Good morning,

The FTSE closed yesterday down 4.4% at 7700, having opened down by nearly 6%.

Today it is currently set to open up 2.2% at 7830.

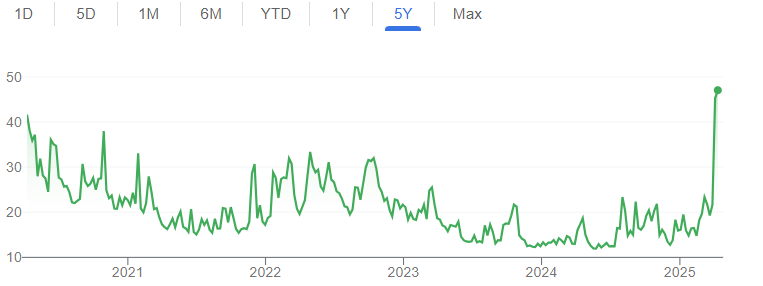

The Vix - the volatility index - is at 5-year highs:

Many of the headlines today concern the potential for deals in relation to tariffs: the EU has offered Trump zero-for-zero tariffs on cars and industrial goods, but Trump also wants the EU to buy a large slug of American energy.

I remain naively optimistic that reasonable settlements can be reached before too long between the US and many countries. A new quote from Trump:

On Monday, asked whether his global tariffs were a strong-arm negotiation tactic or permanent, Trump said: "There can be permanent tariffs and there can also be negotiations, because there are things we need beyond tariffs."

New article: "It's tough out there - how our analysts are coping in 2025" - Megan, Keelan, Roland and myself discuss how we are getting on in this tricky year.

1.30pm: wrapping up the report there! We've had a nice bounce in UK markets (up over 2%) and the US is also set for a bright open, up around 3%. Let's hope for more of the same tomorrow! Cheers.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Unite (LON:UTG) (£3.9bn) | TU & Q1 fund valuations | 75% sold for 25/26 vs 84% in prior year. “On track” for 4-5% rental growth and 97-98% occupancy. | |

JTC (LON:JTC) (£1.4bn) | Full Year Results | Rev +19%, adj PBT +17% to £47m. Net organic growth of 11.3%. “Good start” to the year. | |

Hilton Food (LON:HFG) (£764m) | Full Year Results | Rev +1.9%, vol up 4.4% due to input cost deflation. Op profit +14.8%. Current trading in line. | |

Alliance Pharma (LON:APH) (£347m) | Full Year Results | Rev -1%, adj PBT unch at £31.5m. Mixed performance among brands. 2025 trading in line. | PINK (under offer) |

Equals (LON:EQLS) (£266m) | Final Results | Rev +38% to £132m, PBT -4% to £7.4m. Total transactions +47% to £18.2bn. Outlook: confident. | |

Property Franchise (LON:TPFG) (£259m) | Full Year Results | Rev +146% post BLV merger, +6% LFL. Adj EPS +7% to 31.7p. “Well positioned” for 2025. | GREEN (Graham) I've long rated this as a quality company and I don't think its quality has been diluted by recent acquisitions. If anything, I think it's competitive position has been strengthened and its quality may even have increased. |

Impax Asset Management (LON:IPX) (£193m) | Q2 AUM Update | SP down 19% AUM -25.7% to £25.3bn in Q2 due mainly to loss of STJ mandate. FY profit to be below expectations. | BLACK (RED) (Graham holds) The sharp drop in AUM and the lower profit forecasts are not all that surprising in the circumstances but this stock continues its downtrend regardless. I take a negative stance on this in light of its production of a profit warning. I do maintain that it is still GREEN for value. |

