Good morning! Welcome back to the report. It's fairly quiet on the news feed but we do have some updates that will be worth examining.

I'm afraid that's all we've got time for today - thanks for reading and commenting, we'll see you tomorrow morning!

Today's Agenda is complete.

Spreadsheet accompanying this report: link (last updated to: 7th October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

| HSBC Holdings (LON:HSBA) (£172bn | SR84) | Herald Fund litigation relating to Madoff fraud | HSBC has lost an appeal relating to the Madoff fraud. Further legal avenues remain, but the bank will report a $1.1bn provision in its Q3 results. | Graham [no section below] |

Grainger (LON:GRI) (£1.45bn | SR54) | Welcomes Renters’ Rights Bill, (passed by House of Commons) believes will “raise standards across the private rented sector”. | AMBER/GREEN (Graham) [no section below] This is consistent with a theme that I frequently address: that in most industries, increased regulation tends to be welcomed by larger companies. The Renters' Rights Bill introduces fines of £7k for minor or initial non-compliance by landlords with new rules that include the abolition of "no-fault" evictions, along with a wide range of other measures that are expected to come into force next year. With about 11,000 Build to Rent homes in its portfolio, Grainger will be able to efficiently absorb the cost of these measures, unlike part-time and accidental landlords. The company's EPRA NAV ranges from £1.8-1.9 billion, depending on the precise measure used, and offers a yield of 4.7%, so I think it's potentially worth another look at this valuation. | |

Great Portland Estates (LON:GPE) (£1.40bn | SR35) | Sale for £250m, reflecting net initial yield of 4.48%, “marginally ahead” of March 2025 book value. | ||

Goodwin (LON:GDWN) (£1.16bn | SR62) | SP +42% Updating shareholders to expect “a material increase” in profits. Now exp adj PBT >£71m, versus £35.5m in FY25. Special dividend of 532p. | AMBER/GREEN (Graham) Interesting news here including a profit forecast (which is unusual in itself), a special dividend, and two appointments to the main board, which I suspect has resulted from increased scrutiny now that this is a FTSE-350 member. The share price reaction today is extraordinary. Looking forward, even if you swap out the trailing P/E and put the forecast P/E into the calculation, I doubt that we’d see a particularly inviting ValueRank here. So I think AMBER/GREEN continues to make sense. It’s a remarkably successful company and a remarkably successful investment, but it’s still not a slam-dunk buy, in my view, except for those who can very confidently forecast yet another step-change in profitability in the next year or two (which I acknowledge is perfectly possible, if not probable). | |

Georgia Capital (LON:CGEO) (£892m | SR86) | NAVps +10.8% to 37.25p vs Q2, portfolio revenue +4.9% to GEL 540m, portfolio EBITDA +24.7% to GEL 80m. | ||

Treatt (LON:TET) (£141m | SR60) | Columbia Threadneedle Investments intends to vote in favour, but the number of shares covered by this intention is reduced to 3.27% of TET's total share count. The number of shares which have been promised to vote for the takeover reduces from 6.9% to 6.3%. | PINK (Graham) [no section below] My piece on Friday caused a little bit of commotion as we debated whether or not Treatt was a successful investment. More news today, although less dramatic than Lord Lee's disposal of 730,000 shares. We learn that Columbia Threadneedle's intent to support the takeover by Natara/Exponent has reduced, presumably because they have sold or hedged a portion of their holding. This leaves the "irrevocable undertakings" to support Treatt's takeover at just 6.3%, which is pretty low even before we consider that there's now a 25% shareholder - Döhler ingredients- which may be motivated to block the deal from going through. The proposed takeover is now seriously in doubt, at least at the current price of 290p, and the share price of only 240p is consistent with that view. | |

