Pre 8 a.m. comments

I met the Directors of Staffline (LON:STAF) at a results presentation meeting on 3 Sep 2012, and was impressed with both them and the company, and I explained why the shares looked a bargain at 226p here. They have since shot up 48% to 335p, although it's really been a sector re-rating with most small recruitment companies seeing similar gains.

STAF issues results for year ended 31 Dec 2012, making it one of the first smaller caps to report. This is a positive thing, as prompt reporting of figures is usually indicative of good financial systems & controls, which is essential in a highly competitive, low margin sector such as recruitment.

STAF is really an out-sourcing company, providing mainly blue collar workers (e.g. staff to food processing factories) to large cllients, mainly through basing a member of its own staff on the client premises to manage recruitment at the front line. A clever model which cuts out fixed costs as it doesn't need a separate office funded by STAF, just a desk, computer & a phone at the client's premises.

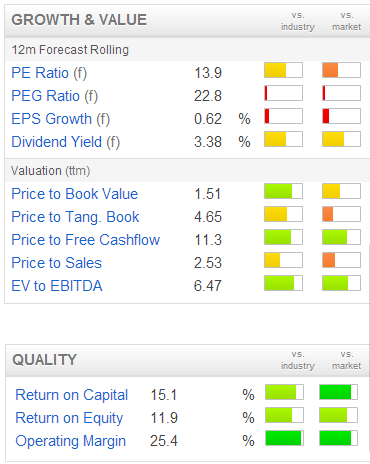

Their results this morning show fairly pedestrian growth in adjusted (excluding goodwill amortisation) EPS up 2% to 35.9p (35.1p in 2011). However, that puts the shares on a still reasonable rating of 9.3.

The all important outlook statement sounds pretty upbeat, saying;

"The first 7 weeks of trading have started strongly and we have developed an excellent pipeline from new and existing customers for the first half of 2013 ...

... I am therefore confident that the Group will enjoy another year of substantial and profitable growth in 2013."

Sounds pretty good to me!

They have also increased the total dividends for the year by 14% to 8.1p, giving a reasonable yield of 2.4%.

I like this company, and the other interesting thing is that their EOS subsidiary is doing very well on the Government's Welfare To Work scheme, which is expected to deliver significant profits for the group over the longer term, although it requires some up-front costs.

I like STAF, but probably won't be chasing the shares up in the short term. I sold mine at 300p a little while ago, but will certainly be looking to buy back if there is a market correction which brings them back down to that sort of level.

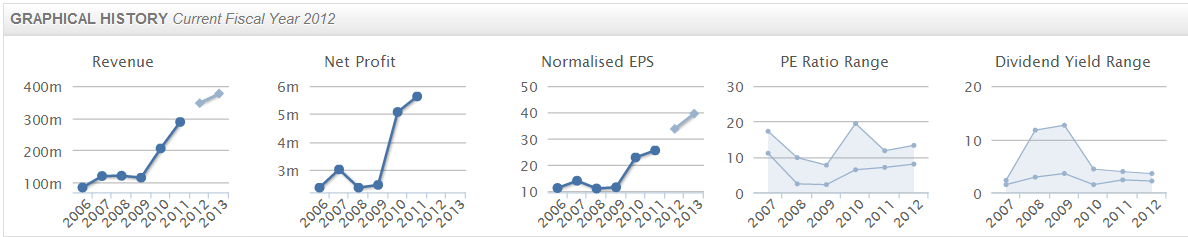

As you can see from the Stockopedia graphical history, STAF has an impressive growth history, and the shares were an astonishing bargain in 2008-9:

Net debt is a modest £4.6m (2011: £4.9m), although the P&L interest charge of £363k suggests that the average debt is probably a bit higher. If we assume an interest rate cost of 5%, then that implies average debt of £7.3m throughout the year, which is less than one year's profit, which is my rule of thumb for whether debt is low enough to pretty much disregard.

Post 8 a.m. comments

I've been negative on Cupid (LON:CUP) for a while now, as heavy Director selling, endless promotion of the shares, and worrying reviews of their websites by users, all created a bad smell around the company. I aried my negative view on the company here, and an interesting discussion followed.

Thank you to Asagi, who posted a link to a BBC expose of Cupid here, a Radio 5 Live investigation which was aired yesterday, which names Cupid, and makes it pretty clear that the company appears to operate in at the very least, an unethical way. My experience is that unethical companies tend to make terrible investments in the long run (as I discovered to my cost with a scammy company called Invox), because sooner or later customers realise they are being ripped off.

