Good morning! It's Roland and Graham here with today's small-cap report.

Today's report is now finished (10.00).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

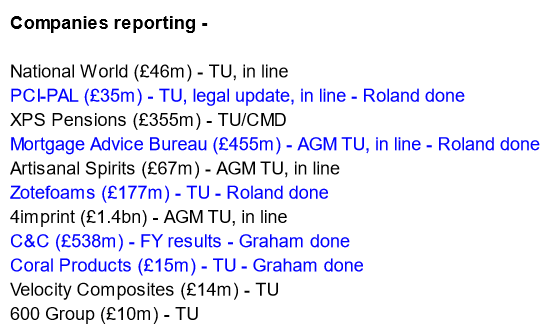

Summaries of main sections below:

Mortgage Advice Bureau (Holdings) (LON:MAB1) - 796p (pre-market) (£454m) - AGM TU, in line - Roland - GREEN

This mortgage broking business reports in line trading against a backdrop of more stable market conditions. MAB gained market share in a declining market in Q1, despite reducing headcount. I remain positive about this business, although it’s starting to look fully priced on a near-term view.

Coral Products (LON:CRU) - 16.75p (pre-market) (£15m) - TU, slightly ahead, forecasts slightly reduced - Graham - AMBER

This company’s broker estimates for FY 2024 are slightly reduced despite news that FY 2023 is ahead of expectations. I still remain impressed that Coral Products is able to digest four acquisitions at the same time. Shares are superficially cheap but perhaps priced right.

PCI- PAL (LON:PCIP), up 5% to 56.2p (£37m) - TU and legal update, trading in line - Roland - AMBER

This cloud-based secure card payment provider appears to be trading well, but faces potentially significant legal risks and has not included an update on cash performance in today’s statement. Too speculative for me, but potentially an interesting business.

C&C (LON:CCR) , 134.4p (-2%) (£522m/€602m) - FY results, profit warning - Graham - GREEN

This drinks/distribution business is trading in line except for a very costly, disruptive ERP upgrade. Leaving that to one side, its drink brands are thought to have seen improved market share. Balance sheet is improved. Dividend declared. Still seems too cheap for me.

Quick comments (no section below)

Zotefoams (LON:ZTF), up 3% to 375p (£184m) - TU, in line & chair succession - Roland - GREEN

This materials group has issued an AGM statement today. Trading during the four months to 30 April “was strong”, with sales up 15% and margins benefiting from pricing and other factors. Cost inflation is said to have eased.

Product volumes were mixed across the different parts of the business, but pricing appears to have been fairly strong across the board. Good cash generation has left leverage at 1.1x EBITDA, compared to 1.2x at the end of 2022.

The company confirms chair Steve Good will stand down at today’s AGM and be replaced by Dr Lynn Drummond, as previously announced.

Outlook: further sales growth is expected, mainly from the High-Performance Products portfolio (foam used in footwear). Market conditions for industrial customers are expected to remain “challenging everywhere except for North America”.

Overall expectations remain unchanged; consensus forecasts suggest earnings will fall by around 5% this year, before recovering strongly in 2024.

Roland’s view: this business seems to be in good health and performing well. Leverage is modest and cash generation appears good. The 2023 forecast P/E of 20 does not seem excessive to me and could prove good value if Zotefoams can deliver on FY24 forecasts. Overall, my impression is positive.

Graham's section

Coral Products (LON:CRU)

Share price: 16.75p (pre-market)

Market cap: £15m)

This is “a specialist in the design, manufacture and supply of plastic products based in Wythenshawe, Manchester”.

I covered their results back in December, and failed to find anything too worrisome. They were digesting a remarkable four acquisitions, which now accounted for the majority of their sales, but all four were said to be performing according to plan.

This morning brings us a trading update for the full year ending April 2023, and it’s good news: revenue is expected to be over £35m, “slightly” ahead of market expectations. As for profits, adjusted EBITDA will be not less than £3.5m, which is ahead of market expectations.

