Good morning!

08:00 - Agenda is complete

14:07 - Report is complete

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

Name (Mkt Cap) | RNS | Summary | Our view (Author) |

Anglo American (LON:AAL) (£30.2bn) | Joint mine plan for Los Broncoes and Andina in Chile will unlock a further 2.7mt of copper production. | ||

JTC (LON:JTC) (£2.3bn) | Rev +17%, adj net profit +10% to £35.4m. FY expectations unchanged. Offer talks continue. | PINK | |

Sigmaroc (LON:SRC) (£1.39bn) | ArcelorMittal withdraws from project to develop 3 net zero kilns. No material impact on forecasts. | ||

Kier (LON:KIE) (£857m) | Rev +3%, PBT +15% to £78.1m. Order book +2% to £11.0bn. FY26 currently slightly ahead of exps. | AMBER/GREEN (Roland - I hold) Today’s results look strong enough and management have edged up guidance for the year ahead. However, my review of the balance sheet and cash flow statement suggest that progress with deleveraging was limited last year. I also take issue with the company’s calculation of free cash flow, which is significantly higher than my estimate. Niggles aside, Kier does seem to be trading well with an attractive pipeline of infrastructure work, particularly in the water sector. With some reluctance, I am moving our view up by one notch to AMBER/GREEN to reflect today’s upgrade. | |

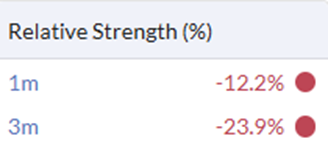

Trustpilot (LON:TRST) (£817m) | Rev +21%, PBT +45% to $3.7m. New £30m buyback. FY EBITDA margin to be ahead of exps. | AMBER (Roland) [no section below] When Graham reviewed Trustpilot’s full-year results in March, he commented on operating leverage from rising revenue and “yet another earnings upgrade”. Today we have more of the same, but I’m not sure if it’s enough to justify the current valuation. Trustpilot’s operating profit tripled last year to $5.8m, but that still only translated into an operating margin of 4.7%. There’s not yet much evidence of economies of scale or network effects, either. Operating costs rose by 20% to $94m, representing 77% of sales (H1 24: 78%). The outlook for the remainder of the year has been upgraded to maintain the improved EBITDA margin (14.6%) achieved in H1. Assuming revenue remains unchanged, that equates to FY adj EBITDA of c.$37m. From what I can see in secondary sources, previous expectations were c.$35m, so this is a useful upgrade. However, with the stock still trading on c.50x 2026 forecast earnings, growth here isn’t rapid enough for me to be positive. I’m going to mirror the StockRanks and downgrade our view by one notch to neutral today. | |

Harworth (LON:HWG) (£554m) | H1 total accounting return 1.1%, NAVps 215.5p. Expect improving land market. | ||

Pollen Street (LON:POLN) (£527m) | AUM +35% to £6.1bn, fee-paying AUM +37% to £4.7bn. FY guidance reaffirmed. | GREEN (Mark) Excellent performance in the Asset Management business with AUM up significantly, especially allocated AUM and therefore fee-paying. There looks to be more to come with another Private Equity round closed just after period end and they are currently raising for a Private Credit fund. H1 fees look to be exceptional, hence why this is an in-line statement with around 60% of FY EPS delivered in H1. The Investment Company performance is also a drag, with PBT lower here than the previous year. Given how good a deal PE funds often end up for the manager, I would rather they didn’t invest in their own funds, but this is probably a necessary part of raising external capital. While the investment side makes cash flows lumpy, I don’t see why the increase in AUM won’t lead to further EPS growth over the next few years and hence makes the 11x P/E and 6% yield look cheap. I still have my doubts about the true value delivered by any Private Equity funds. However, it is also worth noting that buying up UK mid-caps on historically low multiples, towards the bottom of an economic cycle, and leveraging them up, probably isn’t a terrible strategy. As such, there is always a chance that their funds become a source of strong returns on top of the great asset management part of the business. I see no reason to change our positive view at this point in the cycle. | |

Porvair (LON:PRV) (£331m) | Q3 trading was satisfactory. Market trends consistent with H1. | ||

SThree (LON:STEM) | Group net fees -12% YoY. FY25 guidance unch for £25m PBT. New business is challenging. SP -20% | BLACK/AMBER/RED (Mark) Today’s big profits warning for FY26 means that I’m going for that downgrade that Graham almost went for last time. I agree with him that this may be one of the better companies for an eventual recovery. However, that recovery now looks even further away, and the risks that these issues are structural rather than cyclical are increasing. | |

Fintel (LON:FNTL) (£225m) | Rev +18.6% (+4% organic). Adj EBITDA +17% to £11.2m, net debt £30m. Outlook in line with exps. | ||

MJ GLEESON (LON:GLE) (£199m) | Results in line with exps. Rev +5.9%, adj PBT -11.7% to £21.9m. Outlook for FY26 “robust”. | ||

City of London Investment (LON:CLIG) (£196m) | FUM +6% to $10.8bn, net outflows $974m. PBT +15% to $26.0m. Dividend held at 33p. | ||

Brickability (LON:BRCK) (£173m) | YTD trading in line with exps. Despite challenging market, FY adj EBITDA guidance unch. | AMBER/GREEN (Mark - I hold) A short in-line AGM statement would normally be non-news. What makes this interesting is that the recent share price implied that a warning was on the way, and the valuation metrics look compelling for a business trading in such difficult macro conditions. We have to wait for the end of October to see some actual figures for the Half Year, but in the meantime I see little reason to change our positive view. | |

Eleco (LON:ELCO) (£132m) | Rev +13%, ARR +19%. Adj PBT +23% to £2.7m. Good progress. FY outlook in line with exps. | ||

EKF Diagnostics Holdings (LON:EKF) (£130m) | Rev unch, PBT +16% to £3.6m. Analyzer prod +60%. FY25 adj EBITDA to be in line with exps. | ||

