Good morning! There's a nice mix of trading updates, plus a few acquisitions, to look at today.

All done for now, thanks everyone!

Spreadsheet accompanying this report: link (last updated to: 23rd September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Unilever (LON:ULVR) (£114bn) | Revision to timetable for demerger of Magnum due to US government shutdown. Confident of implementing it in 2025. | ||

BHP (LON:BHP) (£109bn) | “A strong start to the year…”, Copper production +4%, steelmaking coal production +8%. | ||

GSK (LON:GSK) (£66.4bn) | “These ground-breaking data show for the first time that cUTIs, including pyelonephritis, can be treated with an oral carbapenem antibiotic as effectively as with an intravenous one.” | ||

Coca Cola HBC AG (LON:CCH) (£12.9bn) | Agrees to acquire 75% of CCBA for $2.6bn, funded by €2.5 billion of bridge financing plus the issuance of new CCH shares worth 5.5% of enlarged group. CCBA is 33% owned by the Gutsche Family from South Africa, and they are selling their entire stake. Philipp H Gutsche says that they will remain invested in Coca-Cola and in Africa through their new CCH shareholding. Completion targeted by the end of 2026. Leverage expected to be towards the top end of their medium-term target range of 1.5-2.0x Net debt to EBITDA. | GREEN (Graham) [no section below] I’ve only mentioned this stock once before: back in Feb 2024, when I was GREEN on it at a share price of about £23. It’s vastly bigger than most companies we typically cover in this report. However, I do like to keep an eye out for news in the soft drinks sector, and this is big news. CCH covers Coke bottling and distribution in dozens of countries including Austria, Greece, Italy, Ireland, Switzerland, many Eastern European countries, Egypt, Russia, Ukraine, etc. Today we get both a trading update with very pleasant organic growth rates baked into forecasts, plus major M&A news. They are buying 75% of the major Coke bottling operations in Southern and East Africa, “Coca-Cola Beverages Africa”, which generated a PBT of $116m in 2024. That makes the earnings multiple look rather large, but hopefully there has been progress in 2025 and into 2026, which could bring the multiple lower. I’m going to leave my GREEN stance unchanged on CCH as its own EPS progress over the last 18 months does justify the share price gains it has achieved, in my view, and the quality of the business is first-class. The Coca-Cola company owns 21%. | |

| SEGRO (LON:SGRO) (£9.1bn) | Trading Update | £22m new rent signed so far in 2025, of which £22m added in Q3. Momentum building in development programme. LTV 32%. | |

Bunzl (LON:BNZL) (£8.0bn) | Quarterly revenue +0.4%. Decline in operating margin moderated. Full year guidance unchanged. | ||

South32 (LON:S32) (£7.2bn) | FY26 production guidance remains unchanged. | ||

Sigmaroc (LON:SRC) (£1.25bn) | Strong Q3 performance underpins confidence in full year expectations. Revenue +6%, adj. EBITDA +17%. EPS to be ≥ 9.5p. | ||

Atalaya Mining Copper SA (LON:ATYM) (£906m) | Production supports full-year guidance and cash position grows. “In a strong position to deliver on its full-year targets.” | ||

Serica Energy (LON:SQZ) (£693m) | The operator has ramped up production, which has now reached a rate of over 25,000 boepd net to Serica. Auctus Advisors FY25 production estimate unchanged at 27.5mboe/d. | AMBER/GREEN (Roland) [no section below] Some good news for shareholders today as Serica announces that Triton production has returned to expected levels following the latest breakdown. However, it’s worth remembering that group production is expected to drop again in November when repairs start to Dana-operated Bittern field infrastructure. These subsea pipework repairs are expected to take three weeks and result in a temporary reduction of over 20,000 boepd net to Serica. The bigger question now is whether TotalEnergies and NEO Next will exercise their pre-emption rights over Serica’s plan to acquire gas field Culzean from BP – see here. If the deal goes ahead, it could be very significant for Serica and dilute the group’s dependence on ageing, non-operated infrastructure such as Triton. Today’s news is better than it might have been and Serica does continue to look decent value, in my view, with a possible 9% dividend yield. While recognising the risks, I think it’s fair to maintain a broadly positive view here – a position reflected by the stock’s Super Stock styling. | |

