Good morning!

Today we have some updates from:

- Scisys (LON:SSY) - recommended cash offer

- Mountfield (LON:MOGP) - final results

- Taptica International (LON:TAP) - new buyback programme confirmed

- Walker Greenbank (LON:WGB) - AGM statement

- GAN (LON:GAN) - legalisation of online sports betting in New Hampshire

- Alumasc (LON:ALU) - trading update

Scisys (LON:SSY)

- Share price: 250p (+22.5%)

- No. of shares: 30 million

- Market cap: £74 million

Well done to holders of this one.

I've only covered it once before, back in March 2018.

This 254.15p bid is at a 24.6% premium to last night's closing price, so anyone who bought into it recently will be feeling lucky.

The premium is even bigger if you consider the price at which the stock has traded over the past six to twelve months.

The Board unanimously recommends the deal. That's a huge help, and probably means that the deal will go through, unless there's an even higher bid.

I can only think of one recommended offer which completely fell through - the offer for Revolution Bars (LON:RBG) in August 2017.

Comment by the SCISYS Chairman:

We believe SCISYS and CGI are highly complementary businesses sharing similar values and are confident that the combination will enable SCISYS to benefit from CGI's size, strength and global reach."

SCISYS is an IT services provider, and in a similar vein, CGI Inc is an international IT and business consulting group (2018 revenues of 11.5 billion Canadian dollars). Their activities sound very similar. Maybe they've been competing for the same work?

The SCISYS directors control 25% of the shares and all of these will be voted for the takeover.

Rationale - SCISYS says that the size of its management team has been insufficient to study acquisition deals which would allow the company to scale faster. They also blame the low valuation attached to the shares as a reason why they couldn't do more deals, using their equity as currency.

My view - those director shareholdings will be a big boost for the deal to go ahead, so I think that's the most likely outcome.

Some shareholders might be annoyed that they don't get to participate in the company's future success, and should vote against the deal if they feel that way.

However, since the directors have clearly stated that they don't think they can scale the business in its current form, and have been frustrated by the company's share price, I would suggest that it's better to let them move on. I don't think it would work out well for shareholders to scupper the deal and then be left with an unhappy, frustrated bunch of directors!

Mountfield (LON:MOGP)

- Share price: 2.05p (+2.5%)

- No. of shares: 254 million

- Market cap: £5 million

My friend Simon Hedger knows about this tiddler, whereas I know very little.

Its principal activity is "the construction and fit out of data centres for the IT industry".

At face value, these are great results. Revenues, profits and the net cash position are all up by meaningful amounts.

The secured order book is only a touch higher, at £16.4 million versus £16.2 million last year. Order books can often be weak predictors of revenue, however.

The main source of excitement for this group of companies seems to be the imminent rollout of 5G technology. So far, 5G has had no effect on its financial performance, but it considers itself "well placed to capture significant new quantities of business" which 5G will generate in this sector from the beginning of 2020.

As for the current year (FY December 2019), management again expect "another strong performance".

Subsidiaries

1) Connaught - suppliers and installers of raised access flooring systems. This had a quieter year, due to the timing of contracts. (I tend to avoid contract-driven businesses these days, after learning the hard way how difficult it is to predict lumpy business.)

2) Mountfield Building Group - the construction division of the group. This had an "extremely good" year, revenue almost doubling. There were "a substantial number of new contracts won in direct negotiation and by tender".

Outlook - very bullish on the prospects for future demand and on Mountfield's ability to meet this demand. It aspires to be "a highly profitable, mid-sized operation".

My view - I have a balanced overall view.

What's good:

- Growing, profitable

- Industry dynamics seems positive

- Specialist expertise

What would keep me away:

- Currently looks too small to have a public listing

- Very contract-driven. Seems lumpy (this issue could become less worrisome if it was larger).

- Not a sector where I feel comfortable, with low margins (the net margin is 4%, for example).

The ValueRank is 97 and on a cheap multiple, I can understand why micro-cap value hunters like my friend Simon, who is more comfortable in this sector, would be attracted.

Taptica International (LON:TAP)

- Share price: 114p (+13%)

- No. of shares: 127.5 million

- Market cap: £145 million

Commencement of New Share Buyback Programme

We have another buyback programme at this bombed-out company.

It's not quite as big as the last one: $10 million instead of $15 million.

Note that it can't pay "more than 105 per cent. of the average middle market closing price of an Ordinary Share for the five business days preceding the date of purchase."

So if the shares keep bouncing higher, I guess there could be days when it can't make any purchases (its broker Finncap will be making these decisions).

On the other hand, on days when the share price is trading below the average close of the past five days, the buyback could be a significant source of share price support.

Walker Greenbank (LON:WGB)

- Share price: 76.75p (+0.3%)

- No. of shares: 71 million

- Market cap: £54 million

This update is in line with expectations. And the share price hasn't reacted too much. So let's not dwell too long on it.

Walker Greenbank is a luxury furnishings company that "designs, manufactures and markets wallpapers, fabrics and paints".It owns numerous brands and has two manufacturing facilities in the UK.

The new CEO is conducting a strategy overview, with the support of the new Chairman.

The UK market is said to remain "challenging", but sales in most international markets (excluding the USA) are ahead on a like-for-like basis this year.

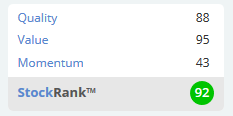

My view - little has changed on the back of this update. Might be worth researching in more detail, especially considering the StockRank of 92.

GAN (LON:GAN)

- Share price: 71.5p (+3%)

- No. of shares: 85 million

- Market cap: £61 million

Legalization of online sports betting in New Hampshire

Great news for investors. This seems like a done deal:

New Hampshire is the 14th State to legalize sports wagering in the US and the sixth to do so this year. Following the launch, nearly 21% of the total US population will be able to place sports wagers online.

I wonder if 888 (LON:888) (in which I have a long position) can capitalise on this? 888 already runs a sportsbook in New Jersey.

The long-term outcome in American states is highly uncertain, but there has to be some value for the likes of GAN and 888 in the possibility that they continue to open up for online gambling, including sports betting.

Alumasc (LON:ALU)

- Share price: 100p (-3%)

- No. of shares: 36 million

- Market cap: £36 million

This is a supplier of "premium building products, systems and solutions".

It's a profit warning:

Whilst we had expected a stronger pick up in revenue in the second half based on a firm order book, Levolux has continued to experience construction project delays both before and after the placement of customer orders, and margins remain below expectations in the embryonic balconies business.

Swift action has been taken in response, including the restructuring of the management team at Levolux. This suggests that the delays were the fault of previous management, perhaps? New management are said to be working on operational improvements.

Underlying PBT for the financial year will miss expectations by 10%-15%. It's weird that the share price hasn't reacted more strongly to this negative surprise!

The 7.35p dividend is to be "retained" - from the wording of the paragraph, I think they are saying it will be kept at this level.

My view - shares look cheap, but it's not a sector where I want to play. Good luck to all holders.

Calling it a wrap there, folks. Have a great weekend! Paul is back next week.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.