Pre 8 a.m. comments

I sold my small position in Creston (LON:CRE) some time ago, as despite them looking very cheap on a PER and dividend yield basis, the shares have gone nowehere in the past six months, just gently undulating up & down. This seemed odd, given that we've been in a roaring bull market for small caps.

It is difficult to make sense of their trading statement today, which in itself is a worrying sign given that they call themselves an "insight and communications group". Surely issuing a clear RNS should be within their area of expertise? Doesn't seem to be.

The first bit is fine, where they state that revenue for the year ended 31 Mar 2013 is expected to be flat at £75m, and the headline profit before tax for that period will be in line with consensus forecast. Last time I looked at their results, I gave up because there were so many different measures of profit they became unintelligible - again not a good thing.

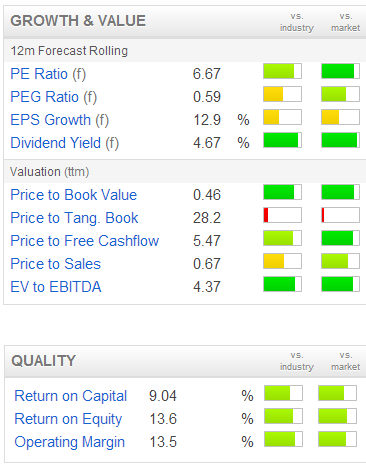

Stockopedia shows consensus forecast for y/e 31 Mar 2013 as 11p, so at 83p that puts the shares on a low PER of 7.5. The PER of 6.67 shown in the table on the left is always the forward PER, so based on current year forecast EPS of 12.4p.

So it must be loaded up with debt then? Actually no, they report a net cash position of £10m at the year end, which is a material figure for a £50m market cap company. Although this cash has mostly come about from an enormous "reverse premium and contribution to the agreed dilapidations obligation for the Group's new London office", of which they say £6.5m has been received.

This is an unusual situation, but agreed dilapidations are where remedial work is necessary to a building, so in other words Creston will have to spend some of that money on repairs to the building at some point. A reverse premium is a financial incentive paid by a landlord to induce a new tenant into entering into a lease. There's no such thing as a free lunch, so if the landlord gives you a bung to take a lease, it's because the rent in that lease is higher than the market rent that you could otherwise negotiate. There are a variety of reasons why landlords pay reverse premiums, but it's usually to establish a high rent, so that they can peg a high capital value on the freehold.

The confusing part is that there is then some narrative about contract wins & losses, but without any context - is this a profits warning, should we be worried or pleased? It's just not clear at all, and I'm left scratching my head. So it will be interesting to see how the market reacts to this trading statement, as I cannot work out whether it's bullish or bearish.

The FTSE 100 is forecast to open strongly today, up 35 points, so will be interesting to see if that bullish tone feeds through to small caps, as it was feeling pretty tired by the end of last week, with volumes pretty low on the shares I follow.

Post 8 a.m. comments

Another share I dumped a little while ago was a highly speculative punt in 2Ergo (LON:RGO). Their announcement this morning sounds intriguing, and I shall put this one back on my watch list, with a view to possibly buying back in at some stage.

This is the one which basically ran out of money, and was forced into doing a Placing at 10p when the shares were 42p, to general uproar. Directors stumped up a lot of that cash personally, which shows commitment, although existing holders were diluted badly, and of course it killed the share price which has gradually drifted down to 10p.

They have today announced various contract wins, which sound encouraging. They have an interesting technology which enables smartphone users to receive & redeem vouchers with retailers, using a small device attached to the till, supplied by RGO.

However, it's all spoiled with the last sentence, when they say that "The Board is in advanced stages of securing funding and expects to provide a further update in due course". So looks like there will be more dilution, and given the way the last fund raising was handled, there's no way I would buy any shares in advance of the fund raising being completed. They also stated at the last one that they would move into profits this year, hence by implication wouldn't need to raise more cash. Hmmm.

It does look a basket case, but at £6m market cap there could be big upside if their technology takes off, and I do like the concept, so am keeping this on my more speculative watch list. They only have £390k in cash left, but banking facilities are unused. I am surprised they are able to obtain any bank facilities, but perhaps the Directors have given Personal Guarantees?

Shares in Snoozebox Holdings (LON:ZZZ) (great ticker!) have taken a 15% tumble this morning to 57p on an update from the company. It's not good. They state that revenue for the year ended 31 Dec 2012 will be not less than £3.78m, a material shortfall. This is due to IFRS recognition of revenue. So it looks like a fairly serious lack of financial control here has emerged during the audit process, would be my guess. Not good. The company should have agreed its revenue recognition policy with the auditors a long time ago.

They do say that the business pipeline is strong, so perhaps negative sentiment might dissipate fairly quickly, we are in a bull market after all. I flagged up Snoozebox as an interesting company last year, but decided it was over-priced after a while, and sold out.

Valuations generally for growth companies are just far too high at the moment in my opinion, and whilst bulls might be enjoying the fun, those valuations can & do sometimes come crashing back down to earth when results are issued, and everyone can see just how stretched the valuation has become.

I remain of the view that it's better to bank the profits & move on, if a share becomes over-valued. Some people say just run the winners, let it go to an over-valuation, etc. But that's an incredibly risky strategy in my view, and has echoes of the late 1990's tech boom, which of course all ended in tears when the bubble finally burst.

They say the financial memory is about 15 years, and that's almost where we are now from the TMT boom & bust, so a whole new generation of market participants is now emerging who don't remember what happens when a bubble builds & eventually bursts.

The market seems to quite like the announcement from Creston (LON:CRE), so maybe my worries were unfounded. Their shares are up 2% to 85p, although on negligible reported volume so far.

Shares in Utilitywise (LON:UTW) have woken up this morning, and are up 7%, so I'm wondering it it's been tipped somewhere over the weekend? Just done some digging, and apparently it has been tipped in both the Investors Chronicle and the FT over the weekend. So that explains that.

The biggest faller of the day is pawnbrokers Albemarle & Bond Holdings (LON:ABM), which have crashed 29% to 132p on a profits warning that was issued late on Friday after the market closed. It doesn't look good. Profits are expected to be "materially below current market expectations" for the year ending 30 Jun 2013, and they have fired their CEO.

They won't get any sympathy from me. Any business that makes its money by exploiting the poorest in society deserves all it gets, and isn't something I would ever invest in.

Finally, I wrote up a report on the Mark Slater's talk at the UK Investor Show here on Stockopedia. If you haven't already seen it, the first part is here. Mark Slater is an intelligent & interesting speaker, and his stock ideas are always worth hearing.

The video of his presentation has just been published too (together with a plug for Tom Winnifrith's pizza restaurant of course!) and can be viewed here. I must have nodded off at some point during the talk, as there are some stocks mentioned which I didn't include in my report!

That's it for today, and talking of nodding off, I think it's time for a nap on the sofa, these early starts don't agree with me! See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions in any of them)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.