Good morning! I hope you slept better than I did! Paul & Graham here with Tuesday's SCVR.

Agenda -

Paul's Section:

Audioboom (LON:BOOM) - I ran through its interim results last night. Can't say I'm impressed. Low margins, mean little operational gearing. The valuation looks much too high on fundamentals. Although it might be valuable to an acquirer, given that it's a significant player in the US podcast market.

Made.Com (LON:MADE) - online furniture seller puts out another profit warning. Big losses of £80m PBT now expected for FY 12/2022. It's running out of cash too, and hints at a placing being needed. Who would want to fund that, given current conditions? Looks too high risk now, of dilution, or worse.

Photo-Me International (LON:PHTM) - excellent interim results. This is one of my favourite value shares, and today's results, plus a special divi, reinforce that. I think the shares are at least 30% undervalued.

Hotel Chocolat (LON:HOTC) - Roland has done a write-up of today's near-50% crash in share price. But it's so interesting, I've looked at it as well, so we can compare notes later. International expansion has gone wrong, and big write-offs are needed. However, I think the strong balance sheet can absorb this. There remains a decent, growing UK core business. Broker forecast for FY 6/2023 is also clobbered by cost headwinds. Not a bargain yet, but it's getting there.

In Style group (LON:ITS) - poor results, and an increased loss is forecast for the new financial year. I can't see the point in this company being listed, and have given this share a wide berth since it listed. Is it a bargain? In a word. no.

Eagle Eye Solutions (LON:EYE) - 550p (up 4%) (£146m) [No section below] - a very good trading update. Looking at the note from Shore Capital, £6.5m EBITDA only turns into £2.6m adj PBT, and 7.6p EPS. Forecasts for the following year don’t look too challenging, although it says the pipeline might slow in tougher economic conditions.

This looks a very good little growth company, with really impressive clients, globally. But a PER of 72 times looks a bit scary. Maybe the company has strategic value to an acquirer, given that it is integrated into lots of big name retailers? It’s a really interesting company, and I can see why people like it. Valuation is the tricky part though.

Graham's Section:

Begbies Traynor (LON:BEG) (£222m) - Excellent results from Begbies, as expected, and the company guides that FY 2023 should be around the top end of expectations (revenues up to £118m and adjusted PBT up to £19.7m). The dividend increases too, and shareholders will be happy. The momentum behind insolvency work is likely to continue for the foreseeable future, as we enter a point in the cycle that is very favourable to the traditional Begbies business. The company has diversified its services and is well-placed to exploit this economic environment. However, I suspect that the Begbies market cap already prices in a large portion of the forthcoming success.

Luceco (LON:LUCE) (£178m) (-2.3%) [no section below] - trading has been “broadly as expected” at this lighting company, since the Q1 update. “Broadly” is code for “slightly worse”, and the shares are trading slightly lower today. The company’s broker has reduced its revenue forecast for the year from £225m to £216m, and reduced its PBT forecast from £25.2m to £23.6m.

The revenue performance is ahead of the pre-Covid (2019) performance on a like-for-like basis, suggesting possible normalisation soon, after the volatility experienced over the last two years (very high demand followed by destocking). Net debt is estimated at £50m, and this may need to be reduced in order to reassure investors. The company also mentions that inflation is a concern re: consumer demand. This stock is cheap against prospective earnings but the reasons for this may be valid, at least until it improves its balance sheet.

Somero Enterprises (LON:SOM) (£218m) (+5.4%) [no section below] - this manufacturer of equipment for levelling concrete provides an H1 update: H1 2022 has been better than H1 2021, helped by “sizable workloads and project backlogs that extend well into 2023”, in the North American market. Europe saw a lower performance than last year, due to “logistics challenges that delayed machine shipments”, but is anticipated to improve in H2.

The last time I wrote about Somero, in January 2020, I said that their opportunity in China should be viewed as speculative. At the end of 2021, they finally abandoned their Chinese growth plans.