Science (LON:SAG) (£182m) | Shareholding in Ricardo (LON:RCDO) over 20% | Holding now 20.08%, avg cost 236p. Retains net cash of £9.3m. Calls for boardroom changes. | AMBER/GREEN (Graham) [no section below] I agree with SAG that 20% is “a key strategic investment milestone” and I think that a 20%+ shareholder does deserve Board representation. However, it will be up to other members of the shareholder register to decide if they’d like to hand over total control to a SAG Chairman. Asking for a full takeover would be a reasonable response (although it’s not at all obvious how that would be funded). |

Gulf Marine Services (LON:GMS) (£171m) | New contract award | New large-class vessel contract in Gulf region for 142 days. No comment on expectations. | GREEN (Roland) [no section below] Once again, GMS notifies investors of a contract award, but doesn’t comment on expectations. The likely reason for this is confirmed by a broker note from Greenwood Capital today confirming that its forecasts are unchanged as they already assume “healthy utilisation and day rates across the fleet”. My reading of this is that today’s contract win is effectively business as usual and – arguably – not really RNS-worthy. However, I continue to see some value here with GMS shares trading well below book value. The main risk is that management decides to splurge on a capital-intensive fleet upgrade at some point. For now, I remain positive. |

Beeks Financial Cloud (LON:BKS) (£125m) | Proximity Cloud Win ($2m/4yr) | New win w/ global FX/multi-asset brokerage. Beeks will support the clients’ FX operations. | AMBER (Roland) [no section below] We recently discussed changes to pricing for Beeks’ Exchange Cloud service, which is designed as a multi-user solution for exchanges. This win is for Proximity Cloud, which provides dedicated physical connectivity in an end user’s own data centre. The win seems positive, but falls within current year expectations, so there’s no change to my view that the stock is up with events on a P/E of 24. |

Gooch & Housego (LON:GHH) (£95m) | Half Year TU | H1 rev +7.5%, order book +4% organic. Outlook in line. Too early to be definitive on impact of tariffs. | AMBER (Graham) [no section below] A very interesting statement contained in this update that “given the Group's considerable US-based manufacturing presence the new tariffs could over time be a benefit to some parts of our business against their non-US competitors.” A reminder that there can be some winners, not just losers from the turmoil we’ve been witnessing. Today’s share price gains help to reverse a portion of the losses suffered so far this month. I maintain my neutral stance as I remain to be convinced that the underlying quality of this manufacturer is above average. |

Intercede (LON:IGP) (£75m) | TU | AMBER (Roland) Revenue and earnings estimates for both FY25 and FY26 have been upgraded by IGP’s house broker today. It’s positive, but can’t hide the reality that starting EPS forecasts for FY26 have been set below the FY25 outturn. This may be due to a lack of visibility at the digital identity protection specialist, or it may reflect faltering growth. Until the answer to this question becomes clearer, I think a neutral view makes sense. | |

Ramsdens Holdings (LON:RFX) (£66m) | TU | Continued positive momentum. FY25 PBT to be at least £13m, ahead of expectations (£12m). | GREEN (Roland) A strong H1 update shows double-digit gross profit growth in gold trading, pawnbroking and jewellery retail. The main risk I can see is that Ramsdens is quite heavily exposed to the price of gold. This aside, I think it’s a well-run, attractively valued business with good momentum. Super Stock styling is fair in my view and I remain positive on the outlook. |

Distribution Finance Capital Holdings (LON:DFCH) (£56m) | Q1 TU | Growth momentum and low arrears performance continues. Launching asset finance in Q2. | GREEN (Graham) I reported on this in some detail. Today's Q1 update is just as I would have hoped and expected - impressive growth continues with very few defaults or arrears. Excited for their next leg of growth as they enter asset finance/hire purchase for individual borrowers. |

Staffline (LON:STAF) (£41m) | Full Year Results | Outlook in line but NICs and interest rates have reduced business confidence. | |

Calnex Solutions (LON:CLX) (£36m) | FY TU | FY25: returned to growth, in line. Monitoring effects of proposed tariffs. Confidence in FY26 growth. | |

Nexus Infrastructure (LON:NEXS) (£14m) | Trading Update | H1 rev +17%, in line. Recovery in housebuilding is now predicted to be delayed by some months. | |

Checkit (LON:CKT) (£13m) | Strategic Update | Cost savings of £3m in response to customer uncertainty. Tariffs not expected to have material impact. |

Graham's Section

Impax Asset Management (LON:IPX)

Down 19% to 122.61p (£163m) - Q2 AUM Update - Graham - RED

At the time of publication, Graham has a long position in Impax.

