Morning!

Mello update: Mello London is next week, and several of us will be there! If you are thinking of going, they have given us a 25% discount code: STOCKOPEDIA25. This will make a 1 day ticket £74.25 (instead of £99) or a 2 day ticket £126.75 (instead of £169).

Tickets can be bought here and the programme is here.

The Agenda is complete... phew! Wrapping up today's report there, thank you.

Spreadsheet accompanying this report: link (last updated to: 5th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Rolls-Royce Holdings (LON:RR.) (£96.9bn | SR70) | Performance in line, and “further confidence in our Full Year 2025 guidance… (underlying operating profit £3.1bn - £3.2bn, free cash flow £3.0bn - £3.1bn) despite continued supply chain challenges.” | AMBER (Graham) [no section below] A fabulous company at an equally fabulous valuation, Rolls-Royce is worth more than the likes of BP, GSK and Barclays these days. Today the company reiterates guidance including fresh cash flow that will nearly match its underlying operating profit – a nice sign that the underlying profit figures are sensible. In commercial aerospace, engine flying hours now significantly exceed 2019 levels and “demand remains strong” with more orders for large engines. In Defence, demand is unsurprisingly “robust” given the current state of geopolitics. The company’s credit rating has been upgraded to BBB+ by S&P: S&P said in August that they expected Rolls-Royce would “continue to operate with a net cash position in the near term, and, despite ongoing shareholder returns, the balance sheet will remain strong and a spike in leverage is unlikely.” That’s great for bondholders but for equity investors I’m not brave enough to take a positive view here: I can’t avoid the stance that the market cap is up with events (ValueRank only 12). Traders may wish to continue riding the momentum here (MomentumRank 99) but I don’t see how the risk:reward is anything special for a long-term investment. | |

3i (LON:III) (£40.4bn | SR91) | H1 return of 13% on opening funds. NAV per share 2,857 pence benefiting from FX translation. 60.1% ownership of Action. | ||

Flutter Entertainment (LON:FLTR) (£31.3bn | SR55) | SP -3% “Solid” performance. Players +9%, revenue +17%. Guidance: revenue $16.69bn (down $380m from previous guidance), adjusted EBITDA $2.915bn (down $570m). Reason: sports results have been customer friendly, and various other factors: “2025 outlook is therefore primarily updated to include the impact of: (i) Q3 performance, (ii) Q4 sports results, (iii) Q4 sportsbook investment, (iv) FanDuel Predicts investment, (v) tax costs associated with the Illinois wager fee which we are now treating as taxable, and (vi) Indian regulatory change”. | BLACK (AMBER/RED) (Graham) [no section below] This gambling giant’s primary listing has been in New York since last year, but it still has a UK listing that’s denominated in pence. The stock has struggled a bit in 2025 and on the basis of today’s Q3 update it’s not hard to understand why. The company posts a much larger net loss than Q3 last year ($789m vs. $114m) and I can’t gloss over it by focusing on the positive EBITDA figure. Interest expense alone is headed for $535m, which will eat about a fifth of adjusted EBITDA. Depreciation and amortisation of the company’s own fixed assets (not assets that it acquired) will cost another $670m. This cuts pre-tax earnings to $1.71bn before any other adjustments are made. The company has rather bravely continued with a $5bn share buyback programme, of which $1bn has occurred in 2025. Given that the stock is trading at 20x adjusted earnings and they also have a leverage multiple of 3.7x (pro forma basis, after adjusting for an acquisition), it's not obvious to me that this buyback is generating any value for shareholders. They say they expect leverage “to reduce rapidly given the highly visible and profitable growth opportunities that exist across the group”, and have a long-term leverage target of 2.0x to 2.5x. But I’m a bit more cautious today than I was last time and considering the reduced guidance, I think a moderately negative stance is now appropriate. | |

Aviva (LON:AV.) (£21.2bn | SR83) | Outlook: full year 2025 Group operating profit to be ~£2.2bn, which includes six months of Direct Line operating profit. On track to achieve 2026 Group targets one year early. New three-year targets: operating EPS 11% CAGR (2025-2028), targeting >20% RoE by 2028. | ||

United Utilities (LON:UU.). (£8.19bn | SR52) | Revenue +21%, underlying PBT +97%. Trading in line with expectations and prior guidance. | ||

Endeavour Mining (LON:EDV) (£7.63bn | SR95) | YTD-2025 production of 911koz, on track for the top half of the guidance range; Q3-2025 production of 264koz. Adj. Net Earnings of $556m (or $2.29/sh) YTD-2025. | ||

Barratt Redrow (LON:BTRW) (£5.62bn | SR42) | CFO steps down “by mutual agreement” and “with immediate effect”. | ||

Spirax (LON:SPX) (£5.23bn | SR73) | Guidance for the full year remains unchanged. Net borrowings £596m, leverage multiple 1.6x. | ||

