Good morning! I'm back home again after a few days in London for various company meetings, so am looking forward to having a few more leisurely days, not charging around on the tube or Boris Bikes! Yesterday I had a very pleasant lunch at Buchanan Communications with Zytronic (LON:ZYT) who delivered their results presentation. So I'll do a write-up on that meeting here on Stockopedia when time permits, probably later today.

It's quiet for results today. The only Listed insolvency practitioner Begbies Traynor (LON:BEG) has issued interim results to 31 Oct 2013. They're not very good - turnover down 14.6% to £22.3m for the six months, and adjusted profit before tax is down 34% to £2.1m. This equates to adjusted diluted EPS down 28% to 1.8p, or 1.7p is you ignore adjustments. However, this is not a surprise, as broker consensus was expecting a decline in profitability this year, since slow insolvency market conditions has been a known factor for several years now. So broker forecast for this year is a reduction to 4.3p.

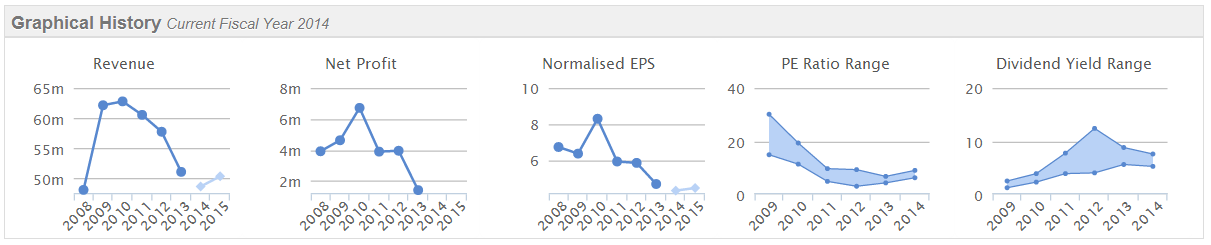

These interim results look to be in line with expectations at 1.8p, since H2 is traditionally stronger than H1, therefore the company seems on track to meet the full year forecast of 4.3p. Note how the business has been shrinking in recent years:

As you can see, turnover & profits have been declining for four years now. However, also note how the PER has been low for several years, and the dividend yield has been getting stronger, and now stands at a very attractive 5.8% forecast for this year (assuming the 2.2p p.a. total payout is maintained).

The interim dividend has been maintained, at 0.6p, which is encouraging. So Begbies has managed down its costs to reflect quiet corporate insolvency market conditions, and is still generating enough profit in tough market conditions to pay a generous dividend. I quite like that.

At some point in the future, there should be an increase in corporate insolvencies, probably when interest rates rise, and the Banks balance sheets are strong enough to make full provisions against zombie company debts - i.e. companies which can service the interest on their debt at ultra-low interest rates, but which have little prospect of being able to cope with higher interest rates, let alone ever repaying the capital.

I seem to have been saying this for years. It's still no clearer when BEG will benefit from this, but at some point they surely will. There's a lot to be said for sticking with companies that are cheap in depressed market conditions, as you get the eventual upside in for free.

Last time I saw management of Begbies, about a year ago from memory, they indicated that vendor price expectations were coming down to more realistic levels, hence we would see some small acquisitions going forwards. They have made one such acquisition, of Cooper Williamson Ltd in Manchester, acquired for £0.9m in a 50:50 split of cash & shares. It's a clever deal, where additional contingent payments of up to £1.6m are payable over 5 years, which means that vendors are incentivised to continue driving the business hard - essential when buying a people business.

Overall these results & outlook seem fairly neutral to me, i.e. I don't see anything particularly positive or negative that should move the price much. Although there are usually a few holders who expect more, and hence sell up on results day, so we might see the price come off a few pence today, who knows?

I'll read through the narrative in more detail later, as usual this report is just my initial reaction to the headline results & outlook, then I plough through the detail later on.