The outlook for 2022 remains in line with expectations: revenues of c. $138.8m, EBITDA of c. $47.7m, and year-end cash of c. $39.9m. I’m not aware of any serious competition facing this company in North America and it appears to be doing well in the European market, too. Encouraged by the QualityRank of 99, the cheap valuation and the net cash position, I have to retain a positive view on this one.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Audioboom (LON:BOOM)

868p (down 2% yesterday)

Market cap £142m

We’ve followed Audioboom for years here at the SCVR. It’s morphed from a basket case, into a much more credible company in the last year or two. It produces podcasts, and sells advertising on them. Nearly all revenues are generated in the USA, obviously a large market, and potentially commanding a higher valuation for the shares. Although US tech has sold off massively in the last year. There was talk of mega cap US tech companies possibly interested in buying BOOM, but that seems to have fizzled out.

As with so many companies right now, the share price has fallen heavily, so I’m wondering if it’s a bargain now? As you can see from the 3-year chart below, the recent sell-off has been pretty brutal -

.

.

Here are my notes from reading through the interim results - released promptly for the 6 months ended 30 June 2022, reporting in US dollars - so some benefit there when translated into sterling, given dollar strength right now -

H1 revenues $40.9m - up 79% vs H1 LY, but only up slightly sequentially against $38m in H2 LY - not sure if there’s a seasonality bias to H2? That can be difficult to ascertain where turnover is rising fast.

Gross margin is very low, only $8.3m gross profit - hence very little operational gearing with a 20% gross margin. This undermines the investment case for me, because rapid revenue growth here doesn’t make a lot of difference to the bottom line.

Adj operating profit is small, at $2.0m

Share based payments are greater than profits, at $2.3m! So whose benefit is the company actually being run for? This looks inappropriate to me.

Forex gain of $1.0m

Profit before tax of just $566k, so it’s certainly not a value share.

Tax losses are big, so probably shouldn’t need to pay corporation tax for a while (retained losses on balance sheet are $38m)

Outlook - good bookings from advertisers, >£68m for 2022 signed, which I assume is in addition to H1 booked revenues, but they could have been clearer on this point.

Softening of advertiser demand in Q3 - not good.

“Confident of achieving our goals for 2022” - I’m not keen on the loose wording here. Would be better to confirm market expectations, with a footnote to say what they are.

Balance sheet check - not particularly strong, but probably OK. NAV is $17.4m, which is not much relative to the £142m market cap, so there’s very little asset backing here.

No intangibles though, and no development spend is capitalised, which is prudent accounting.

Receivables at $19m is too high relative to H1 revenues of $41m. This is an amber flag. It’s all very well booking revenues, but if half have not been paid by the period end, then it raises questions about how robust the sales & profits are in reality.

Cashflow - unremarkable at $1.5m operating cashflow.

Going concern note - says it won’t need to raise more equity. That looks credible, providing the receivables turn into cash. I’m worried that receivables might not turn into cash, because they’re too high.

Broker update - many thanks to Finncap for updating us. It's forecasting $83.0m revenues, and $3.6m adj PBT for FY 12/2022. That's 20.7c in EPS, or 17.3 pence. Giving a current year PER of 50 times! That looks an ambitious valuation. Although BOOM is on a rapid growth trajectory, so if that continues, the company could grow into the valuation. But a bargain, it is not.

My opinion - the valuation here doesn't stack up at all, on a value basis. It’s barely profitable in H1, and isn’t collecting in the cash very well.

Revenue growth is great, but the gross margin is low, so little operational gearing.

In a booming US tech market, this share soared, but people ask tougher questions about valuation in bear markets.

Therefore I think this share is all about strategic value that an acquirer might place on it. That could work out well, but there’s not a lot of substance, in terms of profit & cashflow, to support the current valuation.

Good luck to holders, but I think the tide might have gone out for the bull case on this share. But if markets rebound strongly, then it could be a nice speculative trade, who knows?

Someone might decide it has value as a platform, hence value-type considerations may not apply to how other people might value this share. So I can see potential here, if you take that approach to investments.

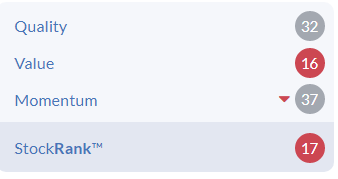

The StockRank system curls its lip at BOOM -

.

Made.Com (LON:MADE)

38.5p (last night’s close)

Market cap £152m

Q2 Trading Update & Revised Guidance (profit warning)

"MADE, the leading digital native lifestyle brand for the home, today announces a trading update and revised guidance"

Hats off to this eCommerce furniture retailer for transparency, with a very clear before & after guidance table (below), but it’s very bad news - now predicting a large loss of £50-70m for FY 12/2022, and that’s just at the EBITDA level.