Caledonia Mining (LON:CMCL) (£522m) | Quarterly gold production of 19,106 ounces (Q3 2024: 18,992 ounces). Reiterates guidance of 75,500 - 79,500 ounces. | ||

ITM Power (LON:ITM) (£482m) | New flagship 50MW full-scope green hydrogen plant is now available to customers, priced at €50m. | ||

NCC (LON:NCC) (£454m) | Adj. EBITDA to be c. £43.5m, in line with expectations. Revenue down 2.5% on a constant currency basis. | ||

XP Power (LON:XPP) (£280m) | Full year outlook is in line. Material step up in profitability in Q3, expected to be sustained through year end. Q3 order intake +18%. | ||

B.P. Marsh & Partners (LON:BPM) (£242m) | NAV +7.1% in H1 to £349.5m. Total shareholder return 9.5% including dividends. Liquidity £52.6m at the end of H1, liquidity now £3.65m. | GREEN (Graham) The company has been putting its excess cash to use in a variety of ways, including dividends and new investments. None of the new investments are worryingly large - which means that portfolio diversification can have a chance to improve. At a 26% discount to fully diluted NAV, I like the valuation on offer here for one of my favourite UK companies and a proven compounder. Past performance is still no guarantee of future performance, even with exceptional management teams such as this, but I’m happy to stay GREEN on BPM. | |

| Supreme (LON:SUP) (£197m) (announced mid-morning yesterday) | Acquisition of SlimFast UK & Europe | Trade and selected assets of SlimFast UK/Europe for £20.1m from Glanbia (LON:GLB). Reported 2024 rev £25.5m & adj gross profit of £9.7m. | |

ASA International (LON:ASAI) (£194m) | Loan portfolio grows 3% in Q3, +32% year-on-year. Stable loan portfolio quality. | ||

Gulf Marine Services (LON:GMS) (£172m) | Net leverage ratio 1.63x (a year ago: 2.31x). Revenue +10%. Highly confident in achieving adj. EBITDA guidance ($101-109m) and leverage target. Zeus FY25 & FY26 EPS forecasts unchanged. | AMBER (Roland) Today’s nine-month results are certainly not bad and show fleet utilisation recovering, after the geopolitical disruption suffered in the Middle East in Q2. However, the standard quarterly reporting structure does mask a 20% decline in the order book over the last six months. I also don’t feel there’s much clarity on future strategy regarding the development of the fleet. Today’s update follows a 20%+ cut to 2025 and 2026 earnings forecasts in September. Broker forecasts are unchanged today, but on balance I’d prefer a little more clarity about outlook and strategy before reverting to a positive view, so I’m remaining neutral today. | |

Brickability (LON:BRCK) (£172m) | H1 FY26 in line with exps, with rev +4.9% to £347m and adj EBITDA c.£28m. Greater H2 weighting due to building safety delays. FY exps unchanged. | ||

Hostelworld (LON:HSW) (£158m) | Acquiring US B2B event platform OccasionGenius Inc for $12m. Provides city-by-city catalogue of attractions through an API. Forecast ARR of €1.5m. | AMBER/GREEN (Graham holds) Downgrading this share to AMBER/GREEN as the acquisition seems overpriced and unnecessary to me, and is being paid for with bank debt. At least the debt is not too expensive (2% over EURIBOR) and should be paid back from profits over the next few years. | |

Trifast (LON:TRI) (£112m) | H1 FY26 in line with exps, rev -6.4% due to softer demand. EBIT margin improved to 6.3%, FY exps unchanged. | ||

Savannah Resources (LON:SAV) (£96m) | Eight claims in total have now been dismissed with four remaining cases, none of which affect progress with the Barroso Lithium Project. | ||

Pharos Energy (LON:PHAR) (£84m) | Six-well drilling programme underway to increase production from existing fields (TGT) and develop CNV. | ||