Bioventix (LON:BVXP) (£122m | SR42) | Rev -4% to £13.1m, pre-tax profit -5% to £10.1m. Net cash £5.1m. Warns changing Chinese market conditions are headwind to sales. Alzheimer’s work ongoing. | AMBER/RED (Roland - I hold) Today’s results make more clear the competitive and onshoring policy pressures in China, flagging up a decline in revenue. While pre-clinical usage of the company’s Alzheimer’s-related assays is growing, there is yet no clarity on whether any are likely to be adopted for clinical use. Success could be transformative, but without this the company appears to be at risk of moving into an extended run-off phase. While I think the business may be reasonably-valued at current levels, falling broker estimates and speculative risk have prompted me to adopt a more cautious view. | |

4Basebio (LON:4BB) (£113m | SR1) | A global Tier 1 pharmaceutical partner has begun dosing patients with an mRNA product developed using 4basebio’s proprietary opDNA® template. | ||

Ondine Biomedical (LON:OBI) (£65m | SR13) | ICU study: Steriwave nasal photodisinfection significantly reduces harmful pathogens in critically ill ICU patients. | ||

Kromek (LON:KMK) (£48m | SR97) | Full year results to be in line with market expectations. H1 underlying revenue at least £6.3m. H1 to have profit before tax and EBITDA instead of LBT, LBITDA. Cavendish broker forecasts unchanged. | AMBER/RED (Roland) Today’s half-year update seems to be as expected and broker Cavendish has left its forecasts unchanged. Looking at the StockReport and FY25 results, I think what’s most interesting here is the change in the business (and its StockRank) that was prompted by January’s $37.5m contract with Siemens Healthineers. The guidance provided today suggests to me that as much as 90% of revenue from this four-year deal will have been recognised within 12 months of signing. While I can see the logic for front-loading given the transfer of IP, this does leave me wondering what remaining performance obligations still remain. Kromek is apparently free to win further similar deals and its financial position is significantly improved, thanks to Siemens. There’s also evidence of continued growth in the core (lower margin) business. However, falling profit forecasts for FY26 and FY27 highlight the one-off nature of this contract - Cavendish warns margins are likely to return to historical levels without another big contract win. Given the uncertain outlook, I'm leaving our previous view unchanged today. | |

First Tin (LON:1SN) (£36m | SR50) | Raised £10.12m, finished with a cash position of £6.37m and NAV £44m. Pre-revenue, loss-before tax £1.6m. | ||

One Health (LON:OHGR) (£30m | SR84) | H1 26 adj. EBITDA to be significantly ahead of the prior year (£0.96m). On track to deliver revenue and adj. EBITDA in-line with market exps. | ||

Eco Buildings (LON:ECOB) (£27m | SR13) | SP +9% 18-unit apartment development in Tirana: all groundworks and foundations completed, triggering 10% payment (€220k). Completion and hand-over of first apartment block now expected ahead of the original timeline. | AMBER/RED (Graham) The stock formerly known as Fox Marble Holdings has gone crazy this month, rising from 3.8p to 24p. Checking Stocko’s shareholder register data, I see that 66.6% of shares are listed as being “held by top holders”, and they are apparently holding on tightly for now, while the remaining free float soars in value. The company offers “the latest in precast walling technology”, meaning that they offer low cost pre-fab walls, and also has marble quarries in Kosovo and North Macedonia. The stock doubled last week when it was revealed that the company would receive a €12.75m deposit in relation to a landmark agreement to supply 20,000 homes over 7 years to the Chilean government, generating c. €420m in gross revenues. Roland was RED on this and I do share his concerns around the highly speculative nature of the business. H1 revenues were only €1.8m and the company did raise funds during the period through new equity, a convertible note and warrants. And I’m not sure how the company has chosen the countries in which it currently seeks to expand - Albania, Kosovo, Chile, Senegal and Sudan. They say that they are seeking ISO certifications that would support entry into Western markets. I think caution is still justified here but I will upgrade our stance from RED to AMBER/RED on the basis that the Chilean government is apparently helping to fund ECOB’s work through its initial deposit. The main question for me is how much fresh equity might be needed to support that contract, and that's before we start to understand the potential margins on that contract. The apartment development mentioned in today’s RNS does not seem very important in the grand scheme of things. |

Graham's Section

Goodwin (LON:GDWN)

Up 42% to £219 (£1.65bn) - Trading Update - Graham - AMBER/GREEN

Nice news with which to start the week:

Further to the Trading Update on 24th September, and in light of the strong trading performance across the businesses, the Board considers it appropriate to update shareholders to expect a material increase in the Group's profitability, supported across all divisions.

