Good morning and welcome to today's report.

Today is Presidents' Day in the US, so American markets will be closed and there will be no news from US companies.

That's all for today - thanks for reading, we'll be back in the morning!

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

| Renewables Infrastructure (LON:TRIG) (£1.65bn | SR87) | NAV, dividend & portfolio update - Q4 2025 | NAVps fell by 5.7p to 104p per share during Q4, due to factors including a reduction in revenue forecasts and lower power prices and outages in Sweden. 2025 dividend target of 7.55p has been met with net cash cover of 1.0x | AMBER = (Roland - I hold) I’m staying neutral ahead of Friday’s results, as I don’t believe today’s (mildly negative) update contains sufficient new information to justify a change of view. |

| Hunting (LON:HTG) (£746m | SR85) | Organic Oil Recovery Pilot Test Result | Notes the Buccaneer Energy announcement, which details the pilot test results at its Pine Mills field in East Texas, using Hunting's Organic Oil Recovery enhanced oil recovery solution. Production within the oil wells reported a 100% uplift, and in one well reduced the water cut to zero. | AMBER = (Mark) This announcement highlights the potential of this technology to improve production and significantly reduce water-cut for operators. However, this potential has been known and this tech was bought for $17.5m last year, meaning that its value may not be significant overall for a £700m+ market cap company. I find it a bit of a mystery that the share price has been so strong here recently, when brokers’ EPS forecasts are consistently declining. None of the Ranks stand out apart from the Momentum Rank. While this remains so strong, I think it makes sense to keep our neutral view. However, without much value support left or an acceptable return on capital, I would be quick to take a more negative view should that share price momentum falter. |

Conduit Holdings (LON:CRE) (£653m | SR56) | Nicholas Shott appointed as Chair of the Board He is an existing non-executive director. | ||

Pinewood Technologies (LON:PINE) (£502m | SR28) | On Friday Apax said it no longer intends to make an offer for Pinewood due to “challenging market conditions”. | AMBER ↓ (Roland) The failure of this offer is disappointing for shareholders, but do the shares now offer a buying opportunity? Looking back at our commentary and recent developments since our last view in June, I note that FY26 forecasts were cut in October and question why Apax Partners might have chosen to withdraw. Is this merely an indiscriminate casualty of the wider AI-SaaS sell off, or did Apax decide the growth opportunity was not as strong as originally thought? With FY25 results due in April, I think it makes sense to take a neutral view until we have more detailed information in recent trading and the near-term outlook. | |

ITM Power (LON:ITM) (£367m | SR20) | Received Notice to Proceed on a 20MW contract that has been previously announced. ITM can now begin work and has added the contract to its order backlog. | ||

Tungsten West (LON:TUN) (£246m | SR32) | Executed supply agreements for the Crushing, Screening and Ore Sorter Facility and the Line Pressure Jigs system. These form part of the plan to restart the Hemerdon Mineral Processing Facility. | ||

Optima Health (LON:OPT) (£189m | SR69) | Acquired PAM for £100m cash-free/debt-free. PAM is a provider of outsourced occupational health and wellbeing services in the UK & Ireland. It generated adj EBITDA of £8.2m from £67m of revenue in 2025, giving a EV/EBITDA purchase multiple for this transaction of 12.2x. | ||

Pulsar Helium (LON:PLSR) (£175m | SR34) | The Jetstream #6 appraisal well has encountered three additional pressurized gas zones, including two interval with estimated bottom-hole pressures exceeding 1,000psi. Drilling of #6 continues. | ||

