Good morning and welcome to today's report.

Despite continued volatility in gold, silver and oil markets, the wider market seemed unaffected yesterday, with the FTSE 100 closing up by 1.1% and the S&P 500 ending the day 0.5% higher.

Today's report is now complete: that's all we have time for today, thanks for reading and see you tomorrow!

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£218bn | SR70) | AstraZeneca has provided the additional information requested by the FDA and expects a decision on subcutaneous administration in the first half of 2026. Saphnelo remains available for intravenous administration. | ||

Plus500 (LON:PLUS) (£2.93bn | SR92) | Event-based contracts have been launched on Plus500’s US B2C platform, including products from Kalshi Exchange. | ||

Wizz Air Holdings (LON:WIZZ) (£1.47bn | SR61) | Passenger numbers +8.5% to 5.35m in January. Capacity rose by 10.5% to 6.34m. Load factor was -1.6% to 84.4%. | ||

A G Barr (LON:BAG) (£728m | SR65) | Revenue +c.4% to c.£437m, adjusted operating margin +c.1.1% to c.14.7%. Full year performance in line with expectations. Acquired Fentimans for c.£38m. | GREEN = (Roland) [no section below] Today’s full-year update highlights three important numbers – revenue up c.4%, double-digit profit growth thanks to improved margins, and a c.20% adjusted return on capital employed. The acquisition of Fentimans for £38m is bold but seems logical to me, given the growth in the adult soft drink space. Fentimans’ 2024 accounts suggest sales of c.£40m and a pre-tax profit of £1.4m. I would hope AG Barr will be able to improve sales and profitability by incorporating Fentimans’ operations into its well-invested facilities and larger distribution network. A forward valuation of c.15x earnings doesn’t seem excessive to me for a business of this quality. Graham was GREEN on Barrs at a higher share price in July 2025. I’m going to leave our positive view unchanged ahead of the FY26 results. | |

Filtronic (LON:FTC) (£403m | SR72) | Revenue flat at £25.3m, pre-tax profit -61% to £2.6m. Financial results in line with expectations. Entering H2 with record order book, FY outlook in line with exps. | AMBER = (Roland) These figures show the expected drop in profits to reflect the group’s rising cost base and flat H1 revenue. However, I think the longer-term story remains intact, with a gradual improvement in customer diversification to reduce dependency on SpaceX and a solid flow of new product launches and developments. Profitability remains respectable too, albeit at a more normalised level. As previously, my main concern here is valuation. I am not convinced that paying 50x FY27E earnings is likely to represent an attractive entry point. For this reason, I’m leaving our neutral view unchanged today. | |

Tharisa (LON:THS) (£388m | SR99) | CFO will retire in July after serving since May 2012. | ||

Fintel (LON:FNTL) (£263m | SR45) | Revenue +c.10% to £85.9m, adj EBITDA +c.17% to £25.9m. FY results in line with exps, adj EBITDA slightly ahead of exps. Confident of further progress in 2026. | ||

Avacta (LON:AVCT) (£216m | SR18) | Cardiac dosing limit removed and path forward to dose selection identified. | ||

Serabi Gold (LON:SRB) (£201m | SR99) | Update on Recent Incidents at Palito Complex and Coringa Mine | Mining and milling operations were at no point interrupted and continue to progress according to budget. Complied with protocols of all relevant agencies and authorities regarding the incidents. Is well-advanced with an internal review of relevant procedures to ensure continue to provide a safe and supportive workplace for everyone. | AMBER/GREEN = (Mark - I Hold) |

LBG Media (LON:LBG) (£190m | SR58) | Revenue +7% to £92.2m, pre-tax profit -3% to £14m. FY revenue and profit in line with expectations. Tough prior year comparator due to Euros football in 2024 - “confident of the growth outlook for FY26”. | ||

Jadestone Energy (LON:JSE) (£138m | SR64) | 2025 average production 19,829 boe/d, in line with guidance. Total production costs $243.0 million, at the lower end of the guidance range. Revenue +3% to $408m. Net debt $89m (FY24 $104.8m) not incl. $23.7m of liftings in January. “We will set out our guidance for 2026 alongside our annual reserves update later this month.” | ||

