Good morning!

Today's report is complete.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Natwest (LON:NWG) (£58bn | SR74) | Agreement to acquire Evelyn Partners from funds advised by Permira and Warburg Pincus for £2.7 billion enterprise value. Creates the UK's leading Private Banking and Wealth Management business. | ||

Vodafone (LON:VOD) (£25.9bn | SR94) | Vodafone Egypt is participating in the multi-year government investment programme in Egypt: encompasses spectrum in the 1,800MHz and 3,500MHz bands, and the renewal of the 2,600MHz band. | ||

Centrica (LON:CNA) (£8.82bn | SR48) | £80 million proceeds from the sale of various non-core energy solutions businesses. | ||

Plus500 (LON:PLUS) (£3.17bn | SR90) | FY25: revenue and EBITDA ahead of market expectations (revenue $757.7m and EBITDA of $345.8m). Actual revenue $792.4, actual EBITDA $348.1m. Started FY 2026 supported by positive momentum across global financial markets, and FY26 is also expected to be ahead of current market expectations ($749.3m and $348.4m). | GREEN = (Graham) PLUS are making it very easy for me to stay positive on them, by consistently putting out strong results and keeping up with market expectations. It is now at the sort of valuation where I’d have to swiftly downgrade our stance, if any serious problems emerged. But for now, I see little reason to fight the trend. This is a highly successful and multi-faceted international trading platform, that has refuted my prior scepticism. | |

TBC Bank (LON:TBCG) (£2.38bn | SR66) | Georgian operations of JSC TBC Bank will be assumed by George Tkhelidze, in order to enable the Group CEO, Vakhtang Butskhrikidze, to focus on the Group's strategic priorities. Deputy CEO of JSC TSB leaves. | ||

SolGold (LON:SOLG) (£841m | SR30) | Takeover to be implemented by Court-sanctioned scheme of arrangement. SolGold shareholders are strongly encouraged to vote in favour. There is support from shareholders owning 35.2% of the company, not including the bidder. | PINK | |

J D Wetherspoon (LON:JDW) (£769m | SR40) | Explanation of Wetherspoon’s policy on assistance dogs. | ||

Porvair (LON:PRV) (£400m | SR84) | Revenue +1%, adjusted operating profit +7% (£26.2m). “The long-term fundamental demand drivers have not changed and Porvair remains well positioned to take advantage of tightening environmental regulation; the growth of analytical science; the need for clean water…” et cetera. | AMBER/GREEN = (Graham) This one is reassuringly boring, with modest operating profit growth generated despite very limited top-line progress. I acknowledge that this might be fully valued here, but I am happy to maintain our moderately positive stance given the very consistent track record and the cleanliness of the figures. | |

Avacta (LON:AVCT) (£267m | SR24) | The company’s Vice President of Chemistry (from 2022) becomes its Chief Scientific Officer. The company’s former CSO will be leaving to pursue another opportunity. | ||

Enquest (LON:ENQ) (£241m | SR63) | Four-year extension to the Block 12W Production Sharing Contract, awarded by PetroVietnam. Extension runs to July 2034. | ||

YouGov (LON:YOU) (£241m | SR67) | The Board and the CFO have mutually agreed that he will step down to pursue other opportunities, with effect from today. He has been with YouGov for nineteen years and will provide support during his notice period for an orderly handover. A new interim CFO is appointed. | AMBER = (Mark) [no section below] | |

Warpaint London (LON:W7L) (£162m | SR60) | Buys the IP, stock and order book of Barry M (not the manufacturing capabilities or any liabilities), out of administration, for £1.4 million. FY25 trading update: revenue £105m (2024: £102m), including £12m from Brand Architekts (bought in Feb 2025). Adj. EBITDA £22m (2024: £25m). Expects a return to organic growth in the new year. | BLACK (AMBER/RED) ↓ [GN] These results have missed Shore Capital’s 2025 forecasts: revenue £110.5m and EBITDA £24.9m. FY26 forecasts are unchanged for now: would have been slightly lower if not for the acquisition announced today. [MS] We have often given this company the benefit of the doubt, as they clearly had a period of exceptional growth in the past, where they appear to have executed flawlessly. The lack of share price reaction today suggest many were expecting worse. However, after today’s profits warning, I have significant concerns over trading visibility for FY26 and the competitive landscape. Until there is some tangible evidence that organic sales growth is back, I think we have to take a more cautious stance going forward. | |