Watkin Jones (LON:WJG) (£81m) | FY25 rev of c.£280m and adj op profit in line with exps. Net cash £70m. Timetables extended on some transactions, but strong pipeline for FY26. | AMBER/GREEN (Roland) [no section below] Today’s update suggests this student property specialist could currently have net cash close to its £81m market cap, with net cash of £70m at the end of September and “a significant portion” of a £10m payment received in early October. More broadly, the half-year accounts showed a net asset value of £133m at the end of March. As a value investment, I think this could be of interest. The shares trade 40% below last-reported NAV of 52p per share and debt levels are now quite low. The main uncertainty seems to be around the near-term outlook. Management admits today that it’s seeing delays on some transactions. Consensus forecasts on Stocko suggest earnings of just 1.2p per share for FY26 – equivalent to a P/E of 26. The company says it’s still confident about the medium term, with strong structural drivers. On the other hand, paid research provider Progressive has opted not to provide FY26 forecasts in today’s note, instead preferring to wait for the FY25 results to be published (probably January). At this point WJG will be a quarter of the way through FY26. For a property developer that should presumably provide a good level of confidence in the outlook, but it’s a shame there’s not more visibility now. Despite this risk, I can’t ignore the apparent value here. I also believe the business should be able to make some recovery over time, even though I suspect profitability will remain lower than in the boom years before interest rates rose. I’m going to leave my previous view unchanged today. | |

Agronomics (LON:ANIC) (£66m) | PrimaColl (vegan collagen) has received FDA GRAS clearance (Generally Recognised As Safe) and can now be marketed in USA. | ||

Celebrus Technologies (LON:CLBS) (£57m) | H1 results to be in line with exps, w/ revenue approx $10.3m and adj pre-tax loss of $1.4m. ARR +14.7% to $15.6m in H1, net cash $27.2m. | AMBER (Roland) [no section below] As I discussed earlier this year, Celebrus’s decision to move from annual licences where revenue is recognised on day one to monthly recurring revenue is resulting in a painful decline in revenue and profit. In effect, profit previously recognised upfront is now being pushed into the future. The upshot is that profit and revenue is expected to return to comparable levels from FY28 or FY29 onwards. In terms of trading, today’s half-year update seems fine to me, with annual recurring revenue up by 14.7% to $15.6m. Net cash continues to provide a substantial safety buffer, too. The StockRanks are neutral on Celebrus (SR 48) and I am also leaving my neutral view unchanged today for two reasons. Firstly, profits are expected to be minimal in FY26 and FY27, with material earnings only returning in FY28. I think that deserves a measure of caution on valuation. Secondly, a decision to stop selling third-party software to one of the company’s largest customers (previously a big chunk of revenue) is also due to be working through the accounts in FY26. What I want to see in order to turn positive is a) continued ARR growth and b) evidence the company is starting to generate free cash flow again under its new accounting policies. Hopefully the company will provide more guidance on FY26 with its H1 results in December. Ahead of this, I’m leaving my AMBER view unchanged. | |

Gelion (LON:GELN) (£44m) | dentity of battery manufacturer in 16 Oct RNS was TDK. Aiming to use Gelion’s CAM technology to develop new battery products. | ||

Argo Blockchain (LON:ARB) (£28m) | SP +3% Existing shareholders will be diluted to a 2.5% equity interest following the restructuring. Delisting from LSE but will maintain Nasdaq listing. | RED (Graham) [no section below] We saw serious dilution on the way here. The shares are up today on confirmation of the level of dilution (existing shareholders left with 2.5% of the company) along with news that the LSE listing will be abandoned in favour of a NASDAQ listing. This has been a basket case among speculative UK stocks for some time, but perhaps a new American audience will find it interesting. | |

Eco Buildings (LON:ECOB) (£15m) | SP +75% Manufacture and supply 20,000 homes in Chile, approx €420m revenue over seven years, Govt-backed, delivery from 2026. The company says it plans to set up a factory in Chile in Q2 26 and complete an initial delivery of 607 homes in 2026, funded by a 50% upfront deposit of €12.75m. | RED (Roland) [no section below] Today’s news has put a rocket under the share price of Albania-based Eco Buildings. Today’s contract award appears to have followed the construction of two show homes in Chile earlier in this year, which was reported here. The terms of this deal mean the company will receive 50% upfront for all the properties it’s contracted to build, with the remainder due on delivery and acceptance by the housing authority. This model could perhaps provide the upfront cash Eco Buildings will presumably need to mobilise on this scale. But I think it’s worth noting that this business reported revenue of just €1.8m in H1, with negative free cash flow of c.€1.3m. The H1 balance sheet also showed cash of €183k and net debt of nearly €6m at the end of June 2025. In other words, this is a small, loss-making business with no track record of delivering large-scale construction projects in Chile (or anywhere else). Even in a best-case scenario, I’d expect some growing pains. Remarkably, the company is also in the process of setting up subsidiaries in Senegal and Sudan, while also building an apartment block in its home market of Albania. In addition to this, Eco Buildings is also embroiled in a €195m arbitration case (using litigation funding) in Kosovo, relating to its former identity, Fox Marble. It’s not clear to me how the company will bridge the cash flow shortfall I expect to see ahead of receiving the first advance payment in Chile. I would not be surprised to see a placing underway in the next few days, to capitalise on today’s share price gains. The StockRanks see this as a Sucker Stock (SR 9) and I agree. It’s possible that Eco Buildings will now evolve into a profitable, mid-sized company, but I would want to see more evidence of progress (and do much more research) to convince myself of this. At this stage, I see this as a speculative situation that could go either way. | |