This is the last call for Ed's latest Webinar here on Stockopedia, which starts at 12:30pm today. The link to book a place is here. For people who are not familiar with the format, Ed talks & demonstrates Stockopedia features at the same time, which you can follow on your screen in real time. Then listeners can submit questions in a text box, if you wish. Or just follow at home without interacting.

To get a flavour for the type of things discussed, here is a video of Ed's last webinar. I shall be listening in today at lunchtime, as these things are pitched for investors of all levels, from beginners to experienced.

There is an update today from Snoozebox Holdings (LON:ZZZ), a company which regulars here might recall I liked in 2012, but went off in 2013, as their exciting plans to create mobile temporary hotels, using converted shipping containers, seemed to be doomed to commercial failure, despite being a clever idea.

The update today is surprisingly positive in tone, and drastic action has been taken to stabilise the business, including a 60% reduction in permanent headcount, which must have been painful.

Whether they've got a viable business in the long run, I don't know, as there don't seem to be any broker forecasts out there. The only indication of profitability in today's statement is this comment (my bolding added);

I am pleased to report that the changes implemented by the new management team are leading to a turnaround of operating performance of the Company and have resulted in a positive contribution to central overheads in the third quarter, compared to the losses reported in the first half of the year.

So a positive contribution to central overheads really only means that direct costs are being covered, plus a bit more. Hence still loss-making overall.

This section is interesting though (again, my bolding of key sentence);

In order to capitalise on the demand, the Company must evolve its product range. We have made substantial progress on this and the next generation product is designed, ready to build and will reduce deployment time and cost dramatically. The integration of systems, utilities and ancillaries minimise the assembly process, thereby reducing overhead costs. The resultant reduction in the deployment time from one week to one day opens up the potential for a substantial increase in occupancy and revenues.

The original snoozebox units had a separate container which provided all the utilities, i.e. water, sewage, electricity, etc. Those will be integrated into the new units built, which sounds an excellent step forwards. Although bear in mind they will need to raise more funding to build new units.

Overall, I am still intrigued by the concept, but am not convinced it will be a very good investment, even from the current depressed price. The market cap is around £14m at this morning's price of 13.25p, which is quite a lot considering the company has not yet reached viability, and that it will need to raise more cash for building more units.

The curious case of Silverdell (LON:SID), where shareholders have effectively been left in the dark for the past five months with the shares suspended, took another twist yesterday with an update that still avoids explaining fully what on earth has actually gone wrong there.

The latest turn of events is that HSBC have exited, by selling their debt to a turnaround investor called Rcapital Partners LLP. Since debt ranks ahead of equity in insolvency, then a highly indebted company is effectively controlled (or can be controlled) by the holders of debt. It is therefore within their hands over how things move forwards. One assumes that Rcapital will be looking to feather their own nest, rather than being kind to shareholders, to whom they have no real obligations.

Or, they might want to retain the Listing, and rebuild the share price, in order to refinance the company permanently, and make a turn on their investment (I'm assuming that Rcapital will have bought the Bank debt at below par value?), I don't know, and it's not clear from yesterday's statement what they are planning on doing. Although I note that Rcapital has already helped itself to two of Silverdell's subsidiaries, which have been bought for £1, and forgiveness of £5.5m debt. These two subsidiaries generated about a third of Silverdell's operating profit, so it looks to me as if the business is now being carved up, and shareholders will probably be left with nothing. What a shambles.

This is a great example of why I usually avoid companies with significant amounts of debt. If something goes wrong, shareholders are then completely at the mercy of the Bank, or whoever the Bank decide to sell off the debt to.

In this case, shareholders have been left in the dark, and it reflects very badly indeed on everyone involved. What I can't quite understand is that the CEO who presided over this disaster is still there, and;

...is sharing in the investment risk and returns with Rcapital Partners LLP in order to align their goals moving forward... The Board supports the transaction as it is the only feasible option available to the Group at this point.

