Good morning!

I'm on Day 4 of my charity challenge, and apart from a headache & irritability (which someone told me is caffeine withdrawal symptoms, as there was no money in the budget for coffee), it's going alright - I think there will be just about enough food to last today & tomorrow. I posted a video blog last night, for anyone who is sufficiently bored to want to watch it! Donations are rolling in, everyone is being amazingly generous, so thank you all very much indeed! We've already raised £850 online, £175 offline, and with Gift Aid that comes to about £1,200 - pretty awesome stuff, in my opinion!

March and April were so busy that I didn't have time to record any audiocasts. However, the one in early Feb with experienced investor/trader Richard Crow, was so popular that I invited him back for a recap. So here is the link for yesterday's discussion between Richard and I. It's nearly an hour long, so lots of material covered, and plenty of interesting stock ideas.

Character (LON:CCT)

Share price: 410p

No. shares: 20.8m

Market Cap: £85.3m

(at the time of writing, I hold a long position in this share)

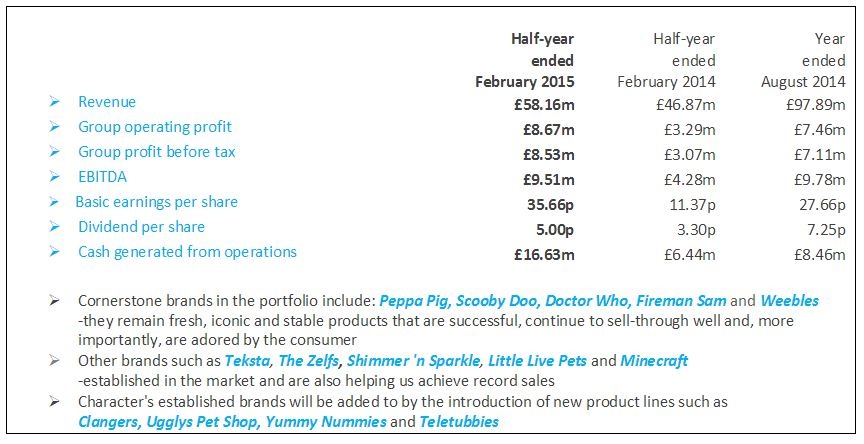

Interim results - covering the six months to 28 Feb 2015 are out today. I nearly fell off my chair when I read the headline figures, which are fantastic, as shown in the table below. They haven't put in the % gains, but as you can see they are massive - PBT is up 178%!

Broker forecast for the current year is 40p EPS, so as you can see, by achieving 35.66p EPS just in H1, they look set to absolutely smash full year forecast.

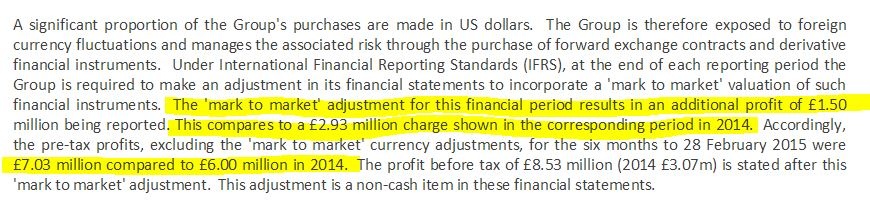

Clearly, from the flurry of early trades, quite a few people rushed to buy more shares. The trouble is, the headline figures are very misleading, and the company and its advisers deserve a serious ticking off for this. You have to scroll down a considerable way through the narrative to come across this vitally important clarification;

So underlying profit before tax wasn't up 178%, it was actually up 17%!

Isn't it funny how companies are so keen to highlight underlying profits when it goes in their favour, but they bury the bad news deep in the narrative when it goes against them! Anyone who bought first thing, on the headline numbers, and read the narrative later, would rightly feel misled.

Anyway, putting that aside, the figures & outlook are still very good, and I think the shares could potentially have considerable more upside. I was on the case early with this share, and flagged that "it looks like this could be a good time to buy their shares..." on 6 Sep 2014, when the shares were 140p.

Then I was more positive here on 8 Sep 2014, flagging them as "cheap" at 214p.

And again on 3 Dec 2014, as "still good value" at 245p.

And again here on 16 Jan 2015, as "a price of 400-500p looks possible", when the shares were 311p.

So it just goes to show that there have been some good winners flagged up here, as well as things that have disappointed. The trading updates from Character have just been getting better & better.

