Good morning!

Once again, there is no shortage of news today.

I will choose some of these to write about (editing this list as the day goes along):

- Alliance Pharma (LON:APH)

- Billington Holdings (LON:BILN)

- DP Poland (LON:DPP)

- GAME Digital (LON:GMD)

- 1pm (LON:OPM)

- SCISYS (LON:SSY)

- S&U (LON:SUS)

GAME Digital (LON:GMD)

- Share price: 24.5p (+2%)

- No. of shares: 173 million

- Market cap: £42 million

Disclosure: I own shares in Game Digital.

Many of you will be familiar with this high street games and video console retailer, operating in the UK and Spain. It has appeared regularly in this report over the last year.

And what a volatile period it has been for shareholders. The share price bottomed out at 19p last year, rallied to over 60p in December, and is now 24p.

It's Cheap!

When I covered it last, I rather pessimistically said that the shares might represent "value" if they were priced at a discount to tangible book value. My rationale was that resources would be needed to pay for the next wave of store closures, and that future profitability was highly uncertain. So to compensate for this, a discount to tangible book value is what I'd be looking for.

We are there now. According to today's results, tangible book was sitting at £86 million at the end of January, i.e. more than double the current market cap.

Within this, the balance sheet is dominated by £85 million of cash.

On top of the cash pile, the company has undrawn banking facilities of up to £75 million, which can be extended by £25 million during peak season.

It also has a Spanish working capital facility and a £55 million borrowing facility from its major shareholder and partner, Sports Direct (LON:SPD).

In other words, this is now a company with very deep pockets. I reckon that its total spending power in cash and undrawn borrowing is in the order of a quarter of a billion pounds, more than 6x its current market cap. Isn't that extraordinary?

One thing that I would do, if I was running Game, would be to find a few million pounds from somewhere to buy back say 20% of shares. The cost would be minuscule compared to the company's total spending power, and it would provide a dramatic boost to future returns, assuming the company survives!

Finding the funds to do this would not be so difficult. Indeed, I would argue that Game has already done it: it has reduced working capital by £19 million compared to a year ago, i.e. nearly half of the entire market capitalisation has been turned into cash, simply by the company managing its inventories and bills more efficiently.

So these numbers suggest the company is very cash rich, compared to its market cap. But investors are worried that it's going to waste the money:

- Losses

The company achieved an operating profit of £12.9 million H1, a deterioration compared to H1 in FY 2017. H1 is always much stronger than H2, since people play video games and buy consoles more in the autumn/winter months than in the spring/summer. Last year, Game turned an H1 PBT of £16.5 million into a full-year pre-tax loss of £10 million. So the total loss this year is likely to be wider than last year.

- Store Closures

Unlike many other retailers, Game has already been through an administration, and its lease terms are less onerous than others. But there will still be frictional costs (e.g. employment-related) in closing down underperforming stores. But hopefully the benefits in future periods will far outweigh the costs.

The UK business has 233 potential lease expiries before the end of December 2018 and the collaboration agreement signed with Sports Direct allows the Group to rollout more BELONG concepts across a significant number of locations, including within Sports Direct stores, which gives rise to many important business and location decisions over the next few months.

That is a massive number of lease expiries. The entire UK business only has 299 stores! The average lease length is only 1.1 years. The average lease length in Spain is less than 1 year.

Management will be very busy deciding which stores to keep and which to let go, and negotiating terms.

I hope that they keep lease lengths low, even for stores they decide to keep, so that the company will retain a lot of flexibility going forwards.

Note that £5 million of "operational efficiencies" (i.e. reduced costs) were achieved in H1, from a combination of rent renegotiation, payroll reduction and lower head office costs.

- Capex - rolling out the "Belong" e-sports format with Sports Direct is going to require some expenditure. This will be part-funded with borrowings from Sports Direct.

Conclusion?

I've bought a very small number of shares in the company this morning, because I'm intrigued by how big its cash resources are compared to its market cap, and the discount to tangible book value. With the average lease length remaining very low, and the company benefiting from rent savings as leases are renegotiated, I think it has a chance to survive and could end up being worth multiples of the current level, if it avoids going bust.

