Good morning!

Wrapping it up there, thanks everyone.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Fresnillo (LON:FRES) (£29.8bn | SR80) | Fresnillo has paid CAD$770 million (US$555 million) in consideration, funded with existing cash on hand. Adds a 10 million oz gold resource base, led by the Novador project - an asset capable of producing 200,000+ oz/year for over a decade. | ||

Associated British Foods (LON:ABF) (£13.3bn | SR82) | 16 weeks to 3rd January. Group revenue -0.9% (constant currency) vs. prior estimate -1%. Primark like-for-like sales growth -2.7%,. total sales growth +1%. | ||

South32 (LON:S32) (£9.87bn | SR87) | FY26 production guidance maintained at operated assets. H1 operating unit costs tracking in line with guidance. Guidance for non-operated Brazil Aluminium is under review as S32 awaits the operator's revised ramp-up profile, following lower than planned quarterly volumes. | ||

Tritax Big Box REIT (LON:BBOX) (£4.35bn | SR63) | £14.2 million increase in contracted rent from asset management activity. 4.0% like-for-like portfolio ERV growth. 33% loan to value. | ||

Computacenter (LON:CCC) (£3.25bn | SR88) | Q4 and therefore the year as a whole ahead of expectations. Revenue +32% (cc). Adjusted profit before tax to be no less than £270m, comfortably ahead of market expectations (£253.6m). | ||

Harbour Energy (LON:HBR) (£3.13bn | SR70) | 2025 production (474 kboepd) at the top end of guidance. Stronger than anticipated free cash flow generation. 2026 guidance: production of 435-455 kboepd, production rates to increase towards 500 kboepd by year-end. | ||

AJ Bell (LON:AJB) (£1.8bn | SR47) | SP +5% Platform: customer numbers increased by 29,000 to close at 673,000, up 20% in the last year and 5% in the quarter. Net inflows £1.5 billion. Investments: net inflows £0.3 billion. | GREEN = (Graham) [no section below] The exceptionally high quality we’ve talked about before remains apparent with AJ Bell continuing to grow at remarkable rates considering both the size that the business has already reached and the maturity of the industry. I note that even the Investments arm is enjoying net inflows, another phenomenon we’ve discussed previously. With AUM of £9.5 billion (up 32% in the year), this is now an important player in the market. And with the stock trading at 17x earnings, it doesn’t look overpriced to me at all (QualityRank 95 with ROCE and ROE of ~50% or higher).. | |

B&M European Value Retail SA (LON:BME) (£1.74bn | SR48) | Q3 LfL revenue at B&M UK down 0.6%. Deeper investments planned to clear discontinued lines, reduce SKU count and to clean up stock. Now expects FY26 Adjusted EBITDA £440m to £475m, compared with previous guidance of £470m to £520m. | BLACK (RED =) (Graham) I’m going to cautiously leave this on RED, which is consistent with our approach to profit warnings. Also I note that net debt was £859m at the interims, approaching 2x the new EBITDA forecast. So there isn’t a very strong balance sheet to fall back on, if trading were to continue deteriorating. | |

Senior (LON:SNR) (£956m | SR64) | Stronger than expected trading since November, notably in Aerospace. Full-year adjusted PBT to be comfortably above previous expectations. There will be restructuring costs (treated as adjusting items in the results) at the Flexonics business. | ||

Boku (LON:BOKU) (£677m | SR48) | Revenue for FY 2025 is expected to be ahead of market expectations at c.$128.5m (exps: $127.5m). FY 2025 adjusted EBITDA also ahead of market expectations at c.$41m (exps: $39.8m). 2026: expects to deliver medium-term guidance of organic revenue growth above 20% on a CAGR basis and adjusted EBITDA margins above 30%. | ||

M P Evans (LON:MPE) (£653m | SR97) | Own crops +8%, total crops -4%. Crude palm oil production -3%. Use of independent crops being deliberately restricted (“a low-margin source of supply”). Average mill-gate price for CPO up 5% vs. prior year. | AMBER/GREEN (Mark) The figures here look in line with recently upgraded Cavendish forecasts, with commodity strength offsetting a decline in production, following a change in strategy to buy in fewer third-party crops. With the share price of MP Evans, and all Palm Oil producers, doing well recently on the back of this commodity strength, there is no getting round that investors will need to take a view on where we are in the commodity cycle for Palm Oil. Those who are bullish and expect current CPO and PK pricing to remain elevated, will see further upgrades and upside to come this year. Those expecting the recent commodity pricing strength to moderate, may be better off getting out ahead of that. The recent declining Momentum Rank gives some pause for thought. However, this remains cheap enough for anyone neutral on commodity pricing to take a mostly positive view. | |

Harworth (LON:HWG) (£538m | SR39) | “We remain confident in achieving £1bn of EPRA NDV, albeit… it is increasingly challenging to deliver against the roadmap set back in 2021. Against this backdrop, the timeline for achieving our milestone extends beyond December 2027, with a range between the end of 2028 and end of 2029. | ||

Wickes (LON:WIX) (£524m | SR93) | 2025 adjusted PBT expected to be in line with market forecasts. Retail LfL revenue growth 5.7% for the year. Group LfL revenue growth 4.9%. | ||