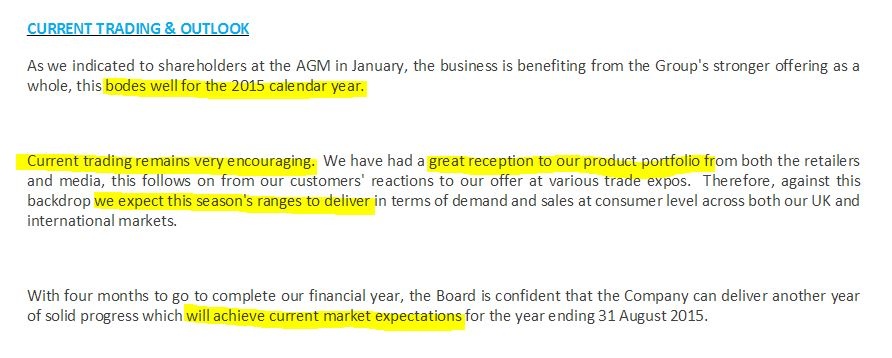

Outlook - sounds very positive. I am happy to place reliance on management comments about reaction to ranges being good, because when they said this last year, it was indeed a precursor to excellent results;

Valuation - It seems a little odd that they are only saying "achieve current market expectations", and not beat them. Given that the H1 EPS figures is close to the full year forecast, I am expecting them to beat expectations by a considerable amount. Remember forecast is 40p, and they are reporting 35.66p just for H1 today, and there doesn't seem any particular seasonality.

Even if we adjust out the mark to market gain of £1.5m, then I make adjusted underlying EPS which the company should have reported, but didn't, of about 29.4p for H1. So even if H2 slips back to say 20p EPS, then nearly 50p EPS should be possible for the full year. At 410p per share currently, that puts them on a PER of only 8.2.

Even if you go with the broker forecast of 40p, which is almost certainly going to be upgraded, then you're still only on a PER of 10.3. So it still looks cheap.

Balance Sheet - looks alright, but not particularly strong. Net tangible assets is £10.9m, and the current ratio is 1.22, so just about OK on my usual rules.

Cashflow - has been remarkably strong, and I'm surprised to see reductions in stock & debtors, given that turnover is up. It looks like there might have been some lucky timing there, so some of the very strong cashflow might reverse in H2. It's all absolutely fine though.

Share buybacks - this is very striking - the company made a terrific call, by buying back 2.3m of its own shares in the six months, at an average price of 260p. This is on top of 1.8m shares bought back at an average of just 182p in the prior year period.

Generally I'm not very keen on share buybacks, because companies seem astonishingly inept at timing them - they usually seem to do them when the share price is too high, and destroy shareholder value. Whereas when the share price is on the floor, and they have surplus cash, they do nothing. That's a general point.

Whereas this company has proven itself to be very shrewd, and has done big share buybacks when the shares were cheap, and trading was strongly improving. Very well done to them! The Executive Chairman has been selling down his stake, perfectly reasonable given that he's 70 year old. Some of those were sold back to the company in buybacks, which is a little odd, but I suppose why not?

My opinion - I'm really hacked off about the results being presented in such a misleading way, but that has only very briefly dented my overall pleasure with this share, indeed I'm happy to hold & buy more at the current level, given how strong the outlook sounds.

The icing on the cake is that Stockopedia likes it too, a StockRank of 98 - I'm always very happy when my own stock ideas also have strong StockRanks.

As regards downside risks, I've covered this in previous reports - toys come in & out of fashion, etc. However, being the 4th largest player in the UK toys market, Character looks to me like a company on a roll.

EDIT: A new broker (Allenby) has initiated coverage with a price target of 575p today, I understand.

Optare (LON:OPE)

De-listing - one of my main motivations for writing these reports is to help readers dodge bullets. Warning readers about shares that look dangerous often leads to receiving abuse from people who are long of the shares, but if it saves other people money, then it's worth it.

Optare is an absolute dog. I've only reported on the company here once, in Aug 2013, where I said;

Please excuse me for quoting myself, but it saves typing it all out again!

Anyway, the above has turned out to be correct, and today the company has announced it's de-listing, with the 75.1% shareholder having approved it, so the 75% vote required at the EGM is a done deal.

The shares are down 56% to 0.07p today on this news, and in my view the shares are worth nothing.

My opinion - this case highlights how important it is to avoid, or consider very carefully, any share which has a controlling (over 50%) shareholder. They can do whatever they like, and minority investors are completely at their mercy.