ConvaTec (LON:CTEC) (£4.66bn | SR43) | On-track to deliver FY25 and medium-term financial targets. Medium-term targets: 5-7% organic revenue growth, double-digit adjusted EPS growth. | ||

Burberry (LON:BRBY) (£4.52bn | SR55) | SP +7% Revenue -5%, adjusted operating profit £19m (H1 last year: £41m loss). “We are still in the early stages of our turnaround, and the macroeconomic environment remains uncertain… We expect to see the impact of our initiatives build as the year progresses.” | AMBER Graham holds) I'm not convinced that this has returned to growth yet, although there is at least the possibility that it has hit the bottom now. The market cap seems aggressive to me, already pricing in a return to £200m+ of clean after-tax profits, a level of recovery that I'm unable to forecast at this stage of the turnaround. But potential takeover interest is evergreen and highly logical in my view, so I'm likely to hang around here for a bit longer. | |

Persimmon (LON:PSN) (£3.95bn | SR76) | Traded in line with expectations during the period. Net private sales per outlet per week +9% to 0.76. On track to deliver our 2025 performance in line with market expectations. | ||

Qinetiq (LON:QQ.) (£2.37bn | SR23) | Organic revenue down 3%, underlying operating profit down 10%. FY26 guidance unchanged, on track to deliver c. 3% organic growth pre-FX and disposal. | ||

Osb (LON:OSB) (£2bn | SR94) | The long-standing CEO has informed the Board of his intention to retire by 31st December 2026. | ||

Shawbrook (LON:SHAW) (£1.98bn | -) | Loan book £18.25, billion boosted by an acquisition. “We enter the final quarter of 2025 with strong momentum, a resilient balance sheet and a clear strategic focus." Anticipates any motor finance redress liability to be immaterial. | ||

Grafton (LON:GFTU) (£1.82bn | SR85) | The Group remains on track to deliver full year adjusted operating profit in line with expectations.” (c. £182.2m). | ||

B&M European Value Retail SA (LON:BME) (£1.65bn | SR53) | Revenues +4%. Adjusted operating profit -31% to £177m. “B&M UK LFL trading in early Q3 has been at the lower end of the 'low single-digit positive to low single-digit negative' percentage assumption range… However, with the majority of the key Golden Quarter trading period still ahead, we reiterate our guidance” for adjusted EBITDA of £470m-£520m. | RED (Mark) My instinct says that we may be a little harsh on a company that remains profitable and dividend paying, even on reduced levels. We normally reserve RED for companies that desperately need fresh equity or where we doubt their business model entirely. However, we still haven’t had a definitive update on the review into the accounting issues here and confirmation that there are no further problems. As such I’m minded to leave the view as is, until those Q3 results give greater clarity on this and recent trading, where the risk remains to the downside. | |

Premier Foods (LON:PFD) (£1.5bn | SR82) | Headline revenue +1.9%. Trading profit +0.4%. On track to deliver full year Trading profit expectations. | ||

Keller (LON:KLR) (£1.05bn | SR81) | Full year outlook remains in line with market expectations (underlying operating profit for 2025: £214m). | ||

Wizz Air Holdings (LON:WIZZ) (£1.05bn | SR28) | Load factor down only marginally to 92.4%. Revenue +9%, operating profit +25.8% (€439m). Outlook: F26 H2 load factor up low single digit percentage points YoY; F26 load factor up around 1% YoY. Cost per available seat kilometer to be broadly flat in FY26. | ||

Atalaya Mining Copper SA (LON:ATYM) (£990m | SR89) | Copper production of 12.1 kt in Q3 2025 and 39.6 kt in YTD 2025. On track to achieve full-year guidance following another positive quarter. | ||

Kier (LON:KIE) (£949m | SR93) | Q3 order book £11.6bn (30 Jun: £11.0bn). “The current financial year has started well and we are trading in line with our expectations” | ||

Alfa Financial Software Holdings (LON:ALFA) (£663m | SR48) | Q3 subscription revenues +16%, delivery revenues +26%, software revenues -30%. “We have increased our operating margin and profit expectations for the full year by c.£2m. Our revenue expectations for the year to December 2025 remain unchanged. Our cost discipline driving the underspend on costs in Q3 is expected to continue through Q4.” | ||

Syncona (LON:SYNC) (£609m | SR71) | Net Assets -1.7% to £1.03bn, 167.9p/share. | ||

Galliford Try Holdings (LON:GFRD) (£497m | SR97) | “The positive momentum has continued into the new financial year, with the transition from AMP7 to AMP8 continuing as expected over the first half of FY26, and we are trading in line with the Board's full year expectations.” | ||

Young & Cos Brewery (LON:YNGA) (£488m | SR84) | H1 revenue +5% to £263.6m, Adj. EBITDA +6% to £63.5m, PBT +21% to £30.6m, EPS +9% to 35p, Net debt -11% to £308.5m, £10m buyback launched. “The second half has started well, but we remain mindful of ongoing economic uncertainty and its potential impact on consumer sentiment, and we will continue to monitor trading conditions closely.” | ||