We looked at Goodwin’s remarkably positive trading update on September 24th, with the shares rising 16% on that day. That day’s news involved a very high workload (£357m), much improved profitability at their “refractory engineering” division, and news of over $200m of order expecting to come in from Northrop Grumman.

But the company continues to do so well, that Goodwin feels compelled to tell the market about it today. Key points:

Trading PBT for FY April 2026 to be in excess of £71m (100% increase vs. FY April 2025, £35.5m).

Order book now stands at £365m with “enhanced visibility across multiple key defence and nuclear programmes that are not yet reflected in the order book” (emphasis added).

Remember that this is a family business that eschews the normal City practice of providing forward expectations:

The Group does not ordinarily provide forward guidance and does not intend to change this long-standing policy. However, given the high increase in pre-tax profitability for the year ending April 2026, on this occasion, it was thought appropriate to do so, as it is correspondingly being matched with a similar improvement in cash flow.

Dividend: they are getting ahead of the UK budget with another dividend.

…bearing in mind the imminent UK Budget that the Chancellor is announcing on the 26th November, the Board of Goodwin PLC has declared a special one-off interim dividend of 532 pence per share in addition to the dividend paid earlier this month of 140 pence and the declared dividend to be paid on or around the 10th April 2026 of 140 pence.

One of the quirks about Goodwin (and I consider this to be a green flag) is that they have allowed their share price to rise to new heights over the years, without bothering with stock split - that’s another normal City practice, to ensure that a stock remains liquid.

But when you have a family-controlled business that doesn’t care too much about managing its stock price, liquidity is a low priority. So we end up with a stock where there are only 7.5 million shares outstanding, and a share price of over £200.

With 7.5 million shares out, the 532p special dividend will cost nearly £40 million.

Pretty nice reasoning:

As the Group approaches a zero net debt position, its strong cash generation, limited non-customer-funded capital expenditure and a resilient balance sheet have placed it in a position of financial strength, with surplus funds exceeding those needed for optimal efficiency.

This new special dividend will get paid on 21st November, in good time before the budget.

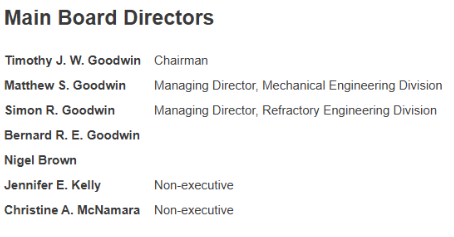

Board appointments: another snub to normal practice has been the lack of a Group CFO on the main.

That is ending now, sort of, with the appointment of Adam Deeth as Finance Director (not CFO), joining the board. He has been Group Chief Accountant (on the Executive Leadership team) since 2023.

Group General Counsel Anthony Thomas also joins the main board as Director.

Graham’s view

Goodwin joined the FTSE 350 index last year. I wonder if this has been the impetus for changes on the board?

With bigger size and visibility comes greater scrutiny, and I suspect that the absence of a CFO and Secretary on Goodwin’s board will have been noted by institutional investors. The FD and Chief General Counsel should now solve that potential issue.

