Good morning!

As things have been rather volatile in recent trading sessions, here are some interesting overnight figures as markets reopen after the weekend:

- FTSE futures down 0.7% (it's still over 10,100)

- S&P futures down 1.1%

- Gold down 7% at $4,575 (the high was $5,600 last Thursday)

- Silver down 13% at $74 (the high was nearly $122 last Thursday)

- Oil down 5%, with Brent Crude at $65.70

- Bitcoin stable at $76,400

The only concrete reason for the gold sell-off that I'm aware of is Trump's announcement of Kevin Warsh as the new Fed Chair (as I discussed in Friday's Week Ahead article).

While Mr Warsh was considered the front-runner for the job, the alternative candidates were considered more "dovish".

Warsh has spoken out many times on the need to reduce the size of the Fed's balance sheet (which is inherently deflationary and negative for commodity prices, as when the Fed sells assets, it reduces the supply of dollars).

It remains to be seen if Warsh will be able to act on his prior beliefs when he takes over at the Fed in May. But the commodity sell-off that his appointment triggered has seen a more "risk-off" attitude take hold across various financial markets.

Gold, in particular, had been rising exponentially in January. It has now given up most of those gains, punishing anyone who jumped onto the trend too late:

Source: tradingeconomics.com

As far as the broader equity markets are concerned, what we've witnessed so far is just a brief period of profit-taking. It remains to be seen whether it follows through to become something more serious.

Today's Agenda is complete.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£211bn | SR70) | NYSE listing will be harmonised across London, New York and Stockholm. FTSE 100 listing will remain. Imfinzi recommendation based on Phase III results showing 29% reduction in risk of progression, recurrence or death vs chemotherapy. | ||

Balfour Beatty (LON:BBY) (£3.5bn | SR76) | Extends existing partnership through to 2033. Option to extend by a further six years based on delivery of initial term, taking potential value to £900m. | ||

Smithson Investment Trust (LON:SSON) (£1.61bn | SR N/A) | NAVps -1.8% to 1,601.5p. Benchmark index return +10.2%. Conversion of SSON into an open-ended fund remains underway and, if approved by shareholders, will allow investors to sell their units in line with NAV, eliminating the previous discount. | ||

GCP Infrastructure Investments (LON:GCP) (£635m | SR77) | Certain social housing borrowers have agreed disposals totalling £47.5m GCP will receive day one cash proceeds of £43m at valuations in line with NAV. NAV fell by 1.1% to 100.27p in the final quarter of 2025. Quarterly dividend of 1.75pps declared, in line with target. | ||

Discoverie (LON:DSCV) (£617m | SR43) | Sales +5% in Q3 (+1% organic). Book-to-bill was 1.03x. Order book provides good coverage for final quarter, full-year adjusted earnings to be in line with expectations. | ||

AEP Plantations (LON:AEP) (£570m | SR97) | 2025 CPO production +7% to 425.8mt at $853/mt (+7% vs FY24). PK Production +13% at $731/mt (+44% vs FY24). | GREEN = (Graham) I'm happy to leave our positive stance unchanged after another constructive update from the company. CPO production continues to increase, helped both by AEP's own production but also in particular by external purchasing, and a new mill is set to open at the end of the year. | |

ME International (LON:MEGP) (£523m | SR74) | Vladimir Crasneanscki appointed deputy CEO w/ immediate effect. He was previously Managing Director UK and was instrumental in the roll-out of laundry services in the UK, a key growth project. | ||

Mortgage Advice Bureau (Holdings) (LON:MAB1) (£453m | SR73) | Welcomes FCA report into the distribution of pure protection products to retail customers. Believes report is “positive development for MAB” and notes the FCA “does not envisage significant market interventions”. | ||

Elixirr International (LON:ELIX) (£392m | SR77) | Acquired for up to £18m (7.8x 2025 EBITDA). Notes Kvadrant achieved 25% revenue CAGR from 2022-25. Kvadrant specialises in “commercial transformation” and “transaction services”. Founder joins ELIX as partner. | ||