Personal group (LON:PGH) (£116m) | Rev +11%, PBT +68% to £3.8m. Strong insurance sales cont’d in Q3. FY outlook in line with exps. | AMBER/GREEN (Roland - I hold) These results look positive to me and do not seem to raise any obvious concerns. I don’t see any reason to doubt the full-year outlook and would guess there could be a little bit of upside to come if H2 remains strong. However, I think it’s worth noting that there’s no strong trend of upgrades here and the group’s 2030 targets rely on doubling annual revenue and achieving a material increase in profitability. For now, I think the shares look reasonably valued and remain happy to hold (in SIF), especially given the more generous dividend payout. Our view remains unchanged today. | |

Springfield Properties (LON:SPR) (£108m) | Rev +5.3%, PBT +96% to £19.0m. Completions -9% to 799. Expects underlying rev growth in FY26. | ||

Focusrite (LON:TUNE) (£97.4m) | Rev for 6m to 31st Aug +6.6% to c£87m, gross margins improved slightly, net debt c£11m, “The Board continues to expect Adjusted EBITDA for the 12 months to 31 August 2025 to be within the current range of market forecasts.” | ||

NWF (LON:NWF) (£85.8m) | “…the Board's outlook for the full financial year is unchanged.” | ||

Eagle Eye Solutions (LON:EYE) (£79m) | FY Revenue flat at £48.2m, Adj. EBITDA +8% to £12.2m, PBT +315% to £3.0m. Net cash £12.3m (FY24: £10.4m) | ||

Headlam (LON:HEAD) (£53m) | H1 Revenue -4.6% to £244.7m, u/l LBT £19.9m (24H1: LBT £15.6m), Net debt £24m (24H1: £28.3m), “market data indicates a slight deterioration in market conditions in the last three months” | ||

Manolete Partners (LON:MANO) (£50m) | “In the period to 31 August 2025, 114 new cases have been added which have generated unaudited unrealised revenue of £4.2 million….Over the last 12 weeks the Company has settled fewer large cases than in the prior year period. In the five months to 31 August 2025, four cases settled at a value greater than £250,000 compared to ten in the same period last year.” Loan facility drawn to £12.5m. | ||

Corero Network Security (LON:CNS) (£47m) | Revenue -10% to $10.9m, order intake -12% to $12.5m, LBITDA $1.4m (24H1: EBITDA $0.7m). Comfortable with FY guidance of $24.0- 25.5m revenue and LBITDA between $1.5 - 0m. | ||

Manx Financial (LON:MFX) (£43m) | “The Bank has signed a Master Services Agreement with AIM traded Fiinu for a minimum three-year exclusivity period to integrate Fiinu's overdraft technology into its product suite.” | ||

tinyBuild (LON:TBLD) (£38.7m) | Revenue flat at $17.0m, Adj. EBITDA $4.2m (24H1: LBITDA $2.3m), Cash $4.6m (31 Dec: $3.1m) after disposal of Red Cerberus for $1.0m. | ||

Ariana Resources (LON:AAU) (£33.3m) | Listed on ASX raising A$11m, Dokwe Gold Project in Zimbabwe continues to be advanced through its DFS, new diamond and RC drilling programme of 11,000m at Dokwe; with drilling to commence in early October. | ||

Kromek (LON:KMK) (£32m) | Revenue +37% to £26.5m, adjusted EBITDA +232% to £10.3m, PBT significantly ahead of market expectations at £3.1m (2024: £3.5m loss),Cash £1.7m (30 April 2024: £0.5m) with $5m received post year end. FY26 trading in line with market expectations. | ||

Powerhouse Energy (LON:PHE) (£27m) | Revenue +23% to £475k, LBT £1.84m (24H1: LBT £1.17m) Cash £1.47m (30 June 24: £2.73m) after £1.375m raise in the period. | ||

Mast Energy Developments (LON:MAST) (£24.9m) | Targeting 1GW by 2030. In advanced discussions with a datacentre developer and owner regarding a 25 MW datacenter development. | ||

Corcel (LON:CRCL) (£22.5m) | To acquire 326-line km of 2D seismic data over the KON-16 block, onshore Angola | ||

OptiBiotix Health (LON:OPTI) (£10.6m) | Revenue +102% to £557k, LBT £1.18m (24H1: LBT £2.79m), Cash £1.30m (24H1:1.26m) | ||

Pennant International (LON:PEN) (£9.73m) | Placing: £1.25m gross raised at 22.5p, a 4.4% discount, used to reduce overdraft. Results: Revenue -39% to £4.5m, Adj LBT £1.8m (24H1: £0.2m), net debt £2.1m (24H1: £1.6m), after £3.1m property sales. Outlook: “..the Group is currently trading in line with current market expectations.” |

* Market caps at previous trading day’s close

Mark’s Section:

Brickability (LON:BRCK)

Up 4% at 55p - AGM Statement - Mark (I hold) - AMBER/GREEN

A short in line AGM statement wouldn’t normally garner much interest. However, in this case it seems that trading in line with the board’s expectations may actually exceed market expectations. Not those of the broker, that have remained pretty flat since March:

But the expectations of investors, who have not wanted to hold the equity into this trading statement:

Perhaps not surprising when this is the market backdrop as described by the company::

Notwithstanding the challenging market conditions, predominantly driven by a slow pace of recovery in housing starts and RMI together with the delays in approvals by the Building Safety Regulator (BSR)...