Pulsar Helium (LON:PLSR) (£161m | SR34) | The Jetstream #6 appraisal well at the Company's flagship Topaz Project in Minnesota, USA has intersected a pressurized gas zone. CEO comment: “Achieving pressurized gas intersections in every Jetstream appraisal well drilled so far speaks to the strength of the geological model we're developing at Topaz.” | ||

Devolver Digital (LON:DEVO) (£124m | SR72) | 2025 full year performance showed improvement over 2024 with growth in both revenues and Adjusted EBITDA. Meeting guidance of more than US$100m in full year revenues. Underlying Adjusted EBITDA pre-impairments is expected to reach USD double-digit millions, marginally higher than consensus expectations. Impairments $3.5m. US$36.4 million net cash. | AMBER↓ (Mark) [no section below] | |

Rainbow Rare Earths (LON:RBW) (£113m | SR28) | Its large-scale pilot plant recently commissioned in Johannesburg is operating the optimised Phalaborwa primary flowsheet in line with expectations and has successfully produced ca.2 kg of a high-grade mixed rare earth hydroxide, which is a commercial product. | ||

Shield Therapeutics (LON:STX) (£103m | SR37) | FDA has granted to Shield an additional 3 years of Data Exclusivity for ACCRUFeR® (ferric maltol). | ||

Wynnstay (LON:WYN) (£93.1m | SR98) | Revenue -4.8% to £583m, Adj. Op Profit +16.5% to ££9.2m. Net Cash £25.7m (FY24: £32.8m), Dividend +1.7% to 17.8p. “Early trading in FY26 is in line with the Board's expectations, and the Group remains focused on delivering further margin, cost and efficiency gains.” | AMBER/GREEN ↓ (Mark) These results rely heavily on one-off restructuring costs being excluded in order to hit forecasts. The cash costs of those, plus increased capex means that the dividend may have been increased for 22 years, but it will be uncovered by free cash flow over the next few years. FY26 is in line and their broker introduces FY27 estimates, but the 8-10% CAGR medium-term EPS growth makes the 13x P/E look high. While the chance of longer-term productivity improvements may yet yield longer-term growth, these changes are requiring increasing capex in the short term and are far from guaranteed. While this remains a SuperStock, and in particular that strong Momentum Rank is in place, it makes sense to be broadly positive…just not as positive as we were when the share price was lower, and the scale of the cash impact of the adjustments was not yet revealed. | |

Aurrigo International (LON:AURR) (£78.2m | SR37) | Expects to report revenue -10% to £8.0m ahead of rebased expectations. Adjusted EBITDA loss and loss before tax are expected to be in line with expectations. Cash position of £11.5m, ahead of expectations, reflecting a successful fundraising of £13.8m net in the year. | RED (Mark) [no section below] | |

Andrada Mining (LON:ATM) (£74.3m | SR30) | Lithium mineralisation was intersected in most of the holes reported, confirming mineralisation from surface down to a depth of 160m. | ||

Power Probe (LON:PWR) (£63m | SR45) | Revenue +25% to $39m. U/L EBITDA expected to be in line with market expectations at $9m.Trading in the initial weeks of 2026 has been encouraging. | ||

Cora Gold (LON:CORA) (£54m | SR30) | Up to £13.7m before expenses raised by issuing 228.5m shares at 6p/share, a 44% discount to last night’s close. Following completion of the Fundraise, Eagle Eye (a Singapore-based single-family office) will hold a maximum of 29.90%. | ||

MTI Wireless Edge (LON:MWE) (£45.7m | SR89) | Acquired the remaining 50% interest in its Australian subsidiary, Mottech Parkland for AUD 0.55m (approximately US$0.38m). | ||

Palace Capital (LON:PCA) (£42.7m | SR53) | Sale of its investment property at Broad Street Plaza, Halifax for £9.9m at a 14.9.% net initial yield. ( 8.7% ahead of the September 2025 valuation). | ||

Cobra Resources (LON:COBR) (£42.1m | SR17) | 13 drillholes completed to date where some mineralisation is visible. First Assays in March. | ||

Kavango Resources (LON:KAV) (£31.8m | SR4) | JORC-compliant Mineral Resource Estimate 33.9koz gold at 2.68g/t declared at Bill's Luck, incl. 2.6koz Measured. | ||

Arecor Therapeutics (LON:AREC) (£29.3m | SR17) | Revenue down 40% to £3.1m incl. Discontinued operations. Cash and cash equivalents of £6.1 million (2024: £3.2 million) above expectations due to closing Tetris Pharma, and $7m received on signing royalty financing agreement. | ||

Kr1 (LON:KR1) (£28.3m | SR27) | Buying Bitcoin and Ethereum as well as their usual holdings. | ||