This is a short but rather unfortunate quarterly update from Impax.

On AuM, there is the loss of the £5.1bn mandate from St James's Place (LON:STJ).

It was already known that this mandate would be lost, but the total net outflow for the quarter is higher again at £7.8bn.

On top of that there are negative movements in asset values of £1 billion.

The result is a 25.7% reduction in AuM in a single quarter.

Again, much of this (c. 15%) was known in advance in terms of the STJ mandate. And global markets were lower in Q1 so it’s not a surprise that asset values would fall. But the size of the percentage reduction in AuM is still very high, even given that most of it was known in advance.

AuM fell from £34.1bn to £25.3bn.

Comment excerpt from CEO Ian Simm:

"Since the start of the calendar year, relative to generic indices, our investment strategies have benefitted from the broadening of market performance away from the US-listed mega-cap stocks that had previously dominated global equity returns. Nevertheless, as we previously signalled ahead of our AGM on 5 March, we experienced a challenging quarter in terms of net flows, with the winding-up of the £5.1 billion St. James's Place Sustainable & Responsible Equity Fund mandate and a small number of account closures within our institutional channel exacerbating the impact of negative market returns."

"Market conditions in the second half of FY25 remain highly uncertain. Given the fall in our AUM and the impact on global markets of an escalating trade war, we anticipate that full year profits will be below market expectations."

Estimates

Many thanks again to Paul at Equity Development for providing fresh estimates this morning. The year-end AUM forecast gets a 20% cut to £25bn, implying that it will be roughly flat over H2. Given the prevailing trends, that would be an excellent result!

Other adjustments to the 2025 forecasts are as follows:

Revenue cut from £155m to £143.5m

Adj. op profit cut from £40.2m to £34.2m

EPS cut from 23.8p to 20.3p

Graham’s view

I’ve been watching this stock fall for a very long time, and clearly I turned bullish on it far too early, as the negative trend of outflows and a declining share price continued long after I started to see value in it.

In the last few months, I couldn’t resist the temptation to pick up an apparent bargain and I attempted to catch the bottom with a small purchase for my personal portfolio.

The share price has rapidly halved since I did that, so Impax is now just a rounding error in my portfolio (less than 0.5%).

I am not tempted to add any more in this scenario, even though I do still think it is incredibly cheap. But I have to accept the possibility that I could be wrong about that - and so for now, I won’t be pouring good money after bad into this hypothesis.

But I also won’t be selling. I honestly don’t think all that much has changed since I invested here (apart from a meltdown in global economic sentiment).

The cut to profit forecasts today is not all that dramatic (15% cut in EPS) and in the context of falling markets is not that surprising either. At the end of the day, I buy into fund managers in order to get a geared return on equities and so I am getting what I asked for.

But what colour should I give Impax today?

The Stock is ranked as “Contrarian”, offering exceptional quality and value but awful momentum:

I’m going to respect the Stockopedia rules and give this a RED today, as in general profit warnings are followed by more profit warnings.

However, personally I do think this is GREEN for value. It’s trading at about 6x after-tax earnings. Investors get £155 of AUM for every £1 invested in the stock, which is an extreme ratio that I’m not sure I’ve ever seen before.

That’s before the £1.1 billion AUM boost coming from the company’s recent “Sky Harbor” fixed income acquisition, for an unspecified cost.

Impax had cash reserves of £91m as of Sep 2024, more than half of the current market cap.

