Good morning! I enjoyed the Stock Market Show on Saturday, in Islington. It was good to meet & chat to other investors, one or two interesting companies, and I enjoyed giving a talk on small caps on the Stockopedia stand, as usual at these events. It's always interesting to meet other investors, and discuss shares that we like or don't like! It's striking how civilised discussions are face to face - why can't bulletin board discussions be equally civilised? Some people seem to turn into monsters once they have an internet connection to hide behind through a pseudonym.

Networkers International (LON:NWKI)

Share price: 51.5p

No. shares: 84.0m

Market Cap: £43.3m

The market has reacted negatively to interim results to 30 Jun 2014 from this staffing company today, with the price currently down a rather harsh 17% to 51.5p, and it doesn't look to have bottomed out yet either, although I doubt it has much further to fall, looking at the modest valuation.

The interim figures don't look too bad to me, although the narrative does seem to be trying to gloss over the downturn in performance, blaming it on the strength of sterling in H1. Whilst that might have had some impact, it's surprising how many companies still manage to do well, despite currency impact. Hence why I try to be a little sceptical about that particular issue - it will be swings & roundabouts in the long run anyway, with the pound having weakened against the dollar in the last few weeks, partially reversing the previous trend, which could present a buying opportunity perhaps?

Profitability - dropped from £3,3m in H1 last year to £2.8m in H1 of this year, a drop of 15%, which they say would have been down 3% in constant currency. Business is done in 12 countries, but the overwhelming bulk is within Europe. So it must be the £:Euro exchange rate that has hurt them.

Outlook - It sounds as if things are improving, so I am wondering whether today's dip might be a buying opportunity?

"Trading in all three sectors has shown growth in recent weeks and the business as a whole is up on last year over the past three months, even after taking into account the adverse currency effect. If this recent performance is sustained throughout the year we will be able to close some of the deficit caused by currencies compared to prior year and set us up well for strong growth in 2015 and beyond."

Balance Sheet - Most staffing companies have invoice discounting debt, and this is no exception. However, overall I think the amounts involved are modest, and the Bal Sheet overall looks healthy to me, passing my simple tests with room to spare.

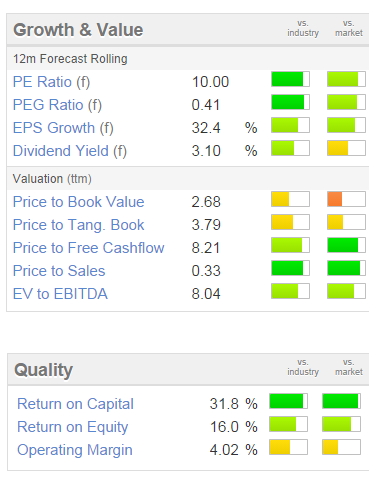

Valuation - As you can see from the usual Stockopedia graphics on the right, there's plenty of green (representing positive scores). Bear in mind that data is based on the closing share price on Friday, and it's now about 17% lower, although bear in mind also that the broker earnings forecasts are likely to be coming down too, but maybe not as much as 17%. Therefore the valuation has probably got a bit cheaper still on a PER basis this morning.

I note that this stock has a StockRank of 99, so the Stockopedia algorithms like this share a lot!

My opinion - taking all the above into account, I think this could be a buying opportunity, so I've bought a little stock this morning at 52p.

I didn't really want to buy anything at the moment, until the Scottish Referendum is done & dusted, but couldn't stop myself hitting the buy button at this price.

Please remember, as with everything on Stockopedia, we are never giving recommendations, just flagging up ideas for further research by readers.

Empresaria (LON:EMR) - The sharp spike up in price this morning in this staffing company was caused by it being featured in a tip sheet that was posted out over the weekend. It really concerns me when shares shoot up on tips - it's evidence of a frothy market, reinforcing the view that we could be towards the end of this bull market perhaps? I don't know what would possess anyone to pay 20% more for a stock just because it's been featured in a magazine? Doesn't sound like a winning strategy to me. It's also a bit concerning that prices are moving just before magazines are published in some cases - indicating that some front-running might be going on ?.

In my view all magazines & newspapers should stop giving recommendations. They should just present their views, and then leave it up to readers to decide what (if any) action to take.

K3 Business Technology (LON:KBT)

Share price: 221p

No. shares: 31.7m

Market Cap: £70.1m

The market seems to like the final results from this software company, with their shares up nearly 3% this morning. I'm not so keen, for the following reasons;

Adjusted profit - in my view this materially over-states the true performance of the company. The reason being that the reported adjusted profit before tax of £6.6m (up an impressive 51% against last year) completely ignores what the company chooses to define as development spending.