Young & Cos Brewery (LON:YNGA) (£503m | SR86) | LfL sales +11.2% for three weeks to 5th January. For the 14 week period ending 5th January, total managed revenue +5.6% (LfL +5.7%). Admission to the Main Market “will enhance the Company's corporate profile and appeal”. | ||

Future (LON:FUTR) (£484m | SR73) | Buys “a UK-based digital publishing group that combines the authority of a trusted media brand with the authenticity and engagement of the creator economy.” £39.9m upfront payment from existing facilities, plus earn-out. Total consideration capped at £80 million (requires growth to FY 2029). | AMBER/GREEN (Mark - I hold) [no section below] | |

Auction Technology (LON:ATG) (£409m | SR25) | AGM TRADING UPDATE & Statement regarding Auction Technology Group plc | FY guidance confirmed. Separately, Fitzwalter attempts to clarify matters, saying there is “inconsistent information between certain shareholders as to the events that culminated in the Company's pre-emptive announcement of FitzWalter's possible offer”. | |

Gulf Keystone Petroleum (LON:GKP) (£403m | SR62) | 2025 gross average production of 41,560 bopd, towards upper end of tightened annual guidance range of 40,000 – 42,000 bopd. 2026 gross average production guidance of 37,000 to 41,000 bopd. Considering a listing on the Euronext Growth Oslo, subject to favourable market conditions. | ||

Mortgage Advice Bureau (Holdings) (LON:MAB1) (£397m | SR65) | 2025: in line with expectations. Revenue +19% (£318m), adj. PBT +12% (£35.8m). Outlook: “the impact of prior economic shocks is now receding… The Group has entered 2026 with good momentum and continues to trade in line with the Board's expectations.” Outlook for refinance lending is particularly strong. | GREEN = (Graham) [no section below] I've been a fan of this (franchised) mortgage advisory business for years, and I'm enthused by today's update. We have double digit revenue and adj. EBITDA growth for 2025, in line with expectations. Productivity as measured by revenue per advisor continues to trend nicely upwards. Looking forward, the mortgage market is set for a busy year with the number of products at an all-time high and borrowers and lenders enjoying post-Budget stability. I'm expecting MAB to perform very strongly in this environment and the signs are positive for continued growth in 2026 (EPS forecast for this year: 50.7p). | |

Elixirr International (LON:ELIX) (£393m | SR74) | FY 25 revenue is expected to meet or exceed market expectations of £149 million. FY 25 Adjusted EBITDA margin is expected to meet or exceed market expectations of 28.1% - 29.2%. Has entered FY 26 with a record amount of revenue contracted for the year. | ||

Judges Scientific (LON:JDG) (£382m | SR41) | Satisfactory performances in the Rest of Europe and China have been more than offset by the USA, where there has been no recovery since the September update. Adjusted earnings per share for 2025 to be in the region of 275p per share, 6% down on current market expectations (292p). Starts 2026 with a lower-than-desired order book. Geotek's next coring expedition is now unlikely to be until early 2027. Board considers it prudent to provide guidance for 2026 Adjusted earnings per share of 200-250p. | BLACK (AMBER/RED ↓) (Graham) While I still have great admiration for Judges, I am going to have to downgrade our stance here by one notch to AMBER/RED, in light of the profit warning. But this is one of those instances where I’ll be eager to go back to neutral or positive, if there is evidence of stabilisation. In the short-term, however, I’d be braced for continued difficulties. | |

Forterra (LON:FORT) (£366m | SR61) | Revenue of c.£386m, 12% ahead of the prior year (2024: £344.3m). Adjusted EBITDA in line with market expectations with margin progression, adjusted PBT and adjusted EPS ahead. Net debt c. £56m. Longer term market fundamentals remain attractive. | ||

Mears (LON:MER) (£287m | SR88) | Expects to report Maintenance-led revenues for FY25 +10% to in excess of £610m. Expects to report Management-led revenues for FY25 -13% to in excess of £500m (2024: £577m). Adj. profit before tax -2% to no less than £62.5m (2024: £64.1m) (slightly ahead of consensus). Average daily net cash position during FY25 of £52.8m (2024: £59.6m). | ||

Taylor Maritime (LON:TMI) (£212m | SR42) | Revenue $28.0m, Net loss $3.2m, Adj. EBITDA $5.2m. Cash $187.7. Distribution of $143.4m to shareholders at 94.41cents per share, based on the unaudited net asset value. | ||

Netcall (LON:NET) (£201m | SR65) | H1 Revenue + 15% to £26.5m (+11% organic), Adj. EBITDA +12% to £6.4m, in line with management expectations. Net Cash £14.8m (30 Jun 25: £27.2m). | ||

Zotefoams (LON:ZTF) (£198m | SR91) | FY revenue +7.2% to £158.5m, slightly ahead of market expectations, Ad. PBT +37.9% to £21.1m, ahead of market expectations. | AMBER/GREEN = (Mark) [no section below] | |