Mind Gym (LON:MIND) (£14m) | Underlying H1 rev -16% to £13.5m, adj EBITDA loss of £1m. Outlook in line with exps w/ H2 weighting. | RED (Graham) [no section below] This is going through a transformation to reboot performance - which is ironic, as the point of MindGym is to help boost the productivity and performance of other businesses. Revenues have been falling for a few years now, and the company is loss-making even at the adjusted EBITDA level - something I always view as a red flag, seeing as adjusted EBITDA profits are the easiest type of profits to make. They have net debt of £1m and are cutting costs, which clearly makes sense in circumstances. However, I wouldn't bet on a turnaround until there are tangible signs of success. It is forecast to make a profit in FY March 2027; for me, it's too soon to bet on that happening. At least the CEO and his wife are well-aligned, owning 55% of the business. | |

Chesterfield Special Cylinders Holdings (LON:CSC) (£11m) | FY25 revenue of £16.5m and adj EBITDA of c.£0.8m, ahead of exps. Positive outlook for FY26. |

Graham's Section

Hostelworld (LON:HSW)

Unch, at 126.1p (£158m) - Acquisition - Graham - AMBER/GREEN

(At the time of publication, Graham has a long position in HSW.)

My initial reaction to this news is negative, because I’m generally looking for organic growth at my investments rather than M&A. Ask an academic, and they’ll tell you that most acquisitions destroy value (for shareholders of the acquiring company, not the target!).

But I’ll try to keep an open mind as I explore this news. The market doesn’t seem to hate it at least, with Hostelworld’s share price unchanged.

What Hostelworld is buying: OccasionGenius Inc.,“a US-based B2B event discovery platform”.

Description:

OccasionGenius empowers businesses to inspire their audiences with a global event dataset delivered via API, comprising a rich, city-by-city catalogue of local 'Things to Do' and a unique global dataset of 'travel worthy' events that inspire travellers to book trips.

Checking OccasionGenius’ website, I see that they target a wide variety of industries including hotels, airlines, residential property, etc. For a hotel business, for example, they can help motivate prospective guests to make a booking, by showing them key events on certain dates.

So why is Hostelworld buying OG instead of simply using it?

Strategic Rationale:

The acquisition accelerates the development of our events capability, giving us immediate access to structured, global event data; content that would otherwise take years to build organically. By integrating this at scale, we expand from accommodation into events, strengthen community connection, and advance our broader social monetisation strategy.

They describe three pillars: 1) enhancing their existing social travel platform (travellers have more reasons to connect with each other), 2) accelerating growth by inspiring new trips that wouldn’t have happened otherwise, 3) creating a unique data set that combines their existing bookings data/social network with event data.

Price: $12m (that’s equivalent to ~€10.3m) on a cash-free, debt-free basis.

Funding: a €10.3m, 3-year loan facility with AIB, paying 2% over EURIBOR (EURIBOR itself is about 2% these days).

Valuation multiple: OG’s forecast ARR is €1.5m by year end, so Hostelworld is paying 7x ARR. That’s bang in the middle of the range of possible ARR multiples, with 6-8x ARR being an average range (don’t get me wrong - this is still a premium valuation, but in the software/SaaS world, it’s considered normal).