I'm sure shareholders will be delighted to hear that the CEO has aligned his personal interests with Rcapital. It is not clear from the statement whether the shares will come back from suspension or not, but my guess is that it's probably game over for shareholders now, whilst the spoils are carved up by the new debt owner.

So what are the lessons to be learned from Silverdell? It's too early to be sure, as we still don't really know what actually went wrong. At first it looked like some kind of giant admin cock-up, but it's dragged on too long now for that to be the case. Therefore there must have been an element of misleading, or at least aggressive accounting going on perhaps?

I never took a big position in Silverdell because the Balance Sheet was stretched - they had a poor working capital profile, whereby customers took 60 days+ to pay Silverdell, whereas Silverdell had to pay its costs, mainly staff, weekly and with no delay. So as they expanded, the business became more cashflow hungry.

Management also failed to put in place adequate equity financing on the Balance Sheet, but instead expanded rapidly using debt. Also their profits seemed to rely on adjustments, and profit didn't translate into cashflow (which is always the biggest warning sign at problem companies).

Also, the CEO was, by his own admission, inexperienced and relied on the Chairman for tutoring. Combine that inexperience with ambition to expand rapidly, and it's a toxic mixture.

There was certainly an element of investor "group think" with Silverdell - where bullish shareholders inadvertently created an environment which blocked out any criticism of the company, as people reinforced each others bullishness on the stock.

Group-think is nearly always a mistake, and you see it very much in evidence on bulletin boards at the moment - where negative voices are aggressively silenced, with a tidal wave of personal abuse. Yet the smartest investors actually listen to bearish arguments first, and only invest when they are satisfied the bears are wrong.

It's vital to remain an independent thinker, and not get sucked into investments just because lots of other people think they are good. That independent train of thought saved my bacon with Silverdell - I somehow sensed something wasn't right there - partly due to the weak Balance Sheet, but also that I just didn't believe management when they assured us that their finances were fine, and no additional equity was needed, when a group of us saw them just a few weeks before the shares were suspended. They tied themselves in knots, and seemed to contradict themselves at a meeting I attended, which convinced me to sell the small position I had taken (against my better judgement) a few days before.

It's also a reminder that, as small shareholders, we are really just cannon fodder - we don't have any rights, and there isn't anybody really protecting our interests. So the investing world really is a jungle out there, especially with smaller companies. A radical overhaul of the entire system is needed, in my opinion.

Several people have asked me why the share price of Vislink (LON:VLK) has been so soft recently? In my opinion it's simply a result of their recent announcement of the shares moving to AIM. Not all shareholders can hold AIM shares, so this is likely to cause some short term indigestion as the shareholder register adjusts. In my opinion, all other factors being equal, that presents a potential buying opportunity.

Several people have asked me why the share price of Vislink (LON:VLK) has been so soft recently? In my opinion it's simply a result of their recent announcement of the shares moving to AIM. Not all shareholders can hold AIM shares, so this is likely to cause some short term indigestion as the shareholder register adjusts. In my opinion, all other factors being equal, that presents a potential buying opportunity.

In the long-term, the move to AIM will probably be positive for the shares, as new investors seeking the tax advantages of AIM (especially exeption from Inheritance Tax after holding for two years), and exemption from Stamp Duty which starts in April 2014 now makes AIM a highly attractive market for investors.

On the other hand, corporage governance on AIM is very poor, so it's very important to scrutinise the conduct & track record of management at each company, and decide whether you fundamentally trust them or not, since in reality there is virtually nothing to stop them doing whatever they want.