Executive Chairman comment: In spite of the challenging trading conditions in the second half of the year, we have had a successful year… This marks a significant step towards our objective of building a specialist UK plastics business of scale, targeting profitable, high-demand sectors".

Estimates: It would be helpful if the company included market expectations in its RNS, as other companies are increasingly doing. Today’s broker note from Cenkos outlines that their previous forecast was for revenues of £34.6m and adjusted EBITDA of £3.1m. So each of those numbers is beaten by £0.4m.

Looking ahead, the estimate for adjusted EBITDA in the current financial year FY April 2024 is reduced by a few percentage points to £3.9m.

Perhaps this is just a minor quibble, but wouldn’t it be more helpful if the RNS itself mentioned that the outlook for FY 2024 had slightly deteriorated?

The broker says that it is reducing its FY 2024 estimate due to the mention in the RNS of “challenging” trading conditions in H2, but the RNS itself says “in spite of the challenging trading conditions in the second half of the year, we have had a successful year”! If I was reading this RNS without access to the broker note, I could easily conclude that expectations for FY 2024 might have increased!

Graham’s view

Putting quibbles around estimates to one side, I continue to think this micro-cap looks to have some potential. I remain impressed that all four acquisitions, vastly increasing the scale of the group, continue to perform as hoped. Remember that the deals were done without diluting shareholders, but instead by leveraging up the balance sheet - a risky play, but with potentially high rewards if it works out.

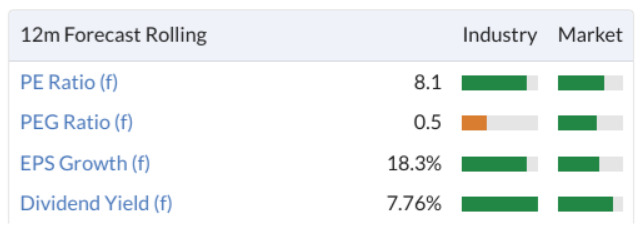

I won’t be able to give the stock the thumbs up since net income is of course expected to come in quite a bit lower than adjusted EBITDA, around £1.6m, so the stock is cheap but not outrageously so in the current environment:

Due to the nature of the business - manufacturing and supplying plastic products - the gross margin is on the lower end of the spectrum at c. 27%. This is not the type of business that I am inclined to put in my personal portfolio, as I would be surprised if economic returns here proved to be significantly above average over the long-term. Let’s hope they can prove me wrong on that point.

On balance, I continue to view this as one of the more impressive little nano-caps that I’ve come across in recent months.

C&C (LON:CCR)

Share price: 134.4p (-2%)

Market cap: £522m (€602m)

C&C Group plc (‘C&C’ or the 'Group’), a leading, vertically integrated premium drinks company which manufactures, markets and distributes branded beer, cider, wine, spirits and soft drinks across the UK and Ireland announces results for the twelve months ended 28 February 2023 (‘FY2023’).

This stock has still failed to recover to the levels it reached prior to March 2020:

I wrote about its H1 results in October, providing an overview of the company’s post-Covid struggles, but thinking that the stock could be well-positioned for a recovery. Looking back now after another 6-7 months, the share price doesn’t agree with me yet!

Here are the full-year results for FY February 2023:

Net revenue +18% to €1.7 billion

Operating profit +75% to €84m

Operating margin increases to 5% (last year: 3.4%)

In further good news, the company declares a dividend for the first time since 2020.

Net debt fell during the year from €191m all the way to €79m. This progress was admittedly boosted by the €66m sale of the company’s stake in Admiral Taverns, but it makes for a radically improved balance sheet. The company’s net debt to adjusted EBITDA multiple is now below its medium-term target range of 1.5x - 2.0x.

Strategic highlights - both Tennent’s and Bulmers are said to have enjoyed increasing market share, but there are challenges for each of them.