It turns into an £80m loss at the PBT level, based on an update from Liberum this morning (many thanks for that) -

.

.

Actions taken - cost-cutting, but no benefit expected in 2022. £10-15m benefit in 2023.

Placing? - this is making it fairly clear that an equity fundraising is likely - who knows what price the institutions will extract for continued support? It could get ugly for existing holders -

"Alongside these cost actions, Management is considering options to allow the Company to strengthen its balance sheet."

What’s gone wrong? - people are spending less on furniture. DFS also mentioned that demand was softening, in its 9 June update. It’s hardly surprising is it, in the current macro environment, that some people would spend less on bigger ticket, discretionary items.

On specifics, MADE says -

£20m profit hit from additional discounting to clear excess stocks,

Supply chains costs & disruption, but expected to “substantially normalise in the second half”.

Cash - it had £31.5m net cash at end June 2022. But as you can see from the guidance table above, that’s expected to drop to £5-30m by year end, quite a wide range.

Balance sheet - was OK, but remember that heavy trading losses feed through into damage to the balance sheet. NTAV is forecast to drop from £74m at 12/2021, to £28m by 12/2022. Hence it’s probably going to need an equity fundraising to prop that up. Although DFS operates with a massive deficit on NTAV, due to favourable working capital, so maybe MADE could do the same? Although the difference is that DFS is profitable, so can borrow from the bank. I doubt any bank would lend to MADE, given the scale of its current losses.

My opinion - I did have MADE on my watch list as a possible turnaround, but the situation has deteriorated so much, that I would now consider this share uninvestable.

The cash pile is being rapidly depleted, due to very heavy losses, forecast to be c.£80m in 2022.

Maybe being digitally native, thus appealing to younger customers, is an achilles heel right now?

I don’t think MADE has proven its business model works yet, with losses in all previous years. The huge loss in 2022 now forecast, and the likelihood of a placing being needed later this year, means this share has now become high risk, and I think is probably best avoided.

It’s another disastrous float - the shares have only been listed for a year, and this has happened -

.

Photo-Me International (LON:PHTM)

90p (up 12% at 08:21)

Market cap £340m

I remember writing a very bullish section on PHTM here on 7 June, so am re-reading that to refresh my memory. At the time, the company reported strong trading, ahead of expectations, and the shares looked dirt cheap on a low PER, with a decent yield too.

Photo-Me International plc (PHTM.L), the instant-service equipment group, announces its results for the six months ended 30 April 2022 (the "Period").

Today’s H1 numbers look good - key numbers:

H1 revenue £115.3m (up 22%)

Adj PBT £16.0m (up 24%)

Diluted EPS 4.35p

Net cash £43.2m

Dividends - good news here, there’s a 2.6p interim divi, plus a 6.5p special divi - very nice!

Outlook - another company giving very clear guidance -

.

Broker forecast - many thanks to Finncap for an update. It has 10.4p EPS pencilled in for this year, double last year.

Hence at 90p per share (although it’s moving around a lot this morning), the PER is only 8.7, which seems too cheap to me, given profits are coming not just from photo booths, but also other activities.

Finncap also highlights that PHTM has raised its prices considerably, so clearly has pricing power, and hence is a good share to hold in a higher inflationary environment. That’s really important right now.

Balance sheet - is strong, no issues here.

Rebranding - from Photo-Me, to ME - makes sense, as this reflects the wider spread of activities.

My opinion - I’ve not gone through all the commentary yet, but skimming it, the company sounds confident.

I remain of the view that this seems an excellent value share. The special divi is icing on the cake.

A more sensible valuation for this share would be 120p+, in my opinion. Plus shareholders get paid well to wait for it to re-rate.

A big thumbs up from me.

.

.

Hotel Chocolat (LON:HOTC)

130p (down 45% at 08:30)

Market cap £177m

Good grief, look at this for a 1-year chart, the valuation for HOTC (always on a toppy rating in the past) has been smashed to pieces, like a shattered dropped praline.

.

.

Is this an opportunity for us to get in at an attractive price, I wonder?

