Apologies, the original report got corrupted, so I'm recreating it from a backup.

I've got loads of companies to report on today, so quite a full report today.

Dialight (LON:DIA)

Share

price: 477p (down 36% today)

No. shares: 32.5m

Market

Cap: £155.0m

Profit warning - and it's quite a nasty one too, the key parts saying:

The warning signs were very evident in the last trading update in April, indeed I predicted that another profit warning could be on the way, in my report of 15 Apr 2015.

It's interesting how the fall-out from the lower oil price is triggering profit warnings in other sectors. So any company with material sales to the oil & gas sector is likely to be suffering to some extent.

Today's update also says that the new CEO is conducting a strategic review, which usually means closure of factories & offices, redundancies - all of which are usually costly.

My opinion - the sheen has very much come off this share, and it's almost impossible to value at this stage. I shall await broker updates. It sounds to me, from today's and April's updates, that this company is a can of worms, with possibly more bad news to come out.

The new CEO is likely to kitchen-sink things at some point, so I'd rather sit on the sidelines until everything has come out in the wash.

On the positive side, the balance sheet looks fine to me, so I don't see any solvency concerns, and it sounds as if the company will remain profitable, albeit at a lower level. This share is unlikely to regain a high PER any time soon though, it looks permanently damaged now, after being a previous stock market darling.

Note that Matt Earl, a talented analyst & short seller, wrote a piece on his blog in Dec 2014 predicting further problems for Dialight. People may not like it when short sellers flag up problems (or potential problems) in shares they hold, but to ignore such concerns is folly, and very often a costly mistake. In my view, Matt is one of the best shorters in the UK, because he publishes detailed financial analysis to back up his view, rather than just trying to spread fear and panic, which is what lazy (and arguably unscrupulous) shorters do.

1pm (LON:OPM)

Share

price: 67.5p (up 20.5% today)

No. shares: 36.9m

Market

Cap: £24.9m

Trading update - the market clearly likes today's update, with the shares up 20.5% this morning, and I can see why. I like this company, it's a small, growing asset finance company, which has addressed the gap in the market from mainstream banks pulling back, or out of asset financing for SMEs.

As you can see from the key bits I've highlighted below, the main out-performance has come from a lower than expected bad debt charge.

Valuation - this is tricky, as asset financing companies are highly cyclical - they make hay when the economy is growing, but they run into a brick wall when recessions hit. Indeed, in bad recessions they often go bust, as bad debts wipe out a good chunk of the loan book, and funding sources dry up.

However, we're probably in a reasonable point in the economic cycle where the UK economy seems to have got into a self-fueling growth phase, as opposed to the last say 5 years when it was on life support of massive Government borrowing, and near-zero interest rates. Arguably it's still on life support, but just not so heavily reliant on it as before.

Is a major recession likely any time soon? Personally I doubt it, although we might see some tremors from the Eurozone.

Taking all that into account, I would be interested in buying into OPM, and valuing it on a PER of about 12-15. I've arrived at that rating by allowing for its strong organic growth, but curtailed by the highly cyclical nature of the business. Also, I believe competition will increase, as banks appetite for asset financing is likely to increase again over time. Therefore the juicy margins being enjoyed by OPM at the moment are likely to come under competitive pressure in future.

House broker WH Ireland has increased their EPS forecast for y/e 31 May 2015 from 3.0p to 3.7p. They've left their 2015/16 forecast unchanged at 4.4p, so there could be scope for that to increase to say 5.0p over time.

Therefore at 67.5p per share, the PER is 15.3 if you use the 4.4p EPS estimate for the current (new) financial year, or it drops to 13.5 if my guesstimate that EPS could rise to 5.0p this year turns out to be correct. That looks a sensible valuation, in my view - neither cheap, nor expensive, in the short term anyway.

My opinion - this is a very good update today, and the shares have justifiably moved upwards. I'd say the price is now about right, so it's not one that I'll personally be chasing higher. However, for longer term shareholders, the good organic growth means that patience could well pay off with further share price rises in the next few years.

The company seems well managed, and has apparently good risk controls in place (e.g. requiring Personal Guarantees from many/most customers). So overall, I like it, and think the shares could do well in the long term. Of course, the trick will be to sell out at the right time, when the first storm clouds are gathering for the next recession, whenever that is.

The house broker is maintaining their 80p share price target.

I've extended out the chart below to three years, to show the strong growth in share price since 2012:

Shoe Zone (LON:SHOE)

Share

price: 175p (up 7.4% today)

No. shares: 50.0m

Market

Cap: £87.5m

(at the time of writing I hold a long position in this share)

Interim results - for the six months ended 4 Apr 2015.