Tennent’s has suffered from the ongoing trend for beer premiumisation. The news from it is slightly more positive today:

"Tennent’s performed strongly, with volumes up 4.8% in the year including 25.8% in the on-trade. Tennent’s continued to gain share in the Scottish on-trade during FY2023, with its share of total beer in Scotland up 1.8ppts to 29.6% in the twelve months ended February 2023… Amongst mainstream beer brands, Tennent’s represents 2 in every 3 pints poured in the On-Trade (68.9%), and across all Beer it represents 1 in every 2 pints poured in the on-trade”

For Bulmers, the cider category has weakened considerably, though C&C says that people are returning to apple cider.

Outlook is again very mixed:

Macroeconomic conditions continue to impact the trading environment which is expected to remain challenging in the near term, particularly in the GB market.

Additionally, the company has implemented an ERP system upgrade - these are so often costly and disruptive, but thought to be necessary! For the C&C distribution businesses, it has taken longer than expected and had a “material impact on service and profitability”. I hope customers haven’t been too put out! It’s a €25m hit to C&C.

Excluding this problem, trading is in line with expectations.

Graham’s view

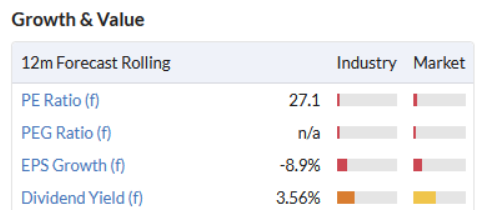

It’s not easy (and perhaps not clever) being positive on this stock, when it seems to be facing an uphill battle to reach the level of profits it had back in 2018/2019.

However, despite the economy and despite the challenges faced by its key brands, it has still managed to earn a net income for FY February 2023 of c. €52m. And these figures turned out to be very clean, with less than €1m of “exceptional items”.

Next year’s figures will be less clean, thanks to the fiasco at the distribution division and its ERP upgrade. And when those figures are released, I will probably be inclined not to write off the ERP-related costs as being entirely exceptional.

Even so, I maintain reasons for optimism with this stock. The balance sheet is much improved, so they are well-placed to deal with the challenges they are facing. Market share within their respective categories remains high. And the declaration of a dividend is a sign from management that the crisis and the difficulties associated with Covid are fully in the past.

I’ll give this stock the thumbs up, as I do think it offers some significant brands at a reasonable price, so there is potentially some value to be had with this one.

Roland's section

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Share price: 796p (pre-open)

Market cap: £454m

This mortgage broker has a good track record and its results were well-reviewed by Graham back in March.

Trading summary: today’s AGM trading update does not contain any nasty surprises. Adviser numbers have stabilised as previously guided, and the company expects to see a return to growth later this year. Management reports a strong pipeline of new Appointed Representatives.

While the value of mortgage completions fell by 21% in the wider market in Q1, MAB’s total completions were broadly unchanged at £5.8bn, suggesting a gain in market share. The company says this is being achieved despite a reduction in advisers since Q4 2022.

MAB says market conditions are showing “early signs of increasing activity and mortgage approvals” after the disruption seen following the mini budget.

Performance remains in line with the Board’s expectations, “with further improvement expected in the second half of the year”.

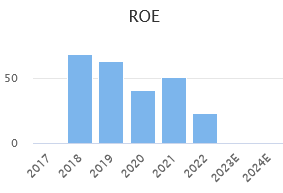

Roland’s opinion: this looks like a solid update from a management team that’s in control and has a clear strategy. MAB’s share price has continued to rise since March and the firm’s shares do not look especially cheap to me. But if growth resumes from next year as expected, then I think the stock could soon grow back into its valuation.

Consensus forecasts price the stock on 30x 2023 earnings, falling to a P/E of 24 in 2024. This may not be excessive if the business can return to generating 50%+ returns on equity as seen in the past.

A longer slowdown in the housing market could put pressure on profitability, but MAB’s commentary suggests to me that the group is able to scale its capacity effectively to reflect market conditions. I remain positive on this stock, although I might hope for a cheaper entry point.

PCI- PAL (LON:PCIP)

Share price: 56.2p (+5% at 09.20)

Market cap: £37m

Trading and Patent Case Updates

As a result of this momentum, the Board is confident that results for FY23 will be in line with management expectations.