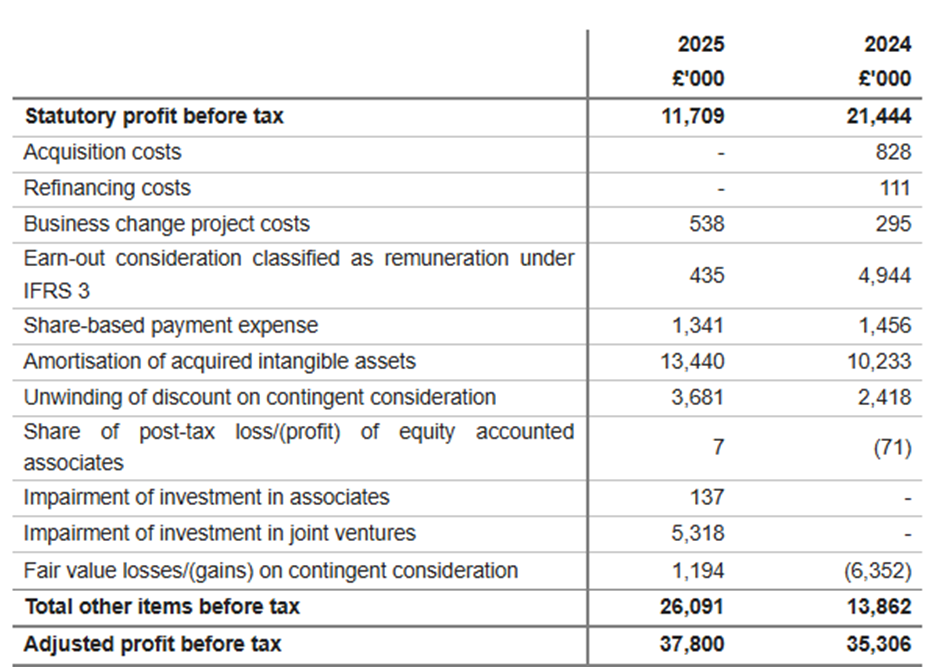

So they are managing the situation well to report “the Board's expectations for adjusted EBITDA(*) for the full year remain unchanged.” Of course, Adjusted EBITDA places a large emphasis on the adjustments, and it bears reminding ourselves of the scale of the adjustments they have historically made:

Although sizeable, most of these I consider reasonable and either genuinely one-off or non-cash. Perhaps only ongoing “Business change project costs” should be added back in, in my opinion.

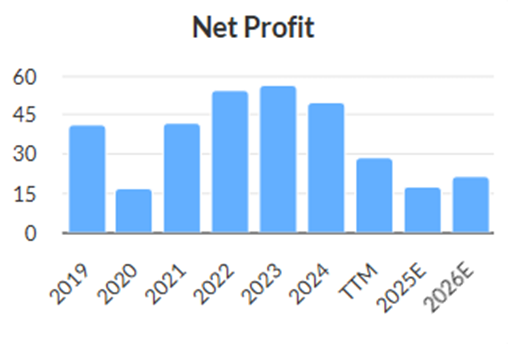

Their broker Cavendish haven’t issued an updated note this morning. Presumably, as nothing has changed. This makes the valuation metrics a sea of green:

This makes this company look great value, especially as these represent a period of difficult end market conditions, with the company saying:

We remain confident in the Group's ability to deliver long-term shareholder value, with the business well positioned to benefit quickly as market demand incrementally improves towards more normalised levels.

Given that they have taken on debt to make acquisitions, it would have been nice to get an update on the current leverage. Although, they haven’t provided any other figures with this AGM update so it isn’t a specific omission. I expect a fuller picture when they release H1 trading figures at the end of October.

Mark’s view

I bought a small position here recently, as it looked just too cheap on current forecasts for a business operating in difficult market conditions. However, I was put off increasing my holding by the continuing sell off in the shares. At £170m market cap, it is possible that institutions are seeing something I was not, and an upcoming trading statement added to the risk. Having had in line trading confirmed, it seems now may be a good time to consider bringing it up to a full position, although I would also like to see some actual figures, which requires waiting until the end of October. Roland rated this AMBER/GREEN after the FY25 results were released in July. I see no reason to change that view today.

Pollen Street (LON:POLN)

Up 2% at 893p - Interim Results - Mark - GREEN

I’ve never been a fan of Private Equity. A lot of the supposed outperformance of such funds appears to come from the idea that such funds are less volatile than direct equity investments. Which is true, but only because they mark-to-model (make-believe), not to-market. In a recent FT article, fund manager Dan Rasmussen describes them as “a money trap for institutions” and highlights the danger institutions are in that have overallocated to this asset class. (Dan goes into a deeper dive of what the issues are surrounding this asset class on the Excess Returns podcast here.)

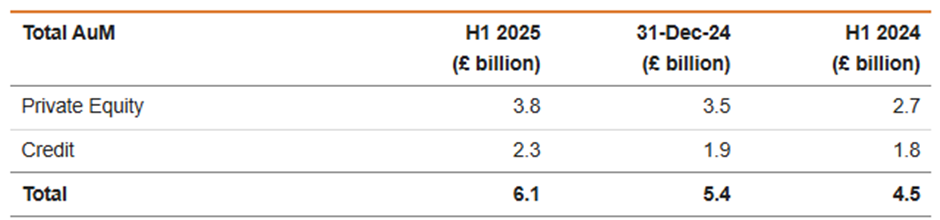

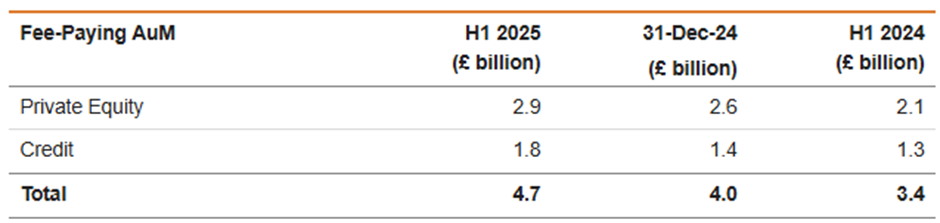

However, just because Private Equity doesn’t look like a great deal for institutional investors, it doesn’t mean it isn’t a great deal for those providing PE funds, such as Pollen. These results highlight this. Not only is this a rare fund manager that is growing AUM rapidly:

And in particular, fee-paying AUM, where they have deployed the committed capital:

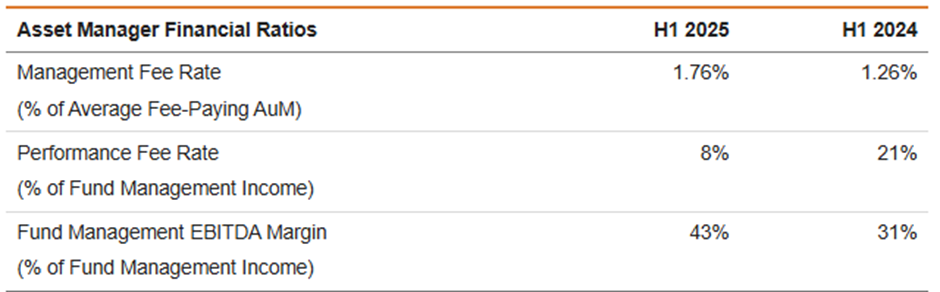

Not only are they able to grow AUM much faster than typical fund managers at the moment, but they can charge much more:

They do point out that some of this is exceptional:

The Group has provided long-term guidance for a blended management fee rate across Private Equity and Private Credit of between 1.25 per cent and 1.5 per cent. The rate for H1 2025 exceeded this range at 1.76 per cent (H1 2024: 1.26 per cent), primarily due to the high level of catch-up fees earned in relation to Private Equity Fund V. No further catch-up fees are expected in relation to Private Equity Fund V, with the final close of that fund having been completed in July. Excluding the £8.4 million of catch-up management fees recognised in the period, the underlying Management Fee Rate would have been 1.37 per cent for H1 2025.

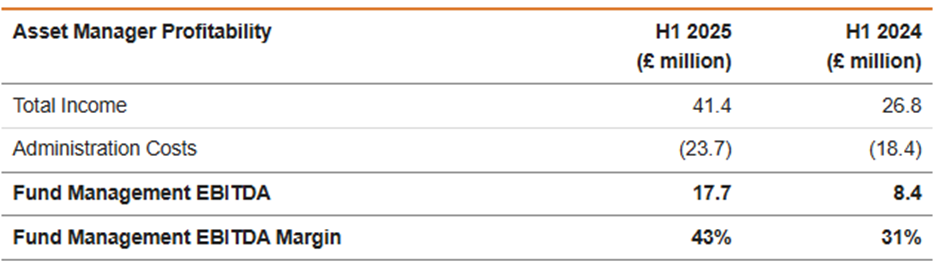

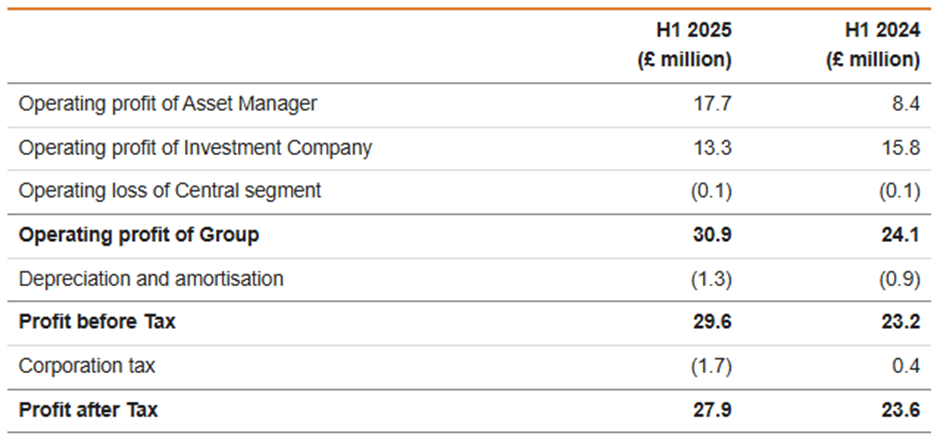

But in a world where fees are under constant pressure, they must be doing something right (or at least good at selling the idea that they will generate high performance.) One of the risks with fund managers is that all of the upside goes to the “star“ managers in the form of bonuses. However, here there are signs of significant operational gearing, with admin costs growing much more slowly than income:

This is helped by their ability to also claim some of the interest income received on unallocated funds:

In addition to management fees, the Group earns performance fees and carried interest, enabling it to share in the profits generated by its managed funds. These amounts are variable and depend on performance exceeding specific return thresholds ("hurdles") over the life of each fund. The Group is entitled to 25 per cent of carried interest across all Private Equity funds from Private Equity Fund IV onwards, and all Private Credit funds from Private Credit Fund III onwards.

Income should grow further as post-period end, as they have closed on an additional private equity fund:

In Private Equity we completed the successful final close of our flagship Fund V in July, securing commitments of €1.5 billion, exceeding our initial €1 billion target. Including associated co-investment vehicles, the Group has raised more than €2 billion in total equity capital for this flagship strategy. This fundraise attracted a range of new Limited Partners and broadened our investor base across North America and Europe, underscoring the deep and sustained confidence from a global base of institutional investors.

And have commitments towards their target for an additional private credit fund:

Private Credit IV also achieved strong AuM growth with £0.6bn in commitments closed at the end of June. We have a robust and advanced pipeline of investors which gives us visibility on achieving our initial £1 billion target during the course of the year. This success in fundraising is underpinned by the long-term relationships we build with our investors, something that we have supported through ongoing investment in our Investor Relations team.