The backdrop here is that this discount shoe retailer floated in summer 2014, all went well until they issued a profits warning in late Apr 2015, blaming unfavourable autumn/winter weather, despite having said a few months earlier that the weather was not affecting them. So all in all, a fairly dismal introduction to the stock market from this one - not only warning on profits in the its first year, but using a lame excuse too.

However, these things happen sometimes with small caps, and it's important not to throw the baby out with the bathwater. Often when a good company runs into temporary problems, that can present a good buying opportunity.

I was bracing myself for another profit warning today, as the share price has been very weak in recent days, indeed it was down 12p yesterday, so I put the chance of another profit warning at more than 50%. So it was a pleasant surprise to read the interim results today, which show figures that aren't too bad, and reasonable outlook comments.

Turnover for the six months is down 5.7% to £78.2m, which isn't a particular concern, as that's due to the planned closure of loss-making shops, but they also mention softer trading towards the end of the period.

Profit before tax fell from £2.7m to £2.0m, so a relatively poor result, but we already knew this period was going to be poor, so actually it's not turned out as bad as I feared. There seems to be a heavy H2 bias to Shoe Zone's trading, so they make their money mostly over the spring/summer period. Therefore the current trading statement is probably more important than the H1 figures, so let's have a look at that.

Outlook - the key bit says:

It will take some time for this company to establish a reputation for being reliable, after the debacle over previous trading updates, but this is a good step in the right direction to rebuilding market confidence.

Dividends - I particularly like that a big interim divi has been announced. One of the key features of this stock at IPO was that it was going to pay big divis, so it's good to see that happening. A 3.2p interim divi has been declared, which is 100% of EPS generated in the half year.

Forecast full year divis are 9.45p, which would yield a healthy 5.4%, if the final divi comes in as expected later this year.

Balance sheet - generally very good. It has £30.3m in net assets, with no intangibles.

The current ratio is very healthy at 1.96. Note that retailers can operate on a lower current ratio than most companies, because they don't have much in the way of debtors (usually just a few prepayments on rents/rates, and 2 or 3 days worth of credit card takings in the banking pipeline). So given that retailers collect in immediate cash on every sale to their customers, but pay their suppliers on typically 30-60 days, then the working capital profile is very good - that allows retailers to run a slimmer balance sheet than companies which sell on credit.

Note that the pension deficit in long term creditors has risen, and is now £6.5m - not a worrisome amount relative to profits/cashflow.

Multi-channel sales - this is starting to look interesting. As well as operating shops, Shoe Zone also sells online, through its own website, and Ebay & Amazon. These areas are showing good growth, up 30% in H1.

Two other points caught my eye - firstly that the customer returns rate is only 10.5% - that is really good. The typical returns rate for clothing by mail order/internet is about 30%. So having a returns rate of just a third of average, is excellent. Maybe shoes have a lower return rate than clothes, I don't know? I've tested out their website, and it works well.

Secondly, the company notes today that multi-channel sales are more profitable than retail sales, so over the long term, maybe this company could morph from a bricks & mortar retailer, into an online retailer?

They don't seem to give the split of what % of sales are currently made online, it would be useful to find out that, if anyone knows please add a comment below.

Store portfolio - all retailers actively manage their store portfolios - ditching loss-making stores (if and when they can, dependent on the lease terms), relocating or expanding sites when beneficial, etc.

However, Shoe Zone seem especially active on this front, probably helped by the relatively low fit-out costs of a shoe shop - essentially just a floor, with some racking to display the product. I doubt if they spend more than about £40-50k to do a fit-out on a typical shop, probably less.

This enables the company to take shorter leases, and then just hand them back if the landlord won't agree competitive terms on renewal. This is borne out by an astonishing statistic from today's narrative that rent renewals are coming in at a 28% reduction!

That is very impressive, and says to me that this is a highly entrepreneurial management, who are worth backing. It's no coincidence that management still own over half the business - these are entrepreneurs with a lot of skin in the game, not hired hands.

My opinion - I'm going to stick my neck out here, and give this stock a thumbs up.

It could yet disappoint again, who knows, but based on today's figures & narrative, I think we could now be over the worst, and providing they don't run into fresh trading problems, then this could be a good point to buy the shares. Possibly. As always with small caps, it's really educated guesswork - we're trying to predict what future trading will be like, as that is what determines the future share price, in the long run.

My best guess is that market sentiment might start to gradually return for this share, so I see more upside than downside from the current price of 175p. Yesterday I was regretting holding shares in this company, but today I'm happy to continue holding.

As usual, the above is just my personal opinion, and never any kind of recommendation. The onus is always on readers doing your own research.