Tristel (LON:TSTL) (£191m | SR75) | H1 revenue +14%, Adj. EBITDA +17%, Cash £13.3m. Matt Sassone, Chief Executive Officer, has confirmed to the Board his decision to resign to take up a worldwide President role with a large US multinational. | AMBER/GREEN = (Mark) [no section below] | |

Kitwave (LON:KITW) (£185m | SR68) | 295 pence in cash per Kitwave Share, 33.5% premium to last night’s close. Recommended by the board. Irrevocable undertakings and a letter of intent for 21.6% of shares count. | PINK (Graham) [no section below] This level of premium (33%) is around the minimum of what I consider to be acceptable and where offers tend to get Board and shareholder approval. The support from shareholders is significant (21.6%) and while it’s not yet a done deal, I would expect a cash offer that is recommended by the Board and already supported by a large block of shareholders is likely to go through. The buyer is a mid-market private equity firm active in the US and Europe, and it’s good to see that this type of buyer is still active in the market despite the strong returns we’ve seen over the past year. Kitwave is a company we’ve had mixed views on (see the profit warning last July) but the buyer is only paying 10x earnings. | |

Kitwave (LON:KITW) (£185m | SR68) | Revenue +21% (-1% LFL) to £802.7m, adj. Op Profit +11.7% to £38m, trading has been in line with management expectations since the Group's last trading update. | PINK (see above) | |

Animalcare (LON:ANCR) (£175m | SR31) | Revenue +20% CCY to £89.1m, u/l EBITDA +50% to £17.4m, (consensus: £89.2m and £17.6m). Net debt £9.1m (FY24: £9.0m). Entered 2026 with positive momentum. | ||

Fonix (LON:FNX) (£168m | SR60) | H1 Adj. EBITDA +6.4% to £8.3m, in line with management's expectations. Enters H2 with positive momentum. | ||

Genel Energy (LON:GENL) (£166m | SR36) | Patrick Allman-Ward as an Independent Non-Executive Director and Chair of the Board. | ||

Eurocell (LON:ECEL) (£123m | SR70) | FY25 Sales and adjusted PBT to be in line with expectations (sales flat). Expect pre-IFRS 16 net debt £22m, (30 Jun 25: £29m) 0.7x pre-IFRS 16 EBITDA, ahead of our previous guidance of 0.9x. “Trading conditions have remained subdued, with challenging macroeconomic conditions and weak consumer confidence continuing to impact both the repair, maintenance and improvement market (RMI) and new build housing.” | AMBER/GREEN (Mark) [no section below] | |

Pharos Energy (LON:PHAR) (£87.6m | SR73) | FY WI Production 5,398 boepd net, in line with guidance (Vietnam 4,095 boepd, Egypt 1,303 bopd). Revenue $115m, Cash $40m. FY26: production guidance increased from 2025 to 5,200 - 6,400 boepd net. Group capex $50m. | ||

Ilika (LON:IKA) (£68.7m | SR20) | H1 Revenue -40% to £0.6m, due to reduction in grant funding. LBITDA excl. SBP £3.2m (25H1: LBITDA £1.9m), Cash £6.9m (25H1: £10.1m) Confident they can secure larger follow on orders for the Steareax M300 batteries. | ||

Kooth (LON:KOO) (£37.8m | SR54) | One year contract with an undisclosed US State for the provision of digital mental health services for up to 100,000 students. The contract has an expected value of $2.6 million. | AMBER/GREEN = (Mark - I hold) | |

Fiinu (LON:BANK) (£32.4m | SR4) | None of the 20 million additional consideration shares will be issued to Granicus Holdings OŰ, since review confirmed order book was below threshold. | ||

Strategic Minerals (LON:SML) (£30.8m | SR27) | £4m gross raised at 1.3p the closing mid-market price of the Company's shares last night. | ||

Emmerson (LON:EML) (£28.5m | SR20) | The Company is required to submit its Memorial (case outline) by the end of Q1 2026. | ||

Works co uk (LON:WRKS) (£25.3m | SR85) | H1 LFL sales +0.3%, Stores +4%, online -36%, Pre-IFRS 16 Adjusted EBITDA loss of £1.0m, adjusted loss before tax of £5.1m (H1 FY25: £6.5m loss)., net debt £5.3m (H1 FY25: £8.5m), on track to deliver FY26 profit in line with market expectations. | AMBER ↓ (Mark) | |

Predator Oil & Gas Holdings (LON:PRD) (£23.7m | SR9) | BON-18 well commenced in Bonasse Field, expected to take 2 weeks and add 300-400bopd. | ||

Artisanal Spirits (LON:ART) (£23.4m | SR17) | In line with expectations with in-market trading improving in H2 versus H1 in the key geographies of UK, Europe, USA and China. | ||

Medpal AI (LON:MPAL) (£22.2m | SR6) | Previously it took an hour to process 40 prescriptions, but with the update in place, the Robopharma robot is capable of processing more than 100 prescriptions in less than 5 minutes. | ||

Maintel Holdings (LON:MAI) (£19.4m | SR34) | Expects FY25 results will be in line with consensus, with total revenue expected to be £92.2m and Adjusted EBITDA expected to be £7.2m. Net debt £18.3m (31 Dec 2024: £16.7m) | ||