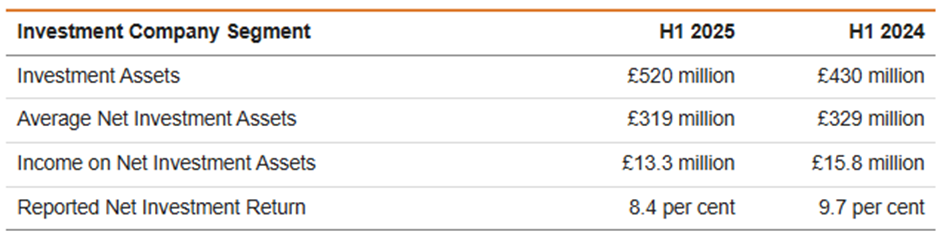

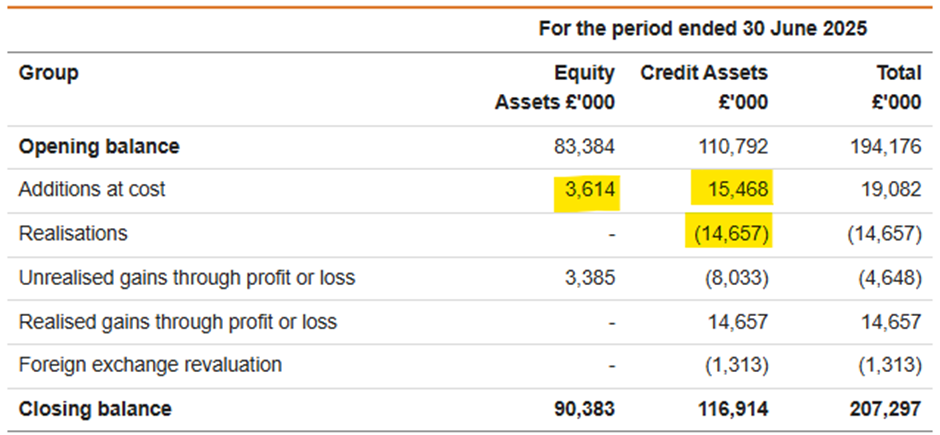

Things aren’t so strong within the investment part of the business, which seems to invest in its own funds:

They explain this as:

Underlying Investment Company returns for H1 were in line with expectations with an Underlying Net Investment Return of 8.8 per cent. The Reported Net Investment Return of 8.4 per cent (H1 2024: 9.7 per cent) was impacted by equalisation effects on investments in our Private Equity and Private Credit funds, reflecting the strong fundraising in the period, and a lower weighting of equity gains during H1 than is expected for H2.

Investing in one's own funds is normal in the fund management industry, with the manager often providing seed capital to develop an investment track record or to show confidence in a strategy/fundraise. However, with these being private equity and private credit funds, the same concerns about the real underlying returns of the funds and access to capital apply equally to Pollen’s own invested funds as they do to third-party investments. This is never really a tangible asset play, so these concerns may be lower than elsewhere:

And while the equity investments may be funded out of cash flow, the bulk of the credit investment additions have been funded through realisations from earlier funds:

However, the reduced profit from the Investment Company does take the shine off the excellent performance of the Asset Manager:

Looking at the cash flow statement, I see that these dynamics mean that net cash from operating activities is just £9.7m compared to the £27.9m PAT. In 24H1, they had significant cash inflows, as they received a large distribution from one of the credit funds, so the cash flow isn’t all one way. However, it does highlight that investing capital in new funds appears to be a cost of growing AUM, and that cash flows will be lumpy. This is probably why the interim dividend payment is effectively held:

The Board is pleased to confirm an interim dividend for the period ended 30 June 2025 of 27.0 pence per share, amounting to a total payment of £16.3 million (H1 2024: dividend of 26.5 pence per share, amounting to a total payment of £16.5 million).

This still represents a yield of over 6%, and highlights that apart from the need to occasionally invest in their own funds, this is a very capital-light business. There is no research on Research Tree, but the consensus on Stockopedia is for 78.2p EPS. So, with a forward P/E of 11, this is also modestly rated for a company that is growing AUM and performance fees. Having delivered 46p in H1, it is tempting to think they may beat expectations. However, there are good reasons to believe that H2 will be a bit weaker than H1, and hence just in line:

Fund Management Income for H2 is expected to be lower than for H1 given the benefit of catch-up fees received in H1. Fee-paying AuM will continue to grow as a result of further capital raises in Private Credit Fund IV and their subsequent deployment. Investment Company investment returns for the full year are expected to be in-line with the returns delivered in FY24, continuing our long track record of delivering stable and robust performance from our balance of direct positions and investments in Pollen Street managed funds. The Group is trading in line with expectations.

Mark’s view

Being a Private Equity manager is a brilliant business and such a good deal for the manager, that the irony is that I wish they didn’t invest in their own funds! However, this appears to be a necessary feature of the industry as it gives confidence to investors that their interests are (somewhat) aligned. Compared to the asset manager part of the business, the Investment Company returns are currently a drag on the overall growth of the business, and mean cash flows are somewhat lumpy, with realisations and reinvestment timelines not always aligned. This is probably why the dividend growth isn’t matching the growth in profits in the short term.

However, there appears to be further growth ahead for the asset manager from the recently closed PE fund and an additional private credit fund currently raising capital. Plus, they will continue to deploy the assets they have under management. While fee levels in H1 look to be exceptional, there seems to be no reason why their annual EPS shouldn’t continue to grow from here, making them look good value, while paying a 6%+ dividend.

I still have my doubts about the true value delivered by any Private Equity funds. However, it is also worth noting that buying up UK mid-caps on historically low multiples, towards the bottom of an economic cycle, and leveraging them up, probably isn’t a terrible strategy. As such, there is always a chance that their funds become a source of strong returns on top of the great asset management part of the business. I see no reason to change our GREEN view at this point in the cycle.

SThree (LON:STEM)

Down 20% at 149p - Q3 Trading Update - Mark - BLACK/AMBER/RED

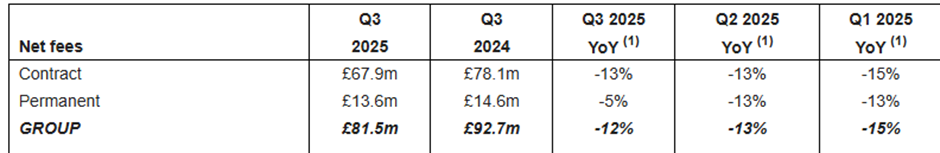

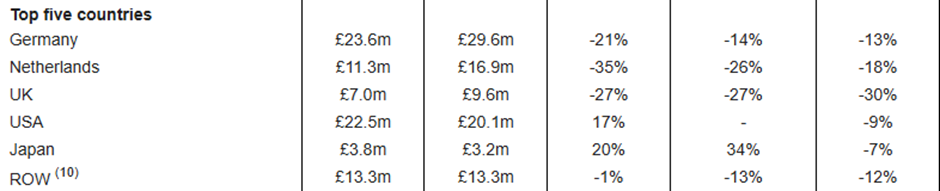

NFI seems in line with trends elsewhere amongst the large/mid-cap recruiters:

Group net fees down 12% YoY(1), with a modest sequential improvement quarter-on-quarter in Q3 supported by a return to growth in the US during the period.