And the stock passes two Ben Graham checklists: the Deep Value checklist and the Defensive Investor checklist.

I am almost talking myself into buying more of this! But there are plenty of other stocks that I perceive as bargains in this environment, and don’t yet own. So I should probably embrace diversification and buy some of them first, before putting more money into a share where the trend is negative and where I did not anticipate this profit warning.

Property Franchise (LON:TPFG)

Up 1% at 408.35p (£260m) - Final Results - Graham - GREEN

The Property Franchise Group PLC, the UK's largest multi-brand property franchisor, is pleased to announce its Final Results for the year ended 31 December 2024 ("FY24").

I’ll be chatting to management here soon, but let’s have a quick overview of these results.

Revenue +146% due to the merger with Belvoir. Like-for-like revenue up 6%.

Financial services income now significant at £19.2m (2023: £1.5m)

Adj. PBT £22.3m (on a like-for-like basis, increased from £11.2m to £13m)

The merger between TPFG and Belvoir completed on March 7th 2024, so 2025 will be the first full year since they joined.

Net debt is £9m after £20m was borrowed to fund the acquisitions of the Guild of Property Professionals and Fine & Country (collectively referred to as “GPEA”).

Dividend is raised to 18p for the year, well-covered by adjusted EPS of 31.7p.

Outlook:

Focused on completing the full integration of Belvoir and GPEA, delivering on the synergies and opportunities anticipated from the increased scale and capabilities

Well positioned to navigate market conditions anticipated in 2025 due to changing government legislation

The strength of the Group's franchise model and diversified revenue streams, along with its enhanced leadership team, provides a strong platform from which to grow and the Board is confident in realising the full potential of the enlarged Group

While confident in their own abilities, they strike a cautious tone on the property market, which they expect to face “a challenging year”.

The CEO 's comment is along similar lines to the above.

New structure: after all of the M&A activity last year, we now have three divisions to consider.

Franchising - 15 brands managing 153,000 rental properties and making 30,000 sales in 2024.

Ewemove is contained within the Franchising division and its progress has perhaps been overshadowed by all of the other developments at TPFG over the past year. But its revenue did increase in 2024 by 17%, to £5.7m.

Financial Services - integration of Brook Financial Services, an authorised representative of Mortgage Advice Bureau (Holdings) (LON:MAB1).

Licensing - similar to Franchising in the sense that licensees pay a fee to trade under the Fine & Country brand, and independent estate agents pay membership fees to the Guild of Property Professional.

Market share: TPFG was responsible for 10% of sales and 7% of managed lettings in the UK in 2024, but “there is still significant opportunity to expand the Group’s market share”.

Graham’s view

I was positive on this share at 410p in January. The share price hasn’t budged since then and EPS forecasts have been stable:

On that point, Canaccord have released a note with minor changes (upgrades) to their earnings forecasts. They now anticipate revenues of £84.2m, adj. PBT of £29.8m and adj. EPS of 35.2p this year.

I see no reason to change my positive stance on this “High Flyer” (a stock that offers both quality and momentum, but is weak in terms of value).

Actually I don’t think the value on offer here is that bad - given the high quality nature of its activities.

I always rated TPFG as a quality company and what really pleases me is that they don’t seem to have diluted their quality with their acquisition spree. Instead, they’ve achieved strategic goals such as expanding their financial services revenue.

The balance sheet does now have some very large intangible assets and has deeply negative tangible equity. The company probably should deleverage now (and according to forecasts it will do so next year). Strategically I think this company is a winner and so I’m happy to stay positive on it.

Distribution Finance Capital Holdings (LON:DFCH)

Unch. at 32.65p (£58m) - Q1 Trading Statement - Graham - GREEN

Distribution Finance Capital Holdings plc, a specialist bank providing working capital solutions to dealers and manufacturers across the UK, is pleased to announce its first quarter trading update to 31 March 2025.

We had full-year results from DFCH recently, and I then posted a management interview with them.