So if you expense the £4.0m of capitalised development spending, then what I regard as real profit is only £2.6m for the year. That makes the £70.1m market cap look far too high, which it is in my view.

Even if you accept the capitalising of development spending, then you still have to take into account the amortisation charge of historic development spending, which is also ignored in the adjusted profit that the company reports. So taking amortisation into account, then pre-exceptional profit drops out at £3.6m. Again, not a particularly good profit figure to support a market cap of £70.1m.

Balance Sheet - As I've commented before, this is very weak, and hence this is not a share I would invest in. The company is totally dependent on bank debt. There are net assets of £52.6m, but once you write off the intangibles, net tangible asset value drops out at negative £11.4m. That's a weak position to be in, and presents a significant risk, as the company has nothing to fall back on if something serious were to go wrong.

Net debt is little changed at £13.6m. So the interest charge on that is likely to be a drag on profits once interest rates rise. Bank facilities have been renewed to Aug 2017, although it is worth remembering that bank facilities can be withdrawn, if banking covenants are breached at any time.

Dividends - Companies with weak Balance Sheets have little, if any, capacity to pay dividends, and sure enough there is a token dividend yield of about 0.5% here.

Outlook - this sounds positive;

The year has seen a strong recovery in the business with the initiatives we have taken in the development of intellectual property for the Retail sector paying dividends. The work we are now doing with Microsoft provides the opportunity for substantial further growth in our Microsoft Dynamics AX proposition, supported by a stable and profitable underlying business. Whilst further investment will be required to exploit the opportunity fully, I am confident that K3 is well placed to do this in future years. With a strong pipeline of opportunities ahead, the outlook for K3 is particularly encouraging.

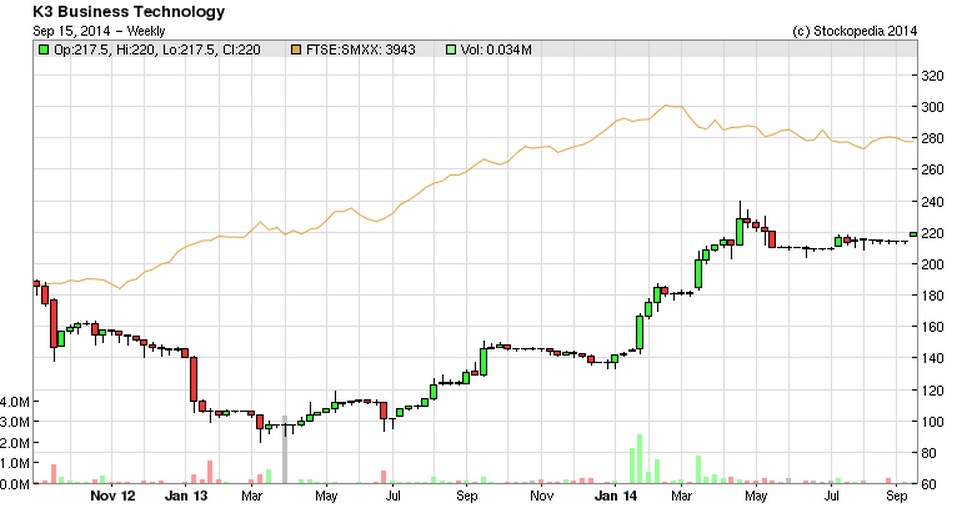

My opinion - Talk is cheap of course, it's the numbers that matter, and in this case I have to say that I'm not impressed with modest profitability after development spending is properly taken into account, and a very weak Balance Sheet. So it's not for me. People who are prepared to ignore all of that, and instead focus on growth, might like it though. Sometimes that approach works, especially in bull markets, so each to their own - people who took a gung-ho approach to these shares a year ago have made a nice profit, so good luck to them!

Plastics Capital (LON:PLA)

Share price: 104p

No. shares: 30.2m

Market Cap: £31.4m

Trading update - This is one of many small caps that investors chased up too high in valuation earlier this year, and it's come down a fair bit to more realistic levels in recent months. Today's trading update is, despite the attempt to put positive spin on it, a mild profits warning. The shares have come down 12% to 104p this morning.

Plastics Capital plc (AIM: PLA), the niche plastics products group, announces an update on trading for the financial year to date and is pleased to confirm that the Company is trading broadly in line with market expectations...