Petrotal (LON:PTAL) (£333m | SR86) | Q3 sales and production of 18,028 and 18,414 bopd. Net income of $3.6 million (Q2:$17.5m). Total cash flat on Q2 at $141.5m. | ||

Public Policy Holding (LON:PPHC) (£281m | SR46) | Q3 Revenue +24% to $48.8m, LBT $6.9m (24Q3: $5.5m LBT), Net debt $38.5m (24Q3: $17.5m net debt.) | ||

Integrated Diagnostics Holdings (LON:IDHC) (£244m | SR96) | Q3 Revenue +39% to EGP2.239bn, EBITDA +45% to EGP840m, Normalised net profit +56% to EGP430m, Cash +37% to EGP1.829bn. “...expect the full-year to close on a strong note, with continued revenue growth and robust margins.” | ||

Fonix (LON:FNX) (£176m | SR54) | …in line with management expectations for the financial year. | ||

Cornish Metals (LON:CUSN) (£98.9m | SR20) | 9mo Loss C$10.7m (2024:C$6.5m loss), Cash C$60.7m, (2024: C$3.3m) due to £57.4m fundraise. | ||

Lords Trading (LON:LORD) (£51.9m | SR45) | SP - 25% 4mo ended 31 Oct: Revenue +9.6%. “the Group expects to report full year 2025 revenue of £480 - £485m and Adjusted EBITDA of between £20m - £21m.” At Interim Results consensus was for £24.8m EBITDA. | BLACK (AMBER/RED) (Mark) Given the scale of the warning here, with Cavendish taking 64% out of FY25 EPS forecasts and 50% out of FY26 EPS, a bland statement on Adj. EBITDA does not appear to fully capture what is going on. Combined with some questionable adjustments and shifting of bank debt to lease liabilities, this gives an impression of a management team not facing up to reality. With these changes to forecasts, this no longer looks good value, despite a 25% fall in share price, and with momentum against them, I have to take a much more negative view of their prospects. | |

Marks Electrical (LON:MRK) (£50.9m | SR40) | Revenue -10% to £53.0m, Adj. EBITDA £0.5m (25H1: £2.0m), Adj LPS 0.31p (25H1: 0.72p EPS), Net cash £1.5m (25H1: £6.7m). “With revenue and profitability improving in October, we remain confident in our full-year outlook and long-term strategy.” | AMBER/RED (Mark) While there are some signs that their adapted strategy is starting to show improvements, this is still forecast to be loss-making this year, and marginally profitable even out to FY28. As such this looks like it is materially overvalued on all but the longest of timeframes. | |

Touchstone Exploration (LON:TXP) (£38m | SR15) | 25Q3 5,141 boe/d (71% natural gas), compared to 4,399 boe/d (69% natural gas) in 25Q2. Funds Flow from Operations: $3.02 million, net loss of $2.06 million.Net debt $77.75 million. | ||

Helium One Global (LON:HE1) (£36.8m | SR27) | Loss $5.50m (2024: $8.69m loss), cash $3.15m (2024: $11.6m) before £8.1m raise post period. | ||

Ariana Resources (LON:AAU) (£33.9m | SR32) | Best intercepts: - 5.10m @ 7.23g/t Au + 3.61g/t Ag - 8.50m @ 3.70g/t Au + 2.09g/t Ag - 7.30m @ 4.02g/t Au + 4.81g/t Ag | ||

Works co uk (LON:WRKS) (£25.6m | SR97) | H1 Sales flat at £128.8m, net debt £5.3m (25H1: £8.5m). On track to deliver FY26 profit in line with market expectations of pre-IFRS 16 Adjusted EBITDA of £11.0m. | AMBER/GREEN (Mark) I have always questioned how “ahead” recent statements here have been, as they chose to exclude supposedly one-off online fulfilment costs from these figures. So it is bad news that these issues appear to have continued into this year and are flagged to have a negative impact on the peak seasonal trading period again. I can see why the share price has reacted negatively to this update. However, this remains a cheaply-rated business, with a store portfolio that is out-performing weak consumer conditions. With the price having dropped over the last few months, I think there are still enough signs of value to remain broadly positive. | |

Argo Blockchain (LON:ARB) (£14.8m | SR7) | The main purpose of the Town Hall is to enable retail holders of the Company's notes and shares to have the opportunity to ask questions about the Restructuring Plan and make their views about any aspect of it known. | ||

DSW Capital (LON:DSW) (£12.6m | SR63) | Network Revenue 32% to £10.3m, driven by the acquisition of DR Solicitors, and growth within existing DSW licensee businesses. Total Income £2.8m (H1 FY25: £1.1m), Adj EBITDA of £0.7m (H1 FY25: £0.1m). H2 Weighting. | ||