Audioboom (LON:BOOM) (£99.8m | SR41) | Crooked produces podcasts including Pod Save America and Pod Save the UK. Audioboom will provide hosting, distribution and advertising. No financial details shared. | ||

Alumasc (LON:ALU) (£88.5m | SR74) | On track for FY expectations. Revenue -12.2% to £50.4m, pre-tax profit -38.5% to £4.0m. Outlook, “strong order book” with “some early signs” of improving confidence. | AMBER = (Roland) While I’m encouraged by today’s in line guidance, current forecasts indicate a 70% H2 profit weighting will be needed in order to meet today’s unchanged forecasts. That would be unusual for this business and I can’t help feeling that the remainder of the year could still be challenging. With a new CEO incoming to replace an incumbent who has been in the role for 23 years, I think it makes sense to remain neutral until there’s a little more clarity on trading and the outlook. | |

NWF (LON:NWF) (£67m | SR58) | H1 revenue -4.3% to £434.6m, adj pre-tax profit -75% to £0.9m. Solid performance in Food and Feed offset by weaker Fuels results. FY expectations unchanged from November’s update. | ||

EnSilica (LON:ENSI) (£49.8m | SR43) | H1 revenue +37% to £12.7m, EBITDA £1.7m (25H1: LBITDA £0.2m), Cash £2.0m (31 May 25: £2.0m). “...the Board has confidence in achieving management expectations for FY26.” | RED = (Roland) [no section below] Today’s results don’t contain too many surprises following January’s half-year update, which Graham covered here. Reassuringly, the company says it has 95% of revenue already booked for FY26, so is understandably confident in meeting expectations. However, while improved profitability in H1 is positive, this remains a low-margin business. H1 operating profit of £0.4m gives an operating margin of just 3.1%. Net debt also remains significant, at just under £5m, with £2m of cash. I would argue that this position doesn’t provide very much flexibility for a business where trade payables of £13.1m significantly exceeded inventories and receivables of £9.9m at the end of November. Our RED view may seem harsh, but Ensilica has a poor record of profitability, while forecasts for 26/27 financial have fallen steadily over the last year and now suggest minimal profit growth vs 25/26. A FY27 forecast P/E of 32 is a further reason for caution, in my view. | |

PCI- PAL (LON:PCIP) (£39.5m | SR40) | Revenue +7% to £11.3m, Cash £2.6m “…enter the second half with strong momentum and confidence in the Group's ability to continue delivering against its strategic objectives and the Board's expectations for FY26.” | ||

Chesterfield Special Cylinders Holdings (LON:CSC) (£18.4m | SR70) | “...significant revenue and earnings growth expected in FY26, underpinned by contract revenues weighted heavily towards the second half of the year, the Board reconfirms its confidence in the mid-term outlook…” | ||

Portmeirion (LON:PMP) (£13.7m | SR58) | FY25 sales +1% CCY to c.£91m, Excluding US, sales were up 8%. | ||

Critical Metals (LON:CRTM) (£13.2m | SR8) | 26H1 LBITDA £527k (25H1: £966k LBITDA). Net Debt £504k, (25H1: £3.7m net debt) following £837k of debt forgiveness & £1.3m fundraise. | ||

Hardide (LON:HDD) (£12.6m | SR55) | An additional follow-on order worth $1m from an existing NA customer for delivery in 26H2. Now anticipates financial performance for FY26 to be ahead of previous expectations. | ||

Shearwater (LON:SWG) (£11.2m | SR41) | Brookcourt Solutions, has secured a c.£9m three-year contract renewal and expansion with a leading Global Financial Organisation. £2.7m to be recognised in FY26. Supports the delivery of FY26 market expectations. | AMBER/GREEN (Mark - I Hold) [no section below] | |

Mila Resources (LON:MILA) (£10.1m | SR25) | Results did not deliver the grades anticipated at depth. |

Roland's Section

Filtronic (LON:FTC)

Down 2% at 179p (£396m) - Interim Results - Roland - AMBER =

I turned neutral on space and defence electronics specialist Filtronic in July last year, citing the full valuation, customer concentration, growing cost base, and the fading boost from the exceptional SpaceX profits in 2024/25.