Despite slow demand and some project delays the Group continues to press ahead. We are making good progress in China and in our packaging businesses. The industrial division is experiencing some project delays and slow sales partly due to customer overstocking, but it continues to have a very strong pipeline of opportunities and previously converted business which should flow into production over the next twelve months. Altogether we anticipate another year of reasonable progress.

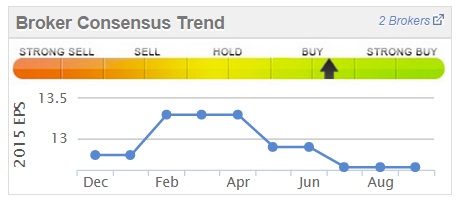

There is more detail in the update, most of which sounds negative. So it's puzzling that the company still says that they are trading "broadly in line", which of course actually means slightly below. Interesting to note that brokers have been easing down forecasts for several months now, which usually happens because the company wants to guide them down because performance is not going as well as the company had hoped.

So I reckon we might be looking at possibly 10-11p EPS for this year, at a guess?

My opinion - As I reported here on 30 Jun 2014, in my opinion the company buffs its accounts up to present the most positive earnings figure possible, with various adjustments, which I think are somewhat on the aggressive side. Therefore it's not something I'd chase up to a fancy valuation. There's a fair bit of net debt too, and not much evidence of organic growth, so I think a high single digit PER is probably about right.

That said, the shares have come off quite a lot, and I think it's getting into interesting territory in terms of price. possibly? So I've picked up a little stock this morning at 102p as a starter position. I've no idea if this will be the bottom for the shares? However, I'm a lot happier buying today at 102p than I would have been at any point in the last few months when the shares were more popular because they were going up, but the valuation was becoming stretched, as I've reported previously.

I'm not really bothered buying into a downtrend, because I've got the stock about 30% cheaper than people who were buying into the up trend a few months ago. That's good enough for me, after all it's all about BLASH, and even if I can't always catch the exact low point, we're probably reasonably close to it now, providing nothing else goes wrong.

Dividends - The dividend was hiked considerably a little while ago too, so it's starting to look interesting as an income share.

Immunodiagnostic Systems Holdings (LON:IDH)

Share price: 381p

No. shares: 29.2m

Market Cap: £111.3m

I've managed to buy shares in two companies that have plunged on profit warnings this morning, so am wondering if I can make it a hat trick?!

IDH shares are down about 17% this morning, so there must have been a profit warning. Let's have a look. Yes, there is a trading update, the main bits say;

Further to the strategic update presented at the preliminary results to improve IDS' long term prospects, on 4 August the Group announced at its AGM that it was experiencing a low level of placements and an acceleration in the decline in manual revenues. In addition, we reported that unfavourable exchange rate movements were creating a "headwind" for reported numbers.

These unfavourable short-term trends are continuing and specifically we have not seen, nor do we anticipate in the near term, our placement rates to pick up materially. Therefore, it is anticipated that revenues for the year ending 31 March 2015 will be below current expectations and in the range of £45m - £47m, which includes an anticipated adverse currency impact of circa £1.5m compared to 2013/14. We continue to work on a number of significant commercial opportunities that would provide upside to the revenue range indicated above. However, due to the uncertainty around success and/or timing, the impact of these opportunities has not been factored into our current expectations.

It's helpful that the company gives a range of figures for forecast turnover, but I can't see any mention of figures on profitability, which matters more than turnover of course.

The company also says today that it will reduce some overheads, and it sounds like they are intending to deploy their suplus cash pile to make acquisitions. Although that does rather confirm that its existing business is now ex-growth, and may be in decline?

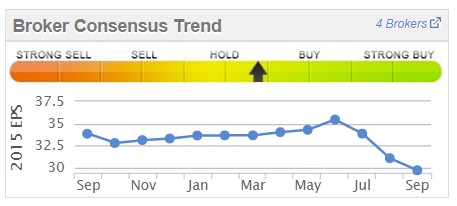

Interesting to note that Stockopedia's little graph of broker forecasts has been flagging a warning sign for the last few months, with broker estimates being steadily revised down:

My opinion - I don't understand the sector, and don't really know how to value this company. Is it in long-term decline now? Who knows?

As you can see from the 3 year chart below, this company has disappointed several times, quite badly, but the share price has then staged a decent recovery as confidence partially rebuilt. However, after this latest disappointment I'm wondering whether the market will be quite so forgiving? For that reason, I suspect it might be best to sit on the sidelines here, as I can't see any reason why these shares would recover any time soon, with no growth, and earnings under downward pressure. The valuation doesn't look appealing as yet, in my opinion.

Time for lunch now, so I'll sign off.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NWKI & PLA, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.