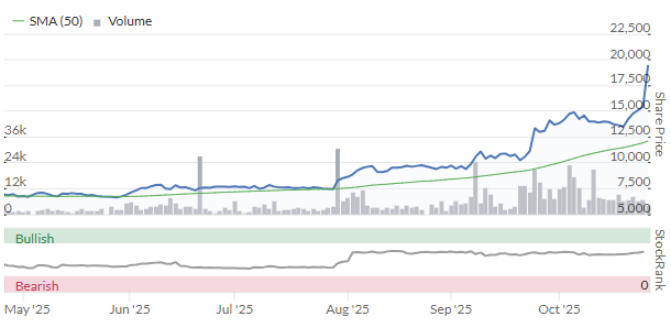

As for the merits of the stock at this level, it’s counter-intuitive for me to be very bullish about a stock that has already risen so far:

Fortunately, Roland gave this an AMBER/GREEN back in July when the share price was merely £83, so we’ve had some kind of positive stance on it during its incredible run (it’s up 160% since then!).

Sometimes, it pays to simply accept it when a good business is trading well and its share price is rising - don’t fight the tape!

But when it comes to valuation, I must admit that I would have a little hesitation about opening a new position here. Let’s say after-tax profits are £53m. That gives us a P/E multiple of 31x for the current year, FY April 2026.

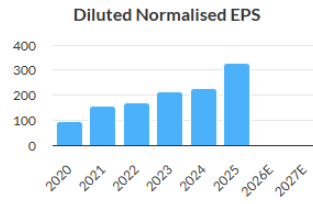

The market is evidently pricing in continued success, and why not? EPS is probably doubling from the level seen in 2025, below, with more good news expected in subsequent years:

There’s little doubt that we should have been more positive on this one, but I’ve never pretended to be able to forecast contracts and workloads at engineering companies: that’s beyond me.

The major clues here that I could have latched onto - and that I have mentioned in the past - were the unorthodox corporate governance behaviours. These can be double-edged swords:

Majority family ownership. Usually a good thing, as families have a strong sense of stewardship when it comes to protecting their legacy. But controlling shareholders can sometimes be dangerous for smaller shareholders.

No forecasts. This is a good thing for those individuals who have the time and the ability to make their own forecasts. For others, valuation becomes more difficult.

Illiquid stock (due to high insider ownership, a high share price, and no stock splits). This doesn’t matter very much, but it can sometimes make it difficult and expensive (in terms of spread) for investors to open large positions, or to exit their positions. It can also lead to exaggerated price movements either up or down, and I guess we are seeing that today in the positive direction!

I can’t bring myself to raise this to GREEN, which could be interpreted as my refusing to embrace the positive trend, but I nearly always try to keep some valuation anchor on my views here.

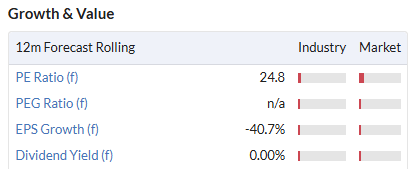

The StockRanks do, too, and they consider this a High Flyer:

Even if you swap out the trailing P/E and put the forecast P/E into the calculation, I doubt that we’d see a particularly inviting ValueRank here.

So I think AMBER/GREEN continues to make sense. It’s a remarkably successful company and a remarkably successful investment, but it’s still not a slam-dunk buy, in my view, except for those who can very confidently forecast yet another step-change in profitability in the next year or two (which I acknowledge is perfectly possible, if not probable).

Roland's Section

Bioventix (LON:BVXP)

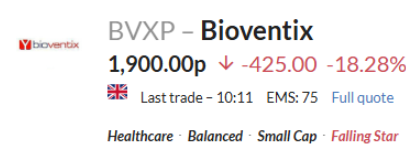

Down 18% at 1,900p - Results for y/e 30 June 2025 - Roland - AMBER/RED

(At the time of publication, Roland has a long position in BVXP.)

Today’s results from clinical antibody specialist Bioventix have received an uncomfortable reception from the market. As a shareholder, I’m not surprised – today’s numbers are below previous expectations, based on forecasts from house broker Cavendish. Revenue and profit are down on last year and expected to fall again this year.

Revenue -4% to £13.1m

Pre-tax profit -5% to £10.1m

Net cash £5.1m (FY24: £6.0m)

Earnings per share -6% to 145.3p

Total dividends -3% to 150p per share

While the profitability implied by these numbers – with an operating margin of 76% – remains deeply impressive, these numbers are still below previous Cavendish forecasts for revenue of £13.5m and earnings of 151.5p per share.