Eenergy (LON:EAAS) (£18.8m | SR37) | First multi-site award with Symphony Healthcare Services, with a total contract value of £0.7m | ||

Ebiquity (LON:EBQ) (£17.9m | SR23) | Expects FY25 revenues of c.£73.4m, adjusted EBITDA of c.£8.1m and adjusted operating profit of c.£4.6m. Expects FY26 revenues and profits to be ahead of FY25. | ||

Ingenta (LON:ING) (£15.2m | SR99) | Revenue flat at £10.3m, Adj. adjusted EBITDA -11% to £1.6m ahead of market expectations. Net cash £4.7m (2024: £3.6m). Final Dividend +10% to 2.75p. | AMBER/GREEN (Mark - I hold) | |

Kelso group (LON:KLSO) (£13.4m | SR36) | Expects to receive cash return from NNC’s disposal of Escode announced yesterday. | ||

Hardide (LON:HDD) (£13.2m | SR42) | Revenue +28% to £6m, EBITDA £1m (FY25: £0.0m), EPS 0.2p (FY25: -1.9p), net debt £1.6m (FY25: £2.1m) . “Strong trading momentum of Q4 FY25 continued into Q1 FY26” | ||

Prospex Energy (LON:PXEN) (£12.4m | SR14) | Contract for the rental of a transformer at the El Romeral gas to power plant in Andalucía, Spain | ||

RC Fornax (LON:RCFX) (£11.5m | SR35) | Selection as a Specialist Provider on Aurora's Evolve network | ||

Cloudbreak Discovery (LON:CDL) (£10.5m | SR6) | 15 samples over 1g/t gold. £1.85m gross raised at 0.56p, 25% discount to last night’s close. |

Graham's Section

Judges Scientific (LON:JDG)

Down 11% to £51.20 (£341m) - Full Year Trading Statement and Notice of Final Results - Graham - AMBER/RED ↓

The introduction doesn’t try to hide the bad news here:

The Board of Judges Scientific plc, a group focused on acquiring and developing companies in the scientific instrument sector, provides the following update on the Group's trading performance for the financial year ended 31 December 2025 and the continued headwinds impacting the outlook for FY26.

The share price is down over 10% this morning but the news can’t come as a major shock to shareholders: Judges has been struggling to regain momentum for some time.

We were most recently neutral on it in November, when we learned that the driving force behind the company for so many years, Mr. David Cicurel, was moving to non-Exec Chair.

Trading conditions

There have been “uncertainties around US federal funding for scientific research” (Trump-related, I presume?). The company informs us today that in the “there has been no recovery since the September update” when it comes to the United States. Other regions have been “satisfactory.”

Here’s a quote from an article published in the last few days by The Hill, a US political newspaper:

After a year of government layoffs and sweeping funding cuts under President Trump, many researchers are hanging on by a thread.

The administration has said it is realigning federal spending to match its agenda, but scientists respond that even proposals that advance the White House’s goals have been ignored or cut. Medical advancements, education research, defense priorities — no area has proven safe from frozen funding, which has also come alongside massive reductions in the government agencies that support these areas.

And in even more bad news for Judges:

Additionally, despite general resilience in industrial-focussed markets, H2 saw reduced investments in offshore wind which had been a strong growth driver for the Group.

Order intake: this saw a "progressive weakening” during 2025, and by the end of the year was down 6% for the full year.

2025 guidance: adjusted EPS will be c. 275p, 6% below expectations of 292p.

For context, adjusted EPS was 283.4p in 2024, and it had been 374.6p in 2023.

2026 outlook: this is unsurprisingly poor.

The Group starts 2026 with a lower-than-desired order book. The reduction in Organic order intake has meant that the opening Organic order book has reduced to 15.7 weeks of sales (31 December 2024: 18.7 weeks; 16.9 weeks without Geotek's coring expedition).

The delivery of Geotek's next coring expedition is now unlikely to be until early 2027.

As we noted at the time of the acquisition of Geotek, the addition of this business was likely to increase the lumpiness of JDG’s results, and this is increasingly evident now.

In the US, “uncertainty remains around the timing of a return to normal trading in the USA”.

2026 adjusted EPS will be 200-250p, “which assumes the absence of a coring expedition and no recovery of trading in the USA”.

Graham’s view

I’m a long admirer of this business but with sustained weak performance, it’s difficult for me to be positive on it now.

It’s not the company’s fault that its share price got overheated a few years ago, with expectations that turned out to be unrealistic:

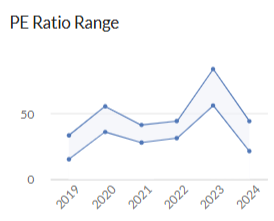

The earnings multiple soared to impressive heights before returning to a more level:

Some reasons to be careful:

This is not just a “blip”; revenues and orders have shown signs of moderating and weakening for a few years now. Organic revenue was already down 8% in 2024, before the company ran into a very difficult 2025.

As a victim of its own success, my impression is that Judges has struggled in recent years to find exciting acquisitions that can successfully move the needle. Geotek doesn’t seem particularly successful at this point.