Ondo InsurTech (LON:ONDO) (£26.8m | SR2) | Alm. Brand Group to roll out LeakBot across its customers. Committed to ordering a minimum of 15,000 LeakBot devices in the next 18 months. | ||

B90 Holdings (LON:B90) (£15.6m | SR27) | Andy McIver, currently an independent Non-Executive Director of the Company, will assume the role of independent Non-Executive Chairman. | ||

Orcadian Energy (LON:ORCA) (£13.6m | SR15) | Orcadian and Albion Labs Canada are working together to explore a potential royalty-based funding structure. | ||

Fulcrum Metals (LON:FMET) (£12.1m | SR12) | Phase 3 optimisation trials show recovery of up to 78%, up from 47% in Phase 1 testing. | ||

Jangada Mines (LON:JAN) (£10.3m | SR25) | LoI for the right to earn an exclusive option to acquire 100% of the high grade Molly Gold Project. | ||

Cloudbreak Discovery (LON:CDL) (£10.2m | SR6) | Proceeding with the acquisition of 90% of the Paterson Gold-Copper-Molybdenum Project, for 330m new shares. Aprox. £1.8m at yesterday’s close. |

Graham's Section

Plus500 (LON:PLUS)

Up 7% to £48.12 (£3.36bn) - FY 2025 Preliminary Results - Graham - GREEN =

Plus500, a global multi-asset fintech group operating proprietary technology-based trading platforms, today announces its preliminary unaudited results for the year ended 31 December 2025.

We covered the year-end trading update here very recently - on 12th January.

That update already gave us the 2025 revenue and EBITDA figures ($792m and $348m, respectively), which were ahead of expectations.

They are double-dipping on that performance today, with the announcement that these 2025 results are ahead of market expectations - that was true on the 12th of January, but it’s not true today, now that expectations have been updated!

What is new is the 2026 outlook.

On January 12th, they were vague:

The Company's Board of Directors remains confident in the outlook for Plus500 in 2026 and beyond, and expects the Group to continue making strong financial and strategic progress alongside delivering further shareholder returns.

Today, they say (emphasis added):

The Company's Board of Directors (the "Board") remains confident in the Group's prospects and expects FY 2026 performance to be ahead of current market expectations.

These expectations are helpfully provided:

Consensus forecasts for FY 2026 Revenue and EBITDA are $749.3m and $348.4m, respectively

I think it’s noteworthy that prior to January 12th, the company was forecast to have FY26 revenue and EBITDA lower than the FY25 figures. (FY25 expectations were for revenue of $757.7m and EBITDA of $345.8m).

Customer P&L

One factor I’m always keen to investigate at PLUS is “customer trading performance”, which are the profits or losses on customers’ unhedged trades. This exposure is not something that I’m used to seeing at other platforms.

Back in 2024, “customer trading performance” (maybe we need another name for it?) generated $44m of profits for PLUS. I think I’m right in saying that it has generally been a positive contributor to profits - in aggregate, customers have lost money.

But in 2025, customers made money in aggregate from their trades, before expenses and this cost PLUS $9.8m. That’s unusual.

For context, “customer income” - the costs charged to customers in the form of spreads, overnight charges, etc. - was some $739m. So customer P&L this year, while negative, hasn’t massively reduced profitability.

CEO comment:

2025 marked a year of accelerated strategic progress for Plus500. We successfully scaled our non-OTC business into a key growth driver, bolstered our position as a trusted provider of institutional market infrastructure, and continued to deliver a strong financial performance with significant shareholder returns.

Key metrics: the average deposit per active customer has more than doubled from $12,000 to $26,900. It’s good news but at the same time I don’t know how meaningful this doubling is, as it’s not a like-for-like comparison. Growth in the US has meant that they now have a different type of customer.

Other metrics have grown at a more modest rate or reduced:

Average revenue per user is up 8%

The number of active customers is down 5%

The number of new customers is down 11%

The cost of acquiring a new customer has also fallen 13%.

It’s an odd set of KPIs, as PLUS continues its evolution into a business with a smaller set of more valuable users.

International expansion continues in the US, Canada, UAE, Columbia, India and Japan (new licences, new.offices, etc.)

Shareholder returns: there is a new $100m buyback, to begin when the current $90m buyback is completed. There are also $87.5m of dividends announced today (similar to last year on a per-share basis).

Balance sheet: there is balance sheet equity of $568m, almost fully tangible, and including cash of $800m+. No borrowings.

Graham’s view

PLUS are making it very easy for me to stay positive on them, by consistently putting out strong results and keeping up with market expectations.