The share price has edged higher since then, but today’s half-year results highlight the reason for my caution. These interim results are in line with expectations, but show pre-tax profit fell by over 60% in H1.

H1 results: key points

The Group delivered an encouraging first-half performance, with financial results in line with the Board's expectations and very positive momentum in new business activity.

These results cover the six months to 30 November 2025. They show the impact of the investment Filtronic has made in its new Sedgefield headquarters and factory over the last year and of the increase in headcount – staff numbers rose by 40% to 186 during FY25.

Revenue was broadly flat in H1, but the increased cost base meant that profits fell sharply:

Revenue down 1.2% to £25.3m

Operating margin: 10.3% (H1 25: 26.6%)

Pre-tax profit down 61.2% to £2.6m

Diluted earnings per share down 62.5% to 1.14p

Net cash excl. leases of £6.8m (FY25: £12.3m)

To be clear, I don’t have any issue with Filtronic’s decision to invest in its long-term future. The group’s balance sheet is strong. In my view, building strong R&D and manufacturing capabilities is most likely the correct thing to do.

The challenge for investors is how to price the stock while this process of normalisation is ongoing, following last year's bumper earnings.

Trading commentary: Filtronic won its biggest ever contract with SpaceX during the half year, valued at £47.3m, for delivery from FY27 onwards.

Diversifying the company’s customer base remains a priority and some progress was made in this regard:

A €7m agreement with a European space customer;

A £13.4m contract with a “leading European defence prime”.

New product development also continued:

Deployment of new GaN E-band products “represents a step change in performance”;

Development underway on additional frequency bands, including “a 550W Ka-band solid state power amplifier” supported by a £1.2m UK Space Agency grant

Next-generation GaN amplifier systems including V-band “on track for launch in calendar year 2026” (i.e. potentially in FY27). Expected to be “a key driver of growth” over the next 3-5 years.

Outlook & Broker Estimates

Today’s outlook is resolutely in line:

After a good first half, with strong momentum in the business, the Board remains confident in meeting current market expectations for revenues and EBITDA for FY2026

The company is entering the second half of the year with a record order book and 90% of FY26 forecast revenue covered by contracted orders. This seems positive, albeit I’d expect a high level of revenue coverage with only four months of the financial year remaining.

I also think it would be helpful for investors if Filtronic started to report the value of its order book, as most listed engineering firms do.

With thanks to broker Cavendish, I can see that estimates for FY26 and FY27 are unchanged today:

FY25 actual adj EPS: 6.4p

FY26E adj EPS: 3.2p

FY27E adj EPS: 3.9p

Roland’s view

I don’t want to sound unduly negative on Filtronic. I am very impressed with the company’s success in recent years and truly hope it can develop into a mid cap British engineering champion. But this is an investment report, so I need to consider both valuation and risk, as well as opportunity.

Customer concentration remains a concern, albeit this is starting to diminish. SpaceX generated 83% of revenue in FY25 – no figure was provided in today’s H1 results, but it’s clear SpaceX remains the main driver of revenue.

Valuation is also a potential issue, in my view. The share price is largely unchanged today, as are broker earnings estimates. This means that the valuation metrics on the StockReport should remain accurate - Filtronic is trading on an FY27E P/E of 50:

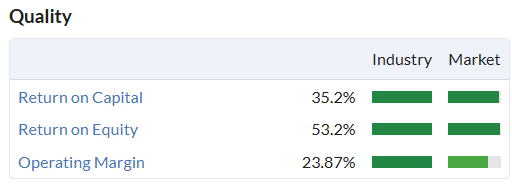

While the quality metrics shown on the StockReport are impressive, these will fall when the H1 results are loaded into the system to generate trailing 12-month figures.

Here are the quality metrics based on last year's bumper profits:

... and here is how I think these metrics will change when today's H1 results are incorporated:

Return on Capital: 22.5%

Return on Equity: 25.8%

Operating margin: 16.6%

These are still excellent figures, but I am not sure they justify paying 50x FY27 forecast earnings unless growth accelerates once more.