Beeks Financial Cloud (LON:BKS) (£156m | SR26) | H1 trading in line with expectations. H1 revenue expected to be £14.7m (H1 FY25: £15.8m) reflecting lower upfront revenue as the business moves to a revenue share model. Underlying run-rate revenue from Private Cloud (ACMRR) rose by 15% to £32.8m. | AMBER = (Roland) I think the main takeaway from today’s update is that the H2 revenue weighting required to meet FY26 forecasts is now c.65%, compared to 55% last year. Although the company provides some reassuring commentary about recent wins and recurring revenue growth, my estimates suggest Beeks hasn't yet secured quite enough revenue to meet forecasts for the y/end 30 June 2026. However, while I’d argue that today’s update has increased the likelihood of a downgrade to FY26 expectations, broker forecasts are unchanged today and I don’t think there’s enough evidence to justify a downgrade. Given the full valuation, I think a neutral view remains fair here ahead of a fuller update at the time of March's interim results. | |

Pantheon Resources (LON:PANR) (£109m | SR22) | Has formally commenced seismic reprocessing focused on the north west section of the Company's Kodiak project, updip from the Theta West-1 discovery well | ||

Helium One Global (LON:HE1) (£72.7m | SR16) | Successful completion of Electrical Submersible Pump testing at ITW-1 at the southern Rukwa Helium Project, produced over the equivalent of 250kbbl of water over a testing period of 20 days, with sustained helium concentrations of 5.4% (air corrected). | ||

Blencowe Resources (LON:BRES) (£40.4m | SR15) | The recent determination by the US antidumping and countervailing duties on graphite active anode material, subject to a final affirmative determination by the US International Trade Commission expected in March 2026, are expected to apply for a minimum period of five years and are additive to existing US trade tariffs. | ||

Skinbiotherapeutics (LON:SBTX) (£32m | SR9) | “In addition to the initial concerns around his [the former CEO’s] conduct, in light of the newly available information, the Board has reason to believe that the former CEO has misrepresented material information to the Board and senior management, the Company's auditors and advisors.” | ||

Medpal AI (LON:MPAL) (£21.7m | SR6) | Completion of its acquisition of key assets from Universal Pharmacy Ltd (in administration), initially announced on 16 Sep. | ||

Eco Buildings (LON:ECOB) (£20.6m | SR15) | Pro bono Eco Buildings home in Tirana successfully handed over to a family displaced after losing their previous home | ||

Pebble Beach Systems (LON:PEB) (£20.6m | SR66) | Additional £1.3m software contract win over 5 years with a Tier 1, US-based streaming company. | AMBER/GREEN = (Mark) This is an additional contract with an existing customer but a prestigious one. Their broker Cavendish confirms that this deal supports their FY26 forecast visibility rather than leading to an upgrade, so it was effectively already in their model. There are no forecasts beyond the current year, but strong order intake, including today’s announcement, means that there is a chance that future years may see improvements in sales. So it makes sense to remain broadly positive. | |

Cambridge Cognition Holdings (LON:COG) (£18.4m | SR13) | Agreement with Ivory for the commercialisation of CANTAB Pathway™ across the healthcare and consumer health markets in India. | ||

Rome Resources (LON:RMR) (£17.6m | SR9) | 1,602 metres of core drilling on Kalayi, DR Congo, during this current drilling campaign, has confirmed the persistence of high-grade tin mineralisation at depth. | ||

Cadogan Energy Solutions (LON:CAD) (£12.6m | SR33) | Successfully started its gas-to-power operations in Ukraine | ||

Prospex Energy (LON:PXEN) (£12.6m | SR15) | Has restarted electricity generation and sales at the El Romeral gas to power plant in Andalucía, Spain. | ||

Cordel (LON:CRDL) (£10.5m | SR15) | Cordel rugged hardware will be purchased by the railroad and installed on a geometry testing vehicle, with commissioning planned for the first quarter of 2026. The initial phase includes capture of up to 3,000 miles of active rail network to support real-world operational validation. No financial figures given. |

Roland's Section

Beeks Financial Cloud (LON:BKS)

Down 6% at 214p (£146m) - Trading Update & Notice of Results - Roland - AMBER =

Today’s half-year trading update from this cloud connectivity provider for financial markets reports trading in line with full-year expectations, but appears to have disappointed the market.