It also highlights that loss-making micro (or nano) caps usually end up the same way - either going into Administration, or being de-listed. When a de-listing is announced, it's usually a loss of at least 50% instantly.

Very occasionally, it can work out, holding shares in a private company, but most of us wouldn't want to. The key advantage of holding listed shares is that you can sell whenever you want, usually.

So hopefully this case is another reminder of the dangers of scraping the bottom of the barrel in terms of market cap, and quality. Plus the danger of a controlling shareholder.

Ubisense (LON:UBI)

Share price: 115p (down 18% today)

No. shares: 25.1m

Market Cap: £28.9m

Profit warning & fundraising - It's definitely blow my own trumpet day today, and why not - after about 4 profit warnings on stocks I like in recent weeks (out of a portfolio of over 50 stocks though), it's probably important to point out some of the things I've actually got right!! This is one of them.

Looking back through the archive, I've repeatedly warned that this company has inadequate financing, indeed was relying on bank debt, which is very dangerous for a loss-making company. Banks are not in the business of providing risk capital to companies (in theory anyway), since their lending margin is not wide enough to suffer lots of bad debts.

My crystal ball was on top form here on 17 Mar 2015, when I commented here (and again, apologies for quoting myself, I'm being lazy);

The profit warning today looks relatively mild - with contract delays meaning that Solutions revenues will be similar to 2014, but Services revenues in line with expectations. They're cutting costs to mitigate the losses. No indication is given of the impact on full year figures, but it doesn't sound disastrous, reading between the lines.

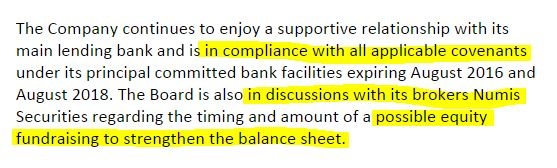

However, the company is skint of course, as I've mentioned before, relying on bank debt. Loss-making growth companies should never, ever have debt. It's a disaster waiting to happen. Anyway, as I predicted, the company needs to raise fresh equity, and comments today;

So clearly the need to raise fresh money was indeed the reason Numis were appointed in Dec 2014, as I suspected. It's dangerous telling the market you need to raise more money, as unless someone supports the share price, then people will just sell in the market, and chase the price down, with Placees repeatedly lowering the price they are prepared to inject fresh funds at.

That said, Numis seem to be very accomplished at doing fundraisings, from what I've observed recently, so we'll see.

The upward chart movement in recent weeks seems spurious, maybe even a little suspicious. So this is one situation where a bowl forming was not a good signal! (that's a reference to my interview with Richard Crow last night, who likes bowls on charts! Although Richard is dismissive of AIM, so he wouldn't have gone near this stock anyway).

My opinion - it's not a sensible investment as things stand now. However, in a bull market, a stock with a decent jam tomorrow story like this company has, might come back into fashion for a while. So if Numis get a decent sized fundraising away, then it's the sort of thing I might have a little punt on, in my trading account, for a recovery.

Globo (LON:GBO)

Share price: 51p (up 7% today)

No. shares: 373.7m

Market Cap: £190.6m

(for the avoidance of doubt, I have no position in this share at the time of writing)

Preliminary results - for calendar 2014 are out today - rather late, four months after the year end. As usual, the headline numbers look amazing - revenue up 49% to E106.4m, EBITDA up 41% to E50.9m, profit before tax up 30% to E35.7m. EPS up 27% to E0.094, ahead of market expectations. However, free cashflow is stated by the company to be only E7.3m - so only 20% of PBT converts into cash.

Intangible assets - the P&L is safely ignored, as it's effectively fantasy, in my eyes. The E35.7m profit before tax is achieved by diverting an enormous chunk of debit entries (costs) from the P&L, and onto the balance sheet, mainly into intangible assets. These are mainly just payroll costs, so they're worth zilch. They're not an asset at all, but they sit on the balance sheet as if they were.

You can capitalise costs into intangible assets under current accounting treatment, if you call it development spending. As Dr Paul Jourdan of Amati pointed out at the UK Investor Show, sitting next to me on the panel discussion about value investing, many fund managers are dismayed with this new accounting treatment, as they had previously fought hard to stop companies capitalising costs into intangible assets. So in his view (and mine), such capitalised costs should be reversed by investors when looking at the accounts.

In this case, intangible assets (excluding goodwill) rose by E12.9m, so at the very least I would deduct that figure from PBT, to reduce it from E35.7m to E22.8m.