This decline appears to be the result of growing competition in China and broader onshoring policies in the world’s second-largest economy. Revenue from China fell to £2.4m (18% of sales) in FY25, down from around £3.3m in FY24.

As noted in previous results, important aspects of the Chinese commercial landscape are going through a process of change. As well as the China First policy in promoting local manufacturing, another major driving force for change is the Chinese Central Government procurement policy that aims to continually reduce all costs, including those of healthcare.

In addition, there is no definitive update today on the success – or otherwise of the company’s antibodies for Alzheimer’s Disease testing. The good news is that progress remains encouraging, with increased revenue (and usage) from Research use Only (RuO) sales:

The volume of such RuO assays is much higher than we had previously expected and reflects the growing interest in and importance of new neurology assays. In particular, RuO assays are being used as part of pharmaceutical clinical trials and by key opinion leaders on Alzheimer's disease for live population studies and for analysing frozen samples from human biobank resources.

However, CEO and founder Peter Harrison acknowledges that the real hurdle for creating shareholder value is achieving clinical adoption of one or more of these products:

However, we are fully aware that approved clinical use of IVD assays in future will be a key milestone and would represent a significant increase in the realisation of value.

Product sales: drilling into the group’s revenue figures for individual products shows just how much the landscape has changed over the last year. Only a better-than-expected performance from the group’s flagship Vitamin D antibody prevented a truly dire year for Bioventix:

Vitamin D (vitD3.5H10) +12% to £6.6m

T3 +6% to £1.46m

Biotins and biotin blockers -40% to £0.69m

Progesterone -16% to £0.53m

Estradiol -19% to £0.42m

Testosterone +1% to £0.33m

Drug-testing antibodies -43% to £0.18m

Tau/neuro SMA sales (Alzheimer’s etc) rose to £605k (FY24: £155k)

Stripping out Vitamin D antibody sales, my sums suggest revenue from other core/historic products fell by 16% to £3.6m.

There’s also a notable change of terminology in today’s results, with multiple references to the company’s “historic core business”, alongside a new focus on “neurology” – rather than simply Alzheimer’s.

For me, this is the most explicit acknowledgement I’ve seen yet from the company that it is (in my view) now essentially a run-off business with one big growth hope.

It’s worth remembering that the timeline for the creation and adoption of new products is typically 4-10 years, so there’s very little probability of anything that’s currently unknown emerging to deliver near-term revenue.

My impression is that the company’s cottage business model – it has just 14 staff and one small facility – is also under growing pressure from corporate competitors globally. I’m not sure this model will work as well in the future as it has done historically.

Outlook

With thanks to Cavendish for sharing updated forecast on Research Tree today, we can see that newly-introduced forecasts for FY26 suggest a further decline in sales and profits:

Revenue £12.5m (-4.6% vs FY25)

Pre-tax profit £9.6m (-5.9% vs FY25)

Earnings per share 136.1p (-6.1% vs FY25)

After this morning’s share price drop, these estimates leave Bioventix trading on a forecast P/E of 14, with a possible 7.9% dividend yield.

Roland’s view

When I covered the interim results in March, I highlighted “growing competition from Chinese firms” and my view that this business could become a run-off investment if it did not achieve significant success with new Alzheimer’s testing antibodies.

Today’s results highlight this growing divide in the business, while leaving shareholders unable to be sure which way the balance might tip. As a shareholder, I’m biased, but I do remain encouraged by the progress and potential for the group’s Alzheimer’s-related work.

Successful clinical adoption and the introduction of widespread clinical testing could be transformative for Bioventix.

However, a number of external factors that could influence the success of this work, including the availability (or otherwise) of potential treatments for Alzheimer’s Disease. Without effective treatment options, I am not convinced that health services will take on the cost of large-scale testing.