Today’s update does seem a little mixed to me. While there’s decent growth in underlying run-rate revenue, H1 revenue is down and the company will need a much heavier H2 revenue weighting than last year to meet expectations:

H1 revenue down 7% to £14.7m, implying a 65% H2 revenue weighting vs 55% last year;

This H1 decline is said to reflect the timing of recent Proximity Cloud wins and a move to a revenue share model within Exchange Cloud (i.e. Beeks funds new deployments upfront and recoups the costs from future revenue) – see here for my previous comments on the company’s service offerings

Annualised Committed Monthly Recurring Revenue (ACMRR) up 15% to £32.5m (+11% sequentially from H2 25);

Net cash down 53% to £3.3m (vs June 2025), following recent deployments.

Operational update: today’s commentary does provide some support for the expectation of a stronger H2.

We’ve reported on various contract win announcements during the period (e.g. here and here) and today Beeks expands on this:

“A high number of substantial contracts were secured towards the latter part of the period”;

These carried a total contract value of “over £7.0m”, of which around half is expected to be recognised as revenue in H2, suggesting perhaps £3.5m in addition to the c.£17m implied by the run-rate revenue figure;

I would note that the language used in the quote above doesn’t necessarily imply that this is new business – some of these could be renewals.

Outlook & Estimates

Canaccord Genuity and Progressive Research have both published updated notes today on Research Tree - many thanks. Analysts at both firms have left their FY26 forecasts unchanged ahead of Beeks’ interim results, which are due on 16 March.

Averaging these two FY26 revenue forecasts (£41.0m and £39.5m respectively) gives me Stockopedia’s consensus estimate for FY26 revenue of £40.3m.

Based on the information provided today, my guesstimate is that there is still perhaps c.£5m of revenue not yet accounted for that’s needed to meet full-year forecasts.

However, today’s comment emphasises the strength of the current pipeline and contracted workload, which management suggest should underpin current forecasts:

The pipeline across all offerings remains at record strength, with major additional customer opportunities progressing through the sales funnel. This, coupled with the strong base of contracted revenue, underpins the Board's confidence in achieving FY26 results in line with its expectations.

Roland’s view

There’s no mention of profit in today’s update, but the in-line guidance can be seen as applying to earnings and revenue.

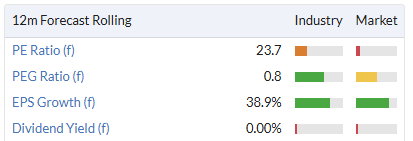

We’ve often commented on the valuation here, which appears to price in a significant level of future growth. This remains true, although FY27 forecast EPS growth of 20% supports a low PEG ratio and suggests the stock may yet justify its tech-style rating:

On the other hand, I remain concerned by the low profitability of this business, which reminds me more of an equipment lessor than a software-led tech business:

I would also note that the underlying trend in earnings forecasts has been negative over the last year, albeit only modestly. FY26 consensus earnings estimates have fallen by c.5% over the last 12 months:

In my opinion, today’s update slightly increases the chances of a further downgrade. However, I think there’s still a plausible path to meeting expectations and do not think there’s enough evidence here to justify a downgrade.

I’m going to leave our neutral view unchanged ahead of March’s interim results

Pinewood Technologies (LON:PINE)

Down 31% at 300p (£345m) - Response to Statement by Apax Partners LLP - Roland - AMBER ↓

Commiserations to shareholders in this automotive dealership software firm, which was spun out of dealership group Pendragon in early 2024. Pinewood shares are down by c.30% this morning, following Friday’s post-close announcement that private equity group Apax Partners does not intend to make an offer.

Investors had previously been hoping for a 500p cash offer that was under discussion in January.

Graham was AMBER/GREEN on this stock in June last year, prior to the bid situation. With the shares now trading significantly below the 400p+ level prevailing at the time of his comments, has today’s news created a potential buying opportunity?

Recent progress, guidance unchanged

The Company occupies a leading position as a mission-critical, full-service, embedded technology provider to automotive retailers and OEMs, benefitting from high recurring revenues and long-standing OEM partnerships.