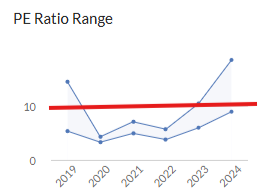

Although I’m unaccustomed to seeing the stock trading at this high valuation:

An earnings multiple of 10x or lower has been more normal:

So I’m not seeing tremendous value here any more: the share price is up by about 50% since the Autumn.

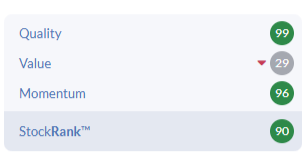

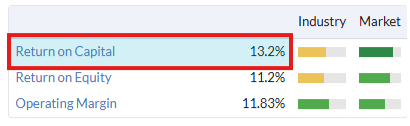

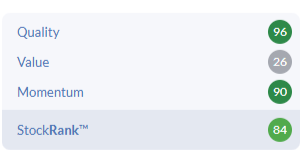

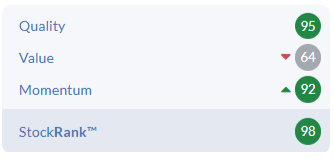

The StockRanks agree with this, seeing little value but still giving it a high score on Quality:

So I’m in full agreement with the StockRank on this occasion: little value on offer, but there are lots of other reasons to stay interested.

It’s now at the sort of valuation where I’d have to swiftly downgrade our stance, if any serious problems emerged. But for now, I see little reason to fight the trend. This is a highly successful and multi-faceted international trading platform, that has refuted my prior scepticism.

Porvair (LON:PRV)

Up 1% to 870p (£405m) - Full Year Results - Graham - AMBER/GREEN =

Porvair plc ("Porvair" or the "Group"), the specialist filtration, laboratory and environmental technology group, announces its results for the year ended 30 November 2025.

There tend to be few fireworks at this company: just solid performance, year in and year out:

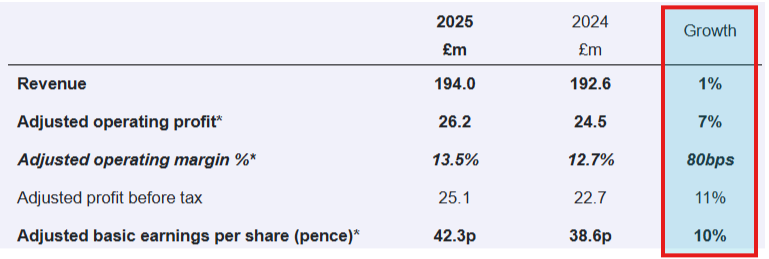

And we have more of the same today: modest revenue growth, but decent growth in profits and EPS. Revenues were held back by a 1% FX headwind, so at constant currencies they would have been a little stronger than what is shown below.

There are reassuringly few adjustments, too. Adjusted PBT of £25.1m is converted to actual PBT of £23.3m. A nice clean result.

The full-year dividend gets nudged up from 6.3p to 6.7p.

CEO comment:

"Porvair delivered record revenue, profit and margin in 2025, despite mixed trading conditions across our end markets. As expected, aerospace demand increased in the second half of the year, while petrochemical sales slowed, and industrials remained mixed. The laboratory end markets showed steady progress throughout the year, with environmental demand continuing to improve. Overall, the Group delivered another year of progress despite economic uncertainty and end-market inconsistency.

It seems that more of the same is expected: “The Group's long-term fundamental demand drivers have not changed.”

If you’re interested, granular detail is provided for every division.

Aerospace & Industrial: very flat year-on-year performance.

Laboratory: 5% constant currency revenue growth and a nice increase in the operating profit margin (from 14.8% to 16.3%). The reasons given: “improved operational focus and continued investment in automation and capacity across the businesses”.

Metal Melt Quality division (which makes “filters for molten aluminium, ductile iron and nickel-cobalt alloys”): flat revenues, higher profit margins.

Current trading and outlook: this section merely repeats what the CEO has already said.

Net cash: £8.4m, an improvement from the small net debt position at the end of the prior year. But they went on to make a £17.8m acquisition last month.

ROCE: the company helpfully calculated this at 14.4%. Checking their calculation of last year’s number, they seem to come up with slightly higher estimates than Stockopedia:

Graham’s view

This one tends to be reassuringly boring.

I’ve been moderately positive on it (e.g. here), with Roalnd, arguing that it’s fully valued.