CEO comment:

"The acquisition of OccasionGenius is a significant development which positions Hostelworld as the first social travel platform with an integrated offering of social networking, event discovery and accommodation. This acquisition allows us to immediately supercharge our platform with a wealth of content that would take us years to build organically and enhances value creation opportunities for our shareholders."

Graham’s view

I’m trying to justify this acquisition. My first instincts are that Hostelworld could have simply been a major customer of OG, using it across its network, rather than buying the entire company. Or even better, created its own version of the same thing, using its existing cash resources.

But then Hostelworld does have 17,000+ hostels on its platform, in pretty much every corner of earth. Being a customer of OG would mean using all of OG’s global data. Perhaps it really was simpler to buy OG than to pay for all of its data on an ongoing basis? That said, how “global” is OG’s data, really?

I’m also saddened to see the company going back into debt, when it took so long and it experienced so much risk in the effort of trying to get itself out of debt, not that long ago.

Here are my summarised views around this deal.

First, the positives:

Simplicity. Gets all of OG’s data on an ongoing basis. Could be the spark that helps ignite faster growth?

The debt is not expensive at 2% over EURIBOR.

HSW is forecast to generate €14.5m of net income this year, and €18m next year. So it should be able to pay the loan back without difficulty. Leverage multiple is “comfortably below our target of 1x”.

Some of the negatives:

Hostelworld are paying a premium SaaS/ARR valuation multiple for this, when their own shares only trade at 10x earnings and at a price to sales multiple of 2x.

They are voluntarily going back into debt, although this is consistent with their leverage “target” of 1x.

OG is listed as only having 2-10 employees on LinkedIn. It seems to me that Hostelworld could have built their own operation doing the same thing for a tiny fraction of the price paid. They say that getting the same wealth of content “would take us years to build organically”.

I’m inclined to sell my Hostelworld shares today, but I haven’t made up my mind yet.

As far as our colour system goes, I’m downgrading from GREEN to AMBER/GREEN.

I hope I’m wrong, but I’m inclined to think as soon as Hostelworld started building up a net cash balance, the money started to burn a hole in their pocket, and they needed something to spend it on. In formal financial terms, this is called having “a target leverage ratio of 1x”. But is it really necessary for a company like this to run on debt? I don’t think so. If they really wanted to get rid of €10m, they could have expanded the share buyback or launched a tender offer.

I hope the acquisition works out, but it gets the thumbs down for me, as I fear that it’s overpriced and unnecessary, and bank money is being used to pay for it.

B.P. Marsh & Partners (LON:BPM)

Up 1% at 675p (£244m) - Half Year Results - Graham - GREEN

BPM always provides plenty of detail on its investees - it’s a specialist investor in the insurance sector - but what interests me most is the big picture.

And the big picture remains as impressive as ever:

9.5% shareholder return in H1, made up of both NAV growth and dividends.

NAV growth 7.1% to £349.5m.

NAV per share grows to 956.1p; the current share price is a 29% discount to this level.

Diluted NAV per share 909.8p, the discount to this figure is 26%.

We did have a H1 update in September which already disclosed the H1 cash figure of £52.6m (July 2025). The current cash figure is given today as £36.5m.

The company has been cash-rich ever since a large disposal triggered buybacks, a new dividend plan, and various new investments.

(Please note that I have completely different expectations of BPM vs. HSW, in terms of cash management and M&A - one is an investment company and the other is not!)

Comment snippets from Brian Marsh OBE, Chairman. He first points out that £8m of dividends have been paid out to shareholders in H1, and concludes his statement as follows:

…we entered the second half of our financial year in an exceptionally strong position in terms of portfolio holdings and NAV. Our new business pipeline is growing and, with our considerable available cash, we are well placed to make further new investments.

As the insurance rating environment continues to soften, we have balanced our portfolio towards supporting specialist teams that can deliver market-beating returns. This is consistent with what has historically been the signature B.P. Marsh operating model of selecting compelling opportunities in insurance distribution."

Activity: they made three investments in H1 and already made four investments so far in H2. The sizes of these investments vary, but the max size seems to be £10m. I like the discipline: while BPM’s portfolio does occasionally become rather concentrated, they aren’t betting their success on any of these new ideas.

Secondary placing: BPM reminds us that a major shareholder sold its remaining 9.8% stake in BPM in August. Buyers included the investment firm Wellington:

This successful exit and diversification of our investor base, including increased holdings by high-quality investors such as Wellington, reinforces market confidence in the Group's long-term growth strategy.