In today’s update, Pinewood management highlights recent progress and reiterates its medium-term FY28 targets:

Acquisition of Seez in February 2025 “strengthens the company’s AI and customer engagement capabilities”;

Taking full ownership of Pinewood North America LLC and a new five-year contract with Lithia are expected to increase total revenue from Lithia to c.$60m by the end of FY28;

Board believes “the company is well-positioned […] to achieve its medium-term FY28 guidance of underlying EBITDA of £58-62 million”.

For context, adjusted EBITDA for 2025 is expected to be £15.8m, according to broker Zeus.

Valuation: after today’s share price drop, I estimate Pinewood is trading on a EV/EBITDA multiple of c.20x. That’s not obviously cheap, but if Pinewood can get close to its FY28 targets then there would very likely be some upside from current share price levels.

Zeus forecasts for the next two years suggest Pinewood’s profits are expected to rise sharply:

FY25E adj EPS: 6.3p

FY26E adj EPS: 12.1p

FY27E adj EPS: 20.2p

Hitting these forecasts would imply an FY26E P/E of 25, falling to a FY27E P/E of around 15. That’s not excessive for a software business, especially as I’d hope to see profitability improve as the business scales.

Roland’s view

I would guess that the size of today’s sell-off might reflect the general fear that new AI services will result in a lasting reduction in demand for traditional software businesses. As I discussed recently, I am not entirely convinced by this argument, especially where platforms (such as Pinewood) are built around in-house data, workflow and transactional processes.

In many cases, I think it’s more likely that successful software companies will adopt AI technology to enhance their specialist offerings.

Graham was AMBER/GREEN in June 2025 and it might be logical for me to maintain that view today. However, before settling on a final view I think there are a couple of more bearish points that are worth highlighting:

October ’25 downgrade: earnings guidance was downgraded in October, with FY26 EPS estimates cut by c.13%:

This was said to be due to a timing issue with a customer rollout rather than any loss of business, but I think it’s still a risk worth considering. There’s no guarantee future growth won’t be affected by further such delays, especially in a sluggish automotive market.

Why did Apax withdraw? In January, Apax Partners was in discussions for a cash offer at 500p. Last week, they decided they didn’t want to proceed. We don’t know why. The only explanation given was that the decision was made “in light of the prevailing challenging market conditions”.

This could reflect the general ‘AI SaaSpocalypse’ that’s taking place at the moment, but another possibility is that Apax has concluded that Pinewood’s future growth may be slower or more modest than it previously expected.

On balance, I can still see some attractions here, but given the factors above and the recency of Pinewood's separation from its former parent, I think it might be sensible to remain cautious until we have more detailed management guidance on current and forecast trading.

I’m going to mirror the StockRanks and downgrade our view to neutral today, ahead of Pinewood’s FY25 results on 22 April 2026.

When we have more clarity on recent trading and an updated outlook, I would hope that we might be able to take a more positive view once again on this promising-sounding business.

Renewables Infrastructure (LON:TRIG)

Down 3% at 68p (£1.62bn) - NAV, dividend & portfolio update - Q4 2025 - Roland - AMBER =

(At the time of publication, Roland had a long position in TRIG.)

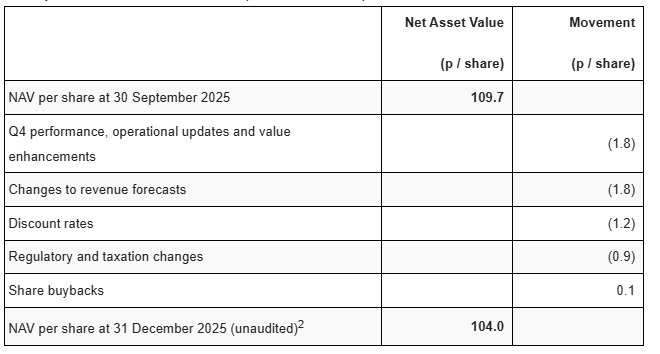

Shares in this renewable energy investment trust have edged lower today after a Q4 upbeat I’d probably describe as mildly downbeat. The main takeaway is that the company’s net asset value fell by 5.2% to 104.0p per share during the fourth quarter.