Plexus Holdings (LON:POS) (£12.5m | SR43) | 2-yr Framework Agreement for rental wellhead services with a UK North Sea operator for a decommission campaign starting in 26Q1. | AMBER/RED (Mark) The rental income that this framework agreement will generate appears to already be in brokers forecasts. FY26 forecasts already require full utilisation of the expanded inventory and this will only make them marginally profitable. FY27 forecasts look better but I cannot see any credible explanation of how they will get there, so this appears to be just general hand-waving. As such, I see no change to our negative stance for this business that has struggled to generate an economic return for all of its 20-year history as a listed business. | |

Safestay (LON:SSTY) (£12.3m | SR58) | Sale and subsequent franchising of its freehold property and hostel, Safestay Edinburgh Cowgate to a private investor for a cash consideration of £5.35 million. Under new ownership, the Property will continue to operate under the Safestay brand as part of a new 10-year franchise agreement. | AMBER/RED (Graham) [no section below] We’ve been worried about this one for a long time: no profits plus a large debt burden in the hyper-competitive accommodation sector. It was confirmed by the company in June that they were considering the sale of some property freeholds, and today we have a deal of that type. The hostel in Edinburgh will continue to operate under the Safestay brand and will remain inside Safestay’s sales and marketing platform. But the returns to Safestay for providing its brand and platform do not sound particularly lucrative: a £75k fixed fee plus various performance-based fees. So ongoing revenues to SSTY from this property may be minimal. The good news is that Safestay is getting back most or all of the money it invested in this property (£4.3m purchase price in 2023, plus £1.2m fit-out costs). The bad news is that the £5.35m sale price is below the £6.36m book value which was recorded on Safestay’s balance sheet. The interim report saw Safestay claiming £21m of net assets, with a very large PPE number (£76m). It’s possible that these shares offer some deep value but personally I’m sceptical and wouldn’t want to get involved. I will upgrade our stance to AMBER/RED on the off chance that balance sheet value or something close to it can be realised. | |

Energypathways (LON:EPP) (£11.5m | SR0) | Commenced engineering studies with KBR and Hazer Group for its planned hydrogen and graphite production facilities. |

Graham's Section

Burberry (LON:BRBY)

Up 7% to £13.41 (£4.84bn) - Interim Results - Graham - AMBER

(At the time of publication, Graham has a long position in BRBY.)

These results aren’t great - but this was expected.

As a long-suffering shareholder here, I’m only too aware of how performance has stalled in recent years:

The share price recovery over the past six months sees the company enjoying a near-£5 billion valuation, despite no meaningful profits yet.

H1 bullet points:

Revenue -5%, comparable store sales +0%

Adjusted operating profit £19m (H1 last year: £41m loss).

Free cash flow minus £50m (last year: minus £184m).

As I said, the results aren’t great. They do at least represent a stabilisation compared to last year, when comparable store sales collapsed by 20%.

Outerwear “outperformed in all regions” in H1 and Q2.

Softs (scarves and accessories) enjoyed double digit growth in H1 and Q2.

Leather goods “improved sequentially between quarters but remained challenging overall in the half”.

The key point for me is that Q2 was better than Q1, and H1 overall was not bad - except for leather goods. The improvement in quarterly sales in Q2 is the first such rise at Burberry in a few years, so it is at least possible now that it has hit the bottom!

Regions: no region stands out in particular when it comes to comparable store sales in H1. The biggest gap is between the Americas (up 3%) and Asia Pacific (down 2%).

Adjustments: the main adjustment is a £37m restructuring charge. I can’t disallow this for companies I don’t own, and then allow it for companies that I do own! So it’s fair enough to take the view that there was really an £18m operating loss, rather than a £19m operating profit.

The restructuring costs in H1 last year were a more modest £12m.

The company is “on track to deliver £80 million in annualised savings by end of FY26”.

Stores: I’m pleased to see the number of stores reduce slightly, with 4 openings and 11 closures. This is a time to be careful and to selectively reduce exposure.

Outlook: not as specific as I’d like, but here it is.

We are still in the early stages of our turnaround, and the macroeconomic environment remains uncertain. Our focus this year is to build on the early progress we have made in reigniting brand desire, as a key requisite to growing the topline. We expect to see the impact of our initiatives build as the year progresses. We will deliver continued margin improvement with a focus on simplification, productivity and cash flow. We remain confident that we are positioning the business for a return to sustainable, profitable growth.

Importantly, there has been a “Strong customer response to Autumn/Winter 25 collections; initial momentum in Outerwear and Scarves now extending to other categories”.

Balance sheet: equity dips slightly to just below £900m. If I exclude both intangible assets and deferred tax assets (a fairly conservative approach), balance sheet equity reduces to c. £400m. This flows from having positive working capital (>£600m) and PPE (£360m) offset by over £500m of borrowings.

It could be a little safer, but as fashion retailers go, this seems a pretty reasonable balance sheet to me.