Bioventix has been styled as a Falling Star by Stockopedia’s algorithms for some time now – and I have to admit this is with good reason.

There could be a big recovery here, but there might also be a further gradual decline in a stock that’s already more than 50% below its all-time highs:

I haven’t yet decided whether to buy more Bioventix shares after today’s drop. Part of me is tempted by the 8% yield and turnaround potential, but I am concerned by the pace of decline in China and the prospect this may continue.

For this reason, the prudent, StockRank-watching part of my brain is telling me that the correct, risk-adjusted approach here would be to wait for some sign of positive momentum before buying any more shares.

After all, earnings expectations have fallen sharply over the last year and could continue to do so:

I’m going to downgrade our view to AMBER/RED today to reflect the speculative risk here. While I think this remains a good quality business that may be fairly valued, limited visibility means I have to recognise an element of speculative risk, too.

Kromek (LON:KMK)

Up 4% at 7.6p (£47m) - Pre-Close Trading Statement - Roland - AMBER/RED

Kromek (AIM: KMK), a global detection company delivering best-in-class solutions for the advanced imaging and CBRN detection markets, provides the following update on trading for the six months ending 31 October 2025 ("H1 2026").

Today’s pre-close trading statement from Kromek confirms that revenue growth is expected to be in line with full-year expectations. I’ll return to today’s update in a moment, but first I want to recap the story here and explain why this stock has caught my eye today.

Kromek isn’t a business I know very well, but the chart flags up a huge improvement in StockRank since September – this business is now styled as a Super Stock:

Checking back shows that this change coincided with the publication of the group’s FY25 results.

Last year benefited from a multi-year $37.5m deal with Siemens Healthineers, with £16.5m of revenue recognised in FY25. This deal included the permanent transfer of hardware (15 furnaces) and “all know-how, IP and related services” needed to allow Siemens Healthineers to produce cadmium zinc telluride (CZT) detectors for single photon emission computed tomography (“SPECT”).

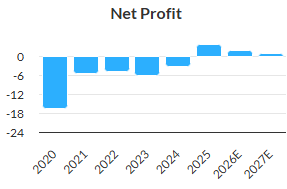

This deal supported significant group revenue growth, seemingly at higher margins than usual – Kromek reported its first ever annual profit last year:

Half-year update: Kromek expects to report H1 26 revenue of at least £14.5m (H1 25: £3.7m). The contribution from Siemens Healthineers will continue to support a higher gross margin and this is expected to support “profit before tax and positive adjusted EBITDA”, compared with negative figures in H1 25.

Management expects to recognise “at least” a further £8.2m of Siemens Healthineers revenue in H1 this year, compared to £nil in H1 25.

In addition, the company says it expected to report revenue of at least £6.3m (H1 25: £3.7m) from the remaining businesses – a year-on-year increase of 70%.

Revenue growth for the full year is expected to be in line with market expectations – Stockopedia consensus shows a figure of £27.1m, suggesting a slight H1 weighting to revenue this year.

Siemens Healthineers - revenue recognition: this H1 weighting is perhaps explained by the heavy weighting to Siemens Healthineers revenue in H1.

This deal is a four-year contract worth $37.5m. As I understand it, Kromek has provided a perpetual but non-exclusive licence to Siemens to use its patents, and will provide all the knowledge transfer required over the four-year period to allow its customer to start producing its own CZT detectors.

During the contract, Kromek will produce CZT detector tiles in its own facilities. The 15 furnaces purchased by Siemens are only due to be physically transferred at the end of the four-year period.

Given the structure of this deal and the (presumably) irrevocable right the customer has to use Kromek’s IP, I can see why payments might be front loaded.

However, I am a little surprised by the extent of this. Siemens revenue is expected to be £8.2m in H1 26. Adding this to £16.5m of Siemens revenue recognised last year gives me a total of £24.7m, or around $33m. This appears to indicate that 90% of revenue from the contract will have been recognised in less than one year (it was signed in January 2025).