Cashflow statement - I find this far more revealing than the P&L, when looking at the accounts of companies that I suspect are indulging in creative accounting (several changes of auditor at Globo strongly reinforce that suspicion - one of many red flags with this company).

Several things jump out at me. Firstly, why is a company with substantial net cash paying substantial interest payments of E4.1m? Also, why did a company with substantial net cash repay E10m of borrowings, but take out E30.0m of new borrowings in 2014? That simply doesn't make sense to me. If you have a lot of spare cash, then you pay off your borrowings, to save interest. You don't take out new, larger borrowings. Very, very odd. Can anyone shed any light on that?

So the net cash from operating activities is E31.0m. Of that, most of it, E24.4m is spent on capex. Since tangible assets are negligible, what this means is that almost all of that money was spent on intangible assets - i.e. payroll costs! Add in interest received, and you arrive at free cashflow of E7.4m, which is near enough (after rounding) to the company's statement that it made free cashflow of E7.3m.

They also spent E9.1m on acquisitions, which is fair enough, it's fine to exclude that from free cashflow, as it's discretionary.

Therefore, the way I look at things, the free cashflow figure of E7.4m is effectively the real level of profitability the company is achieving, and the much higher P&L numbers are fantasy. You don't have to agree with me, this is just my opinion.

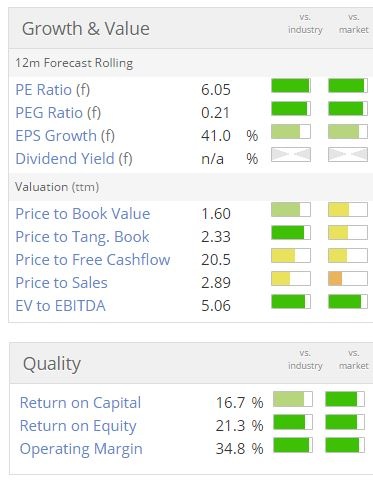

As is often the case with companies that indulge in creative accounting, it can fool a computer model! So you can see that the StockRank is high, at 85, and the Growth & Value section is a sea of green.

This is where, in my opinion, you need shrewd human input, to spot the flaws that the computers can't necessarily pick up, because the computer has to assume that the reported accounts are perfect. I don't, and I know what to look for, to identify the imperfect ones!

The non-existent dividend yield is a big tell. Again, a hugely profitable company with pots of cash should be paying decent divis, right? Yes it should, but Globo has never paid a divi. Something just isn't right here, in my view.

Balance Sheet - I've covered intangible assets already, but the other odd items here are "other receivables" within fixed assets - it's very unusual to see any debtor figure up there. I think this might relate to the deferred payments from when the company inexplicably decided to sell 51% of a part of the business to its management, and gave them a cash dowry to enable them to "buy" the business back. There is only one reason to explain why that was done - it was to get the figures off the consolidated balance sheet. It's now an associate, which is a single line entry.

Debtors - this is always a warning sign, if it's more than the usual range of about 60-90 days turnover. In this case trade debtors are E50.8m, which is 48% of turnover for the year. That's way too high, and I don't care what the reasons are, it's just far too high. The ageing of it looks to have deteriorated somewhat too, see note 4 to today's accounts. Although it's easy enough to credit off old, unpaid invoices, and then re-invoice them anew.

A lot of the unpaid debtors are probably Greek Govt, or Greek corporate debts. Which with Grexit impending, what's the likelihood a lot of Globo's debtors will have to be written off? Very high I would say.

Furthermore, there's another E21.1m in other debtors, which relate to deferred income. So the company has booked sales (and hence profit) through the P&L, but not yet billed the customer. So it sits in other current assets until an invoice is raised, and then moves into debtors. So really, total debtors are E71.9m, which is the bulk of 2014's entire turnover!

Cash - the company says it has E82.8m cash, and it did raise a load from a Placing some time ago. So why does it also have E42.4m in bank borrowings? Are they masochists, who enjoy paying the bank interest unnecessarily? On the face of it this seems crazy, but maybe there is an explanation - is the cash marooned in one country, and the debt in another possibly, I don't know?

My opinion - the figures have never looked right with this company, and I strongly believe that sooner or later, there will be big write-offs from this balance sheet. I don't believe the figures, to be blunt. Nor does the market, or the PER wouldn't be 6, would it?!

That said, there does appear to be something here. If you do believe the numbers, and some people might, then there seems good growth in licenses sold, etc.

Anyway, as you might have guessed, it's not for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.