On a related note, I see that Cavendish has increased its target price for Filtronic today to 225p (c.25% above current levels). I think the valuation methodology used here is worth noting. The broker’s analysts have used an EV/EBITDA multiple of 29x based on their estimate of FY29 EBITDA.

In broad terms, this means they have applied the current valuation to projected profits in 3.5 years’ time in order to calculate a new target price.

While I think Filtronic could have strong prospects, I would personally want a larger margin of safety than this if I was considering investing.

Primarily due to valuation, I’m leaving our neutral view unchanged today.

Alumasc (LON:ALU)

Up 5.8% at 259p (£94m) - Interim Results - Roland - AMBER =

After October’s profit warning, today’s unchanged full-year guidance will be a relief to investors fearing further downgrades from this building products group.

Departing CEO Paul Hooper reports a “robust order pipeline” supporting “continued anticipation of a materially stronger H2”. A stronger second half will certainly be needed if Alumasc is to hit forecasts – today’s H1 pre-tax profit represents less than 30% of full-year estimates.

H1 results: key points

In October, Alumasc downgraded profit forecasts, blaming pre-Budget uncertainty and more challenging market conditions. We can now see the full impact of this weak H1:

Revenue down 12% to £50.4m;

UK revenue -5% to £46.9m

Overseas revenue -56% to £3.5m

Adjusted pre-tax profit down 46.7% to £4.0m

Interim dividend held at 3.5p per share

For some context, FY26 adjusted pre-tax profit is expected to be £14.4m, so this H1 results represents less than 30% of the expected full-year results. That leaves a very significant H2 weighting of 70% if full-year results are to meet expectations. In my view, this suggests some risk of further disappointments.

Alumasc does provide some reasons to justify a more positive outlook on H2:

£2m initial order for a project at Changi Airport in Singapore received in December;

Work on CLK airport project in Hong Kong is now resuming after a pause in H1 (£2m of orders remaining);

£1.1m of annualised savings achieved in the UK “to reflect the near-term outlook”;

Order book 27% higher at Dec 25 than Dec 24, excluding CLK project.

However, without more detail – such as the value of the committed order book for H2 – it's not clear to me how close the Alumasc is to securing the necessary revenue to meet full-year forecasts.

Looking at the segmental results, it’s clear that the majority of the H1 revenue slump was due to the Water Management business:

Water Management revenue down 23% to £22.7m;

Building Envelope revenue down 6% to £19.0m;

Housebuilding Products revenue up 15% to £8.7m.

Within Water Management, the CLK project accounted for £5.5m of revenue in H1 25 and zero in H1 26 – so this large single project effectively accounted for the nearly 80% of the decline in revenue across the group over the last six months.

Checking back to last year’s results, CLK revenues were brought forward last year, so there was always some risk of a corresponding shortfall to follow. This seems to be where weak UK markets caused a problem – replacement revenue was hard to find in H1, especially in the run-up to November’s Budget.

Margins, cash & balance sheet

Alumasc’s adjusted operating margin fell to 8.9% in H1, from 14.1% for the same period last year. Looking at the income statement shows that underlying operating rose by 1.8% to £13.7m compared to the same period in the previous year. I assume this reflects higher employment costs and perhaps a relatively high proportion of fixed costs in the business.

Lower margins were reflected in weaker cash generation in H1, with operating cash flow falling from £8.7m to just £3.3m. In fairness, this was also affected by a £1.5m inventory build towards the end of Q2, which management says is needed to meet “growing order intake” for H2. Over the full year, cash generation is expected recover somewhat as the H1 working capital build unwinds.

Working capital movements were reflected in a £1.9m increase in net bank debt during the half year, taking net debt (excluding leases) to £7.7m. Management says this reflects covenant leverage of 0.5x, which looks comfortable to me.

Outlook & Estimates

We continue to expect some market recovery later in 2026, with reducing interest rates and some easing of the Building Safety Act delays, although the timing of this is uncertain.

Management remains “confident in our ability to deliver a full year in line with the Board’s expectations”.