DP Poland (LON:DPP)

- Share price: 34.5p (-1%)

- No. of shares: 152.6 million

- Market cap: £53 million

Readers haven't been requesting this lately but I see from the archives that Paul used to cover it, usually arguing that it was overvalued (when the share price was much higher than the current level - well done, Paul!)

It's of interest to me, since I own shares in the related company DP Eurasia NV (LON:DPEU). DP Eurasia is (or at least was, until I bought Game Digital) the most speculative stock in my portfolio, and I position-sized accordingly.

Actually, I feel the same way about DP Eurasia as Vegpatch apparently did about DP Poland, when he wrote about it in Sep 2016, calling it his "dirty little secret"! But DP Eurasia is about ten times larger than DP Poland in terms of revenue and number of stores, and is already profitable, so they are quite different.

On to these results. 2017 was a big year for DP Poland. The RNS headline is "momentum continuing to build".

- 19 stores opened in 2017, from 35 to 54 stores

- Total System Sales1 up 51% to 58m PLN 2017 (39m PLN 2016)

- 17% like-for-like2 growth in System Sales 2017 on 2016

The GBPPLN exchange rate is 4.79, so the total system sales are c. £12 million.

The plan is to reach up to 70 stores by the end of this year, which would mean a slightly lower number of store openings compared to 2017. But still a doubling over two years.

What really matters is the performance of mature stores, and the company reassures that mature stores are outperforming original expectations in sales and EBITDA. The CEO says:

Our most mature corporate stores of 6+ years delivered significantly higher sales and EBITDA in 2017 than our original mature store model predicted.

That's big news, but for now the company remains loss-making.

31 stores have opened in the last two years (i.e. 57% of the estate). The initial investment and the burn while they develop is having a strong negative impact on DP Poland's results.

The company also blames food and labour cost inflation, and price promotional activity.

Future Prospects

I've listened to a CEO interview this morning, where he says that commissary capacity is now able to serve up to 150 stores. So there should be no problem in supplying raw materials to stores for the foreseeable future.

In addition, I see that the company just launched its first national advertising campaign in Q1 2018 (i.e. too late to affect today's numbers), with "encouraging" results.

I don't think I'm going out on a limb by suggesting that a big part of the formula for Domino's success around the world is its name recognition and the power of its brand.

But it's a chicken-and-egg situation, since it funds advertising from sales. It hasn't had the financial success yet to fund major advertising.

Consider this:

We tested national television advertising for the first time in January and February 2018 with 2x 2-week campaigns; the sales response was strong with like-for-like growth in System Sales ranging between 30-40% during each of those television advertised fortnights... television will become an important medium for us when we reach the critical mass to justify it on a regular basis.

Outlook sounds fine. Price pressures are easing and the company looks forward to "another year of robust growth".

My opinion

I'm interested, but haven't bought the shares yet. It's still quite small, and the losses are material compared to the company's resources: it made a pre-tax loss of £2.6 million in 2017, leaving it with net assets on the balance sheet of £14.5 million, or £5.6 million if you exclude non-current assets.

Therefore, I think it might need to raise some more money at some point. I would be interested to invest when I'm more confident that it doesn't need any more funds.

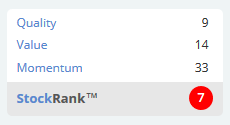

The algorithms cautiously give it a weak StockRank, as in general most companies with these financial metrics don't make it.

Billington Holdings (LON:BILN)

- Share price: 261p (+2%)

- No. of shares: 12.9 million

- Market cap: £34 million

I've not covered this structural steel maker before, so have been checking out the coverage in the archives.

To get a broad view of its divisions, here is a link to the profile on its own website. It is processing about 30,000 tonnes of steel a year.

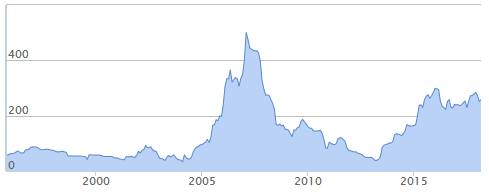

Investment success so far has been determined by when you bought in the cycle:

Today's results are great, showing more progress in the latest bull cycle:

Return on capital is surprisingly good for a heavy business, at 20%. Checking its historical track track record, I think this is about as good as it gets for the company. ROC is much lower, or negative, in the bad times.