The growth outlook for this cloud-based secure payment provider is currently clouded by legal cases. But PCI-Pal’s market cap has risen from £29m to £37m since Graham wrote about this stock in March, so the market seems to have become more optimistic.

Today’s update covers both trading and legal issues, so let’s take a look at what has unfolded over the last two months.

Trading update: new sales seem to have accelerated during the second half of the year (y/e 30 June 2023).

PCI-Pal says that newly-won annualised recurring revenue for the year-to-date has risen to £3.4m, from £1.47m at the half-year mark. According to management, 86% of these new contracts have come through the company’s partner network, with £3.0m from new customers.

This represents a 34% increase in new business, compared to the same period last year.

Highlights are said to include “a number of enterprise deals in the US”, including a deal with a Fortune 50 healthcare provider and “one of the largest electronics companies in the world”.

PCI-Pal also reports the company’s largest contract to date in Australia, with “a well-known global insurer”.

Outlook: trading for the full year is said to remain in line with management expectations. Broker FinnCap reiterated its forecasts this morning, guiding for an adjusted loss of 2.8 pence per share this year (note available on Research Tree).

Stockopedia consensus forecasts suggest PCI-Pal could turn profitable next year.

With a market cap of £37m, this business is currently valued at 2.5 times forecast sales for the year. That’s not necessarily an outlandish valuation for a tech stock. But I don’t think we can ignore the risks posed by the company’s ongoing legal dramas.

Patent Case update: PCI-Pal’s operational progress may not count for much if it loses in court.

The company is currently involved in legal cases relating to patent infringement claims brought by rival payment operator Sycurio Limited. PCI-Pal has also made counter claims alleging the invalidity of related Sycurio patents.

Since the last update in March, the two companies have swapped expert witness reports and held discussions regarding the case. However, there doesn’t seem to be much prospect of a settlement:

To date these discussions have not produced any sensible settlement options that the Board believes are in the best interests of the business. The Board continues to seek the best outcome for the business and is entirely prepared for trial on that basis.

A UK trial relating to these claims is scheduled for eight days from 12 June 2023. A ruling is expected up to four months after that time.

It’s worth noting that US court proceedings are also expected – in its March results, the company said these were yet to be set, but expected in late 2024.

Roland’s view: PCI-Pal appears to be trading well. Although I am not familiar with the firm’s competitors, I have no reason to doubt the quality of the company’s product or its growth potential.

I should also point out that the company says it has plans in place such that if it loses the patent cases, it can make changes to its products “to continue operating in a non-infringing manner”. This suggests that the firm could shrug off such a legal loss, but I suspect the reality could be more challenging.

Would customers and regulators remain supportive and accept the technical changes?

Would the changes affect the future development potential of the product?

We don’t know.

I think it would be easy for shareholders to underestimate the risks in this situation. Even if the legal issues can be resolved without any impact on trading or growth, I think there’s a risk the firm could still run short of cash.

In the half-year results, management said they were confident the company would reach monthly cash flow breakeven during the second half of the year.

This target was not mentioned today, nor was the current cash balance disclosed. The latest update we have is that cash stood at £3.4m at the end of February 2023. For contrast, cash burn during the first half of the year was £3m.

I haven’t looked into the funding arrangements for the company’s legal cases. But even if they have been fully funded externally, I think there remains a risk that the firm will need a further injection of cash to reach operating profitability.

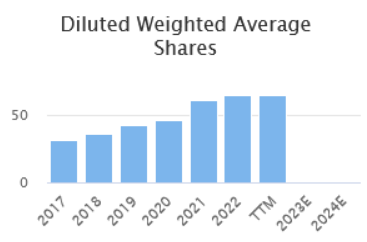

Shareholders have suffered significant dilution in the past – the share count has doubled since 2017:

In my view, this is an interesting business with decent growth potential. It could easily also become a takeover target.

However, while the legal situation remains uncertain and the business continues to lose money, I think it’s prudent to view this as a highly speculative situation.

I’m going to rate the shares as amber. It’s too risky and uncertain for me, but I think there could be an opportunity here, if the company can resolve its legal issues favourably.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.