Key headlines:

Electricity was 5% below budget for the quarter. Stronger pricing and offshore performance was offset by economic curtailment of production (Sweden) and grid outages (UK onshore);

Independent power prices forecasts fell due to lower gas prices and reduced demand for green certificates;

The UK government has changed the inflation basis for Renewable Obligation Certificates and Feed-In-Tariffs from RPI to CPI, as previously discussed. This has the effect of reducing future cash flows and thus reducing NAVps. This issue affects 19% of TRIG’s 2026 projected revenue.

It’s worth remembering that with businesses such as these, NAV is a financial construct based on future cash flows from the assets – not a measure of tangible asset value.

I’ve reproduced a table below showing how the drop in NAV breaks down. The majority of the impact comes from below-forecast generation and changes to power price forecasts:

Operational update: TRIG is engaged in a number of projects to develop new assets or improve existing ones. Progress appears to have been mixed during the quarter. Completion of the 78MW Ryton battery project has been delayed to Q2 2026 due to grid connection delays and a change of electrical contractor.

However, the 100MW Spennymoor project remains on schedule to complete in 2027.

In wind, the repowering of a French onshore wind farm is underway. This work should double capacity to 25MW and is underpinned by a 20-year inflation linked, government-backed tariff at €86/MWh.

Dividend: an on-target Q4 dividend of 1.888p means TRIG has hit its full-year 2025 target for a payout of 7.55p per share. This is said to have been covered 1.0x by cash after scheduled debt repayments.

While TRIG’s model of tying debt repayments to contracted cash flows is arguably prudent and de-risks the business, it also restricts flexibility. Going forward, management is aiming to maintain or increase the dividend as possible, with the aim of improving cover.

However, with cover now down to the bare minimum, I think there’s some risk of a cut unless a significant disposal can be achieved. Assets sales are being worked on, but the current market is difficult and TRIG (like others) is struggling to make disposals as quickly as hoped for.

Share buybacks: at around 67p, TRIG shares continue to trade at a sizeable discount to book value. Thus management is continuing with a buyback programme, as this theoretically provides more attractive returns on investment than most possible new projects.

Management say the remaining c.50% of the £150m buyback programme will be accelerated after TRIG’s annual results are published on 27 Feb 26.

Roland’s view

If I was being emotional about it, I’d probably say that TRIG just can’t catch a break at the moment. But I think the reality is that the macro environment for renewable investors, especially in wind, is just not as favourable as it used to be.

I think it’s fair to say that the capital structure of entities like TRIG was designed for a period of falling interest rates and strong government subsidies.

Today we have higher finance costs and (often) less generous subsidies than previously. In addition, grid delays and weather-related underperformance seem to have become a bigger issue than they were a few years ago.

While I think the debt-secured on these assets remains fairly secure (as illustrated by TRIG’s recent oversubscribed £200m debt offering), generating adequate returns on equity has become more difficult.

Consolidation seems one potential solution, while another opportunity might be greater use of corporate power purchase agreements to sell future generation. We know that TRIG is pursuing the latter, at least, and I would not be surprised if it was pursuing the former in private.

Ultimately, while today’s update is relatively poor, TRIG remains one of the larger and older operators in this sector, with a fairly decent portfolio of assets.

With the stock trading at a 35% discount to NAV and offering an 11% dividend yield, I think some of the risk of a dividend cut is priced in.

At this level I think the risk/reward situation is fairly balanced so I am happy to remain neutral (and continue holding) until more clarity emerges on the outlook for this sector.

