Good morning, it's just Paul here today.

Today's report is now finished! Thank you for all the interesting reader comments this week.

Countdown to Mello Chiswick - on Tue & Wed next week. I'll be along in the afternoons (SCVR writing in the mornings as usual) and evenings, so hope to share a drink & a natter with as many Stockopedia subscribers as possible, do say hello to Graham & I if you're there!

** STOP PRESS ** - David at Mello has just been on my WhatsApp, saying that, as a thank you for Graham & I doing some presenting at Mello, he'll let 5 Stockopedia readers have Mello Chiswick tickets for just £10, for the Tuesday next week only - use code: ME23TEN here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Quiet for news today -

Paul's Section:

First of all, 3 rather dull sections that I prepared last night -

On Beach group (LON:OTB)

105p (£174m) - Interim Results - Paul - AMBER

I had a look at these figures the other day, but ground to a halt, as there’s not enough for me to go on, to form a view.

H1 is the seasonally slow, winter half year, for this beach holidays agent. So it incurs a fair bit of the up-front marketing spend for the peak summer bookings period, but in the seasonally slow half of H1 to March 2023. Therefore, there’s not really anything to be gleaned from its H1 performance, which was around breakeven, the same as last year. The big expenditure is marketing, which can be flexed up or down to suit.

I also find the balance sheet rather tricky to analyse, with very large receivables, client trust account, and trade payables. So it’s difficult to know how these balances would move about on a day-by-day basis.

Paul’s opinion - neutral, as trying to work out how the business is likely to perform in future requires too much guesswork at this stage. Although with the share price having almost halved from a recent spike, I am wondering if it might be a more speculative trade, for a bounce? There's also the question about how much the holiday sector will recover, given the cost of living squeeze?

OTB was achieving about 16p EPS pre-covid, and now has c.27% more shares in issue. So if it matches pre-covid performance, then we could guess that EPS might reach about 12.6p. Put that on a PER of say 10-12, and I get to a rough valuation of 126p-151p. Since the price is currently 105p, that suggests to me that there could be something worth researching further here, if you want to invest in the holidays sector.

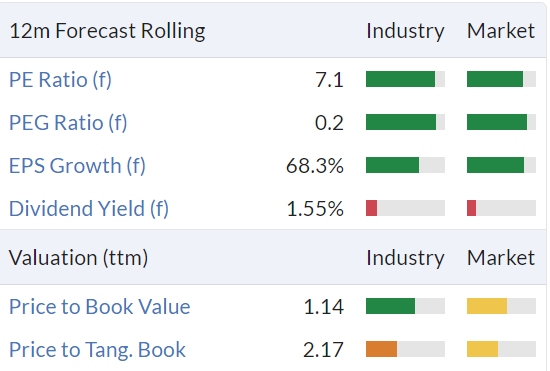

It also looks cheap on broker forecasts, with the StockReport showing a forward PER of only 7.1

Overall then, I'm intrigued, but haven't got enough information, so will say I'm AMBER.

Plant Health Care (LON:PHC)

Up 7% to 10.9p y'day (£34m) - Remaining Listed on AIM - Paul - RED

I mentioned this poorly performing, loss-making company here on 2 May 2023, when it announced it was consulting shareholders on whether to de-list or not. Yesterday it announced vague details of its consultation, which sounds encouraging, with shareholders wanting it to maintain its AIM listing. It sounds like another fundraising is likely at some stage, with at least some sign of shareholder support.

I’ve just had another quick look at its 2022 results, and they’re really bad - another large loss, and cash running out. Why get involved, when there’s currently no sign of this being a viable business?

Mirada (LON:MIRA)

Down 66% to 6.5p (£0.6m) - De-listing - Paul - RED

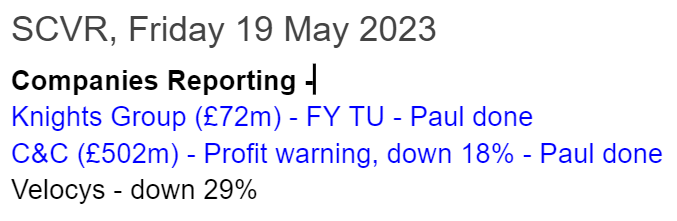

Delisting - announces it will de-list. The usual problems are mentioned - e.g. low & volatile share price, inability to raise fresh equity, lack of liquidity, and costs/hassle of a listing. It also points out that having one major shareholder with 87% of the company is an issue. The share price fell 65% on the delisting news, and the market cap is now only about £0.5m, so clearly it makes no sense to remain listed.

Once again, we need to be carefully checking everything in our portfolios, particularly tiny, loss-making companies like Mirada, for their shareholding structures.