The company suffered controversy in the past for burning inventories rather than discounting them. The inventory balance reported today is down by £140m over the past 12 months - good news for cash flow, and hopefully eliminates the need for too many awkward decisions about what to do with unsold stock.

Net debt finishes H1 at £93m, before leases. That should be very manageable against adjusted EBITDA of £499m.

Having said that, we need to be careful when looking at companies with lots of expensive leases, such as Burberry, as they have an additional form of leverage beyond bank debt.

The company calculates its leverage multiple as 2.2x, after it includes its £1 billion lease debt in the calculation. That’s a very cautious way of calculating the leverage multiple, but if leases make you nervous, there is some logic to it.

Graham’s view

One quarterly rise in sales does not make a growth stock. I’m not getting the bunting out just yet.

Honestly, I’m a little surprised that the market likes this share so much, already pricing in a recovery to £200m+ of clean after-tax profits at this £5bn valuation. I don’t think we’ll see that in FY March 2027, and it would be pretty brave to forecast it for FY March 2028 at this stage.

So maybe I should be selling out here, and moving on? I’m certainly considering it. Although given Sod’s Law, a takeover would probably be announced the next day.

I’ve been invested here for years, always wondering if I might wake up some day and find that LVMH or Kering had decided to add it to their stables. Moncler was reportedly thinking about it last year.

So through sheer intransigence, I’m likely to hang onto this one. But I think our current neutral stance continues to make sense.

Mark's Section

Plexus Holdings (LON:POS)

Up 9% at 7.9p - New Wellhead Framework Agreement - Mark - AMBER/RED

Here are the details of this win:

Plexus has agreed a two year framework agreement for the supply of rental surface wellhead systems, associated equipment, and offshore support with a UK operator. As a call-off contract with no fixed value, work will proceed according to the operator's project schedule and requirements.

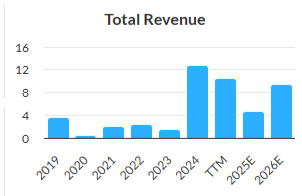

As perhaps an indicator as to where the North Sea is going, this is for decommissioning not new production. They may not be short of work for this in the future. However, it is hard to quantify, as Plexus will be paid as and when the customer uses their rental kit, with first orders expected at the start of next year. This comes too late to save a poor FY25 which has seen no repetition of a lucrative licensing deal:

Their broker, Cavendish, make no changes to forecasts for this agreement with the jump from £4.7m revenue in 2025 to £9.4m in 2026 already including much higher activity in the North Sea from this and similar projects. Following the fundraise to invest in an additional eight rental sets, the company had 16 sets. Cavendish said “...we estimate this could generate an annualised £9.4m revenue once fully deployed…”. So that suggests that the current forecasts already include full utilisation of the current inventory.

On that £9.4m revenue for FY26 Cavendish forecast £3m EBITDA, but the company to be marginally profitable. Depreciation is a real cost for an equipment rental business. Looking forward, Cavendish have 0.58p Adj EPS for FY27, which would put them on a more reasonable 14xP/E but this is on a revenue forecast of £11.8m. However, with no further investment in the rental fleet forecast (which would presumably require another equity raise) and Cavendish saying that £9.4m revenue is full deployment of the current inventory, a 25% rise in revenue would presumably require them to raise their rental rates by 25%. I’m not convinced that North Sea operators would agree to such terms in a framework agreement. So I’d like to see a much stronger argument from the broker as to why that sort of revenue is achievable before being willing to use FY27 forecasts in any valuation exercise.

The company does trade at a modest discount to Book Value, although the Price to Tangible Book Value is high for an equipment rental business:

Investing on this basis needs investors to have faith that the current £8m of intangible assets on the balance sheet are actually worth that. The signing of licensing deals in the past suggests that there is some value . However, a licensing deal that hasn’t repeated suggests that the application of their technology is limited. Plus, these assets in the current form at Plexus are unproductive, as they aren’t forecast to produce an economic return on full utilisation in FY26. It seems that the company need to scale further in order to generate sufficient rental income to justify that intangible valuation. Such scaling will require both industry demand and further fresh capital.

Mark’s view

We’ve taken a broadly negative stance here in the past, with Graham saying in response to their last operational update:

As the company is still at such an early stage in its development and offering very limited profit margins for now, I’ll leave my moderately negative stance unchanged, to reflect the view that this is a high-risk play.

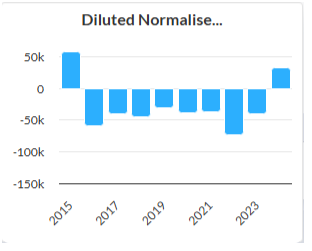

The company has been listed for over 20 years, and almost never generated an economic return in the last decade:

It is not forecast to generate an economic return anytime soon.

They say that “one swallow does not make a summer” and likewise, one unquantified framework agreement, that was already in broker forecasts, isn’t enough to change our AMBER/RED stance.