Outlook

I'm looking for clues as to where we are in the cycle. Billington offers a few notes of caution:

The structural steel market continues to show signs of stability. However, during the period under review the Company has seen an escalation in the raw material prices for steel manufacturers, resulting in consistent increases in steel prices. The cost of structural steel sections, the Company's primary raw material, has increased by some 40 per cent during the two years to March 2018. Consequently, this presents a challenge to the wider structural steel market to remain competitive with alternative forms of construction.

Later:

..forecasts indicate that, for the next two years, structural steel consumption in the UK will remain at the levels seen in 2017, which is positive for the Company. Additionally, a small number of projects were completed in Europe during 2017 and the number of enquiries received for steelwork projects in these territories has increased, therefore providing further opportunities outside of the core UK market.

Overall, it sounds balanced and perhaps we can have cautious optimism that steel will remain a good sector in which to do business for the medium-term? That should allow for more share price upside and an attractive dividend yield, given how the shares are priced:

Stockopedia awards it a StockRank of 90, putting it at or above that magical top-decile of rankings.

I'm not yet familiar enough with Billington to consider buying it, and I don't usually own heavy industrial stocks. But it has left me with positive first impressions.

S&U (LON:SUS)

- Share price: 2340p (unch.)

- No. of shares: 12 million

- Market cap: £281 million

This is another stock I want to cover because of its similarities to something in my personal portfolio: PCF (LON:PCF). Both companies are in subprime motor finance (though PCF is moving up the credit chain). Neither company offers PCP contracts.

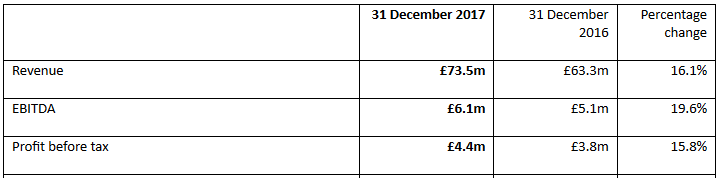

Results are quite excellent:

- Revenues up 32% at £79.8m (2017: £60.5m)

- Profit before taxation up 20% at £30.2m (2017: £25.2m)

Advantage Finance, S&U's main operating subsidiary, has produced its "18th successive year of record pre-tax profits", in a "buoyant but competitive car market".

Net assets are now £153 million, so that the latest Price to Book ratio is 1.84x. Not cheap by any means, but nor is it a million miles away from the sort of rating you'd expect in these conditions. (PCF was trading at 1.7x yesterday, but its share price is up 6% today).

Used car values are rising materially. This makes sense - cars keep improving in quality, and last for longer, so they don't need to depreciate as much. There is also a gain to be had from cautious consumer sentiment, as more people choose to avoid the depreciation suffered in a vehicle's early years (which ironically reduces the depreciation they suffer, by increasing the demand outstanding for them).

S&U's return on average equity achieved in the year, by my calculation, is 16.7% - excellent.

A consumer recession would be painful, no doubt. But it wouldn't be all bad. There would probably be a lot more demand from consumers for subprime lending, and S&U would have its pick of who to lend to. Used car values would suffer, but again you would expect them to suffer less than new car values.

So with a sufficiently long time horizon, and the willingness to take on a moderate level of risk, I think this would make for a sensible investment, even at the current level.

Elsewhere, I note that 1pm (LON:OPM), the SME lender with a specialisation in asset finance, has announced a new £35 million facility. It has been awarded by British Business Bank, the State-owned economic development bank. The news follows on from the announcement last month that 1pm was trialing a peer-to-peer lending platform with retail investors as a funding source.

So it's making really good progress, with total funding now greater than £155 million.

At the risk of repeating myself, the funding story I remain most bullish about in this sector is PCF's continued development as a retail bank.

Alliance Pharma (LON:APH)

- Share price: 69.1p (+4%)

- No. of shares: 474 million

- Market cap: £328 million

I covered this for the first time a year ago, coincidentally on the same day I covered Game Digital for the first time.