Today they are back again with a Q1 update. Some key points:

Loan book up by almost £50m since year-end to £713m. Year-on-year increase of over £100m or c. 17%.

1,388 dealer customers, up 12.5% year-on-year.

Defaults remain few and far between:

The quarter has seen a continuation of the extraordinarily low arrears performance with 36 dealers one day or more in arrears at 31 March 2025 (31 March 2024: 18 and 31 December 2024: 33), including 27 dealers in legal recovery. Total arrears finished the period equivalent to 0.7% of the Group's loan book

Asset finance and hire purchase will be launched for individual consumers later this quarter.

They continue to buy back shares having launched a programme in January that would see them spend £5m or buy back 17.5 million shares (whichever is cheaper).

The Board remains committed to its buyback programme and continues to believe that the current share price materially undervalues the Group's future prospects and its intrinsic earnings potential.

Graham’s view

I’ve identified this as a share I’d be interested to add to my personal portfolio, albeit it’s another one that I would add in small size. DFCH will enter the hire purchase market in niches that it understands well and without any legacy issues. At this valuation it looks pretty exciting to me:

Roland's Section

Intercede (LON:IGP)

Up 7.5% to 137p (£80m) - Trading Update - Roland - AMBER

The combination of strong revenues and high operational gearing is expected to result in improved forecasted profitability, subject to completion of the year end audit.

Today’s update from this digital identity security group is ahead of expectations, thanks to higher revenue and stronger than expected margins. This update appears to be a follow-on from last week’s contract win update, when Intercede made the following statement:

These orders, all received via our partners, will ensure that FY25 revenue will be ahead of the Board's expectations, and will also enhance the Group's contracted revenue backlog for FY26.

Today we have some clarity on the impact of last week’s upgrade, thanks to a further update from the company and updated earnings forecast from brokers (for those investors who can access these).

Here are the main points from today’s RNS:

Following the year-end audit, FY25 revenue is now expected to be £17.7m, versus previous consensus of £16.9m. This remains well below the £20m achieved in FY24 (due to a large one-off deal) but is better than expected.

Recurring revenue of c.£10.2m represented 58% of total revenue in FY25, “reflecting the continued progress in licence wins and low churn rates”

Strong operational gearing means the higher revenue is expected to translate into improved profit margins and higher earnings.

Year-end net cash of £18.7m

Updated estimates: Intercede doesn’t quantify the expected benefit to profits from higher revenue. Fortunately its house broker Cavendish has provided updated estimates today – many thanks.

FY25E: adj EPS +3.7% to 5.6p (previously 5.4p)

FY26E: adj EPS +18% to 5.2p (previously 4.4p)

Upgrades are clearly positive. But I think the key point here is that Intercede’s earnings are still expected to fall next year, despite Cavendish’s expectation that revenue will rise to £18.4m.

There are two ways to interpret this – either Intercede is struggling to maintain momentum, or else this business simply doesn’t have much visibility on forward orders. As such, these forecasts may be conservative, with scope for further upgrades through the year.

In fairness, Cavendish points out that its FY25 forecasts were originally set at revenue of £14.8m and £1.4m EBITDA. The end result was £17.7m and c.£4m EBITDA.

Perhaps the conservative argument carries some weight, given the record of upgrades over the last year:

Roland’s view

Intercedes shares have retreated from last year’s highs:

However, the stock remains on a fairly elevated valuation, trading at c.30x forward earnings:

It may be true that visibility is limited and further upgrades will follow through the year. But with FY26 earnings expectations set below FY25 as a starting point, I find it hard to have strong conviction (even with my growth investor hat on).

Intercede’s quality metrics are excellent, but the growth story still looks a little uncertain to me and there’s no evident value on offer:

This stock could become either a High Flyer or a Falling Star, but right now it’s Neutral. I think this is a fair view.

Mark went AMBER/RED on Intercede last week, but I think this is a little harsh given today’s upgrades.