Dependence on government funding is a double-edged sword and at the moment, Judges is on the wrong end of this risk.

The wide range of possible outcomes for 2026 (200-250p adjusted EPS) implies limited visibility.

Some reasons to be positive:

The business is still profitable; even at the low end of new guidance.

At the top end of new guidance, the shares are now trading on a PER of 20x, which is not a terrible entry point for investors who believe in the long-term resilience of the group.

The new CEO (from February 2026) has been with Judges for nearly 3 years already, and had a long stint at Halma and before that at Renishaw. Perhaps he’ll bring some new ideas that can reinvigorate performance?

While I still have great admiration for Judges, I am going to have to downgrade our stance here by one notch to AMBER/RED, in light of the profit warning. But this is one of those instances where I’ll be eager to go back to neutral or positive, if there is evidence of stabilisation.

In the short-term, however, I’d be braced for continued difficulties.

B&M European Value Retail SA (LON:BME)

Down 0.2% to 172.68p (£1.74 billion) - Q3 FY26 Trading Statement - Graham - RED =

B&M European Value Retail S.A. ("the Group"), the UK's leading variety goods value retailer, today provides a trading update for the third quarter ("Q3") of its current financial year ("FY26"), relating to the 13 week period from 28 September 2025 to 27 December 2025.

We’ve been sceptical about this one and for pretty good reasons, including some accounting problems.

Today’s update does little to inspire confidence, with the company cutting profit forecasts.

Revenue figures:

UK LfL -0.6% in Q3, -0.2% year-to-date.

Group +2.9% in Q3, +3.6% year-to-date.,

CEO comment:

We entered our Golden Quarter sharper on price to reinforce our value proposition with our customers. Price investment has continued, particularly in FMCG, and while the full benefits will take time to come through, I am encouraged by the early signs of like-for-like (LFL) sales growth at B&M UK late in the quarter. This includes the strong sell through of our seasonal ranges, which contributed to 3 percent UK LFL growth in December, with similar LFL trends continuing in early January trading.

I get that this is a value retailer and it’s competing on price, but as an investor I instinctively recoil from the phrase “price investment”. I’d prefer a much plainer phrase - discounting, or even price cuts - rather than a phrase that makes these things sound grander than they really are.

The strategy of “price investment” is not the only issue affecting results currently:

…we are identifying opportunities to make deeper investments in clearing discontinued lines to support planned reductions in SKU count and to clean up stock as we restore on-shelf availability towards industry benchmarks. As with our pricing actions, these are investments in the long-term strength of B&M, but they do impact near-term financial performance. As a result, we are revising our full-year guidance downwards to reflect these actions and the financial underperformance at Heron. We now expect FY26 Adjusted EBITDA (pre-IFRS 16) to be in the range of £440m to £475m, compared with our previous guidance of £470m to £520m.

Let’s use the midpoints of these ranges to estimate how large this profit warning is. The new midpoint is £457.5m, while the old midpoint was £495m. That’s an 8% reduction.

The second paragraph quoted above is again rather euphemistic. What it amounts to is more price cuts! This time on old stock.

Again, I recoil from this sort of phrasing. Whenever I hear something like “we are identifying opportunities to make deeper investments”, I interpret it as “we have to make deeper price cuts in order to get rid of our old inventory”.

Looking ahead, the CEO is more confident:

I remain confident that the actions we are taking will restore sustainable LFL growth at B&M UK over the next 12 to 18 months and provide a strong foundation for future growth."

Graham’s view

I do think we’ve been very harsh on this one, giving it a RED, but I’ve not seen anything in today’s update to change that stance.

The share price has barely reacted, implying that investors are already very sceptical and able to price in a profit warning like this.

The earnings multiple is in single-digits, as you’d expect:

I’m going to cautiously leave this on RED, which is consistent with our approach to profit warnings. Also I note that net debt was £859m at the interims, approaching 2x the new EBITDA forecast. So there isn’t a very strong balance sheet to fall back on, if trading were to continue deteriorating.

Mark's Section

Ingenta (LON:ING)

Down 7% at 97p - Trading Update - Mark (I hold) - AMBER/GREEN

(At the time of writing, Mark holds a long position in this stock.)

Good news here:

The Group expects to report revenues for FY25 of £10.3m (2024: £10.2m), with adjusted EBITDA ahead of market expectations at £1.6m (2024: £1.8m).

However, I’ve got to say that I did expect this. At the half-year they did £0.9m adjusted EBITDA, and while each half can be noisy, it didn’t take much for them to beat full year expectations, and I think many shareholders took the same view. This is a very conservatively run company, and adjusted EBITDA here is almost certainly adjusted down to account for the FX effects seen in H1.

Broker coverage:

In order to work out how this all plays out, I turn to Cavendish’s update note. This is actually a slight miss on their revenue forecasts, but gross profit increases slightly due to better mix. The beat on EBITDA flows down the income statement to give a 22% upgrade in Adjusted EPS to 10p. Although this is a sizeable upgrade to EPS, it is still down on the previous year. I wouldn’t be surprised if the company are still holding something in reserve and end up slightly higher than this, but it is still unlikely to exceed the previous year’s figure.