Assuming these expectations are the same as those of house broker Cavendish, this implies FY26 adjusted EPS of 29.1p, only marginally lower than the 29.9p achieved in FY25.

This puts the stock on a forward P/E of c.9x, which seems slightly cheap to me, but not excessively so.

Roland’s view

While I have no reason to doubt the company’s guidance, I do think it would have been valuable for the company to provide a little more detail on order book revenue coverage achieved for the full year and how the order book is expected to support a 70% H2 profit weighting.

After such a large profit shortfall in H1, I think it would be an impressive feat for Alumasc to achieve broadly flat earnings for the year as a whole.

If I was considering an investment, I would also be inclined to wait until after the incoming CEO, Pamela Bingham, takes charge in March. Departing boss Paul Hooper has been in charge for 23 years, so it would not be entirely surprising to me if there were some slight changes to strategy or expectations once Ms Bingham has familiarised herself with the business.

On balance I’m going to maintain our neutral view today. While there’s been no further change to expectations, I can’t help feeling that Alumasc could still face a challenging H2.

Mark's Section

Serabi Gold (LON:SRB)

Up 6% at 280p - Update on Recent Incidents at Palito Complex and Coringa Mine - Mark (I hold) - AMBER/GREEN

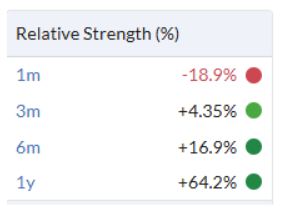

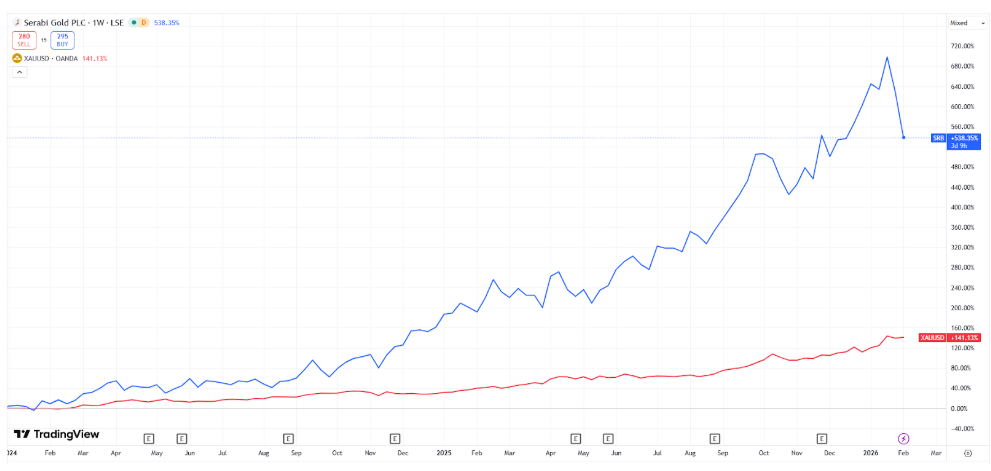

Recent events at Serabi highlight why we have always been AMBER/GREEN on this company, despite its very high StockRank and the great long-term returns. While the 1-year returns are still great, the share price has dropped by almost 20% in the last month:

Mining is a risky business and in previous DSMRs we have listed the various things that could go wrong. Two of them have happened in the last few days. The first is that the gold price has taken a big tumble. The second is that the company has suffered from two fatalities in a few days, one at each of its operations.

In terms of gold price, while a fall certainly does sour sentiment to the sector, that is probably a relatively minor part of the decline in share price in the last few days. Gold miners are geared to the gold price, so their price exaggerates moves in the commodity. Since the start of 2024, the gold price has more than doubled, but Serabi rose 5x:

However, the rise in gold above $5k/oz always had a speculative feel to it and the reaction from miners was relatively muted, despite their high exposure. Other miners have not reacted as strongly to the recent fall. For example, Pan African is still up around 6% over one month. Over three months, Serabi has actually underperformed the dollar gold price:

This leads me to conclude that the recent drop is more about the operational issues than the gold price.

