Good morning!

PuriCore (LON:PURI)

There's a profit warning from this disinfectant company. Having recently disposed of its endoscopy business, Puricore now has plenty of cash. At this morning's share price of 36.5p (and with 50.1m shares in issue), the market cap is currently £18.3m. This compares favourably with net cash of $3.9m at 31 Mar 2014, plus $25.3m cash (after costs) of the disposal, giving $29.2m, or £17.1m net cash before taking into account any trading losses since 31 Mar 2014. Or in other words, the company had 34.1p/share in net cash if you adjust the 31 Mar 2014 figure for the disposal. That price should provide a fairly firm floor for the share price in my opinion, and means that downside risk is limited from this point.

The business is more-or-less thrown in for free, which given its historic performance is probably sensible. However, markets look forward, not backwards. So with some big name clients in their supermarket focussed business, buying a consumable product, it seems to me that there is a viable business in here somewhere. Perhaps it needs a change of management to strip back costs, and have a sharper focus on sales growth?

Encouragingly, today's announcement repeats the previous possibility of a partial return of cash to shareholders, which would be an excellent move in my opinion. I don't like the idea of £17.1m burning a hole in their pockets, so shall be writing to the company to express this preference, and suggest other shareholders follow suit. I feel that a 20p per share cash return (about £10m) would be the best course of action.

There is some good news in today's announcement, with demand for consumable products strong;

In-market demand for consumable implementations has been encouragingly strong with existing and new customers signing on for the new products. Meeting this demand in a short timeframe has resulted in higher than expected service costs during the period, which is being addressed as an operational priority. The Board remains confident that with enhanced investment in sales and marketing resources, accelerated market share can continue to be achieved.

So taking that at face value, it means increased losses in the short term, but problems caused by demand being strong are the best type of problems to have, as they are fixable, and should lead to higher profits once fixed.

The disposal of the endoscopy business is described as a distraction, which is fair enough, it would have taken up a great deal of management time.

The conclusion is that H1 is going to be poor;

As a result of all these factors, the Company expects to report an operational EBITDA* loss for H1 2014, materially lower than the positive EBITDA reported for H1 2013. Full results, including the financial impact of the sale of the Endoscopy business, will be provided in the interims to be released in early August.

Personally I'm looking through short term performance, and am more interested in what the strategic review decides, and whether they can deliver on the potential of the remaining business. Remember that a Director spent £700k buying shares here last autumn, and that decision has been validated by the value in the endoscopy business, but not yet with the rest of the business.

The market has been savage with the share price today, marking it down to 34p now, so at par with net cash. Although bear in mind that whilst the company is loss-making, the net cash figure will go down. Let's see where we are in six months time anyway - it's not a share to trade, you either believe that a good business can be created out of this, or you don't. Meanwhile the cash pile at par with the market cap acts as considerable downside protection for the time being.

EDIT: A reader called "BeatingMrIndex" has made a very good point in the comments below. As he points out, having sold the profitable endoscopy business, PuriCore is now a considerably smaller business. Therefore the high management salaries need to be lowered accordingly to match the smaller size of the business.

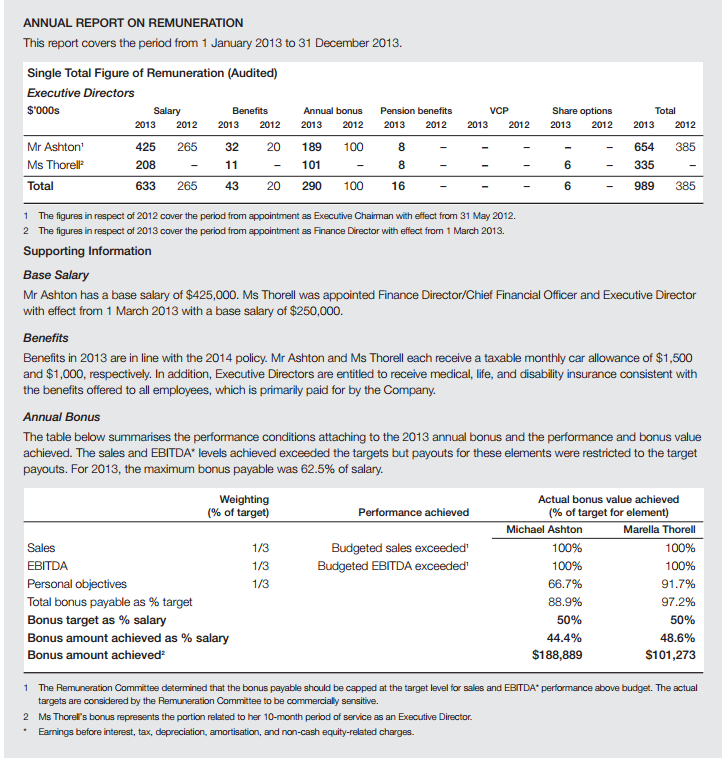

Please click on the thumbnail image to see the relevant extract from the 2013 Annual Report. Bear in mind these figures are in US dollars, so you need to divide them by 1.71 to convert into sterling. The bonus scheme is a joke in my view - no loss-making company should be paying any bonuses to Directors at all. So that needs scrapping for starters. I didn't include the Non-Execs pay on the following page, as that looks fine.