I’m going to revert to our previous neutral view ahead of further updates as the year unfolds. AMBER.

Ramsdens Holdings (LON:RFX)

Up 10% to 225p (£72m) - Trading Update - Roland - GREEN

FY25 profit before tax ahead of expectations and expected to be at least £13m, fuelled by growth across core income streams and the continued benefit of the high gold price

It’s good news for shareholders in this pawnbroking and retail group today, with the second earnings upgrade of 2025:

Let’s take a look.

Today’s update covers the company’s fiscal H1, from 1 October 24 to 31 March 2025. Here are the main points:

FY25 pre-tax profit is now expected to be “at least £13.0m”, 14% ahead of FY24 (£11.6m).

Helpfully, the company includes a footnote showing that previous expectations for PBT were £12.0m – so today’s upgrade is an 8% increase.

The company says the upgrade is due to “positive momentum”, particularly in its precious metals trading business. The main driver for this is the price of gold, which recently topped $3,000/oz. This is presumably prompting more people to sell their gold items to Ramsdens:

Today’s update helpfully provides an indication of the H1 change in gross profit in each of Ramsdens’ divisions, allowing us to estimate H1 gross profit.

Gold buying: Ramsdens says that gross profit from its precious metals segment was 50% higher in H1 when compared to H1 24.

Looking back at last year’s interims, the gross profit figure was £5.0m, so we can assume that gross profit from precious metal trading was c.£7.5m in H1 25.

A new gold-buying website was launched in March, “which is expected to increase awareness of this service and attract new customers”.

Pawnbroking: the company says pawnbroking gross profit rose by 10% in H1. Based on last year’s interims, that implies a H1 25 figure of £6.1m.

A new dedicated pawnbroking website launched in November is said to be starting to attract new customers.

Jewellery retail: gross profit increased 15% on the prior period, ahead of expectations. This implies a gross profit figure of £7.7m.

Foreign exchange: gross profit was flat on the prior year (H1 24: £5.0m). The company points out that Easter is later this year, so it’s possible that some trade has slipped into H2.

Outlook: my sums suggest gross profit may have risen to c.£26m in H1, 17% ahead of last year’s figure of £22.m. While today’s update doesn’t include details of costs, I think it’s fair to assume that a decent chunk of this will drop through to pre-tax profit and earnings.

Capital expenditure during the period has been relatively restrained, with two new stores, two merged stores (into one unit) and one closure – so the net store estate was unchanged at 169.

Management has previously said they would scale back store openings in the face of higher employer costs and the weaker consumer outlook. Focusing on website development is likely a more cost-effective way to reach new customers.

Estimates: broker Panmure Liberum has done the sums and upgraded FY25 EPS estimates by 10% to 29.7p today. Many thanks for this coverage.

With the stock trading at 223p at the time of writing, Ramsdens is now trading on a forward P/E of 7.5 with a potential 5.8% dividend yield. That doesn’t seem expensive to me, with one possible caveat.

Roland’s view

One characteristic of Ramsdens’ business is that it is more heavily exposed to the gold price than its larger rival H&T.

Last year, H&T’s pawnbroking gross profit was 7.5 times the group’s gross profit from gold purchasing. For Ramsdens, the two figures were roughly equal.

This gold exposure is also evident from today’s update. The risk is that gold prices could go into reverse at some point. I have no idea how likely this is given the unpredictable macro environment, but it’s clearly a possibility. Equally, gold could go higher still in its role as a safe haven asset.

As things stand now, I can’t see any reason to change our previous positive view on Ramsdens. The stock looks modestly valued even on trailing results:

Quality metrics are also very strong:

A return on equity of 16% on a stock trading at 1.2x book value looks appealing to me, implying a possible return on equity cost of c.13%.

Given the apparent strength of momentum here, I expect the StockRank to remain high following today’s upgrade:

I’m staying GREEN ahead of the H1 results in June.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.