Contracts:

Although the company highlighted a new Edify customer onboarded during the period, I can’t help feeling they are a little disappointed with the slow pace of converting a large sales pipeline into new customers. This is perhaps understandable given how weak much of the business landscape was in the latter part of 2025, with few companies committing to new software systems, given their own variable outlooks. However, this hasn’t been helped by the previously mentioned difficulty in getting salespeople with the relevant specialist skills. However, they are a little reticent around how long it will take to see the fruit of recent sales activity in the numbers, saying they are:

…confident that new business activities will bear fruit as the year progresses, and achieving growth in profitability from the 2025 level will to some extent be dependent on the speed with which new customers can be onboarded. The Group expects to announce FY25 results in April 2026 and will provide a more detailed outlook on 2026 at that time.

And:

Looking forward, the existing teams are actively working on sales proposals which will be submitted in the first quarter of 2026 which we hope to report on in due course.

Cash:

While I largely expected the EBITDA beat, this is a pleasant surprise:

…closing cash balances at 31 December 2025 of £4.7m (2024: £3.6m). The Group has no debt.

This cash figure was ahead of my expectations, especially as they paid £630k out in dividends during the year. It also came in significantly above Cavendish’s £3.8m estimate. Today’s commitment to pay out a further 2.75p final dividend, means that Cavendish’s forecast is also exceeded.

Valuation:

Cavendish point out:

Ingenta trades on an FY25E adj P/E 10.5x (ex-cash P/E of 7.4x), a significant discount to its peer group on 18x.

This is a very cheaply-rated stock compared to an already cheap UK small-cap market, let alone the software sector.

Mark’s view

I view this company as pretty much a free option at the current price. The high level of recurring revenues together with the high free cash flow these generate, plus a third of the market cap in net cash, means that the current valuation looks more than underpinned, even if their strategy to drive sales growth fails to deliver.

The total addressable market for their software solution is huge, so there is a certain amount of frustration in the market with the slow progress in delivering a sales uplift. A sentiment I share. However, with long sales cycles and weak market conditions in 2025, it shouldn’t be surprising that it will take some time for additional sales efforts to be seen in the numbers. If they can generate meaningful sales uplift, the recurring nature of the wins mean that Cavendish’s 260p Price Target doesn’t look out of place.

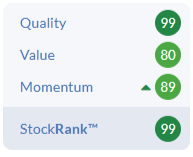

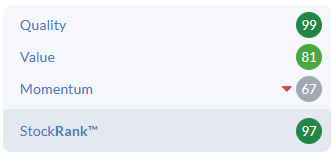

Hence, I am in no rush to sell, or change our previously mostly positive AMBER/GREEN view. Especially while it remains one of the most high-rated stocks by the Stockopedia algorithms:

M P Evans (LON:MPE)

Up 1% at 1264p - 2025 Crop and production - Mark - AMBER/GREEN

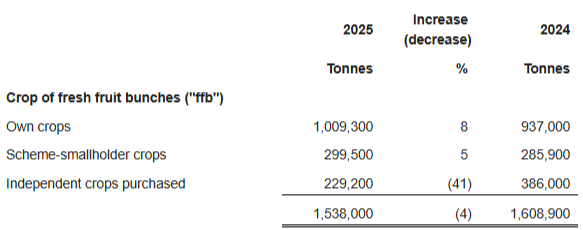

Their own crops delivered a decent increase in production. However, there was a significant decline in third party crops bought in:

The company is keen to point out that:

The Group continue deliberately to restrict the amount of independent crop purchased for processing in its mills, a low-margin source of supply, with an overall 41% decrease in 2025. This is part of the Group's ongoing strategy to change the input mix to its processing facilities to prioritise its own, higher-margin, harvest.

It did mean that overall production was down 3% for both Crude Palm Oil and Palm Kernels

Pricing:

The decline in production has been more than offset in the increase in price achieved:

The Group received an average mill-gate price for its CPO of US$866 per tonne in 2025, 5% higher than the US$823 in the previous year. Prices for PK were, on average, US$748 per tonne in 2025, a substantial 42% higher than the US$525 in 2024. This high-price environment has had a positive effect on the Group's revenue and profitability, as reported in the Group's announcement on 10 November 2025.

It is this huge increase in the price of Palm Kernels that has had a significant positive impact on profitability at MP Evans and all Palm Oil producers. Palm Kernels are the seed inside the oil palm fruit, meaning that they will always be a smaller part of palm production. While crude palm oil is mainly an edible oil, whereas palm kernel oil often goes into detergents, cosmetics and personal care. This makes demand less price sensitive, and growth in demand for these products has been responsible for the big price rises.

Looking at the numbers, it seems these are in line with wat their broker Cavendish expected for 2025, following upgrades towards the end of the year.

2026:

Looking forward the company say:

Pricing in early 2026 remains robust, with the Group tendering its CPO output for sale at approximately US$850 per tonne

It would be good to get an update on the Palm Kernel pricing, as strength there has also been a big driver of recent upgrades.

There is also the issue of recent flooding:

Consistent with the Group's announcement on 2 December 2025, work to restore normal operations at the Simpang Kiri estate in Aceh following some flooding has progressed well and there was no material impact on the Group's crop, production or costs for 2025.