The market is right to be concerned. Investors have no idea how operationally strong a company is on the ground. However, I have long been of the opinion that the safety record gives great insight into this and if safety processes are good, so will be the rest of the operations. Going beyond the personal tragedy, which I have no desire to gloss over, two deaths in such a short period of time raises big questions about how strong their operational processes are, and how consistently they will be able to meet production forecasts.

These are the details of the first incident:

…a fatality at its Coringa underground operation on 25 January 2026. The accident was related to mining activity at a production face. No other personnel were injured in the incident.

This sounds like either an accident with explosives, heavy machinery or a failure to make part of the mine stable.

And these the second:

…a fatality at its Palito underground operation on 30 January 2026. The incident was related to a traffic accident underground at the Palito Complex. No other personnel were injured.

This sounds like a vehicle operating underground struck someone. In both cases, there will be an investigation, but it sounds like either there was a failure to communicate effective safety procedures or a failure to adhere to them, as these are not things that should happen on a mine site. The outcome of the investigation will depend on where the failure lay. What we can expect is:

An investigation from the regulator as to whether mine safety plans were followed. This will cause at least some disruption to a localised part of each underground mine.

Serabi will need to pay compensation to each worker’s family.

Possible fines, especially if the regulator finds systemic failures or known hazards were ignored.

Costs associated with the internal safety review and actions to strengthen safety protocols.

What it won’t do is lead to mine closure, unless it can be shown that there are such serious breaches that mining processes need to be completely overhauled. Industrial action is unlikely as the two deaths occurred on different sites. Also unlikely are huge regulatory fines unless there is malfeasance, something they address in today’s update:

The Company has complied with protocols of all relevant agencies and authorities regarding the incidents and continues to provide support to the families of those affected and staff during this time.

Short-term production should also not be affected, again confirmed today:

…confirms that mining and milling operations were at no point interrupted and continue to progress according to budget.

However, mines tend to have specific plans to access ore in the grades and the quantities required, so any disruption can have a negative impact on longer-term production targets. It would certainly be wise to assume that FY26 will see production come in towards the bottom end of the target range until the quarterly production figures indicate otherwise.

Mark’s view

On balance of probabilities, I viewed the share price drop in response to these events as an over-reaction. There almost certainly will be a financial and a production impact from these events, I just expect it to be significantly less than the £70m or so lost from the market cap over this incident (and gold price drop). Hence, I was a buyer of shares here yesterday on that basis.

Given that many investors will have ridden the share price up over the last few years, there will be a number of investors who are overweight in Serabi, and I can easily see why some may choose to take profits at this point. Especially since this update highlights the risks of the sector and why I don’t think it should be a large position for anyone.

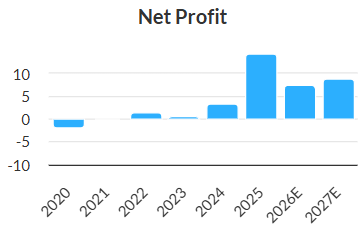

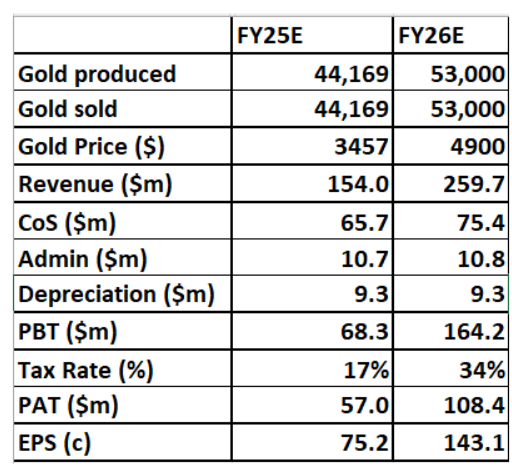

Fundamentally, though, I continue to see good value. Gold has made a decent recovery above $4,900/oz this morning and while I expect it to be volatile going forward, some conservative assumptions on costs and tax would still see FY26 profits almost double at the current gold price:

So I don’t see the need to adjust our previously mostly positive stance of AMBER/GREEN, despite two tragic and unfortunate events marring the start to 2026.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.