Pre 8 a.m. comments

It will be interesting to see how the market reacts to today's Trading Update for the year ended 31 Dec 2012 from Surgical Innovations (LON:SUN). SUN make equipment for minimally invasive surgery, and at 7.2p per share have a market cap of £29.2m.

Of the £5.6m orders intended for delivery in H2 of 2012, £1m slipped into the first week of 2013, due to capacity constraints at their Leeds factory, and a delay in US regulatory approval in Dec 2012. Those sound like valid reasons for 2012 falling short of expectations, so turnover will now be £7.6m, against forecast of £9.1m (according to Stockopedia's market consensus figure shown in the StockReport here).

The shortfall in 2012 will be a flying start to the 2013 figures of course, so given that we're in a bull market, this might be seen in a glass half full way? Gross margins have improved 3 points to 50.3%, which is positive. They only mention adjusted EBITDA, and not profit, which is slightly ahead of 2011 at £2.85m (versus £2.8m).

So at a 50% margin, £1m of sales would equate to delayed profit of £0.5m, and by my calculations that means they would have hit market consensus profit had it not been for the one week delay. So if I held these shares, I wouldn't be panicking over this.

Interestingly, they are increasing capacity, part funded by the award of a £5m RGF, which I think stands for Regional Growth Fund.

These shares had an amazing run from 2009 to 2011, ten-bagging from 1p to over 10p, but have since fallen back to 7p. With EPS having been fairly static for 3 years around 0.45p, which puts them on a PER of about 15, in my opinion they look fully priced. Also there is no dividend, which I see as a significant drawback. So this one's not for me at this price.

Structural steelwork company Severfield-Rowen (LON:SFR) got itself into a bad position by losing control of some contracts, warning on profit, and having issues with too much debt. The shares have got off lightly so far in my view, since a fall to 77p gives it a market cap of £70m, which given the uncertainty and likely losses for 2012 seemed generous.

It looks like they are kitchen-sinking it today, with a Trading & Financing Update that has a series of hefty provisions totalling about £20m, being taken on 9 problematic contracts. So this situation just boils down to poor management - i.e. not managing costs properly, and/or under-pricing contracts. Basic stuff for any business surely, so this is a deeply unimpressive situation.

The bottom line is that they are planning on tapping shareholders for a whopping £50m, and it looks like the banks will be supportive, as you would expect, since shareholders are stumping up the money to get the banks off the hook!

This all looks bearish for the share price, since a substantial new equity fundraising of £50m will have to be priced at a deep discount given that the market cap is £70m now. So it wouldn't surprise me to see these shares halve from their present 77p, or even more, it all depends on how much the shareholders financing the new shares want to dilute other existing shareholders. A deep discount on a rights issue effectively forces everyone to participate. Or the company might just do a Placing, which is quicker & cheaper, but upsets people who are not invited to participate.

(this section of the report was published just before 8 a.m., which is a new idea I'm trying out to get a time-sensitive report out just before 8 a.m., then follow up with more detail around 10 a.m.)

Post 8 a.m. comments

Here is the second part of today's report, with less time-sensitive comments.

SFR has not fallen as much as I expected (yet), so it's clear the share price is being supported. This could present a good shorting opportunity at 71p, in my opinion.

People who say the UK economy is not recovering are missing a trick. The housing market is buoyant, with housebuilders now in rude health, and also the car market is recovering - as evidenced by upbeat results & outlook statement from Pendragon (LON:PDG) this morning. Their underlying profit before tax is up 18%, although it's a wafer thin margin of just 1% of sales. Uderlying EPS fell 13% from 2.3p to 2.0p.

This is guesswork, but I could imagine EPS rising to 3-4p in an economic recovery, as operational gearing kicks in, so at 20p PDG shares might end up looking cheap in a year or two's time? They are on a PER of about 10 right now, which is hardly expensive, although there is a lot of debt, but that is revolving finance for their stock, so asset-backed. Their interest cost is falling rapidly, from £54m in 2011 to £30m in 2012.

I might look into Pendragon in more detail when time permits. They say that, "vehicle markets are recovering in the UK and in 2013 growth is expected in new, used and aftersales". Pretty good.

On the other hand, looking at PDG's 12 month chart, the shares have had a fantastic run recently, and I would find it very difficult to buy them now, after such a rise.

I might wait for a pullback to around 18p before dipping into this one. If I miss it, so be it, there are plenty more fish to fry!

l suspect this is why equity markets are surprisingly resililent, when big ticket things like housing & cars recover, then investment comes back, and that tends to flow into a broader economic recovery. Hence why I'm much more bullish on the economic outlook than most commentators. I think we should be positioning ourselves for a cyclical recovery, and looking at shares which have operational gearing - i.e. where a relatively small rise in turnover feeds through to a big increase in profitability - so companies with a mainly fixed cost base, and high gross margins are ideal.