They pointedly don’t say that there has been no impact to 2026, which leave this open to the possibility that production may be down

Forecasts:

Cavendish sees EPS dropping by 27% in FY26 to 154cents, based on a $750/tonne mill-gate CPO pricing. There is still scope for this to be upgraded if pricing remains firm. However, they say it is too early in the year to consider this. Whatever happens they expect the dividend to increase, and give a 4.8% yield.

Mark’s view

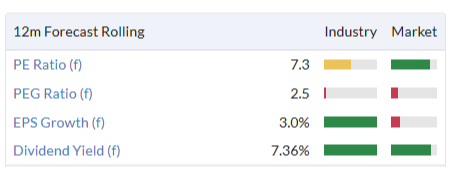

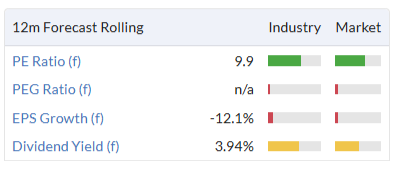

The share price has done well over the last few years. Despite this, it still trades on a forward P/E of less than 10:

However, it has always been a cheaply-rated stock, reflecting that it is largely a commodity play. Over the very long term, management has done well, growing the business. However, overlaid on this is significant gyrations in price reflecting the medium-term commodity cycle:

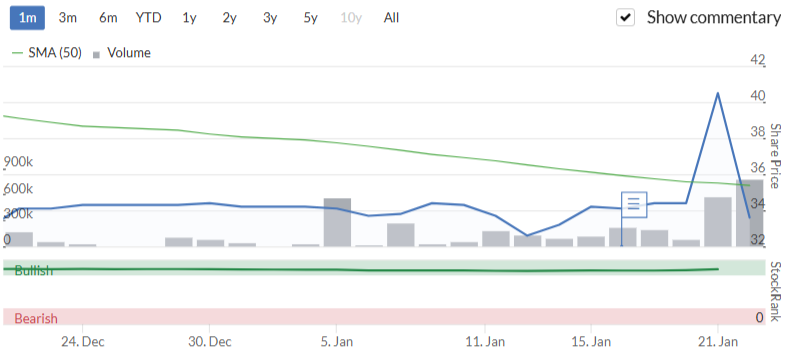

I don’t expect that to change anytime soon, so anyone investing here absolutely has to take a view on where we are in that commodity cycle. Those who are bullish and expect current CPO and PK pricing to remain elevated, will see further upgrades and upside to come this year. Those expecting the recent commodity pricing strength to moderate, may be better off getting out ahead of that. The recent declining Momentum Rank and share price chart suggests that at least some larger investors are taking that view:

However, it remains a SuperStock, and not that expensive, so I don’t think these concerns are enough to change our previously mostly positive view of AMBER/GREEN.

Kooth (LON:KOO)

Up 7% at 112p - $2.6m contract win with new US State - Mark (I hold) - AMBER/GREEN

(At the time of writing, Mark holds a long position in this stock.)

Details of this contract win are a little vague:

…announces that it has agreed the terms of a one year contract with an undisclosed US State (the "State") for the provision of digital mental health services for up to 100,000 students. The contract has an expected value of $2.6 million (the "Contract").

The sad fact is that provision of mental health services has become a bit of a political hot-potato in the US. The issue seems to centre on the idea that parents should be involved with all aspects of care for their children, including mental health. This makes sense until you realise that this may also stop teens accessing the support they need, in some cases. Like so many seemingly unrelated things these days, this has been polarised along political lines. So this contract win is far more likely to be a “Blue” state than a “Red” one.

The one year contract term suggests that there is a certain amount of trial to this win. Their landmark contract in California averages out at $47m revenue per annum, and serves 6 million 13-25-year-olds statewide.

However, winning business in a new state, even for a smaller number of users and an initial term, is good news, as it expands the potential for future wins and longer term contract extensions. A British company winning these contracts against what is usually much larger US corporations suggests that their product offering is particularly strong.

The strength of the market reaction reflects this potential, plus that the shares have sold off significantly since their July trading update disappointed the market. The issue is that they rather surprised the market by spending £7.2m on direct marketing in H1 to support their California contract. I suspect that this spend was always planned, but that this was very badly communicated to the market.

In September, they guided adjusted EBITDA down 6-8%, but due to FX impacts rather than trading, meaning the £9.4m EBITDA Canaccord forecast still stands. It is disappointing they didn’t take the opportunity today to confirm this. Even if they get close to this, an EV/EBITDA of less than three seems low for a company with a unique product and significant growth potential.

Mark’s view

This contract win shows why I have kept the faith here, despite a recent share price performance suggesting that FY24 trading was a one-off that would never be repeated. The concentration risk remains high. California remains around 90% of their US revenue, even with this additional state win. However, the upside remains high, as the ability to roll out their platform across many more states and into other countries is undiminished. I don’t see that badly communicated marketing spending changes that.