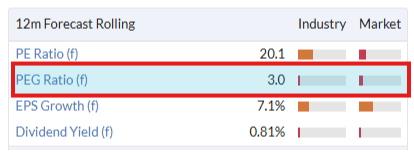

That remains the case today, in my view, at an earnings multiple of 20x and with Stockopedia categorising it as a “High Flyer”.

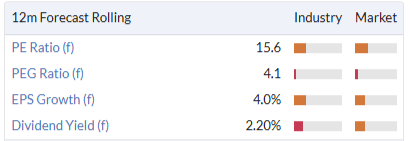

Indeed, sceptics might well point at the PEG ratio and argue that it’s overvalued:

For my part, I’m going to continue to give it the AMBER/GREEN colouring, as I view it as a steady ship, with healthy finances, and very modest in how it presents its results. There’s a lot to be said for trust and after so many years of consistent performance, and considering the very stable (even rising) earnings forecasts, I view this as lower-risk than is typical for a company of this size (according to the commentator's curse, its next announcement should be a profit warning).

Mark's Section

Warpaint London (LON:W7L)

Up 8% at 215p - Acquisition of Barry M brand & FY25 Trading Update - Mark - BLACK (AMBER/RED ↓)

There’s a saying in the market that bad news travels slowly. So since we had to wait until February for this Full Year trading update, many were not expecting great things. Here’s the timing of FY trading updates over the last few years:

12 Jan 2024 - FY23 Organic Sales Growth +33% - “ahead of market expectations”

6 Feb 2025 - FY24 Organic Sales Growth +14% - no comment

9 Feb 2026 - FY25 Organic Sales Growth -9% - no comment

The FY24 trading update caused a 20% drop in the share price, not so much because the figures were slightly behind consensus, but investors did the maths and the initial 15% revenue growth in January was not going to be enough to hit FY expectations, and marked the shares down accordingly. Two things stand out:

To go from +15% revenue growth in January to finishing the year -9% organic shows how much trading deteriorated during the year.

The company seems much less keen to comment on how trading matches expectations, when it misses the numbers.

When I read the tone of today’s update, I was in no doubt that this was a weak set of numbers. The Shore Capital note is freely available to investors, so investors will quickly realise that this is a 5% miss on revenue and a 14% miss on EPS:

| Date | Revenue | EBITDA | Adj. PBT | Adj. EPS |

|---|---|---|---|---|

29 Apr | 128.6 | 32.2 | 29.0 | 27.0 |

23 Jun | 120.3 | 32.2 | 29.0 | 27.0 |

10 Sep | 110.5 | 24.9 | 21.3 | 19.7 |

Today | 105.0 | 22.0 | 18.4 | 17.0 |

Most Recent Downgrade | -5% | -12% | -14% | -14% |

For me, this undermines much of the work management has done to build trust over the last few years. Investors want companies who hit (or ideally exceed) expectations, but equally when things go wrong, we want management that are upfront about it, rather than leaving the broker to break the bad news.

Kudos goes to ridavies, who correctly called that Warpaint were struggling this Christmas due to the level of discounting on the Amazon store.

H2 organic revenue was down 11% year-on-year, versus a 6% drop in H1.

Outlook:

Management definitely see 2025 as a one off blip as the CEO says:

Looking ahead to the new year, we expect to see a return to organic growth across the Group and also expect to be able to update the market on further significant new customer roll outs with our full year results in April.

This sounds positive, but he also said "We expect to see continued growth across the Group in 2025” this time last year. So, in reality, it seems they have very little visibility on trading.

Shore keep their FY26 forecasts the same, despite the miss for FY25, which would mean revenue grew 14% and EPS 28% in FY26 if they hit these forecasts.

Cavendish also maintain their forecasts, but these are more conservative on revenue:

| Source | Revenue | EBITDA | Adj. PBT | Adj. EPS |

|---|---|---|---|---|

2026F Shore | 119.6 | 27.2 | 23.6 | 21.7 |

2026F Cavendish | 116 | 26 | 23 | 21.1 |

This is partly supported by the other piece of news, today - the acquisition of an additional brand.

Acquisition:

This is one benefit of having net cash in a business such as this. It can be used to take advantage of the weakness in competitors:

…acquisition of the Barry M brand, including its IP, stock and order book, but excluding the manufacturing capabilities and any liabilities, out of administration, for a cash consideration of £1.4 million.

They go on to list its presence in 1,300 stores and approximately £15m of revenue. They probably got a bargain, as accounts to 29th February 2024 for the Mero Group, show £2.1m of raw materials and £3.6m of finished goods. The accounts for FY25 aren’t on companies' houses, but I don’t see why stocks wouldn’t be at a similar level. However, given that this company went into administration, I’m not sure it will be immediately profit enhancing.