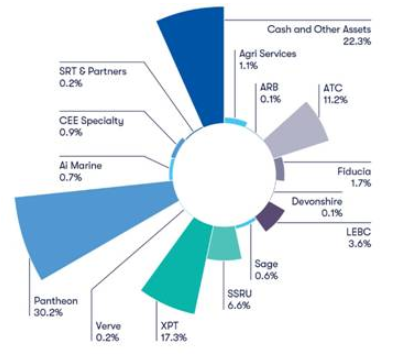

Portfolio breakdown

Here’s a nice image of the portfolio:

The main investment is Pantheon:

Pantheon is a UK-based specialist insurance broker specialising in property, casualty, professional lines & reinsurance and delegated authority established in partnership with Robert Dowman. Pantheon acquired 100% of the share capital of the Lloyd's broker Denison and Partners Limited.

Comment on insurance market trends from the CIO: rates are soft (down 7% globally in H1), with plenty of capacity, and this trend is expected to continue. But M&A is buoyant and the CEO says there will be “continued opportunities for… investee companies to expand and develop, either organically or through selective acquisition.”

Graham’s view

This is not the most exciting share in the market but it knows how to make money for its investors, as it has done for many years. It’s a good example of a compounder:

In StockRank terms, it’s a 96, and a Super Stock, and it passes 10 bullish stock screens.

That being said, the sparkling results of FY Jan 2025 are not really repeatable, as they came from an extraordinarily successful disposal. Disposals like that aren’t going to happen every year.

Even so, this is one of my favourite shares and I’m tempted to open a fresh position.

Roland's Section

Gulf Marine Services (LON:GMS)

Up 7% at 16p (£184m) - 9M 2024 Results - Roland - AMBER

I find it’s often helpful to consider the disclosure in a trading update – the information the company is choosing to make prominent and that which it is seeking to obscure or exclude. Shaping the narrative in this way often helps companies to create the impression they want, while distracting investors from other less favourable metrics.

Quarterly comparisons can be an example of this. The standard convention is to make comparisons with the same quarter one year earlier. This may be appropriate for some businesses, especially where there’s seasonality. But it can also mask a sequential change over previous quarters.

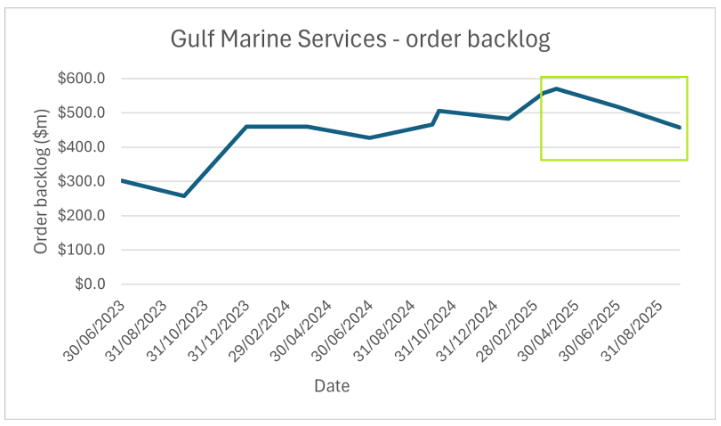

Today’s update from liftboat operator Gulf Marine Services is a good example of this. Management reports an order backlog of $457.5m at the end of September, just 2% lower than on the same date in 2024.

Broker Zeus helpfully describes this as “broadly steady” in a new note today. But if we look at the change in Gulf Marine’s order backlog sequentially in 2025, we see that the pipeline of secured future work has fallen by 20% over the last six months:

Admittedly, contract wins can be lumpy. I recognise that this may not be a long enough decline to view as an established trend. But while the company still has around 2.5 years’ revenue on its order books, I am not sure I’d describe the order backlog as being stable this year.

I should emphasise that I am not suggesting that either GMS or Zeus are being misleading. Today’s update is perfectly standard quarterly reporting. But I think it’s an example of when we can gain extra insights by thinking about other comparisons we might make, rather than relying solely on those highlighted by the company.