Hotel Chocolat Group plc, a premium chocolate brand, today announces a trading update for the 52-week period ended 26 June 2022 ("FY22").

Roland has written a more detailed article about Hotel Chocolat (LON:HOTC) so I’ll just summarise the key points below from my own review of today’s update.

FY 6/2022 underlying PBT in line with expectations at £22m.

Statutory profit will actually be a loss (not stated how much), due to write-downs related to US operations (only 1 store remaining), and Japanese JV. The interim accounts showed a £19.5m loan to the JV within non-current assets. So it sounds as if that’s likely to be written off possibly? It sounds to me as if the Japanese operation is likely to be abandoned (31 stores). Also possibly the US online only operation could be ditched? But these overseas operations were small, so not particularly material to the figures.

Hence it's retrenching back to the UK market, and most profitable product lines, following a strategic review.

Cash of £17m remaining, but it’s squandered a lot of the £40m raised in July 2021 (cash was £54m at Dec 2021). £50m undrawn RCF, so plenty of headroom.

Considerable cost headwinds mentioned, with some mitigating actions - hence a big drop in forecast earnings today.

Big drop in forecast earnings for FY 6/2023 - Liberum has dropped from 14.1p to 5.6p, a 60% drop.

Bounce back expected in FY 6/2024, with Liberum at 12.0p now (was 18.2p)

My opinion - clearly the dream of international roll-outs has gone badly wrong, so the share has de-rated sharply.

So I think we now need to see HOTC as a UK business, with good potential - the commentary today is upbeat about UK expansion plans.

The goal is to get EBITDA to 20% by 2025, which would be c.£40-50m, so if this can be achieved, then the shares would surely be higher than the current £177m market cap?

Is the share price collapse an over-reaction? No, I think the current price of 130p looks about right, given the greatly reduced profit outlook, and what looks like the failure of international expansion. Hence a much lower rating is justified.

If it gets down to a quid a share, I’d be tempted to pick up a few (currently down 47% at 124p).

The balance sheet looks sound, with NAV of £132m at Dec 2021, including £20m freehold property. So writing off the JV receivable of nearly £20m would not put HOTC into an existential crisis. That hit can be absorbed fine, I reckon.

Obviously questions are going to be asked about management competence, and there will be a lot of very unhappy fund managers berating them I imagine. Management have controlling stakes, so probably won’t be going anywhere, and will be more motivated to fix things than anyone else.

HOTC is starting to look interesting. Not quite a value share yet, but not far off.

.

In Style group (LON:ITS)

49p (down 34% at 11:28)

Market cap £26m

Poor results from this eCommerce fashion business. It’s sub-scale I think, and isn’t making any money.

Revenue £57.3m (up 28%)

Loss before tax of £(1.5)m

I ignore EBITDA, because development spend of £1.4m was capitalised onto the balance sheet.

Net cash has halved to £5.8m, but boosted post year end with an invoice discounting facility for wholesale receivables, only costing 2.0% p.a. per note 19, so there must be additional fees I imagine, as 2% doesn’t sound realistic as an all-in cost of the borrowing facility.

Outlook/guidance - admirably clear, but it's not good news - expecting £2.0m EBITDA loss for the year.

My opinion - I don’t think ITS should have floated, but it’s one of many eCommerce businesses that took advantage of the pandemic boost to take money from fund managers with an overpriced float.

This is a crowded space, with lots of me-too operators, with very few actually making any money.

ITS has enough cash to keep going for maybe another couple of years, but it’s difficult to imagine that a consistently profitable business is likely to develop here, given that it’s up against bigger & better competition. Shares are likely to continue in a slow, downward trajectory to zero eventually. Maybe they can pull something out of the hat, you never know, but it doesn't look a viable business to me.

.

Graham’s Section:

Begbies Traynor (LON:BEG)

Share price: 144.7p

Market cap: £222m

We have covered this professional services firm in good detail previously.

Paul covered the year end trading update in May, and I covered an acquisition they announced in June.

Here are today’s results for FY April 2022:

- Revenue £110m (2021: £83.8m)

- Adjusted PBT £17.8m (2021: £11.5m)

- PBT £4.0m (2021: £1.9m)

The adjusted PBT is in line with what was expected, as of last month.