Brokers (and AIM itself) need to stop allowing micro caps to float with absurd shareholder structures like this -

Knights group (LON:KGH)

Up 9% to 93p (at 08:35) (£80m) - FY Trading Update - Paul - GREEN

Knights, a fast-growing legal and professional services business in the UK, today provides a trading update for the year ended 30 April 2023.

We last (briefly) looked at this expanding chain of legal firms here in Nov 2022, when a reader TheFloatingInvestor flagged a £1m Director buy, after a reassuring trading update. I had a quick look, and confirmed that it looked super-cheap.

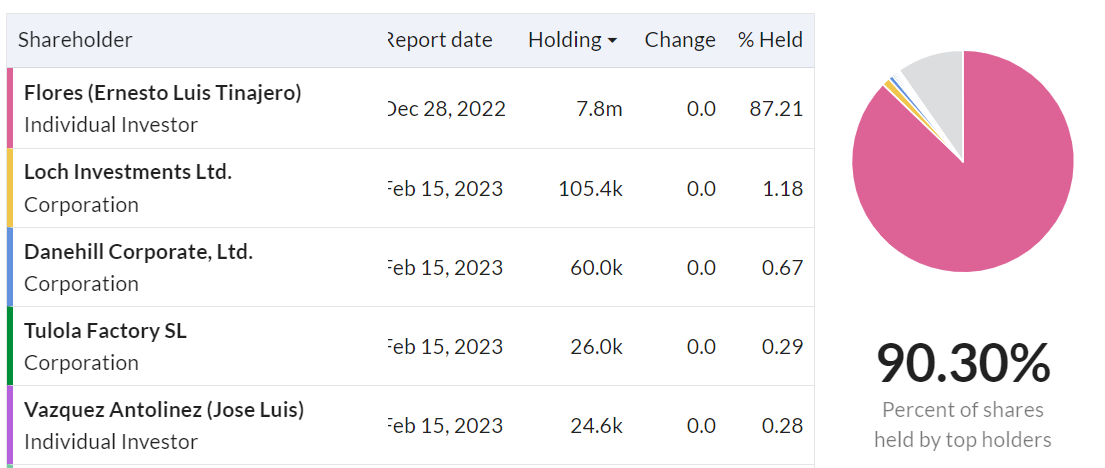

Although I’m not a fan of listed legal/accountancy firms, due to their inherent conflict of interest between fee earners and outside shareholders. Mind you, when something gets down to a forward PER of 4.0, with a healthy dividend yield on top (although no asset backing), value investors are compelled to take a closer look! Here are Knights value stats as of last night -

Today’s update - is for FY 4/2023 - key points -

Revenues £142m (up 13% vs LY) - although this is £4m behind the StockReport’s consensus broker forecast.

Underlying PBT c.£21.5m (up 19% vs LY) - the StockReport figure is not directly comparable, since it is PAT of £17.1m. That implies a corporation tax of around 20.5%, which is in the right ballpark. It’s a pity Knights didn’t specify if the £21.5m adj PBT is in line with expectations or not - that’s the most important piece of information in a trading update, so to omit it is a schoolboy error in my view. I’ve just lodged a complaint with the company’s advisers.

EDIT: I've just had a reply saying my feedback has been passed on to the company, and that the house broker has apparently issued an update note which indicates that yes, this update is in line with their expectations. So maybe it's one of those updates where, by not mentioning it, the implication is that's it's in line with expectations. I much prefer that to be specifically stated, rather than implied. End of edit.

Debtor days - key for lawyers, as it’s capital tied up. This is a reasonable 30 days (i.e. unpaid customer invoices for the last 30 days billings, which is very reasonable actually). Plus a total of 87 days is quoted for “lock up” - which is unpaid invoices, plus unbilled work-in-progress. I haven’t compared this figure with other listed lawyers, but it sounds reasonable, at just under 3 months. This is improved from 98 days lockup at H1 end.

Net debt is £29m, significant given the market cap of £80m. Well within the £60m facility limit. Also well down on the £35.6m reported at end Oct 2022.

Acquisitions - 2 in the year, have gone well. 2 more in the pipeline. So it sounds like the business is on the front foot, making further acquisitions. It seems to be buying up smallish legal firms outside of London. So a key question would be to find out how they manage all the different firms, and what synergies & disciplines are imposed. Often legal firms are quite badly run, and inefficient, so there can be advantages to bringing them into a well managed group. Although how are the big fee earners retained & incentivised, is a key question?

Balance sheet - there’s no asset backing, with the last reported balance sheet showing NTAV of around nil. So bear in mind that the working capital is financed with bank borrowings, which increases risk if something were to go wrong. Plus of course bank borrowings are more expensive now.