Unfortunately, Gulf Marine has previous form when it comes to selective disclosure. When I wrote about the company in September, management were keen to highlight a small increase to adjusted EBITDA guidance for the year.

What they didn’t mention in the RNS was a 20%+ cut to earnings forecasts for both 2025 and 2026. This was only visible to investors with access to broker notes:

Moving on, let’s take a look at the remainder of today’s third-quarter update.

9M 2025 results summary

Gulf Marine’s standard practice is to report nine-month figures rather than Q3 numbers. So these results cover the nine months to 30 September 2025::

Revenue up 10% to $138.3m

Adjusted EBITDA up 7% to $81.5m

Net debt down 22% to $172.2m

Finance costs down 35% to $11.6m (9M 24: $17.9m) due to lower interest rates & refinancing

Net leverage ratio: 1.63x (9M 2024: 2.31x)

Fleet utilisation down 4% to 88%

Average day rates up 10% to 36.0k

These seem pretty solid figures to me, on the whole. Day rates have continued to rise as vessels roll off lower-cost contracts onto new contracts. When paired with the reduction in finance costs, I’m confident debt levels should continue to fall towards the 1.5x leverage threshold at which the company has promised to consider shareholder returns.

Although debt reduction slowed slightly in Q3 compared to the same period in 2024, this is understandable given the cost of the Saudi Arabia tax settlement earlier this year.

One point that interested me is whether the geopolitical disruption flagged up in June persisted in Q3. This was said to have affected Q2 utilisation, but my sums suggest utilisation did recover in Q3:

H1 utilisation: 87% (H1 24: 91%)

9M utilisation: 88% (9M 24: 92%)

Q3 utilisation: 90% (Q3 24: 94%)

Outlook: CFO Alex Aclimandos says GMS remains on track to meet 2025 objectives, with unchanged EBITDA guidance of $101-109m.

This forecast implies Q4 EBITDA of $23.5m at the mid-point, which is lower than the quarterly average of $27.2m so far this year, so the guidance seems realistic to me.

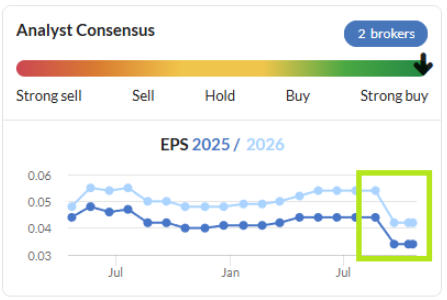

Today’s broker note from Zeus has also left EPS forecasts unchanged:

FY25E EPS: 3.3 cents

FY26E EPS: 3.9 cents

These forecasts price the shares on c.6x 2025 earnings, falling to a P/E of 5 for 2026.

Roland’s view

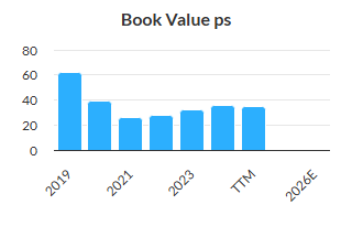

Gulf Marine is continuing to deliver on its strategy of deleveraging, which should result in a gradual increase in net asset value. Despite some dilution from new shares issued through historic warrants, this has shown up in the accounts as expected:

In theory, this NAV accretion should support a share price re-rating over time. In practice, the market has remained a little reluctant over the last couple of years:

For this reason, GMS shares continue to trade at a hefty 40% discount to book value.

Investors considering the stock today need to ask if this is a fair valuation, or if the shares are too cheap.

In my view, there probably is some moderate value here. But I don’t think GMS is as cheap as it might seem. I’m keen to see if the decline in order backlog continues or reverses and I cannot ignore the reality that at some point, management will have to decide whether to commit funds to fleet expansion and/or renewals.

Mistiming fleet upgrades was the original cause of the company’s debt problems – but the risk remains for the future. Even if fleet investment is managed more successfully than last time, low returns on assets suggest to me that a discounted valuation is probably fair.

I took a neutral view on this stock in September, due to the cut to profit forecasts for 2025 and 2026. Today’s update is in line so I’m left with a difficult choice on whether to revert to an AMBER/GREEN view, or stay at AMBER.

It’s a finely-balanced decision and I suspect some readers may disagree, but I’m going to stay neutral for now until there’s more visibility on the outlook and strategy for 2026.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.