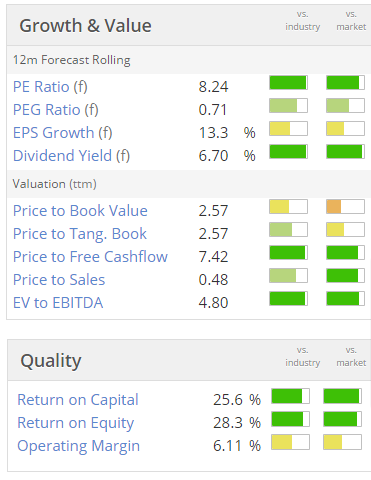

Here are the valuation figures from Stockopedia, based on last night's closing share price, which look pleasingly green:

Boohoo.Com (LON:BOO)

Share

price: 27.75p (up 6.7% today)

No. shares: 1,123.1m

Market

Cap: £311.7m

(at the time of writing I hold a long position in this share)

Trading update - this relates to Q1, being the 3 months ending 31 May 2015.

The backdrop here is that BOO floated in 2014 at a very rich valuation of over £500m, at 50p per share, because it was growing very fast at the time, and was already decently profitable. The wheels came off in early Jan 2015, with a profit warning - sales in the autumn had disappointed, and the growth rate had slowed considerably. So the shares bottomed out below half their original IPO price.

Obviously that sort of major disappointment is going to cast a shadow for some time to come, but in my opinion this has created an excellent buying opportunity, and this share is my favourite growth company right now. I've no idea what the share price will do short term, but my intended holding period is 2 years+.

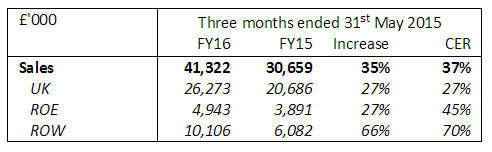

Anyway, here are the key points from today's Q1 update (BOO has a 28 Feb year-end, so these figures relate to Mar, Apr & May 2015):

(ROE= Rest of Europe, ROW = Rest of World, CER = Constant Exchange Rate)

Note that it is still mainly a UK business, with just under 64% of Q1 sales from the UK. However, it is pleasing to see Europe, and especially RoW growing strongly - this is due to a focus on certain key markets (e.g. USA & Australia), rather than a pebble-dash approach across many countries. That is working well clearly, and is one of the things that I think could trigger a re-rating upwards for these shares, as the market begins to appreciate this is gradually becoming a global business.

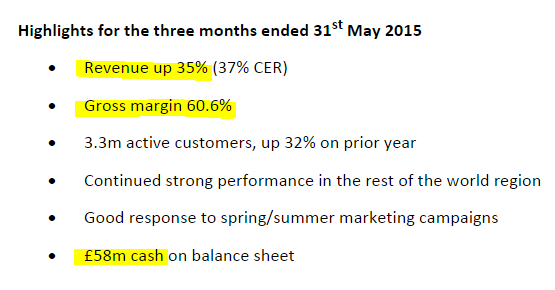

The highlight points from today's update are interesting (I've highlighted the ones that matter most to me):

Firstly, this is very strong organic growth. That deserves a premium rating.

Secondly, the gross margin is very high - far higher than e.g. Asos. What this means is that BooHoo is a cash machine, throwing out an astonishingly high profit margin in the mid-twenties in percentage of turnover, before marketing costs. The company then spends typically 15% of turnover on marketing - a huge amount.

You can't usually generate big sales growth online without big marketing spend. Investors mistakenly think that there are no barriers to entry for online retailing, but there are - the biggest one is marketing spend. The ideal scenario is to achieve viral marketing at negligible cost, but in practice that doesn't often happen. So lots of competitors are out there on the internet, but the customers haven't heard of them. Whereas the 3.3m active BooHoo get emails from them, see their TV adverts, billboards, and in particular as BOO targets a young, mainly femaie demographic, the company has embraced Vloggers (video bloggers), some of whom have more followers than major fashion magazines.

So the way I see it, BOO is in a sweet spot where it is already highly cash generative, and is choosing to spend a large chunk of that positive cashflow on marketing. Yet it still leaves enough profit behind to have an EBITDA margin of c.10%. This is fantastic stuff. I make no apologies for being very excited about this company's long term potential.