Lords Trading (LON:LORD)

Down 25% at 23.3p - Trading Update - Mark - BLACK/AMBER/RED

It all seems fairly positive here, with group revenue for the four-month period up 9.6% year-on-year and they choose to highlight some reasonable growth figures, for example:

Like-for-Like ("LFL") revenue in the Group's Merchanting division, which was 11.5% ahead in H1 2025, was 1.8% down on the prior year comparator, in the four months ended 31 October 2025. Notwithstanding competitors aggressively targeting market share in the Period, the division has delivered a gross margin improvement of 50 basis points compared to the equivalent four-month period in 2024.

However, their Plumbing and Heating division saw LFL revenue 8.3% lower. An acquisition offsets this drop though. This leads to the following guidance:

As a result, the Group expects to report full year 2025 revenue of £480 - £485m and Adjusted EBITDA of between £20m - £21m.

This is a bit cheeky, in my opinion. While this guidance is clear, there is no reference to any previous expectations. I had to search the footnotes of their Interim Results released in September, to find what they considered to be previous guidance:

Company compiled consensus expectations of Adjusted EBITDA for the year ended 31 December 2025 as at the date of this announcement show an average of £24.8m and a range between £24.7m and £25.1m.

That’s a 17% miss on Adj. EBITDA at the midpoint of the range. It is not like anyone is missing that this is a profits warning, with the shares down 25% today. All of this adds to the impression of a management team that is reluctant to call things as they are.

When I looked at it in May following their Final Results, I didn’t like their adjustments as most of these appeared to be real ongoing costs. At the time, I said:

It is also worth noting that EBITDA is a poor measure here, with significant lease liability payments excluded. In such cases, it is usually best to look at the cash flow statement. Net debt has increased by £3.9m, meaning free cash flow was just £1.7m after adding back the money spent on acquisitions and dividend payments.

Their stated reduction in net debt was excluding lease liabilities and they had undertaken a sale and leaseback post period end. This is one example where IFRS16 is actually quite useful. While it reduced bank debt, it didn't change the group's financial position. There is no update on this in today’s trading update.

Thankfully, the research on this company is from Cavendish and individual investors can access this with free registration. Showing the folly of relying on Adj. EBITDA, the Adj. PBT forecast is down 60% and Adj. EPS down a whopping 64% to 1.0p. I’m pretty sure I’m going to disagree with those adjustments when I see them, too!

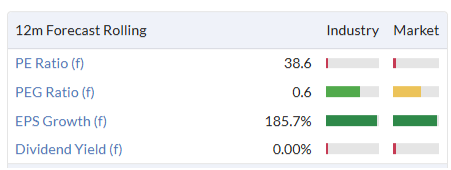

Cavendish see net bank debt some £3.2m higher as a result of this weak trading and no easy fix - they reduce FY26 Adj. PBT by 46% to £4.3m and FY26 Adj. EPS by 50%to 1.8p. This blows a hole in these valuation metrics:

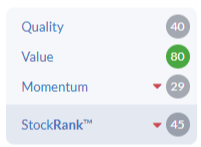

This now looks expensive in the current forecast window, despite the 25% fall today. This had a fairly neutral Stock Rank going into this warning:

But I can see all three of the component ranks being materially lower once the algorithms have digested the updated forecasts and FY25 results when they arrive next year.

Mark’s view

When I looked at this in May the share price was 29p and I just about clinged on to Paul’s previous AMBER view on the basis that there was scope for a recovery, with possible green shoots being seen in Q1 this year. I said that “without these positive trends, I would be much more negative here.” With these trends having disappeared I am now taking a more negative stance of AMBER/RED. With the share price at 23p, this now looks expensive on forecasts (even without applying more sensible adjustments) and risky given the scale of the debt (incl. lease liabilities).

Works co uk (LON:WRKS)

Down 9% at 37p - Half-year trading update - Mark - AMBER/GREEN

This is an inline statement, but the market clearly expected better as the shares are down this morning. Sales are essentially flat:

In H1 FY26 The Works delivered total sales of £123.8m, 0.3% lower year on year (H1 FY25: £124.2m)(1), and a total like for like sales ("LFLs") increase of 0.3%.

With store LFL up 4%, but continuing problems in online:

Online sales, which represent less than 10% of sales, declined by 36% in the Period. This reflects the impact of operational challenges experienced following the transition to a new third-party fulfilment partner. Action has been taken to help mitigate the impact, however reduced outbound capacity and increased costs are expected to continue through the peak trading period while we work with our partner to provide a long-term solution.

This company was one of Ed’s highlighted companies that rose strongly on an ahead statement in May, with the shares subsequently doubling in short order:

However, I’ve questioned quite how ahead they really were. At the time they said:

Pre-IFRS 16 Adjusted EBITDA (2) is now expected to be approximately £9.5m for FY25 (FY24: £6m), which is ahead of market expectations (3).

But the footnotes revealed:

Pre-IFRS 16 Adjusted EBITDA excludes Adjusting items in relation to exceptional fulfilment costs (£1.2m) and exceptional restructuring costs (£0.6m).