Keeping revenue forecasts the same, after an acquisition that adds potentially £15m of revenue, is effectively a large downgrade to organic growth. Downgrading revenue and keeping profit forecasts the same proved to be purely delaying the inevitable in early 2025.

Increased competition?

The big question remains is Warpaint’s claim that current trading weakness is all about consumer market conditions. I have written in the past about the lipstick Effect, the idea that cosmetics should be relatively immune to consumer downturns. Indeed, it could be argued that a more price-conscious consumer should benefit better value brands, such as W7L and Technic.

Large competitor Elf Beauty has not been without its challenges in 2025, but the recent Q3 results looked strong, for a period that Warpaint has struggled. Here is the Refinitive summary of those:

Co lifted its annual profit and sales outlook after beating Q3 estimates, driven by steady demand for its low-cost cosmetics

Brokerage Canaccord Genuity believes ELF’s brands continue to grow faster than the industry, driving market‑share gains, and sees significant white‑space opportunities across the portfolio that could fuel further expansion

Co sees FY net sales of $1.60 billion to $1.61 billion, up from its earlier forecast of $1.55 billion to $1.57 billion

This is what Google Gemini says about Elf in the UK:

e.l.f.'s UK success is driven by an aggressive retail and acquisition strategy:

Retail Partnerships: The brand has significantly expanded its shelf space in major retailers, including Boots, Superdrug, and Amazon UK.

Brand Acquisition: The May 2025 acquisition of Rhode (founded by Hailey Bieber) was a major catalyst for UK growth. Rhode's debut at Sephora UK in November 2025 achieved "record-breaking" sales, helping drive a 38% increase in e.l.f.'s total net sales for the quarter.

I can’t help thinking that this highlights the difference between the ambitions of the companies. Elf buys a skincare brand founded by a model married to a pop star for $1bn. Warpaint buys a brand founded by a man called Barry for £1.4m. Warpaint may well have got the best deal out of this in the short-term, but I’m less convinced that they will be a net winner in the long term.

So, I don’t think it is a given that Warpaint’s sales weakness in 2025 has been entirely due to weaker consumer conditions in the UK. The additional rollout programme into new retail outlets, that occurred in H2 should drive some progress in 2026.

Valuation:

Cavendish say:

The market had clearly been anticipating a downgrade, with the shares off c42% in the past six months. On our updated forecasts and Friday’s close, the shares are trading on 11.3x FY25E P/E, falling to 9.5x for FY26E. While the backdrop remains challenging, we believe the shares are at levels which we think represent an attractive entry point. Our 400p target price is unchanged.

However, this price target seems aggressive as it would see the shares back on a forward P/E approaching 20x. It also requires them to actually hit those FY26 numbers. Something that seems doubtful, given today’s trading update.

On the plus side, a dividend yield of around 6% and net cash shows that this remains a cash-generative business that isn’t shy about returning excess capital to shareholders.

Mark’s view

Today’s profit warning was clearly expected as the share price has actually risen on the miss. Some will take this as a sign that things have bottomed here. However, when looking at today's update, I come away with a number of worries. The first is the lack of willingness to be upfront about the miss, and name it for what it is. The second is the lack of visibility, with +15% organic revenue growth in the first month of the year, turning into -9% for the full year. The third is the distinct possibility that their markets have become much more competitive, and that this is the real reason for weaker sales in FY25, not just a consumer reluctant to spend.

We have often given this company the benefit of the doubt, as they clearly had a period of exceptional growth in the past, where they appear to have executed flawlessly. However, after today’s profits warning, I put very little faith in their ability to hit their FY26 numbers, as it seems that for whatever reason, they just don’t have great market visibility at the moment. They say they successfully delivered their expected strong second half rollout programme into new retail outlets, but that didn’t stop organic revenue dropping 11% year-on-year in H2.

Until there is some tangible evidence that organic sales growth is back, I think we have to take a more cautious stance going forward. AMBER/RED ↓

Wynnstay (LON:WYN)

Flat at 400p - Final Results - Mark - AMBER/GREEN ↓

Wynnstay pleasantly surprised the market before Christmas saying that trading was “modestly ahead of current market expectations with adjusted profit before tax of approximately £9.0m” on 1 December.