You do sometimes feel that when Directors talk about shareholder value, they're just paying lip service to the concept. I'd like to see a rocket put under this management, and some decisive progress made in the next 6 months. Although credit where credit's due for selling the endoscopy business for a favourable price.

All Leisure (LON:ALLG)

I've looked at this small cruise ship operator several times over the years, and for a brief time owned a few shares in it. The company seems to have problem after problem, with ship breakdowns, and they also seem extraordinarily unlucky with geopolitical events. Wherever a war breaks out, this company seems to operate a cruise ship there, and ends up having to suspend operations. Or some catastrophic mechanical breakdown occurs if there hasn't been a war lately. OK I'm exaggerating, but it's just been one thing after another over the years.

Interim results to 30 Apr 2014 are published this morning, and they are terrible - but that's because the company loses money over the winter, and makes money over the summer. Although looking at the prior full year comparatives, they didn't make much in the summer.

Travel companies often have stretched Balance Sheets, but this is one of the worst I've ever seen. The entire business is financed by customers deposits. That is true of many travel companies, airlines, etc, but it's fundamentally wrong in my opinion.

At 30 Apr 2014 current assets were £20.8m, but current liabilities were £71.9m! That's a shockingly bad position. So current assets are only 28.9% of current liabilities - which would be insolvent for most companies. It's only because customer deposits are continuously paid up-front (and are included within creditors, as deferred income) that the business can continue operating at all.

Net tangible assets are negative by £17.1m.

For good measure, there is also a further £10.1m of long term creditors.

Dividends were stopped in 2011.

It's just dreadful in my view, I wouldn't go near these shares, as they are ridiculously high risk in my opinion.

If you're happy to ignore the risks though, the outlook has some positive noises in it;

Looking forward there are some positive signs for future trading. Where previously the Group had experienced later bookings, trading at this early stage of the financial year 2014/15 has started well in both the Cruising and Tour Operating divisions. Sales remain ahead of last year.

...The Group will benefit further next year from further capacity reduction in the Cruise division through the previously announced disposal of mv Discovery. We expect these factors to provide the basis of a significant improvement in shareholder returns.

It's uninvestable as far as I'm concerned, but good luck to holders.

Coms (LON:COMS)

Lots of small caps are falling at the moment, especially ones which are more speculative, or difficult to value.

Coms has come back down to where is was late last year, on a series of disappointments;

A trading update today starts by saying;

To date, trading across all of the Group's business has been encouraging and, as stated in the announcement of the results for the year ended 31 January 2014, the Board remains confident that the Company is on track to meet market expectations for the current financial year.

That sounds OK. Looking at broker consensus, it is for a huge jump in turnover to £46.8m this year, with profit more than doubling to £2.6m. A further big rise in profit to £5.6m is forecast for next year. This is starting to look potentially interesting at a market cap of about £41m (at 4.07p per share).

The company then goes on to warn on H1 profit at the profit before tax level, due to restructuring costs following acquisitions. If you take a bullish view, you would look through this as a temporary factor, which is probably why the shares have hardly moved today, at least after a nervous blip down first thing.

The company says that H2 should see a "significant improvement in profitability".

The FD has stepped down, but is staying with the company - it looks like this was due to the awkward announcement on 13 Jun 2014 about auditors requiring the reported EBITDA figure to be reduced from £1.4m to £827k. So a more experienced FD is being sought, which sounds sensible to me. This is a problem that bedevils many fast growing companies - the original medium to senior management usually lack the experience to handle their existing job once the company becomes much larger. Replacing them can be fraught with difficulty and awkwardness, so they are often left in situ until something goes wrong.

The Chairman has also resigned, "for personal reasons". So it looks like they're having a good old management clear-out. Although you do wonder what the circumstances are, and if there is anything for investors to worry about?

The CEO comments make me a little nervous, and on balance I'll wait to see the next set of interims before taking this one any further. Today he says;

Dave Breith, CEO stated: "The Company is performing well and, whilst the integration of the various businesses acquired has also gone well, it will take time to see the full benefit of the cost synergies we have identified. We have a strong pipeline of potential contracts, of varying sizes and terms, and I remain extremely confident in the Company's ability to deliver against market expectations.

I reviewed the last set of numbers (for the year ended 31 Jan 2014) from Coms here on 9 Jun 2014, correctly concluding that the shares were too expensive at 6.2p.

I can't really take it any further, as the valuation is still high at £41m market cap, but if they meet broker forecasts for next year, then the stock would be cheap. Trouble is, the forecasts show exponential growth in profit, which is impossible for me to verify.

So my view on the company is neutral, but am flagging it as something that readers might want to research more for yourselves. If so, do please report back in the comments below.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.