Good morning everyone,

It's busy today in RNS-land. I intend to cover the stocks mentioned in the title above.

Paul's article can be found here, covering AO World (LON:AO.), JD Sports Fashion (LON:JD.), Debenhams (LON:DEB), Moss Bros (LON:MOSB), Mothercare (LON:MTC) and Robinson (LON:RBN).

Stadium (LON:SDM)

Share price: 84.5p (+3%)

No. shares: 38.2m

Market cap: £32m

Trading Update, Acquisition and Notice of Results

The bottom line is that trading for 2016 was "broadly in line with market expectations".

The order book has seen "significant" year-on-year growth, and net debt was £3.5 million.

There is also news of a small-ish acquisition (£0.75 million in cash). Sounds fine.

My opinion:

This update probably won't change anybody's mind on the attractiveness or otherwise of the company.

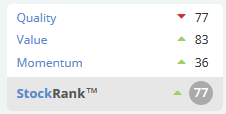

The higher-margin technology division is growing at a slightly faster rate than the rest of the business, bank debt is manageable, and profitability is on a decent trend. So plenty of reasons to take a look at it, along with a healthy Stockrank!

STM (LON:STM)

Share price: 43.5p (+14%)

No. shares: 59.4m

Market cap: £26m

Another "in-line" trading update (generally, I will cover trading updates more briefly than results statements, especially when they are in-line).

The Board is pleased to announce that the

Group has traded in line with market expectations of profit before tax

of £2.7 million for 2016 (2015 actual: £2.7 million).

Kudos to the company for quantifying market expectations in this announcement, rather than inviting readers to look it up somewhere else.

Some positive sounds that growth might ramp up in future years, after the flat result in 2017:

As was anticipated, the pricing initiative taken by the Board in the earlier part of the year has significantly increased the take-on of new business for its QROPS international pensions product with new policies for the second half of the year up by circa 50 per cent on the first half of the year and 27 per cent on the second half of 2015. As previously indicated, whilst this strategy resulted in a reduction in first year profitability, it does result in an increased level of recurring revenue for future years. This leaves STM well placed to deliver significant growth in revenue and profit in 2017.

QROPS is a type of overseas pension scheme, which is a bread-and-butter product for STM (a cross-border financial services provider, catering to high-net-worths and corporates).

Checking the STM website, I see they are offering a "zero establishment fee" on QROPS until March 2017 (and presumably until after then, if it is working?)

Tolerance of short-term losses on customer acquisition and customer set-up is a key part of the competitive dynamic in some industries. It looks as if STM have realised that their business model still works with higher losses per customer on set-up.

I have seen first-hand how some businesses will accept customers which won't become profitable unless they stick around for 5-6 years. That works sometimes with long-term products, e.g. with pensions and other financial policies which could be in force for several decades.

STM shares look good value to me against profitability, and the business looks to be in pretty good shape. So I'm not sure what the "catch" is yet. There is usually a catch!

GYM (LON:GYM)

Share price: 193.5p (-3%)

No. shares: 128.2m

Market cap: £248m

Yet another in-line trading statement. Companies seem to be predicting their profitability rather well at the moment!

- Earnings for 2016 are expected to be in line with consensus market expectations (which I understand to be for pre-tax profit of £8.7 million).

- Revenue growth of 22.6% for the year.

- Year-end members grew by 19% to 448,000.

- Year-end net debt of £5.2 million (down from £7.1 million).

I'm not clear as to why the market's reaction to today's statement has been so muted. 15 new gyms in the year is at the lower end of guidance, but the outlook for 2017 suggests that 20 new gyms is highly achievable.

I suppose growth in members could have been a bit higher. Members grew at a much higher rate of 28% in the prior year.

Pure Gym

The Gym Group remains the only listed company in the "disruptive" fitness sector, as rival Pure Gym abandoned the listing process last October, claiming that it was an unfavourable IPO environment.

With the FTSE now at all-time highs, perhaps Pure will be tempted back to the market? As these two companies grow, it's likely that their ownership structures will evolve. Indeed, they may wind up under common ownership, eventually.

My opinion:

Gym shares have made no progress since their 2015 IPO, which seems a bit harsh to me, given the growth profile and the operational milestones achieved. I expect that 24/7, flexible, highly-automated gyms will grow the size of the overall fitness market, while continuing to steal market share from conventional offerings, for many years to come.

Saying that, it's quite possible that I have been too easily impressed by the business model. A strictly quantitative approach would not recommend any investment here. See the company's StockRank:

Premier Oil (LON:PMO)

Share price: 92.5p (+1%)

No. shares: 511m

Market cap: £472m

We don't usually talk about the black stuff here (I mean oil, not Guinness).