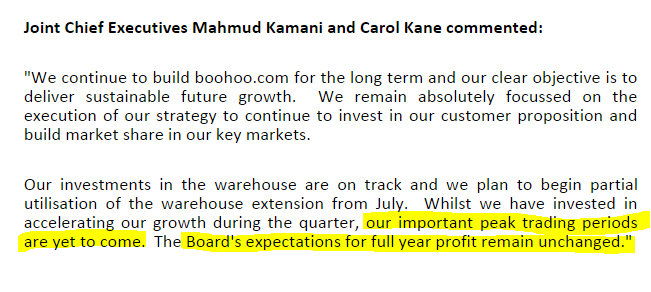

Outlook - today's statement makes positive noises about full year forecasts, whilst keeping a bit of wiggle room in case trading in the peak periods disappoints:

I listened in to the analyst conference call this morning, which was entirely hosted by the FD. He made lots of interesting points, but in particular he made it clear that they can adjust their profit figure, depending on how they spend on marketing, vs much they want to drive growth. The company tries to achieve a balance between driving growth (by spending more on marketing), whilst maintaining a 10% EBITDA margin.

However, recently the company has achieved excellent sales growth by spending more on marketing, and allowing the EBITDA margin to fall as a percentage, but remain the same in cash terms (i.e. a slightly lower percentage, but of a larger top line). I think this is absolutely the right strategy. At the moment the stock market is giving the highest valuations to companies which deliver the highest top line growth. I think that's nuts, because it means companies like Ocado, and AO World, which hardly make any profit at all, are valued at sky high multiples of (very little) earnings. Whereas BooHoo makes a far better profit margin, yet is valued like a conventional retailer. There's a serious mismatch there, and I believe BOO could get a fairly big re-rating once the market realises this. I've no idea when that is likely to happen, but personally I'd be surprised if this share hasn't regained the 50p IPO price by this time next year.

Balance sheet - provides excellent downside protection, with £58m cash reported today. There isn't any debt. What is even better, is that as BOO grows, it generates more cash, because they keep stockholding low, sell for cash, but have delayed payments to suppliers. So growth requires no additional working capital.

There has been a fair bit of capex, to finance a very big warehouse expansion. Warehouse automation is a possibility in future years.

Valuation - BOO has surplus cash of £58m, which is just over 5p per share, or nearly 20% of the market cap. That is not a seasonal spike either, it's genuinely surplus cash, in my view. Some of it might be spent on share buybacks - there is nothing imminent, but in the CC today the FD said that a decision would be made after the AGM, when the company is seeking authority to buy back up to 10% of its own shares.

Take off the cash, and the Enterprise Value is about 22.75p.

Peel Hunt have upgraded their forecasts this year, and suggest 1.2p EPS this year. So that puts the shares, on a neutral cash basis, on a PER of 19.0. I reckon that's good value. More importantly, the earnings figure could be a lot higher, if they just ran the business for cash. Remember that they're reinvesting a lot of the profit to drive the top line higher.

Peel Hunt have EPS rising to 1.4p next year, and 1.8p the following year, which really shouldn't be a stretch to achieve, so the cash neutral PER falls to 16.3, and then 12.6.

I am expecting growth to receive a significant boost shortly, when BOO launches its mobile App. It's scarcely believable, but the company doesn't have a transactional App, despite 50% of its web traffic being through mobile devices. This is insane, but it provides the potential for a big boost, if customers can transact immediately on their mobile devices, instead of just browsing. The App is due for imminent launch, and is in final testing.

My opinion - as you can probably tell, I really like this share! Yes it's in a competitive sector, but this company is executing very well, and crucially is building a bigger moat all the time with its heavy marketing spend.

From the CC today, I reckon management really want to go for it, in terms of growth, and hence there's a risk that the stock market might take fright at EBITDA margins falling from the very high historic levels. However, if that drives more exciting top line growth, then I reckon the market will value that more highly than a fat profit margin.

As a former retailing man myself, I can only wonder at how amazing it is to have a business which has turned the fixed costs of a store network, into a variable cost of marketing spend. They are also finding that giving up a small amount of gross margin in overseas markets, by lowering selling prices, has had a big impact on top line growth. So I'd like to see more of that - they should be grabbing market share, and be prepared to make lower profits in the short term, in my view.

Overall then, this is the share I'm most excited about as a core long term growth stock in my portfolio. As always please DYOR, and if you have any reservations, or disagree with my enthusiasm, then please say so below in the comments. I want to hear the bear arguments, as it's essential to consider pros and cons, to avoid getting too carried away with things.

Well done if you got this far!

Further, brief comments are in today's YouTube video, on the following companies: Ensor Holdings (LON:ESR) , Castings (LON:CGS) , Best Of Best (LON:BOTB) , Flybe (LON:FLYB) , AO World (LON:AO.) vs Boohoo.Com (LON:BOO) .

Please note that I put in clickable links in the description box on YouTube, where you can skip directly to each company, if you don't have the time or inclination to listen to the whole thing.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SHOE, BOO, BOTB, FLYB, and has a short position in AO.. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.