Auction Technology (LON:ATG) (£373m | SR26) | ATG Board unanimously rejected FitzWalter's proposed 400p offer. “In light of the Board's rejection and refusal to facilitate access to due diligence, FitzWalter confirms that it does not intend to make an offer for ATG.” | PINK | |

VP (LON:VP.) (£217m | SR65) | Alice Woodwark assumes the CEO role from today. Her predecessor, Anna Bielby, will remain employed as an advisor until 31 Mar 26. | ||

Midwich (LON:MIDW) (£204m | SR67) | Adam Councell appointed as CFO. He was previously the CFO of Marlowe from 2021 until its takeover by Mitie Group in Aug 25. | ||

Gooch & Housego (LON:GHH) (£190m | SR63) | James Corte will join as CFO from 9 April 2026. | ||

Begbies Traynor (LON:BEG) (£190m | SR88) | Rebranding to become BTG Consulting plc to “more accurately represent” its range of services and strategy. Ticker will change to BTG, at a date TBC. | ||

Cab Payments Holdings (LON:CABP) (£184m | SR53) | Helios Consortium has made an increased cash offer of $1.15 per share. Helios has control over or has received a letter of support for the offer in respect of 50.33% of CABP shares. | PINK | |

GCP Asset Backed Income Fund (LON:GABI) (£118m | SR84) | NAV -6.4% to 59.55p at 31 Dec 25. Does not intend to provide further asset-level detail on NAV movements due to “concentration” of portfolio and ongoing disposal discussions. Declares quarterly dividend of 1.58125pps. | ||

Brave Bison (LON:BBSN) (£80 million | SR34) | MiniMBA has signed €1.3m training contract with “one of the world's largest food and beverage conglomerates”. Will be recognised in the current financial year. | ||

Churchill China (LON:CHH) (£43m | SR83) | Trading in the second half of the year met its expectations, with turnover for the year at circa £76m and profit before tax expected to be in line with market expectations. “Materials performed well despite reduced sector volumes, although the decision of a key UK customer to source their materials supply directly will influence revenue going forward. However mitigating actions are expected to limit the impact on profitability.” | AMBER = (Roland - I hold) 2025 trading was in line with expectations and performance in Europe showed some signs of recovery in H2. However, the core UK market remains under pressure from macro conditions and Churchill’s materials business has lost a key customer. Despite a double-digit share price gain so far this year, the stock continues to trade c.25% below tangible book value. I share the StockRanks’ view that this market-leading and venerable business is a Contrarian play and I would have liked to upgrade to AMBER/GREEN today. However, the lack of any clear outlook statement today means I’m going to stay neutral a little longer. | |

Tungsten West (LON:TUN) (£38m | SR27) | Debt funding progressing well, with a number of potential lenders advanced into term sheet stage. Long-lead orders for key equipment and detailed engineering work advanced. “This work programme will have the Company producing tungsten concentrate within 12 months of funding.” | ||

Atome (LON:ATOM) (£34m | SR11) | Finalisation of the definitive project financing documentation for the Villeta Project is continuing with key stakeholders. Now targeting Final Investment Decision to be achieved around the end of February 2026. | ||

XP Factory (LON:XPF) (£25m | SR57) | “Given slower than expected Boom B2C performance over the key festive period which has continued into January, the Board now expects FY26 revenue and EBITDA to be below current market estimates with the Board expecting FY26 pre-IFRS16 adjusted EBITDA of between £5.0m and £6.0m… FY27 is also therefore expected to be a year of consolidation, with remaining uncertainty driven by market conditions.” | BLACK | |

Metals One (LON:MET1) (£22m | SR5) | Increased investment in Fulcrum through exercise of 2.9 million warrants at 5p. Increases shareholding to 6.3%. | ||

| Goldplat (LON:GDP) (£19m | SR98) | Trading Update | As a result of higher gold prices, increased volumes and operational agility and improvements, the Board expects that results for FY26 will materially exceed prevailing market expectations. | |

Various Eateries (LON:VARE) (£19m | SR46) | FY September 2025: revenue +6%, LfL sales +2%. Adjusted EBITDA £1.4m. Net cash £4.6m. Strong start to FY26, LfL sales +9% over 5-week festive period. | ||