But Premier is one of the most closely-followed oil stocks and has been in a rather intriguing situation for some time: carrying several billion dollars of debt, and unable to satisfy its covenants, but with the lenders seeing no alternative but to repeatedly defer the covenant tests while they come up with a plan for how to proceed. There is no simple way for them to get back what they are owed!

Today's trading update shows that operationally, the company did well in 2016:

- Record production, up 24% on 2015.

- Opex per barrel of $15.7.

- Below-guidance capex spend of $690 million.

The problem: net debt of $2.8 billion, dwarfing the market cap, and overwhelming the company's ability to satisfy normal EBITDA covenants.

To give a sense of the scale of the company and its complicated situation, just consider that it had a huge, $6.3 billion dollar balance sheet at June 2016, funded by total liabilities of $5.4 billion and equity of just $855 million.

That equity figure included goodwill of $240 million and capitalised exploration/evaluation costs of $900 million (implying a negative tangible net asset position).

Refinancing

Amazingly, Premier may have found a creative solution which will not inflict too much pain on existing shareholders:

The long form term sheet, in which these commercial terms are embedded, is at an advanced stage and is expected to be circulated to all lenders for their review and formal approval shortly. At that time, Premier expects to announce the full detail of the commercial terms which Premier anticipates will include equity warrants as part of the economics to lenders. Implementation of the refinancing will not otherwise be conditional upon the issue of new equity.

Pricing of the warrants is critical: the higher the price, the fewer which would need to be exercised to recapitalise the company, and the less dilution for the existing base.

Of course, they can't be priced too high, or they won't be exercised, and therefore will achieve nothing for anybody.

On that basis, I'd continue to expect significant dilution for existing shareholders (and regard the existing equity as uninvestable), but it will be interesting to see how it plays out.

Whatever deal is on the table, it will need to be offered to all bondholders who might otherwise be able to enforce their position at some point. It looks as if the convertibles haven't agreed to anything yet:

Substantially the same economic terms will be offered to the retail bondholders as to the Private Lenders and these will also be disclosed at the same time as the terms being offered to the Private Lenders. Negotiations with the advisers to an ad hoc committee of the Group's convertible bondholders are ongoing.

SuperGroup (LON:SGP)

Share price: 1735p (+1%)

No. shares: 81m

Market cap: £1,410m

Interim Results for the 26 weeks ended 29 October 2016 and Peak Trading Update

Excellent performance from this fashion brand. Note the impact of currency, due to the impact of foreign stores:

Dividend

The interim divi is raised 26% to 7.8p.

Operational

Strategic goals beings met with next generation stores, North America progress and China store openings.

Peak Trading Update

For the 10 weeks to 7 January, revenues increased by 20.6% y-o-y, with like-for-like growth of 14.9%. (at constant currency, this will be lower).

Net Cash

At the end of H1 was £40 million.

Outlook

CEO remarks:

Having traded well through our peak trading period,

the Board remains confident in delivering full year underlying profit

before tax in line with analyst expectations6 and in the Group's long term growth prospects as Superdry becomes a global lifestyle brand."

Very helpfully, the company explicitly tells us what it believes these expectations to be: underlying pre-tax profit for the year to April 2017 of £86.2 million (upgraded from £84.6 million pre-Christmas).

Footnote 7 also includes a range of extremely helpful points of guidance on capex for the year (£60 - 70 million), central costs, working capital, etc. While FTSE-250 companies should have better guidance than the small-caps, it's always appreciated when you find it!

My opinion

This is a share which I have previously bought on behalf of others, and I would still call myself a fan of the company.

When I purchased it before, it was a very strong candidate according to the Greenblatt Magic Formula.

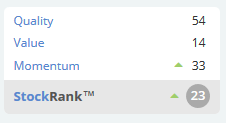

Stockopedia computers inform me today that SuperGroup is not currently in the top 30 UK Magic Formula stocks, which is no surprise given the declining Value Rank:

It's difficult to maintain very high levels of bullishness with the share price having increased 70% in two years, but on balance I'd still feel positive about owning this, if I currently had a stake.

I'd just like to mention one element of caution in relation to the Chinese expansion.

The way that SuperDry originally caught on in the UK was by using random Japanese characters, which ordinary people didn't understand but which were perceived as cool. Customers assumed it was a trendy Japanese company, not a British company using badly translated phrases.

To put it mildly, I don't think this strategy would work in China.

If I may generalise, Chinese people will not automatically perceive something as "cool" just because it has random Japanese characters on it. For one thing, Japanese characters are not exotic or mysterious, since many of them are derived from Chinese characters.

It would be akin to a Chinese company putting random French words on clothing items, and thinking that this would be considered cool in the UK (it might be, of course, but there is an awful lot more to it than that).

The quality of the merchandise, the store layouts and many other factors could help to bring SuperDry success in China, but success will definitely not be achieved in the same way that it was done in the UK!

That’s all from me today – I hope

you’ve found this miscellany of stocks reasonably interesting!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.