Pre 8 a.m. comments

Good morning! The most important announcement for me this morning, and hence the one I shall cover before 8 a.m. (in case it warrants some immediate action in either buying more, or selling) is Vislink (LON:VLK), who have just issued an Interim Management Statement (IMS).

I bought some shares in Vislink on 25 Mar 2013, and explained why here.

Their IMS today sounds OK. It covers the period from 1 Jan to 23 Apr. Q1 order intake is slightly down at £13.3m (vs £13.4m last year). It also mentions a number of contract wins, including for Moto GP - Vislink make the special cameras that are used to show the driver's view from a racing car. They are the world leader in this type of broadcast equipment.

What I like best is that Vislink once again reiterate their financial goal of achieving annualised turnover of £80m and a 10% operating profit margin by the end of 2014. That is highly significant, because last reported turnover and adjusted operating profit for calendar 2012 were £57.2m and £3.1m respectively. So they are targeting almost a tripling of profit in 20 months!

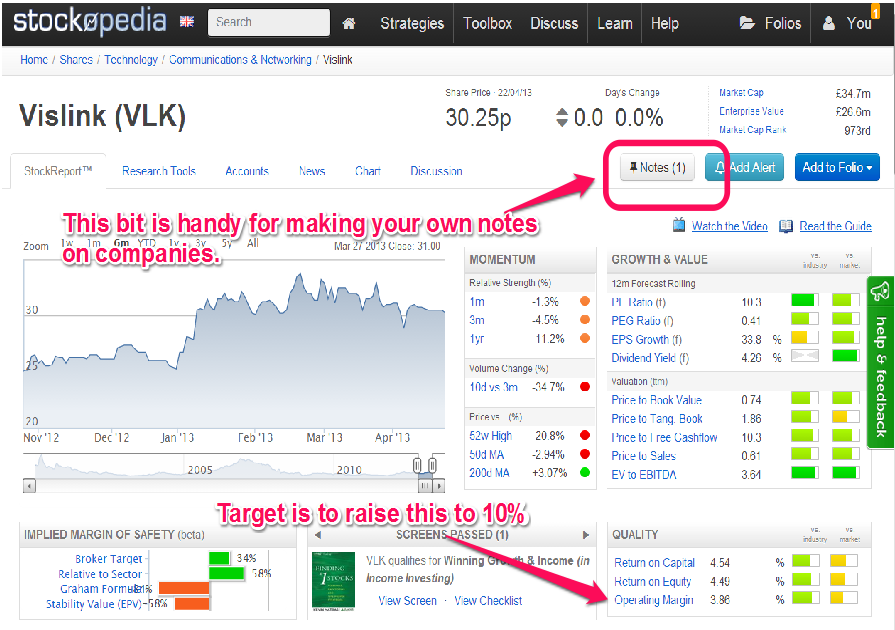

That would suggest a market cap of around £80m, or a share price of 70p. That's more than double the current share price of 30.5p (a current market cap of £34.7m). Bear in mind that VLK is sitting on net cash of £8.1m, and the valuation starts to look ridiculously cheap - we're only really paying £26.6m for the business itself. They can use the surplus cash to make acquisitions - i.e. buy in additional earnings.

Therefore, if they deliver against plan, I am pretty confident that we'll be looking at a much higher share price, hence I'll certainly be buying the dips here from now on - I could see Vislink becoming a much larger holding in my portfolio. Buyers now are also locking in a generous 4.1% dividend yield.

I particularly like businesses that spend a lot on R&D, because if the money is spent wisely, then today's R&D spending will be tomorrow's srtong growth. Vislink spent £5.1m on R&D last year, or 9% of turnover.

The balance sheet looks fantastic, with net current assets of £16.1m, being a ratio of 2.4 to 1 (i.e. current strongly top-heavy with current assets of £27.9m, versus current liabilities of £11.8m). There are negligible (£1.3m) long term creditors. The more I look at it, the more convinced I am becoming that these shares are simply the wrong price. I think they should be around 50p in the short term, not 30.5p, with scope to rise to 70p after that if they achieve their financial targets. It's not often I feel this confident about a share being under-valued. As usual please "do your own research", and if you think I've missed something, or am too bullish, then please say so in the comments section - these reports are intended to be interactive. Obviously as always, no advice is intended, these are just my personal opinions.

Post 8 .a.m. comments

Well that was an interesting flurry of activity in Vislink (LON:VLK) this morning. The first few bulletin board comments were negative, people expecting better current trading, and hence the price came off 2p on some early selling. This presented a good buying opportunity, and I've managed to top up at 28.5p, which looks to have been near the lowest price this morning - more through luck than judgment, as the timing was down to me first having to raise the cash by selling some other stuff (I'm usually 100% invested, and am at the moment).

That's already in profit, so a successful morning's work so far.

I'll certainly be buying more VLK on any more dips, there seems to be good support around 28p, so that sort of price is where I'll be hovering, this is well on it's way to becoming one of my larger holdings, so I must do some more detailed work on it. At the moment I haven't really looked into the product in any great detail, or compared it to competitors, etc, as I tend to let the financials do the talking. Would be good to meet the management - so if any forum organisers can get them along to a meeting, that would be really good.

Shares in PR group Next Fifteen Communications (LON:NFC) are down 14% to 99p this morning on publication of their interim results to 31 Jan 2013. Diluted adjusted EPS dropped out at 4.2p, so 8.4p annualised (a PER of 11.8), and they have net debt of around 10% of the market cap. So doesn't look especially good value to me based on these figures. There is also a mild profits warning for H2, and restructuring costs, so I won't be following up on this one.

PR & marketing firms are generally quite cheap at the moment, so I quite like the sector as a possible cyclical recovery area - i.e. if they're cheap now, then they could look very cheap once a proper economic recovery is underway. I think Creston (LON:CRE) looks better value, which reported yesterday, and on reflection I was perhaps too harsh about their outlook statement yesterday?

Speech recognition software company Eckoh (LON:ECK) issues a pretty upbeat trading update today. Whilst the valuation looks rather full, they do have a decent amount of cash on the balance sheet. So if they do something useful with that cash (e.g. a profitable acquisition) then the valuation might look more appealing. I note also a 25% increase in the dividend.

My instincts to hold back on buying back into 2Ergo (LON:RGO) proved correct, as the shares are down 18% today to 8.5p. Whilst their new contract wins sounds intriguing, I'll be waiting until they have got their latest fund-raising done before considering whether to buy back in, as the last one was done at an astonishing 76% discount to the market price at the time. I do like the look of their product though.

Omega Diagnostics (LON:ODX) looks potentially interesting. They've announced the grant of a US Patent today. It's small, but profitable already, and looks reasonably priced based on forward earnings estimates.

As an aside, check out the latest new features & developments at Stockopedia here. I've not had a proper look myself yet, but there seems to be a lot going on.

Right, I have to dash, train to catch.

See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in VLK only (increased this morning at 28.5p), and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.