Interestingly, here it is contract recruitment that is doing worse:

Contract (83% of net fees) down 13% YoY, whilst Permanent down 5% YoY.

This is in contrast to many recruiters, where permanent recruitment in an uncertain economic climate has been the biggest source of pain. This may well reflect SThree’s focus on the contractor market, or its technology specialism. These are actually a slight improvement on recent trends, especially for permanent recruitment:

Both Germany and the Netherlands saw declining trends, the Uk was bumping along the bottom, while only the US and Japan grew:

They say that this is inline with guidance overall:

Performance for FY25 expected to be in line with previously announced £25 million PBT guidance

However, the real damage is to FY26:

Persistent softness in new business activity is expected to impact FY26 PBT consensus(5) by c.£20 million due to the Group's operational gearing. This alongside our investment initiatives, which are fully funded through careful cost management in FY25, is expected to result in a FY26 PBT of c.£10 million.

This is huge downgrade for a year that was meant to be a year of recovery:

I’m not sure the statement gives us the full picture. If this is about investment and this is being fully funded by cost-down elsewhere in FY25, how come this impacts FY26 so severely?

Unsurprisingly, it is AI that’s requiring the investment:

Our tech-enabled model gives us the platform to invest in agentic AI functionality, to deliver quality STEM candidates quicker and more efficiently, which when coupled with certain investment initiatives and further cost optimisation, will result in a stronger, more agile business. Together with our specialist expertise in delivering STEM workforce solutions, we have the digital foundations, scale, and differentiated value proposition to be the market leader in an evolving STEM talent landscape.

But this in itself may be problematic. Candidates are using AI to complete CVs or recruiters applications or tests. Then the recruiters are using AI to screen applicants and do initial rounds in the name of efficiency, but with the use of AI all round, no one is quite sure if they are actually getting a good match. I have heard stories of employers recruiting for technical roles and after short-listing three candidates for interview, only one turns up; the other two turn out to be AI bots that have been programmed to appeal to the AI recruitment process. Of course, the big question is what’s the point? Well the bot programmers are clearly hoping there would be no in person/Zoom interview for remote roles and the bots would be able to do most of the job for a professional salary. Given the ease of trying this out, there is little cost to rolling the dice. The real cost is borne by the company that accidentally hires an AI bot, or has to run multiple recruitment processes for the same job.

Specialist recruitment used to be a people business. A specialist recruiter knew all the qualified candidates for a role, or the right questions to ask a new candidate and then only put suitable candidates forward. It was effective, but inefficient, so companies resented paying the high fees to find a candidate, or contractors resented giving away an ongoing chunk of their fees. The answer was to automate as much of the process as possible, but that automation leaves the process open to automation on the candidate side of the process. I don’t see any easy way out of this.

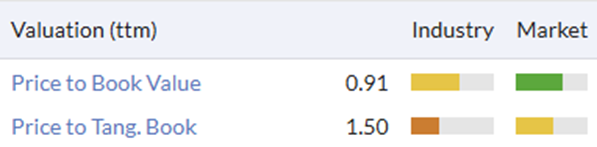

At these levels, TBV may be providing some support:

But this doesn’t speed up any eventual recovery, that now looks a long way away.

Mark’s view

When Graham looked at this in July, he said:

I think I can (just) maintain my AMBER stance on this for now, but if we interpret today’s share price reaction and the implied H2 PBT weighting as precursors to a full-blown profit warning, AMBER/RED might be more appropriate.

Today’s big profits warning for FY26 means that I’m going for that downgrade. I agree with Graham that this may be one of the better companies for an eventual recovery. However, that recovery now looks even further away, and the risks that these issues are structural rather than cyclical are increasing.

Roland’s Section:

Personal group (LON:PGH)

Unch at 371p (£116m) - Interim Results - Roland - AMBER/GREEN

(At the time of publication, Roland has a long position in PGH.)

Today’s half-year results from this workforce benefits and insurance provider seem to read well, with a big increase in profits and a shift to a generous 100% dividend payout ratio. Even so, guidance is unchanged today and the market reaction has been underwhelming. It seems investors may have been expecting an upgrade today, after a run of strong momentum that’s seen the stock double over the last year:

Interestingly, the StockRanks have turned a little cooler on this stock since July’s trading statement triggered a share price surge. I would take this as a reflection on weaker value credentials:

Let’s take a look at the results to see if they highlight any concerns.

H1 results summary

Revenue for the half year rose by 11% to £23.3m, with recurring revenue rising by 12% to £45.7m on an annualised basis. This supported a 68% increase in pre-tax profit to £3.8m – although note this still implies a (typical) H2 weighting to results. Reassuringly, the group reported growth across all three of its operation segments, following the disposal last year of the loss-making Let’s Connect unit:

- Insurance annualised premium income +12% to £38m

- Benefits Platform annual recurring revenue (ARR) +10% to £6.9m

- Pay & Rewards ARR +6% to £0.76m

These support a 78% increase in earnings per share to 9.6p, while strong cash generation left the net cash position broadly unchanged at £26.9m (nearly a quarter of the market cap). This cash generated interest of £662k in H1, or 17% of pre-tax profit. A useful boost. This level of interest is equivalent to around 4.9% annualised on £27m, suggesting the company’s treasury management function is doing a good job. This cash–rich situation has prompted management to adopt a more generous dividend policy:

For FY2025 and going forward, the Group now intends to pay dividends equivalent to approximately one times basic earnings per share for the full year, confident that a progressive dividend can be maintained on this basis.