Game was priced at 42.5p that day, and I was sorely tempted! Meanwhile, Alliance Pharma was priced at 47.6p, and I was neutral on it. That report is available at this link.

Last year, my main concern was that the debt/EBITDA ratio seemed on the high side.

Despite making expensive acquisitions in 2017, Alliance still managed to reduce debt by a few million pounds, finishing the year at £72 million.

The company reckons that its adjusted net debt/EBITDA ratio finished the year 2.46x, although I don't see how exactly it calculated that.

The covenant says that this ratio needs to stay below 3x. Granted that the company may enjoy greater than average visibility of earnings, but I'm more comfortable when this multiple is closer to 2x.

It would have been about 2x if not for the latest acquisitions:

Excluding the acquisitions completed in December 2017, our leverage at 31 December 2017 would have been 2.06 times.

It will head back toward 2x again, excluding the effects of more deals:

Based on current business performance and excluding any acquisitions we may make during the year, we expect leverage to continue to reduce during 2018 to below 2.0 times by the end of the 2018 financial year.

Ok, I'm now satisfied that the balance sheet is fine.

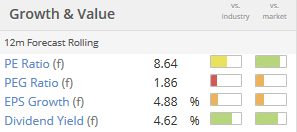

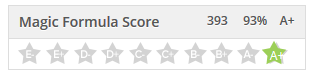

Pharma is not my specialty, but the broad financial picture this stock presents does look very nice. The StockRank is 85 and it is top-ranked according to my preferred stock screen, the Greenblatt Magic Formula:

It was mentioned in the comments that Stockopedia computers peg this stock as having an Earnings Manipulation Risk.

If you dig in to the reasoning for this, it arises from the following three factors:

- "Excessive sales growth" (not surprising, given the Buy & Build strategy)

- "Sales, general and administrative expenses not under control"

Alliance comments on its expenses as follows:

As planned, the Group increased investment in sales and marketing during 2017, focusing on our International Stars to support sales growth; this additional spend resulted in an increase in administration and marketing costs (excl. depreciation and amortisation) of £2.4m to £30.8m, representing 29.8% of sales.

- "Decreasing depreciation rate" (statistically, earnings manipulators don't sufficiently depreciate their fixed assets)

Depreciation is small for a pharma company, I wouldn't worry about this.

My conclusion is that Alliance is probably a false positive when it comes to the automated earnings manipulation test.

SCISYS (LON:SSY)

- Share price: 132p (+3.5%)

- No. of shares: 29 million

- Market cap: £39 million

This is an IT service provider, with a wide range of capabilities. On its own website, it says:

It is impossible to list all of the SCISYS capabilities. As a software and solutions company SCISYS has solved a huge range of customer problems using a wide range of technologies.

It then proceeds to offer a graphic illustrating its various areas of expertise, as follows:

Nice results today:

- Revenues up 25% to £57.2m (2016: £45.7m)

- Statutory operating profit increased to £4.7m (2016: £2.8m)

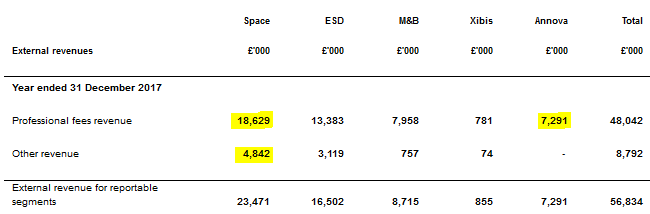

The really big contributors to revenue growth were the Space segment and an acquisition called Annova:

There are too many moving parts for me to be able to gain a strong understanding of this stock in a short period of time. It does have a very good track record of profitability over the last decade or so, and share dilution has been negligible.

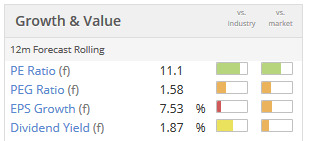

The balance sheet isn't bullet-proof, and not much growth is forecast, but this is arguably reflected in the earnings multiple.

Ok, that's it for today! I'm out of time.

Have a good evening.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.