So key things to consider is whether they consistently pay dividends, whether management remuneration & share options packages are fair & reasonable. Whether increases in pay have been linked to increases in shareholder value. Do they have enough "skin in the game", i.e. personal shareholdings? Do they run the company in a prudent way? Do they make themselves available to shareholders who wish to contact them, or are they high-handed in their treatment of shareholder queries? Do they get out there and present the company's results to groups of private investors? Are the Non-Execs really independent, or are they just mates of the CEO? These sort of questions are easy to find out answers to, and build a picture of the people involved. Some investors like to meet management (I do) to get a flavour for what they are like as people, whereas others find that clouds their judgement, so whatever works for you is best.

Going back to Vislink, the shares look excellent value to me at 41p, based on forecast EPS of 2.85p EPS for 2013 and 3.9p for 2014. I reckon that 3.9p could be too low, and personally I am working on the latest Edison forecast indicating 4.2p for 2014. So that puts the shares on a PER just under 10, which seems far too low given the company's strong performance, Balance Sheet with significant net cash, decent dividend yield, and ambitious management with good turnaround & acquisition track record in the past.

But as always, this is NOT a recommendation, we don't do recommendations at all on Stockopedia, this is just an idea for readers to do your own research. It's very important generally not to allow the background noise of short term market price fluctuations to divert one from the investing fundamentals. So if a good quality stock gets cheaper, in my view one should be considering buying more, not selling! It's the other way around - so I think about selling things when they've gone UP, not down! BLASH is the ultimate goal for what we do after all.

The market has reacted positively to this morning's trading update from small finance company 1pm (LON:OPM), ahead of their interim results to 30 Nov 2013. This is a smashing little company - they are doing a roaring trade providing asset financing to SMEs, in the space that seems to have been vacated by conventional Banks. So think in terms of people setting up a new cafe or hairdressing salon, they will go to 1PM and arrange the financing, typically about £20k per deal, for the equipment needed.

It seems to be all systems go at 1PM, with the key part of today's statement saying;

The Board expects to report significant revenue and profits growth for the first six months of the current financial year compared to the corresponding period last year.

It's now just a straightforward matter of growing the business by lending more. The funds are provided by a mixture of equity, and loans from HNW individuals or companies, who get something like 7-8% interest received from 1PM, who then lend the money on at nearer 20% to the end customers. So a really simple business model. 1PM seem to have good internal controls over underwriting, and structure deals usually with personal guarantees from the borrowers.

Of course at some point this space will become more competitive as the Banks return, but in the meantime 1PM are making hay. Thinking back to my days as an FD in the 1990s and early noughties, asset financing was very competitive, with the interest rate margin made by Banks only about 2-4%. So bear that in mind, since 1PM are arguably making super-normal profits with their lending margin at about 10-12%, due to lack of competition. It's not going to stay like that forever, so in my view the growth has to be balanced up with the likelihood of lending margins narrowing over time.

I've had a very quick look at the results from micro-cap plastic manufacturer Coral Products (LON:CRU). They're not very good, and the share price is down 14% to 9.75p at the time of writing. That means the market cap is only about £4m, so there really isn't any point in it being Listed. Although it did start paying a 0.5p p.a. dividend in 2011/12, so if that is maintained then it could be interesting, as that's almost a 5% yield.

One should always look at the dividend-paying ability, rather than what is actually being paid, and in this case the Balance Sheet is a bit stretched, with some debt, and their profit record is weak, so I wouldn't rely on this dividend being maintained in the long term.

It's just too small. Although the micro cap space is lively at the moment, and the most unremarkable businesses are seeing sudden spikes in their share prices. So for wild gamblers, this area can be quite interesting in a bull market. Although I note that, with this being a capital-intensive business, once you add back the (non-cash) depreciation charge, this business is actually generating quite decent EBITDA - of £860k in H1.

There are also some interesting-sounding contract wins in the outlook statement, so you never know, for risk tolerant investors this might be worth a look?

Right, that's me done for today, I shall nip out and buy some sandwiches, make a few phone calls, then settle down to listen to the boss's Webinar here from 12:30!

See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in BEG, and VLK.

A small caps fund to which Paul provides research, has long positions in VLK and ZYT)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.