Paul’s opinion - I previously thought Knights looked cheap, and today’s update confirms that.

So it’s a GREEN view from me, although I’ve only done a fairly brief review this morning, and would suggest anyone buying the shares needs to do considerably more research, as always, because we cover so many companies here, it’s possible we might have missed something important.

In particular, I can’t remember what went wrong in March 2022, but that was the trigger for the shares massively de-rating, so that would be the first thing on the list to research in more depth.

Maybe there’s an opportunity here, with the business seemingly having recovered, but the share price has not followed suit, still in the doldrums. Note the StockRank has also been rising strongly and is now quite good -

C&C (LON:CCR)

Down 17% to 127p (£502m) - Profit warning - Paul - AMBER

C&C Group plc (‘C&C’ or the 'Group’), a leading, vertically integrated premium drinks company which manufactures, markets and distributes branded beer, cider, wine, spirits and soft drinks across the UK and Ireland…

Graham normally covers this Irish-headquartered group, and did an excellent review here in Oct 2022, which I’ve just read to get me up to speed quickly.

A ERP system upgrade has gone wrong at the businesses (Matthew Clark & Bibendum) bought out cheaply from the collapse of Conviviality in 2018 -

it has encountered significant challenges, in terms of time, cost and customer service…

We’ve had a few companies report similar problems with IT upgrades recently, eg Virgin Wines UK (LON:VINO) - a reminder to see announcements about buying new IT systems at any company as an amber flag maybe?

They thought the issues were under control in March 2023, but deteriorated again in April. May is getting better, but involving heavy additional costs.

What’s the financial impact? Hefty -

C&C currently expects a one-off impact of c.€25 million associated with ERP system disruption in FY2024, reflecting the cost associated with restoring service levels and lost revenue. There is expected to be a consequential increase in working capital in FY2024, however leverage is expected to remain within the Group’s stated range of 1.5x to 2.0x.

The rest of the business is performing in line -

Excluding the impact on MCB, C&C is currently performing in line with management expectations for FY2024 and the Board is confident in the Group’s medium and long-term strategy and prospects.

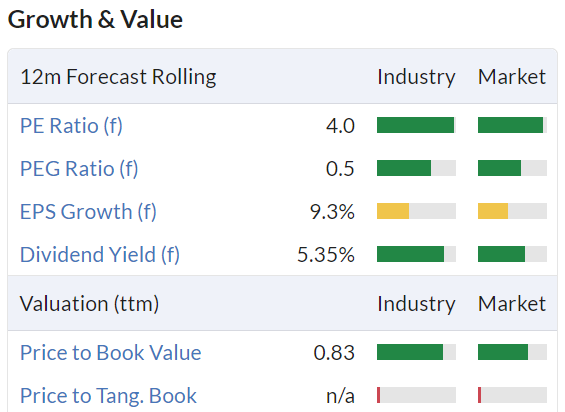

Guidance - this sounds quite strong actually. I’m assuming that the reiteration of previous guidance is because the one-off impact above will be treated as exceptional, and adjusted out? -

C&C re-affirms the guidance given in its Pre-Close Trading Statement of 23 March 2023. Specifically, the Group expects to report operating profit of €84 million. C&C’s strong free cash flow generation, together with increased balance sheet strength will also enable a re-instatement of dividend payments to shareholders, with respect to FY2023.

Management changes - the CEO has fallen on his sword, or been pushed maybe, as the Chairman and CFO step up, the CFO becomes the new CEO.

Results are due out shortly, so hopefully it’s a day Graham is working, so we can get his more expert view -

The Group will issue FY2023 full year results on Wednesday, 24 May 2023.

Paul’s opinion - it’s dangerous buying after a profit warning, as problems can snowball quickly - I’m sure everyone can remember how fast Conviviality unravelled, with minor initial problems soon becoming massive, insurmountable problems that ended up with the group going bust. Hence it’s bound to unsettle investors in CCR that the same businesses which brought down Conviviality have now dented CCR’s share price by 18% today.

I’ve had a look at CCR’s last balance sheet, and it’s solvent, but not particularly strong, with NTAV of 85m euros, which I don’t see as being a lot, given the size of the business. It’s dependent on bank funding, so the covenants do matter.

If the IT problems get sorted out promptly, then I imagine this issue could just be a bump in the road, providing possibly a good entry point for investors who already like the company.

Or, it could get worse, we don’t know.

Personally, I don’t see anything serious enough to be ringing alarm bells, but can’t get madly excited about the upside either. So it’s a neutral, AMBER view from me at the moment.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.