I note the StockRanks are also broadly positive at the moment:

Mark's Section

Pebble Beach Systems (LON:PEB)

Up 14% at 18.9p (£22m) - Contract Win - Mark - AMBER/GREEN =

This is an additional contract with an existing customer but a prestigious one. At £260k/year, this is just 2% of FY26 revenue estimates. However, as software sales it will be relatively high margin. Their broker Cavendish confirms that this deal supports their FY26 forecast visibility rather than leading to an upgrade, so it was effectively already in their model.

However, the company remains on a relatively modest sub-10 forward P/E, so anything that supports these estimates is good news.

The big question is whether a higher rating could be justified; historically, the company has struggled with growth, and revenue has declined in real terms over the last decade. They have got a previous perilous debt situation under control, but there is still modest net debt.

We viewed the company mostly positively, when they jumped on a materially ahead statement in the middle of last year. It is worth noting that this beat was largely due to cost-cutting rather than an improvement in sales, so it was the least sustainable form of ahead statement.

There are no forecasts beyond the current year, but strong order intake, including today’s announcement, means that there is a chance that future years may see improvements in sales. So it makes sense to remain broadly positive.

Hunting (LON:HTG)

Up/ 1% at 480p - Organic Oil Recovery Pilot Test Result - Mark - AMBER

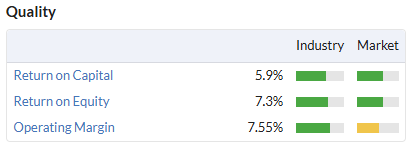

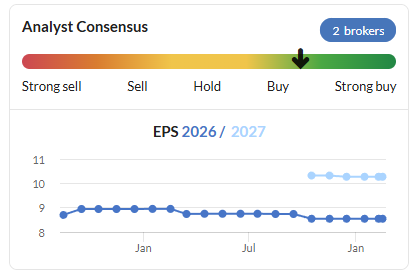

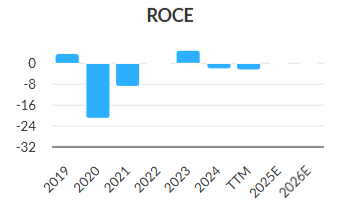

I’ve got to say, I’m a little confused by the recent market reaction to this company. Normally when brokers trends look like this:

…the share price graph is diametrically opposite to this:

History:

I’ve been reasonably positive in the past on Hunting. It operates in a cyclical business, and for a while was a net net: it traded at a discount to the value of its cash and inventory. It seemed likely that, despite a historically low Returns on Capital…

…it would have its day in the sun. It appears to have had that, as it now trades at a decent premium to Tangible Book Value:

Yet there is little sign that these assets have become more productive.

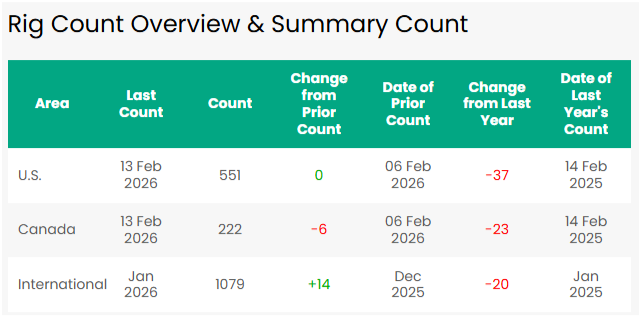

Rig Count:

Historically, their perforation gun business, Hunting Titan, had been a big driver of profits, and it was a recovery in the rig count in the US that I expected to be the driver of returns. However, there has been little sign of this, and the rig count has just continued to decline, according to Baker Hughes:

Recent strength:

Instead, the share price appears to have been driven by two things:

- Enhanced Shareholder Returns: Hunting extended its share buyback programme to $60 million in December 2025, citing sustainable cash generation and a strong balance sheet. The company also committed to 13% annual dividend growth through the end of the decade.

- Strategic Pivot to Subsea: Management significantly raised its 2030 revenue target for the Subsea Technologies segment from $250 million to $470 million. This reflects the successful integration of recent acquisitions like Flexible Engineered Solutions (FES) and the OOR business.