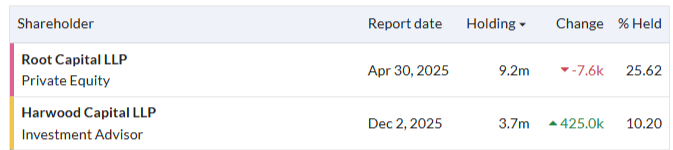

The shareholder register also gives me confidence that this potential may eventually be reflected in the share price:

In a separate announcement today, Harwood/Rockwood went above 11% on 20th January. The Root Capital holding is a stub from listing, and appears to be held in Root Capital II Fund, which has been in disbursement for sometime and may even be the fund's last holding (Root was renamed ScaleUp in 2021). They last placed shares at £2.80 and while that may be some level above today’s price, I think it would be around that level that Root would be looking for an exit. It may require a renewal or extension of the California contract to be in the bag, to give some earnings visibility. However, there looks to be a deal to be done to me, if any of the US healthcare tech providers wanted to scale up in a growth area.

This is all speculation on my part and should be taken with a pinch of salt. However, I think the shares look better value today than they did when I took a broadly positive view following their last contract extension, so am happy to remain AMBER/GREEN.

Works co uk (LON:WRKS)

Down 17% at 34p - Interim results and Christmas trading update - Mark - AMBER ↓

There appears to have been some speculation yesterday that this trading update would be good. This means that the share price reaction today isn’t as bad as it looks, as the stock has just reverted to the level earlier in the week:

As it happens, these are said to be in line with previous expectations:

Remain on track to deliver FY26 profit in line with market expectations of pre-IFRS 16 Adjusted EBITDA of £11.0m and sales and profit growth in FY27.

Christmas Trading:

While the overall performance may be in line, there is significant variation between stores and on-line. H1 sales were already known at +4% LFL store and -36% LFL on line. Christmas trading doesn’t look great though:

Over the 11 weeks to 18 January 2026….Store LFL sales increased 1.2%…online LFL sales declined 51.8%, in-line with our revised expectations as we went into the festive period, resulting in total LFL sales declining 4.2%

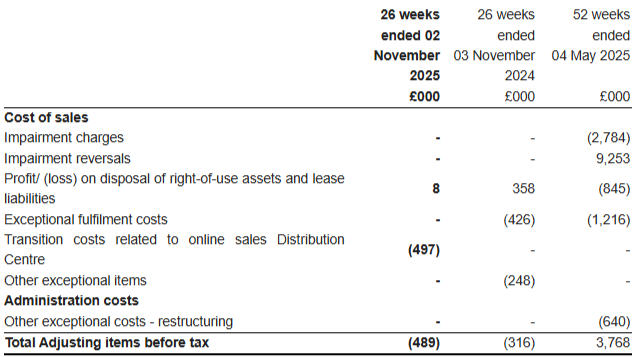

They had problems last year, and booked £1.2m of exceptional fulfilment costs due to issues with third party logistics. This led me to question how ahead they really were last year. If they hadn’t excluded these as one-off, they would have missed expectations and not beaten them. And these issues have proven to be anything but one-off - they changed logistics suppliers, and appear to have had an even worse performance. In their results presentation, they confirmed that they will still be booking “a small amount of exceptional fulfilment costs”. They say this should be lower as the biggest impact is on profit by controlling demand. However, this does question how in line they really are without seeing the figures.

While they largely blame the logistics providers, I can’t escape the feeling that if they have had similar issues two years running with two different providers, the issues may be internal, not external. There appears to be no mention of any claims against either of the supposedly under-performing logistics companies.

In the H1 results released today, there are no exceptional fulfilment costs, but they do exclude £0.5m of costs related to the change of logistics provider:

If we accept these adjustments, then there are signs that they do have some positive momentum. Adj. LBT is down to £5.1m from £6.5m, in their typically loss-making half.

Balance sheet:

Net debt excluding lease liabilities is down from £8.5m to £5.3m, again in a period where inventories will be at a high. Lease liabilities still exceed lease assets by £13.8m, this is down from £19.2m the year before suggesting that they are in a better position on their leased estate.

Net tangible assets have increased over the last year, due to retained profits, but standing at just £6m there isn’t any real asset backing here. There is no dividend, and I still don’t think they are in a strong enough position, over the whale trading year, to pay one any time soon. Not least, they would need to do a capital reduction to form a distributable reserve, as retained earnings are negative.

Mark’s view

I’m struggling to form a cohesive view on this one. Let’s weigh up the evidence:

Pros:

If you accept the adjustments its still very cheap on forward earnings

H1 results suggest reasonable momentum on earnings and debt

The store performance is very credible in difficult market conditions

In line for the FY despite online issues.

Credible strategy of focussing on non-screen-time activities for children

The Stock Rank is 85

Cons:

Online performance very poor for second year running and I’m not convinced they have yet got a handle on this.

Ongoing exceptionals not very exceptional, and cast doubt on the quality of previous ahead announcements

Retail is a highly competitive sector

Momentum Rank 54 and 6m share price down 30%

No capacity for dividends or buybacks in the short term

Not much downside protection should things go wrong.

I think overall I’m going to stay neutral, at least until it is clear that the online issues are behind them. AMBER

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.