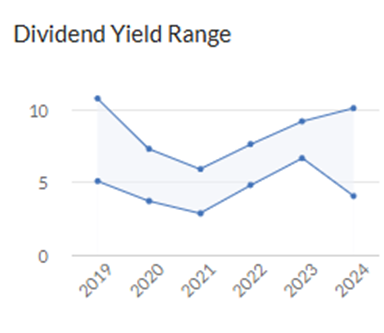

Targeting a 100% payout ratio and a progressive policy implies management expects earnings per share to rise annually, indefinitely. Statistically this is unlikely to be true, but given the strong cash position and positive near-term outlook I can see why the payout has been increased. Personal Group has historically been a high-yielding stock, but recent strong share price growth has seen the yield drop to its lowest level since the 2021 market boom:

On a side note, I’m happy to see some surplus cash actually being returned to shareholders, rather than passed to sellers through buybacks. Personal Group is a member of my SIF portfolio, which has an income mandate, so this focus on cash distribution is especially welcome.

Insurance: this business generates the majority of revenue and profit so deserves a closer look.

Insurance revenue rose by 13% to £17.4m, while adjusted EBITDA was 25% higher at £6.6m – a 38% margin. The company says claims levels were “broadly consistent year on year” and reports customer retention of over 80%. Penetration rates at existing clients rose to 13.7%, from 13% previously, thanks to “increased field force efficiency”, training and recruitment – this is a product that’s sold face-to-face. I have some lingering doubts about the value this business offers to end users, given its high profitability. But there’s no doubt that health insurance generally is a growth sector at the moment in the UK, so this could support a further increase in penetration rates among large clients.

To expand its reach and perhaps offer a more compelling value proposition, Personal Group is currently developing new “Group Cash Plan” and “Digital Insurance” services which it says are progressing well. I wonder if these could be lower margin services – and if so, whether there might be some cannibalisation from the core insurance offering.

Benefits & Rewards: this is a digital benefits platform providing employees with access to a range of benefits through an integrated online service (Hapi).

Sales cycles with large clients are described as “protracted”, but revenue rose by 5% to £4.0m, or £6.9m annualised. Revenue is generated from client subscriptions and commissions received from third-party suppliers on the platform (when end users purchase a service or product). Margins appear attractive here too, as this segment generated a 14% increase in EBITDA to £2.4m in H1. That’s a 60% EBITDA margin!

One important element of this is the partnership with Sage (disc: I hold), which allows the platform to be offered through Sage’s Employee Benefits offering. In an effort to reach more smaller companies, Personal also partnered EB Now in H1, “an employee benefits provider for the SMB market”.

Outlook & Estimates

Trading so far in H2 is said to be strong and CEO Paula Constant says new wins during the first half of the year have “expanded our addressable customer base and laid the foundations for continued growth”. However, expectations for the full year are unchanged, despite a strong start to H2:

Pleasingly, we have seen a continuation of the strong new insurance sales into H2 2025, with retention rates remaining robust. This combined with the Group's growing proportion of recurring revenues underpins the Board's confidence in achieving market expectations for the full year.

Broker Canaccord Genuity has kindly made updated forecasts available on Research Tree today and confirms unchanged revenue forecasts and minimal changes to profit expectations:

- FY25E EPS: 20.1p (prev. 19.7p)

- FY26E EPS: 24.9p (unch)

The dividend forecasts for FY25 is increased to 20.6p (prev. 18.0p), giving a prospective yield of 5.7%.

Roland’s view

I can’t really fault these results. Personal Group appears to be executing well and delivering on its plans. Meeting forecasts in the current market environment is hardly a major disappointment. On balance, I think the tone of today’s results suggests there could be a little upside to forecasts this year. However, this year’s forecast EBITDA of £11.6m remains a long way from the group’s 2030 target:

Underpinning the Group's success is the quality and relevance of our offerings, with the macroeconomic environment creating a growing market need, with employers increasingly recognising the importance of insurance cover and for their employees. We see considerable room for growth ahead and have line of sight to achieving our 2030 ambitions of delivering at least £100m revenue, £30m EBITDA and £20m SaaS ARR.

Forecasts for FY25 imply an EBITDA margin of 24% – well below the 30% margin implied by the 2030 targets above. Personally, I wonder if the company will be able to achieve the level of growth required to meet these targets while maintaining the current level of profitability in insurance.

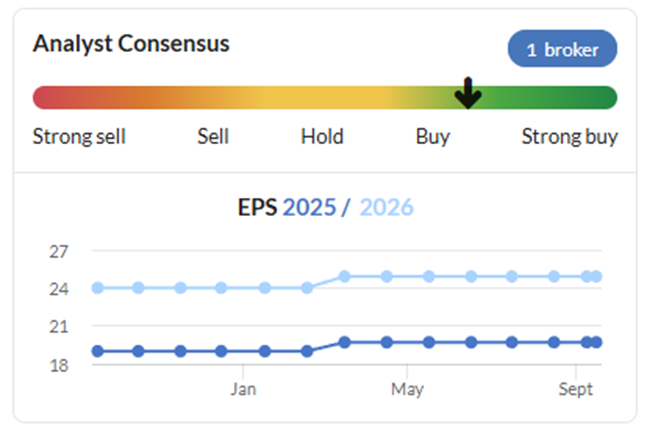

After a strong run, I’m not entirely surprised to see today’s cool reception from the market. Earnings expectations have remained largely unchanged over the last 18 months, so it’s natural for the stock’s re-rating to slow at some point:

On balance, my view remains broadly favourable here. I don’t think the shares are the bargain they were 12 months ago, but the valuation doesn’t seem unreasonable to me for a business generating 20%+ returns on equity and holding surplus cash. AMBER/GREEN.

Kier (LON:KIE)

Up 5% at 202p (£904m) - FY25 Results - Roland - AMBER/GREEN

(At the time of publication, Roland has a long position in KIE.)

I took a neutral view on this construction group (which is also a member of my SIF rules-based portfolio) when it issued an in-line trading update on 3 June. It looks like perhaps I was too cautious. Kier shares have risen by more than 20% since then and remain rated as a Super Stock by the Stockopedia algorithms:

Today’s full-year results are in line with expectations, but include an all-important upgrade to expectations for the year ahead. Let’s take a look.

FY25 results summary

All of the group’s main headline numbers moved in the right direction last year:

- Revenue up 3% to £4,087.8m

- Adjusted pre-tax profit up 6% to £125.4m

- Reported pre-tax profit up 15% to £78.1m

- Average month-end net debt: £49.2m (FY24: £116.1m)

- Year-end order book +2% to £11.0bn

Shareholders will be rewarded with a 38% increase to the full-year dividend, which rises to 7.2p per share (3.5% yield).