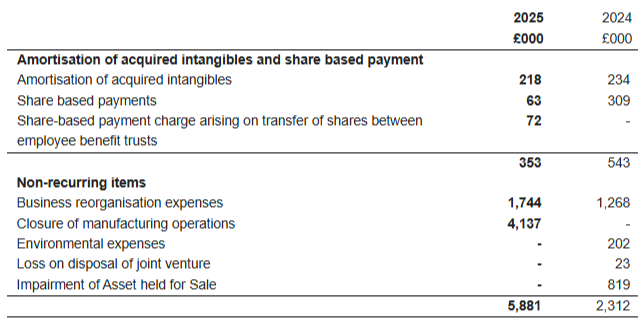

In these results, this comes in at £9.2m, up 21% on 2024. However, looking at the statutory results, PBT is down 15% to £3.5m. So this bears looking into in more detail. Here are those adjustments:

The big jumps are in business reorg costs, and the cost of consolidation of their feeds business. While clearly the right thing to do for the business, I can’t help feeling the scale of these costs is worth noting. Adj. PBT increased by £2.3m due to operational improvements, but those improvements cost them 2.5x that amount in one-off costs. Looking at the notes to the cash flow statement, these all appear to be cash costs, as far as I can tell.

Cash balance:

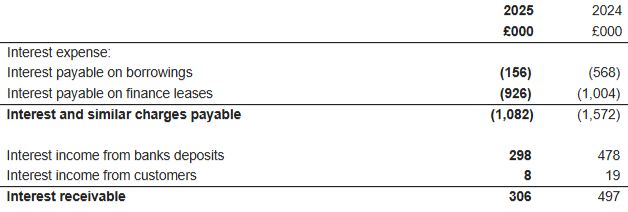

These cash costs and increased Capex are why net cash excl. lease liabilities is down from £32.8m to £25.7m in the year. This remains a healthy cash balance versus a £93m market cap. However, the relatively small net interest income suggests that net cash isn’t at this level throughout the year:

As does the much lower figure of £10.3m at the half-year.

Net assets have declined from £134.8m last year, and £136.3m at the half-year, down to £132.8m as a result of these exceptional cash costs. However, this remains at a premium to the current market cap.

Turnaround

The good news is that, while future developments look to have an increased capex element, the restructuring part of “Project Genesis” looks largely complete:

Project Genesis was introduced to stabilise and streamline the Group's operations. Following successful completion of the first phase of the project and with a solid operating platform now in place, the Group has embarked on a new five year plan, Wynnstay Strategy Genesis, designed to drive sustainable growth.

The strategy prioritises targeted investment to expand capacity, the development of stronger customer propositions, deeper engagement in core markets and disciplined capital deployment. While Project Genesis will remain active through to its completion in 2027, Wynnstay Strategy Genesis establishes the principal framework for the next phase of the Group's strategic and financial progress.

Dividend

The cash balance does allow them to increase their dividend:

Progressive dividend maintained: proposed final dividend 12.1p, taking total dividend for the year to 17.8p (2024: 17.5p) marking 22 years of unbroken dividend growth.

However, at a rise of just 1.7% (less than inflation) this is perhaps more about maintaining that record, rather than a signal about future returns. So when management say that this sub-inflation increase is “signalling the Boards confidence in the Groups underlying cash generation” that isn’t perhaps as re-assuring a message as they thought they were conveying! The dividend yield of 4.5% is pleasant but not exceptional, partly due to a share price that has done well recently.

House broker, Shore, suggests net cash (incl. Lease liabilities) will decline from the current £9.8m down to just £1.6m in two years time, making the dividend effectively uncovered by free cash flow.

Business Segments:

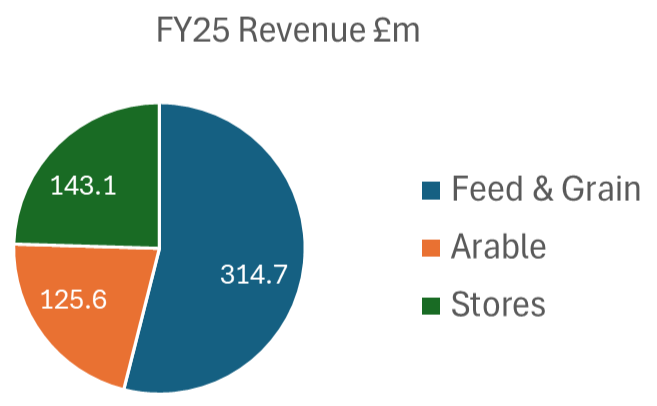

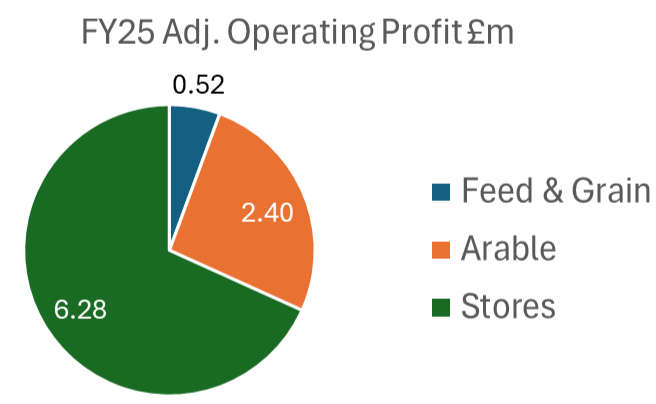

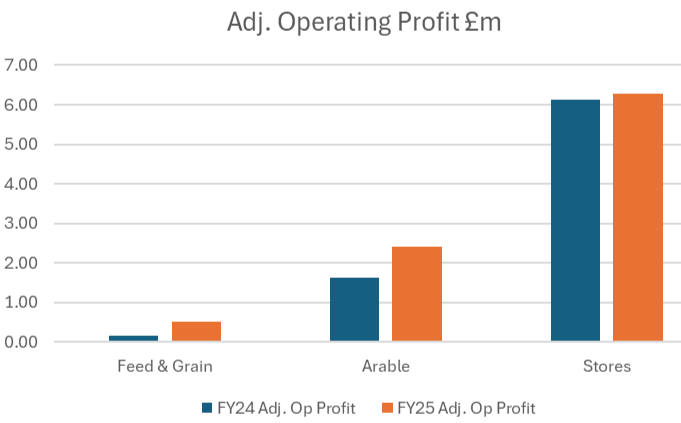

While the revenue shows a balanced split between business segments, dominated by Feed & Grain…

…when it comes to profitability, this is largely an agricultural retailer:

The efforts to improve these businesses can be seen in the trend:

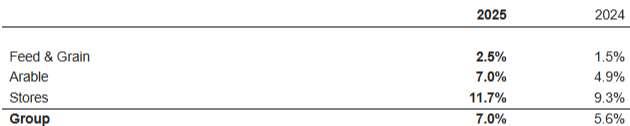

However, there is a lot more work to do to make this generate acceptable returns on capital overall. Here is what they tell us their return on net assets are for each segment:

That improvement in Feed and Grain is presumably before exceptional costs. One thing to note is that the increased capex as part of their proposed turnaround strategy is in the lowest performing segments suggesting that it may well cost money in the short term to show long-term improvements.

Forecasts:

The company say they are trading in line in the first few weeks of the year, so their broker, Shore, leave their FY26 forecasts for adj. PBT the same at £10m. They also introduce FY27 forecasts with 10% profitability growth. Modest dividend rises are forecast. However, as I have already commented, the dividend is expected to be uncovered by free cash flow, leaving net cash to decline over the new few years.

Valuation:

Shore say:

Wynnstay trades on a FY26F PER of 12.8x, EV/EBITDA of 5.1x and div yield of 4.5%. A >20% discount to its historic 6.5x EV/EBITDA, a 30% discount to its 575p NAV/share, and a credible strategy/pathway for >10% RONA (vs 7% currently) should ultimately drive a rerating on continued strategic delivery, supported by market share gains and sustainable earnings growth.

This doesn’t exactly set my pulse racing. 12.8x forward P/E for a company with 8-10% medium-term EPS growth, giving a 20% upside if everything turns out well, just doesn’t look great value compared to much of the UK small cap market.

Mark’s view

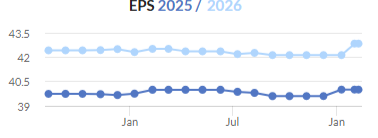

Roland was GREEN on this at 345p in December last year, following their beat of expectations. It continues to make sense remaining mostly positive, given the SuperStock designation, and in particular that strong Momentum Rank:

However, today’s results also show some caution is warranted in my opinion. The ahead statement lent heavily on some very large cash costs being excluded from the numbers. Both Feed & Grain and Arable are generating returns below their cost of capital and are requiring further investment in an attempt to bring that up to an acceptable level. If they manage this then we should see a continuation of recent trends of increasing PBT. However, improvements will take time to be seen in the numbers. Shore forecasts 8-10% medium-term EPS growth, which makes the forward P/E of around 13 look quite high, (partly due to the recent share price strength into these results). There is net cash, but the interest figures suggest the year end figure may be closer to the peak level, rather than the average during the year. Plus, their house broker forecast cash outflows over the next two years.

With a share price now around £4, this is more of an AMBER/GREEN for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.