B90 Holdings (LON:B90) (£16m | SR23) | 2025 revenue ahead of market expectations, EBITDA in line with market expectations, reflecting higher marketing spend. | ||

CAP-XX (LON:CPX) (£13m | SR11) | Revenue +9% (A$2.6m). Loss after tax A$1.5m. Cash A$2.9m. “We are running a lean, debt-free company that currently maintains a healthy cash runway and a strong orderbook.” | ||

Litigation Capital Management (LON:LIT) (£11m | SR21) | Credit facility increased from $75m to $100m, covenant waiver extended to 1st March 2026. LIT is working “towards a long-term resolution of its capital position”. | ||

Zoo Digital (LON:ZOO) (£9m | SR49) | Increase in Request for Proposal activity. Chairman and another NED step down. |

Graham's Section

AEP Plantations (LON:AEP)

Up 2% to £14.95 (£580m) - Trading Statement - Graham - GREEN =

AEP Plantations Plc, which owns, operates and develops sustainable palm-oil production in Indonesia and Malaysia, today announces a trading update covering the financial year ended 31 December 2025.

M P Evans (LON:MPE) made it into my “12 stocks of Christmas”, and AEP is an obvious alternative for anyone interested in palm oil.

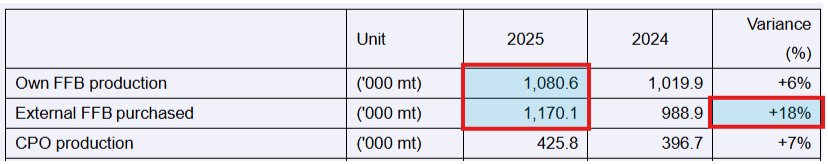

Unlike MPE, AEP has been increasing the quantity of external crop that it purchases (external FFB purchased), with more external crop purchased than it produced on its own:

Its own production rose 6%, “primarily driven by improved output from young and matured palms in the Bengkulu and Kalimantan regions in Indonesia”.

The increase in external purchases was “primarily due to new third-party crop intake at the recently commissioned HPP Mill (North Sumatra) and Bengkulu region”.

Total production is up 7%, slightly lower than the 8% figure given at the previous trading update.

Development: the five-year target to develop 10,000 hectares is on track with 2,440 hectares replanted, and new planting on 221 hectares. As noted previously, a new mill is on track for completion in December 2026.

On the November floods: “conditions across the estate have now largely returned to normal and the flooding will not have a material impact on the Group's overall fruit production or financial performance.”

Comment by the Executive Director:

"We are delighted with the operational progress we have made during the course of the year.

As well as managed replanting, our objective, over time, is to sustainably lift yields through improved agronomic practices and tighter estate management, including the use of enhanced monitoring systems.

Our business has been supported by a strong pricing environment, giving us good cash flow, which provides a solid financial base to support future growth and deliver long-term shareholder value."

Graham’s view

With strong commodity prices (although your belief in that may have been rocked in recent days!), it’s been a very pleasant environment to own shares in the likes of AEP:

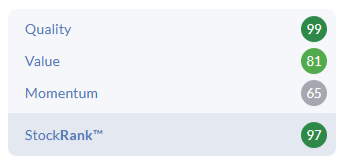

I note the StockRank of 97:

The usual warnings about foreign shares don’t really apply, as this has been listed for over 30 years and paid dozens of dividends.

One thing to be aware of is that the ownership situation is a little unusual, as I mentioned last time. The majority shareholder is Genton International, previously controlled by Lim Siew Kim, who passed away in 2022. So I think her heirs must control AEP now, but they don't seem to have any Board representation currently.

That's just something to take note of - it’s always useful to know if there’s a majority shareholder involved. But I’m happy to leave our GREEN stance unchanged today after another constructive update from the company.

Roland's Section

Churchill China (LON:CHH)

Down 5% at 376p (£41m) - Full Year Trading Update 2025 - Roland - AMBER

(At the time of publication, Roland has a long position in CHH.)