Management reports “strong operational delivery across all businesses” and I think it’s fair to say the group’s three-pronged strategy probably is helping the business grow while reducing volatility in group profits.

Infrastructure: revenue rose by 7% to £2,136m, but adjusted operating profit was slightly lower at £111.0m (FY24: £112.3m). This saw divisional operating margin fall to 5.2%, from 5.6% in FY24.

Management says the fall in profit was due to a one-off gain last year and points to strong demand from water utilities as the AMP-8 investment cycle gathers pace. Kier’s infrastructure business has a £6.5bn order book, with 87% of revenue secured for FY26.

Construction: revenue was almost unchanged at £1,911m, but the completion of some lower-margin government contracts helped to support an 8.4% increase in operating profit to £75.0m.

This pushed up the segmental margin to 3.9% (FY24: 3.6%). Kier reports some big new business wins, such as additional space at HMP Northumberland (>£100m) and four education projects worth c.£210m. Clearly it’s natural for a large contractor like Kier to be working on such large projects. But I think projects such as these do provide some perspective on this management claim that an “average order size of c.£20m” in Construction helps to limit “our exposure in the event a project does not go to plan”. I am not sure the real level of project-specific risk in Kier’s construction business is quite so reassuring as this. Even so, the group’s Construction business does seem to be performing well at the moment. The change in mix to improve profitability is clearly a good development.

Looking ahead, the divisional order book is £4.5bn, with 95% of FY26 revenue already secured.

Property: slightly unusually in this sector, Kier also has its own property development business. This develops a mix of industrial and residential property and had a relatively good year, with revenue of £38m and an adjusted operating profit of £12.2m.

(The FY24 figures of £71m and £6.2m were distorted by a large one-off sale at seemingly much lower returns.)

Return on capital employed in property was still low at 6.7%, but the company says that following recapitalisation, this division is on track to achieve a “consistent ROCE of c.15%” by FY28.

Balance sheet & Cash Flow

Average month-end net debt halved to £49m last year, while Kier ended the year with an improved net cash balance of £204m. Year-end window dressing and big working capital movements are typical in this sector, so it’s the average month-end figure that’s more useful here. However, looking at the accounts, I’m not sure how much indebtedness really decreased last year. The balance sheet shows gross debt of £1,485.3m at year end, 6% higher than the FY24 gross debt figure of £1,402m. The reduction in net debt reflects an 8% increase in year-end net cash to £1,689.4m.

In addition, the company reports today that suppliers are paid in an average of 34 days. Looking at the outstanding trade payables suggests a slightly different view, though. Average FY25 payables of £1,108m represent almost 30% of cost of sales of £3,746.3m. Said differently, this seems to suggest it takes over 100 days for Kier to turnover its payables, on average. I am sure the 34 day claim is correct, so I wonder how representative the year-end balance sheet really is of Kier’s year-round financial position.

Free cash flow

on a related note, I can’t help feeling that Kier’s calculation of free cash flow is also a little generous. The company reports a free cash flow figure of £155m today, but I can’t get close to this. Working down the cash flow statement gives me a free cash flow sum of around £86m, including all finance, tax and lease costs. This is actually a pretty respectable result, compared to reported net profit of £56.4m. My figure is also a near match to the £77m total I get by adding the reduction in net debt (£37m), dividends (£24.1m) and share buybacks (£16.1m).

Outlook

I’m slightly sceptical about how fast Kier is really deleveraging. But my overall impression of these results is that they are fine and do not highlight any serious concerns. Looking ahead, departing CEO Andrew Davies says the group has already secured 91% of FY26 revenue and around 70% of expected FY27 revenue. Perhaps understandably, he is confident in the group’s momentum and upbeat about prospects for the year ahead:

Building on our outperformance in FY25, the Group has started the current financial year well and for FY26 is trading slightly ahead of the Board's expectations.

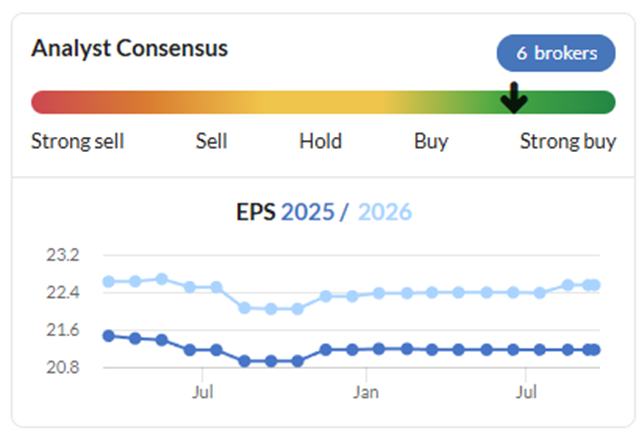

I don’t have access to any updated broker estimates today, but I would guess that consensus estimates could rise by perhaps 2%-4% after today’s results are digested. FY26 estimates have already been (modestly) upgraded on two occasions over the last 12 months – albeit they remain below expectations from early 2024:

Roland’s view

Today’s results leave Kier trading on a P/E of around nine, with a forecast yield of 3.8%. For a low-margin construction group that generated a 12% ROCE last year, I think this is probably a fair valuation. The company says it’s on track to increase adjusted operating margin from 3.9% to “4.0%-4.5% over the next three to five years. Any improvement in margins should feed through to improvement in cash generation. I can’t deny the momentum here, but I’m a little disappointed Kier is still operating through the year in a net debt position. Achieving average net cash remains a long-term goal, however.

I need to decide whether to upgrade by one notch to AMBER/GREEN, or maintain my previous AMBER (neutral) view. I’m inclined to be neutral, in part because of my caution about this sector. But given the evidence we have about the benefit of repeated upgrades, I can’t ignore today’s improved guidance. An encouraging pipeline of higher-margin infrastructure work in the water utility sector also looks promising. With slight reluctance, I have moved our view up by one notch to AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.