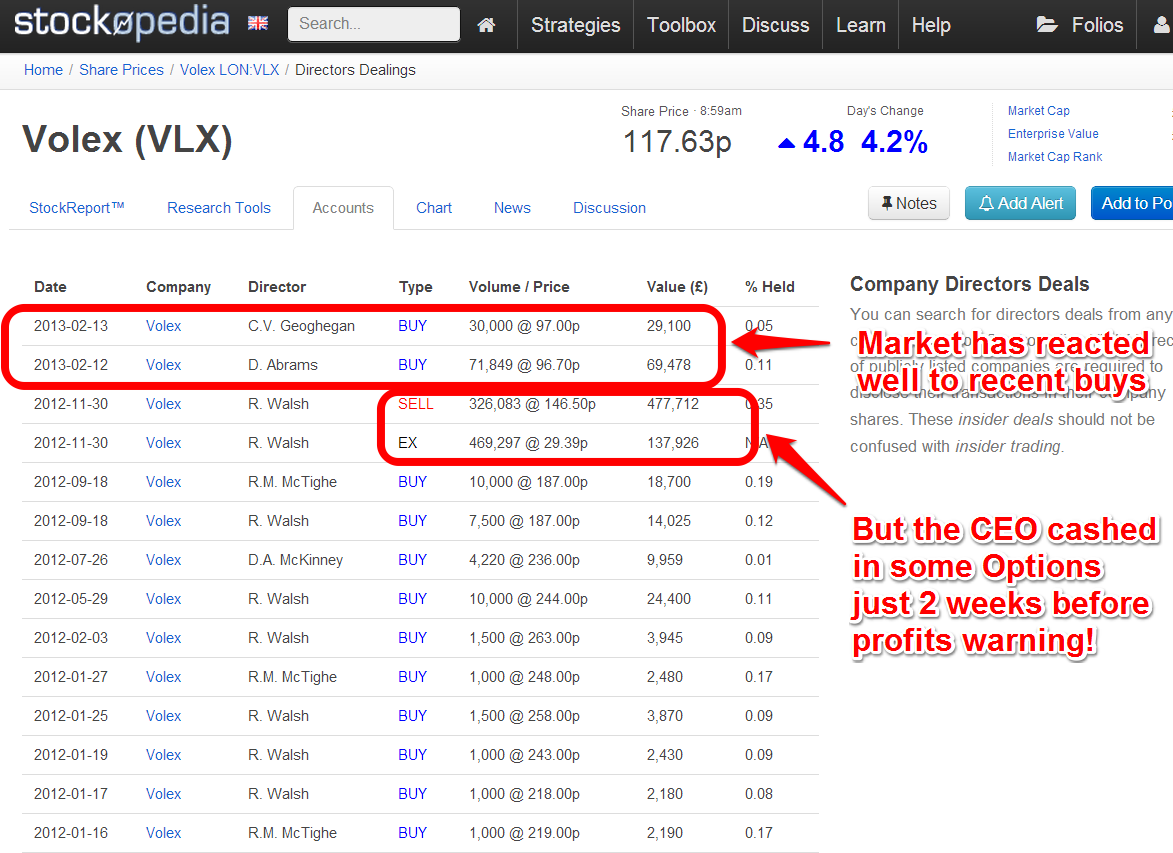

I note that recent Director buying has put a rocket under shares in Volex (LON:VLX). They were up 15p yesterday, and another 5p today to 118p.

All well and good, but remember that the CEO cashed in several hundred £k of share options just 2 weeks before the last profits warning.

Surely this should be investigated?

Volex has some appeal as a recovery situation, but they have been very accident-prone, so personally I'm hovering on the sidelines with this one, not willing to commit yet. It's a very low margin business, whose customers continuously squeeze out any profit margins VLX manage to build. I prefer businesses with more pricing power, as profits tend to be more resilient.

To access the simple, colour-coded table of Director deals, just hover your mouse over the "Accounts" tab at the top of the Stockopedia StockReport, and "Directors Dealings" is the last option from the pop up menu.

Synectics (LON:SNX) announce that they have renegotiated the terms of a previous partial acquisition, which has enabled them to acquire the remaining 49% of a German security company called Indanet AG for a final cash payment of E1.64m, instead of the previously agreed earn outs up to E8m. Sounds positive, but they don't state how Indanet is trading, so we don't really know.

I am meeting with the Synectics Directors for lunch next Wednesday 27 Feb after their results, so if you have any points you'd like me to raise, then feel free to leave a comment after this article. I always read all comments, and respond where needed. It looks a good company, but as with so many shares at the moment, recent rises mean the valuation is probably now about right.

That's it for today. Did you find the new pre-8 a.m. report useful? Should I carry on with that idea, or doesn't it make any difference to you? Let me know through the comments below.

Regards, Paul.

(of the companies mentioned today, Paul does not hold long or short positions in any of them)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.