Therefore I shall be ignoring any apparent value in Cupid, and deploying a bargepole for their shares. I see they have taken another leg down this morning on the bad publicity. The whole sector needs to be properly regulated, to stop cowboy activity and the way some companies apparently mislead customers, which is not only unethical, but downright nasty, playing with the emotions of sometimes vulnerable people in order to make a profit. I don't like that sort of thing one bit.

Shares in Thorntons (LON:THT) have put on an 8% spurt this morning, on publication of their half year results, which are a rather strange, slightly extended 28 week period to 12 Jan 2013. My first question is therefore, why are they reporting 28 weeks, and not 26 weeks?

It looks as if their strategy to "rebalance the business" is working, by driving new areas of growth, mainly commercial sales, in response to continuing declines in retail turnover. Although they have sailed very close to the wind in recent years, with high levels of debt, and a yawning pension deficit.

Bank facilities of £57.5m are in place until Oct 2015, and seems to give plenty of headroom in both amount, and timing. Although the cash position is likely to be at a seasonal peak at the reported date of 12 Jan, following the Christmas sales peak.

So H1 profit before tax and exceptionals rose by £2.3m to £5.3m, which looks encouraging. However, H2 was a small loss last year, and might reach breakeven this year if there is a similar improvement in trading in H2 as there was in H1. So perhaps around £5m profit for the full year.

Compare that with £17.5m net debt (at a seasonal low point), and a pension deficit of £30m, and the balance sheet still looks very stretched to me. It's difficult to see how the company will be able to pay any meaningful dividends for the foreseeable future, unless there is a significant further improvement in trading. That said, the brand has some appeal.

The shares are much too risky for my taste, and I am also worried about lease liabilities, so although it looks like Thorntons stands a better chance of surviving, I don't see the shares as offering attractive risk/reward at all, given the extent of the liabilities.

Microgen (LON:MCGN) is an IT company which looks potentially interesting. I've just been looking through their preliminary results for the year ended 31 Dec 2012, issued today, and like what I'm reading.

Their shares are up 6% to 117p today, which gives them a market cap of £95.6m (NB. Where a share has moved intra-day, always re-calculate the market cap yourself, using the current share price multiplied by the number of shares in issue, as most websites show the market cap from the previous day's close, which by now is out of date if the shares have moved significantly today).

Revenue declined 17% to only £32.3m, but they made a terrific operating margin of 28%, to deliver operating profit of £9.0m (down £0.5m against 2011). I do like buisnesses with pricing power, although need to investigate whether this includes one-off licence fees, or whether it is recurring.

Diluted EPS is 8.3, so that gives a PER of 14.1, not cheap but consider that they have £32.1m in net cash, or a third of the market cap! Although as with most IT companies, a good chunk of that cash is actually deferred income, i.e. money that customers have paid up-front for services not yet delivered. So to arrive at a true net cash figure, one should always be prudent and deduct deferred income from net cash, which gives a true surplus cash figure of £17.8m, or almost 19% of the market cap.

I also like that the company is focused on shareholder value, and boasts that it has returned 100% of its 2008 market cap to shareholders since in divdends, share buybacks, and tender offers.

They announce today a special dividend of 5.2p on top of the final dividend of 2.2p, flat against last year.

So this one looks worthy of further research. I wonder what it does, and if there are any growth prospects, as the business looks flat in terms of actual & forecast profits. My worry is that they have a profitable niche which may gradually slip away. If anyone has time to check out this company, I would be interested in your findings.

Results for Forbidden Technologies (LON:FBT) show good percentage growth in turnover, but it's still tiny at £813k for the year ended 31 Dec 2012. There is also a typo in the results, where the Statement of Consolidated Income is stated as being for year ended 31 Dec 2011, when it should read 2012. Whoops!

I'm struggling with a market cap of £22m for a company at this early stage.

House builders Persimmon (LON:PSN) and Bovis Homes (LON:BVS) both announce results today, so it's always worth checking those out, as housing is such a big factor in the economy overall, and a good gauge of both sentiment and general economic activity.

Bovis reports a 75% increase in EPS, and an 80% increase in its dividend. Persimmon reports underlying profit up 52% and forward sales "strongly ahead". Recession, what recession?! It's important sometimes to look at the signs of growth which are out there, and which the BBC seems so determined to prevent us hearing, with their daily serving of doom and gloom!

OK that's it for today, see you same time tomorrow. I am off to the ShareSoc Investor Day meeting tomorrow in London, so the morning report might be a bit shorter & earlier tomorrow. Hope to see some of you there.

Regards, Paul.

(of the companies mentioned today, Paul does not have any long or short positions in any of them)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.