Group compiled market forecasts for FY25 and FY26 are currently pre-IFRS16 Adjusted EBITDA of £8.5m and £10m respectively.

If you added back in those exceptional fulfilment costs then they would have been below expectations. In the Final Results in July, they gave more details:

…during the second half of the period our third-party online fulfilment centre faced significant and unexpected operational challenges. This affected capacity and resulted in significantly increased costs per order….£1.2m of exceptional fulfilment costs were incurred in relation to higher costs per order versus planned levels due to the third-party service disruption and these have been included as an adjusting item in the period.

So it is a little worrying that these issues are impacting online sales this year as well, and they are still seeing reduced capacity and increased costs which will impact the peak Christmas trading period. So when they say “we are on track to deliver FY26 profit in line with market expectations of pre-IFRS 16 Adjusted EBITDA of £11.0m.” I can easily see them adjusting out another set of “exceptional” fulfilment costs. This means that the reported EBITDA could well be below the pre-upgraded figure of £10m, in the same way that it would have missed expectations in FY25 without the adjustments.

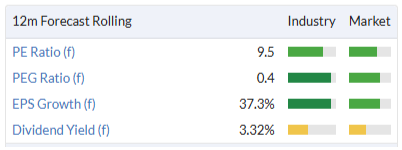

I don’t think I can be too harsh here, this is still a company where its stores are outperforming the wider market and is on a relatively low rating:

It is worth noting that there is no dividend, and this probably reflects the big working capital swings during the year. Net cash of £4.1m at the year end is £5.3m of net debt at the half year. Lease liabilities still exceed lease assets by around £15m, meaning that many stores are still not trading at the level assumed when leases were agreed.

Despite today’s fall in share price it remains a share price winner over the last year so the StockRank is likely to remain in the upper echelons:

However, I can see why the market has reacted negatively to this update. They absolutely have to get a handle on online fulfilment and logistics. This is a highly competitive segment and further problems could easily undo all the good work they are doing in their store portfolio.

Mark’s view

Roland had a mostly positive view following results in July when the share price was 60p+, saying he was “...impressed with progress. I’d argue that there could be some scope for further upgrades later this year, if LFL sales growth can be maintained and there is no repeat of last year’s logistics problems.”. That hope appears to have gone but the share price is now much lower, meaning that better value appears to be on offer. On balance, I am happy to stay broadly positive at AMBER/GREEN.

B&M European Value Retail SA (LON:BME)

Flat at 163p - FY26 Interim Results - Mark - RED

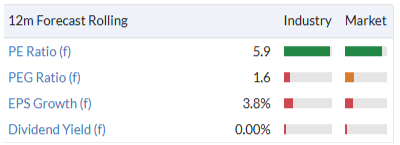

Group revenue may be up but every other figure in these interim results is going the wrong direction, even on an adjusted basis:

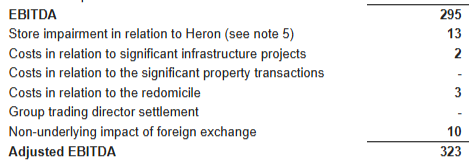

The adjustments themselves are large, at least when they work their way through to PBT. However, they are largely non-cash or one-off:

This marks a torrid time for the company where confidence in their systems and controls has been dealt a major blow:

We announced on 20 October that following a system integration change, freight costs had not been correctly recognised. While the error did not impact any audited historical financial information, it did impact assumptions that determined our 7 October Trading Update and outlook. The Board commissioned a review of the matter, which is being conducted by EY. We expect the review to be completed in the coming weeks and we will update further at our Q3 Trading Update in January 2026.

This doesn't give much confidence that it is all behind them. And this doesn’t build trust that there is a short-term fix for their current trading:

B&M UK LFL1 trading in early Q3 has been at the lower end of the 'low single-digit positive to low single-digit negative' percentage assumption range we outlined on 7 October 2025. However, with the majority of the key Golden Quarter trading period still ahead, we reiterate our guidance range for FY26 Group adjusted EBITDA (pre-IFRS 16) 2 of £470m-£520m.

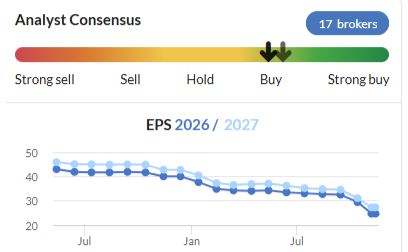

The current market cap is around £1.65bn, which means that the EV (pre-IFRS 16) is £2.51bn. So this is on 5.3x EV/EBITDA at the bottom of that range. Reasonable but not outstanding value. The issue is that with Q3 weak so far and a broker consensus trend looking like this, how much faith would you put in them reaching even the bottom end?