As a reminder, there has been lots of acquisition activity at Begbies. Therefore, while total revenue is up 31%, the organic revenue growth is merely 7%.

I tend to think that organic growth should drive the valuation at most companies, because it’s higher-quality growth.

However, if you trust a company’s ability to deliver successful acquisitions over an extended period of time - and arguably Begbies deserves that trust - then it becomes plausible to give credit for both organic and non-organic growth!

The importance of your view on the acquisition strategy becomes even more clear when we consider the huge discrepancy between adjusted PBT (£17.8m) and actual PBT (£4m).

The difference is explained by “transaction costs” and amortisation of intangibles:

So what are these transaction costs? They do include M&A fees, but actually their main component is something called “deemed remuneration” (please try to stay awake at the back!).

Definition from today’s RNS:

Deemed remuneration, which relates to acquisition consideration, where the vendors have obligations in the sale and purchase agreement to provide post-acquisition services for a fixed period. This consideration is charged to profit over the period of service;

If I try to put this in Simple English: this means that when Begbies buys a company, part of the cost is allocated to payments for the sellers to continue working. This cost is then charged to the Begbies P&L over time, as the work is carried out.

Is it reasonable to adjust this out of PBT? Well, we are now venturing into opinion. Some people will say that it’s fine to adjust it out.

Personally, I would be a little cautious - because I’m not sure that the acquired companies would have generated the same level of revenues, without this work being done. What was the nature of the work being carried out, and what would have happened if it hadn’t been done?

Also, I’m not entirely sure about what will happen in future years, when the sellers inevitably walk away or retire. These are people-based businesses, after all.

It’s the same when we talk about amortisation of intangibles. Some people will say that it’s an accounting fiction, and there is no problem adjusting it out.

And while I agree that the accounting rules are far from perfect, I’m not happy to completely ignore the cost of acquiring intangible assets, such as customer lists.

So for me, the truth is somewhere between the adjusted PBT and the actual PBT. And if I put my sceptical hat on, I get an answer closer to the actual PBT!

Cash flow - when the income statement is very complicated, it’s useful to sense-check the results with a look at the cash flow statement.

At Begbies, the net cash from operating activities for 2022 comes in at £9.8m. This is a useful starting point from which to value the company, in my view, that gets away from the complications on the income statement. It’s an after-tax figure that is effectively “the bottom line” in cash flow terms.

The only proviso I would add is that there were share-based payments of nearly £3m (including payments for deemed remuneration) that serve to inflate the Begbies cash flow. I would therefore be inclined to value Begbies on “real” cash flow of c. £7m. But there is scope for a wide range of views on this, and some people will prefer to stick with adjusted PBT.

Outlook - Begbies has benefited from, and is likely to continue to benefit from, the economic disruption we are experiencing:

Started new financial year in strong position and confident of delivering plans for further growth towards the top end of current market expectations*

Insolvency market (by volume) has returned to pre-pandemic activity levels and is expected to increase further in the current year and beyond

Development of group and our extensive areas of expertise, leaves us well positioned to respond to the challenging economic backdrop

Full marks to Begbies for including in the RNS the FY April 2023 analyst forecasts: revenue of £110.0m-£118.0m and adjusted PBT of £18.5m-£19.7m.

Dividend - the total dividend for the year increases to 3.5p (value £5.4m). The company has an excellent dividend track record and the dividends are covered by free cash flow.

Balance sheet - £85m in net assets, but only £9m after deducting intangibles. The company reports a net cash position of £4.7m.

My view

I’ve always had a positive view on Begbies, and I’ve been impressed by the smooth integrations achieved during its acquisition spree.

My concern now is primarily to do with its valuation. I’ve seen professional services companies go badly wrong before - they are people businesses, usually with limited tangible asset backing, and unpredictable earnings. This needs to be accounted for, in the valuation.

To me, the current valuation at Begbies is pricing in an avalanche of insolvencies. And while I agree that such an avalanche is probably on the way, I prefer to buy cyclical companies when this sort of upside has not already been priced in.

I’m not completely alone in my view, as I also have the Stockopedia computers for company. They struggle to find value here, and award a ValueRank of only 20.

So I give huge congratulations to Begbies investors for the capital gains they’ve earned, but I suspect that the easy money has already been made here, and that the shares are likely to be “up with events” at around their current levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.