December 2019 is ancient history, but for the record:

- revenue +49% to £58 million

- organic revenue growth +16% (I tend to think that organic growth is a more important metric for most companies)

- adj. operating profit +48% to £5.9 million. Organic growth 28%.

- statutory loss because of acquisition expenses and earn-out provisions (payments which will have to be made to the sellers of the acquired businesses)

There is no guidance given for 2020.

Covid-19 impact

I have to scroll far down into the report before finding a section about the Covid-19 impact.

TPG thinks its order book and pipeline are secure:

The business is robust as it participates in several long-term strategic government and institutional programmes in the UK and overseas. More than 80% of the year-end order book can be ultimately traced to programmes from government and international institutions and major prime contractors.

My view

Unfortunately I don't have a strong view on this one. I like simple companies with clean (non-adjusted) accounts and fat operating margins, and which aren't too labour-intensive. I don't invest in consulting or engineering groups. So this one is definitely not for me.

No point in trying to be an expert in every sector!

If you have faith in the adjusting items reducing in future years or not mattering, then it could be attractive. Obviously, if you have some sector insights that would be a great help, too.

The size of the adjustments is a big turn-off, personally.

Pendragon (LON:PDG)

- Share price: 7.69p (+5%)

- No. of shares: 1.4 billion

- Market cap: £107 million

Q1 Trading Update & Covid-19 update

This car retailing and aftersales group records a Q1 underlying loss of £2.3 million. This is after an estimated £10 million hit from the lockdown.

Last year, the Q1 underlying loss was £2.8 million, and there was no lockdown. So it was on track for a huge improvement over the year, until mid-March.

New car sales are massively struggling, as I've already mentioned today.

Pendragon says that its franchised UK retailing division outperformed the market with a LfL sales decline of 19% (while the new car market in general declined 31%).

Current status - all sites were closed on March 23rd.

Most service centres are back open now, at reduced capacity. 20% of technicians are back.

Car sales are happening over the phone and Pendragon is working on a home delivery service for online sales. Sounds like it has work to do, to catch up with Motorpoint (LON:MOTR).

Net debt is £100 million.

Reopening is "expected" (hoped for?) on June 1st.

My view

A good update and there is not much to criticise at Pendragon.

The balance sheet may be strengthened by a disposal that is planned for this year and there's also the potential for M&A activity at some point in the future - the company had outline discussions with Lookers (LON:LOOK) earlier this year.

This entire sector has been very cheap for some time and if you can spot one or two winners, you could be rewarded with a takeover or a very significant share price rebound. Pendragon was a heavy multi-bagger after 2009 and again after 2011. Lookers was another huge performer after 2009.

Both shares have given back most of their gains, and for understandable reasons. If their balance sheets survive this period and we get a healthy market in a few years, then I'd expect them to do very well. It's not easy to bet on that in the middle of a depression, though, is it?

That's all I've got for today, thank you very much!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.