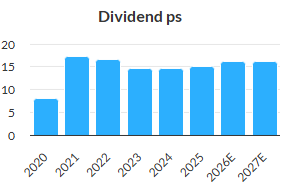

There was the promise of an almost 10% yield based on brokers forecasts for the payout to be maintained:

But with the interim dividend cut by about a third, this no longer looks realistic. If this was repeated at the full year, the yield would be around 6.5%. Good, but not as good as it has been.

There is a fairly sensible plan in place to see this return to growth:

B&M's original customer proposition remains strong, but our execution has drifted. This has impacted our trading performance, which our first half results reflect. Outlined alongside our 7 October Trading Update, our Back to B&M Basics plan is a set of immediate actions to bring about improvements in four key areas of our retail execution: Price, Promotions, Ranges, and on-shelf Availability. Our number one priority is to return B&M UK to sustainable LFL growth.

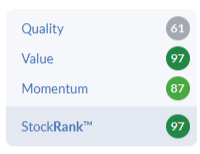

The combination of EPS bouncing back and a higher rating to reflect increased confidence in their strategy may yet make this a good recovery play. However, even I am scared off by the zero Momentum Rank here:

It will no doubt take a while until the refreshed strategy has a positive impact on sales and financials and it would seem wise to wait for more signs of that, especially as the initial indications are for a weak Q3.

Mark’s view

Roland marked this down to RED, in response to the announcement of their accounting issues last month. My instinct says that this may be a little harsh on a company that remains profitable and dividend paying, even on reduced levels. We normally reserve RED for companies that desperately need fresh equity or where we doubt their business model entirely. However, we still haven’t had a definitive update on the review into the accounting issues here and confirmation that there are no further problems. As such I’m minded to leave the view as is, until those Q3 results give greater clarity on this and recent trading.

Marks Electrical (LON:MRK)

Down 5% at 46p (£48m) - HY26 Interim Results - Mark - AMBER/RED

The woes continue at this online electrical retailer:

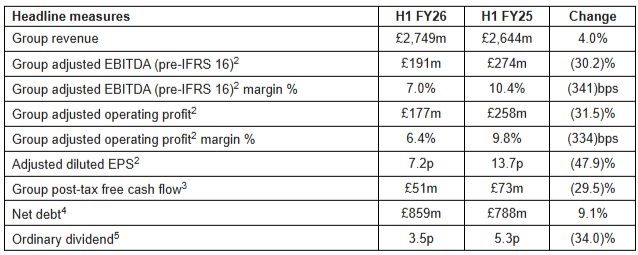

· The Group reports revenue of £53.0m, down 9.9% YoY against a challenging, declining market being down 2.0% in H1-26.

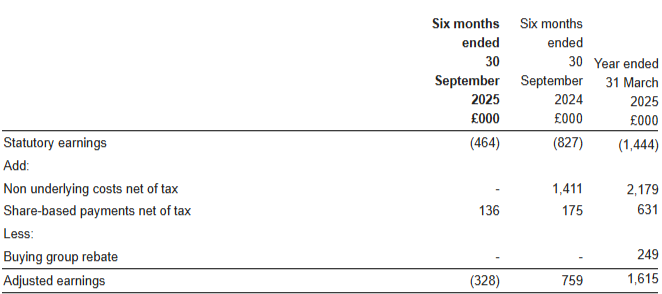

The report marginally positive EBITDA, but once all costs are accounted for, this becomes a loss-making period. It is good to see fewer exceptional items, with just Share-Based Payments excluded this time:

They trumpet their high customer satisfaction figures, and I believe them. It is easy to keep customers happy by selling them goods for less than it costs to source and deliver those goods! Something that larger competitor AO found out eventually, and had to change tack.

There are some signs of recovery at Marks:

With revenue and profitability improving in October, we remain confident in our full-year outlook and long-term strategy. I am extremely proud of the dedication and commitment shown by our colleagues over the past year. Despite softer financial results, significant progress has been made behind the scenes to strengthen our foundations. We are building a business for the future, and our focus on delivering best-in-class customer service continues to underpin that ambition.

The problem has been that their strategy has left them between a rock and a hard place, with a shift back to premium products to improve delivery as a percentage of cost, coming up against a weak consumer looking to trade down. Some progress on this front is better than none, but there is a long way to go.

In line is also not particularly impressive with this meaning loss making for the full year, after a big profit warning in September. Their broker Cavendish’s forecasts go out to FY28, but even here they can only manage to 0.95p EPS putting them on a slightly bonkers forward forward P/E of around 50.

The price has been held up by retail giant Frasers buying:

They clearly think that there is a route where they make an economic return on their stake, presumably with Marks being part of their larger group. However, with the founder still holding around 74% of the shares he can presumably name his price, and Frasers are not known for overpaying.

Mark’s view

On a valuation basis alone this looks materially overvalued in current market conditions. There’s always a chance of some kind of deal with Frasers being done if Smithson becomes fed up with the current malaise. However, I don’t invest (or give a view) based on such speculative factors. It remains an AMBER/RED

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.