To add context to this, Siemens made an initial upfront cash payment of $25m in FY25 (between January and April 25) and has since paid a further $5m. Clearly the German group was also happy to commit most of the cash up front.

Revenue recognition is a complex topic where management is often required to make subjective judgements. Kromek provided some extra detail on this situation in the footnotes of last year’s results. In short, my understanding is that revenue is normally recognised when goods and services are transferred to the customer.

However, in this case management had to consider “the initial value received by the customer upon signing of the agreement by virtue of patent licensing”. As far as I can see, this is given as the justification for the high initial revenue recognition in FY25 and (I assume) the large initial cash payment Kromek received.

I don’t know enough about the business to speculate on this in more detail. But with 90% of Siemens Healthineer revenue expected to be recognised in the first year of a four-year contract, it looks like the contribution in future years will be much lower.

Broker Cavendish recognises this in its commentary today:

We remind investors of the mix effect of revenues and the expected impact this will have on gross margin in FY26E/FY27E – normalising towards historical levels in future years – as the proportion of high margin revenues from the Siemens Healthineers enablement agreement reduces.

Cavendish also emphasises that Kromek has the potential to win similar deals with other third parties and to continue growing its core business. But there’s no guarantee of this, so the risk of a return to past levels of (un)profitability remains.

Outlook

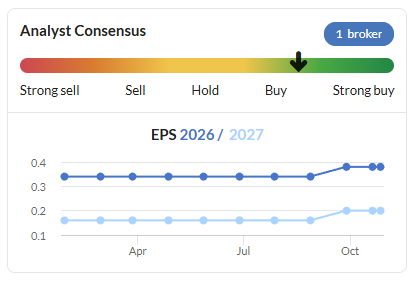

Thanks again to Cavendish for providing an updated note today. The company’s house broker has left its forecasts unchanged, highlighting slowing revenue growth and declining profits relative to FY25:

FY25 actual: revenue £26.5m / adj EPS: 0.74p

FY26E: revenue £27.1m / adj EPS 0.38p

FY27E: revenue £30.5m / adj EPS 0.20p

As the StockReport highlights, the shares don’t look that cheap on a forward basis:

Roland’s view

I’ve spent some time looking into this situation to understand what happened last year. But the StockReport data provides us with a short cut to the same conclusion. While last year’s maiden profit was impressive, the forward trend suggests that without significant further wins, this may not have been a sustainable level of profitability:

Kromek’s high ValueRank reflects the backward-looking nature of this metric (value investing traditionally relies on historic data, not forecasts).

While earnings forecasts were upgraded in September, the expected drop-off in FY26 is more significant at this stage, in my view:

While there does appear to be decent growth in the remainder of the Kromek business (excluding the Siemens Healthineers contract), profit margins have historically been poor – Kromek could not even break even on £20m of revenue in FY24.

I wonder if the Siemens deal provides a possible explanation – the high upfront payment is said to reflect the transfer of IP, rather than physical product. Does this mean that in more normal transactions where Kromek is only selling products, pricing power is limited? The FY24 results showed overheads exceeding gross profit, resulting in an operating loss on nearly £20m of revenue.

If I was considering an investment here, I’d want to understand more about this business. For example:

Is the core business likely to benefit from operating leverage and higher margins as growth continues?

What is the market opportunity for another Siemens-type deal?

If I’m correct and 90% of the contract value has been recognised within the first 10 months, what else remains to be delivered over the next three years?

While I am definitely not suggesting anything is amiss, recent years have seen a number of UK-listed firms run into problems relating to revenue recognition.

Graham and Mark have both taken an AMBER/RED view on this business this year, prior to the publication of the FY25 results. For me, it's a finely-balanced choice between AMBER and AMBER/RED.

On balance, the lack of visibility and seemingly front-loaded profitability of the Siemens deal means I'm going to leave our view unchanged at AMBER/RED - with profits expected to decline rapidly back to more marginal levels without another Siemens-type deal, I am not sure of the attraction at current levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.