The Company is pleased to confirm that trading in the second half of the year met its expectations, with turnover for the year at circa £76m and profit before tax expected to be in line with market expectations.

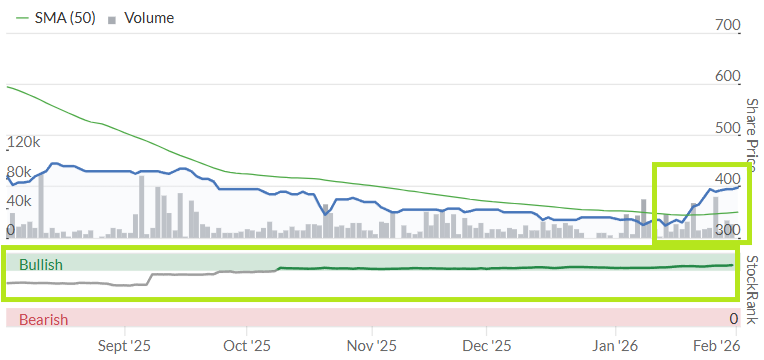

Shares in this leading supplier of crockery to the hospitality trade continued to drift lower after I took a neutral view in September. But it seems that investors in this fairly illiquid stock have been expecting more positive news – the share price had risen by nearly 20% year-to-date, ahead of today’s statement:

I think it’s interesting to note the StockRank has also been trending higher.

My position in this AIM stock is underwater, but I averaged down in December, so I am inevitably biased. Even so, I think today’s in line update is broadly positive and provides some hope that the run of earnings downgrades we saw last year may have bottomed out.

2025: key points

H2 trading “met expectations”

Full year trading in line with market expectations, with revenue of c.£76m and pre-tax profit expected to be £6m

Year-end net cash of £10.8m (FY24: £10.1m)

Although Churchill cut its dividend last year, this was a prudent decision. The improved year-end net cash balance demonstrates how this has allowed management to protect its balance sheet while continuing to invest to support an eventual recovery.

Geographically, it seems trading was mixed:

UK: “maintained market leader status” but end users were affected by weaker macro conditions. Run-in to Christmas was more positive with demand from pub groups. Year-end “order pipeline” (not necessarily the same as the order book) was ahead of the prior year;

Europe: H2 improved relative to the same period in 2024. Year-end result “broadly in line” with 2024 (i.e. probably slightly below);

USA: ended the year ahead of 2024 despite USD devaluation;

Rest of World: weaker, as dependent on major projects which have been delayed.

Raw Materials: Churchill owns its own clay business which supplies raw materials for internal use and sells to external customers. Unfortunately, “a key UK customer” has decided to source its own materials directly going forward, so will no longer be buying from Churchill.

Management says that mitigating actions are expected to limit the impact on profitability, but I think this is a disappointment all the same. I’d be interested to know the reasons for this decision and the source of alternate supply – I can’t imagine there are all that many alternatives in the UK.

Outlook: no outlook comments were provided today and I don’t have access to any broker notes.

Roland’s view

This family-controlled business has a long and respectable history as a market leader in the UK. Profitability has come under pressure since 2023 due to high energy costs and weaker demand.

My view is that demand will recover in line with normal cyclical patterns. However, I am concerned about the impact of high electricity costs on UK manufacturers and the impact this may have on their competitive positioning and profitability.

More broadly, I share the view of the StockRanks that this is a potential Contrarian stock, with high quality and value but weak (although improving) momentum:

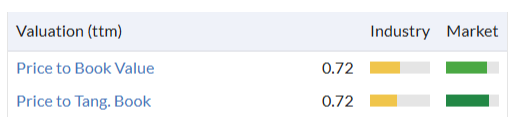

Based on today’s year-end update, nearly a quarter of the market cap is covered by net cash. Churchill also trades at a significant discount to its tangible net asset value:

Ahead of today, 2026 forecasts were for a flat result versus 2025. Given the complete lack of outlook guidance today, I am going to retain our neutral view a little longer.

However, I would hope to be able to upgrade to AMBER/GREEN when the company’s final results are published and some forward-looking commentary is provided.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.