Organic Oil Recovery:

It is this last point that we see in today’s announcement:

As noted in the announcement, production within the oil wells reported a 100% uplift, and in one well reduced the water cut to zero. Buccaneer Energy notes that the OOR technology will be rolled out across other wells within its portfolio.

Hunting is delighted with this successful pilot treatment, which highlights the impact that the Company's OOR solution can have on oil production.

When I look at the Hunting website, it points me to a series of technical papers on the subject. While I have a penchant for a technical paper on finance, ones on Organic Oil Recovery are a little beyond me. Thankfully, Google Gemini is able to give me a nice summary:

How OOR Technology Works

The OOR process is a unique form of microbial enhanced oil recovery (MEOR) that functions in two distinct phases without the need for external microbes or harmful chemicals.

Phase 1: Nutrient Injection. A scientifically designed, biodegradable nutrient treatment is injected into the reservoir through existing water injection systems. This causes targeted resident microbes to rapidly multiply.

Phase 2: Microbial Activation. A specific nutrient limitation triggers the microbes to change their cell wall structure from hydrophilic (water-attracting) to hydrophobic (water-repelling).

Oil Mobilisation. These hydrophobic microbes move to the oil-water interface, reducing surface tension and breaking down trapped oil into tiny micro-oil droplets. These droplets can then flow more easily through the rock pores to the production well.

Key Benefits to Operators

The technology offers several operational and environmental advantages:

Cost-Efficiency: It requires zero capital expenditure (Capex) as it uses existing field infrastructure and is simple to deploy.

Rapid Results: Production increases are typically observed within 2 to 12 weeks following treatment.

Water Management: It lowers the water cut (the ratio of water produced to total liquids), which reduces lifting costs and improves the overall oil-to-water ratio.

H2S Reduction: The process can lower levels of hydrogen sulphide (H2S) in the production offtake by outcompeting the bacteria responsible for its formation.

Sustainability: It is 100% biodegradable and has a smaller carbon footprint compared to traditional thermal or chemical EOR methods.

I can see how this is a very neat solution, and would be very valuable to operators. This Pine Mills field pilot project reportedly led to a doubling of output and reduced the water cut in one well from 80% to 0%.

However, Hunting acquired the global rights to this technology in a $17.5 million deal in early 2025. Since then the Hunting Market Cap has risen by $420m. So while they may have got a good deal acquiring and being able to market this technology, it would be highly unusual for an uplift of this size to be purely down to this deal.

Mark’s view

In the past, there has been a clear undervaluation of this business by UK stock market investors compared to its assets, and taking into account its cyclical nature. However, I’m not sure that discount remains.

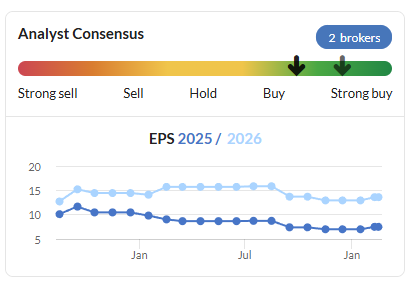

The company still doesn’t generate a strong return on capital, meaning its quality rank is middling:

It is no longer cheap compared to its near-term earnings or assets, meaning that the Value Rank is average too. Indeed, it appears to trade at a premium to most brokers’ target prices, which is always a warning.

This leaves the high StockRank almost entirely dependent on the Momentum Rank. We are big believers in Momentum at Stockopedia; winners tend to keep on winning. However, I am incredibly wary of this when it is not backed up by fundamental momentum. In this case, the strong share price and declining brokers’ forecasts, leave the company at risk of a significant draw down on any bad news.

We’ve been neutral here in the recent past, and given the strength of the share price momentum, I think it makes sense to keep our AMBER view. However, I would be ready to quickly take a more negative view should that share price momentum falter, as there are some big questions around whether it is backed up by positive changes in the fundamental outlook.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.