Good morning! The market opened down heavily first thing today, but has since bounced back. I suppose the escalating situation in the Ukraine must be worrying everyone, but I cannot see why that should make me adjust my investment portfolio. So I'm not.

French Connection (LON:FCCN)

Rather annoyingly, fashion retailer French Connection has ignored the convention of issuing trading statements at 07:00, so that everyone has one hour to digest the contents before the market opens. Instead the company has issued a stonking trading update today at 08:39. The price shot up about 10% within seconds, and it is obvious why;

In the 11 weeks to 12 April 2014, UK/Europe Retail LFL's were up 11.0%, continuing the positive trend as our retail initiatives and improved product range continue to gain traction.

Given that this company has really struggled in recent years, a bounce back to an 11% increase in LFL sales is remarkable. Although they do go on to caution that the prior year comparatives were soft, at -4.5% for the equivalent period.

Even so, this completely transforms things. Thinking back to my days in ladieswear retailing, a sales increase of this magnitude means that your buyers have really hit the spot in terms of the fashions. That means you sell a lot more at full price, so there should be a double benefit from a higher gross margin, although today's trading statement says nothing about that.

I've done some very rough calculations based on last year's interim figures, and I reckon this should translate into additional H1 retail sales of about £5.1m, at a 55% gross margin that is £2.8m in additional profit. Add another 2% gross margin onto all UK/Europe retail sales (my assumption), and that adds another £1m. So that gives a possible improvement in H1 profitability just in the UK/Europe retail division of about £3.8m. Given that the group made an H1 loss of £6.1m last year, it looks as if a sharply reduced loss of about £2.3m for H1 is now on the cards. Add in some improvement from the other divisions, and they could be approaching breakeven for H1. That would be a very good result, as it's an H2 weighted year, so it's now a real possbiliity that FCCN could actually report a profit for the full year to 31 Jan 2015.

At 75p per share, and with 95.9m shares in issue, the market cap is £71.9m. The group's own net cash makes up getting on for half of that valuation (although the year end is a seasonal peak for cash). There should be further profit upside from the gradual closure of loss-making shops as leases expire.

So all in all, this has now moved from an each way bet on a turnaround being possible (with the downside protected by a bulletproof Balance Sheet), to an actual turnaround that is now clearly happening. As such I shall be sitting tight on my remaining shares, having top-sliced some a little while ago after it doubled in price. Onwards & upwards here, I reckon!

Everyone thought I was mad buying these shares at 20-30p in 2012-13, and there was near unanimous negative sentiment surrounding the shares, so the turnaround possibility was thrown in for free. As Antony Bolton says, your best investments are often the most uncomfortable purchases originally.

Today's trading statement should certainly trigger broker upgrades.

It's Mello Beckenham tonight. There will be a company presentation, and also a panel Q&A with two leading small caps fund managers, so should be an interesting evening, see you there! (click here for booking details)

Networkers International (LON:NWKI)

Most recruitment companies shares have gone through the roof in the last year, on growing earnings, and expectations of stronger results as Western economies recover. One which has been relatively subdued is Networkers International. Results for calendar 2013 are issued this morning, and look reasonable to me.

Adjusted EPS is up 11% to 5.21p (2012: 4.7p), although most of the increase seems to have come from a reduced tax charge compared with last year. Adjusted profit before tax is only up 1.4%. Although the tax rate is actually still high, at 37%, so it doesn't look as if the company has benefitted from an unusually low tax rate, quite the opposite. Maybe it generates most of the profit in high tax jurisdictions? That needs looking into, but it's a source of potential upside from a lower tax charge in future perhaps?

Given that the shares can currently be bought at 53p, that is a historic PER of 10.2, which looks good value to me, providing there is not too much debt.

So, looking at the Balance Sheet, I am pleasantly surprised. Net tangible assets are £14.4m, and there is a healthy working capital position, with current assets being 167% of current liabilities - that's a lot better than many small recruitment companies. Non-current liabilities are negligible at £241k, so that's another positive tick.

The cashflow statement reads very well too. It's generating plenty of cash, paying a decent dividend, and being a people business requires little capex. Debt is being paid down well too. Note that the final dividend has been increased strongly at 54% to 1.0p, giving a full year dividend of 1.7p (2012: 1.25p), for a yield of 3.2%.

These are all good numbers in my view. The only concern is a lack of growth - other recruiters have been showing stronger growth, and are hence more highly rated by the market in terms of PER. So outlook is important here. The company today says;

Whilst current trading is in line with 2013, market conditions do appear to be improving in all our markets and we see significant opportunities for growth as the year progresses.

That sounds encouraging, so given that the price is only a PER just over 10 times 2013 earnings, then we might be looking at say 8-9 times 2014 earnings? That's good value in my opinion, so I've picked up some more stock this morning personally.

Another point worth mentioning here is that the company appears to be buying back its own shares gradually. It's very unusual to see the average number of shares shown on the Stockopedia StockReport declining every year, which is the case here, reducing by an average of 1.5% each year. This is very good for existing shareholders, as it drives up EPS, since earnings are being divided by fewer shares each year. It should also mean the dividend grows nicely each year too. Not a huge consideration, but a definite positive.

Another point worth mentioning here is that the company appears to be buying back its own shares gradually. It's very unusual to see the average number of shares shown on the Stockopedia StockReport declining every year, which is the case here, reducing by an average of 1.5% each year. This is very good for existing shareholders, as it drives up EPS, since earnings are being divided by fewer shares each year. It should also mean the dividend grows nicely each year too. Not a huge consideration, but a definite positive.

The top shareholders list has some excellent shrewd names on it, including Nigel Wray, Hargreave Hale, and J Moulton, which I presume might be venture capitalist Jon Moulton? There's a lot to be said for following shrewd investors, as arguably they've done the Due Diligence for you. Although it's also a lot harder for them to exit, so care needs to be taken that you're not buying into their stale bull positions.

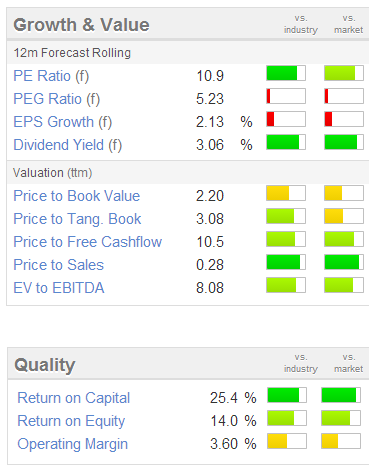

As you can from the Stockopedia valuation graphics above left, there's a lot of green here. It's unusual to see a low PER combined with high scores in the "Quality" section. Although note that these graphics flag that earnings growth has been poor to date. If they can rejuvenate earnings growth, then these shares look set for a possible re-rating.

As usual, please be sure to DYOR, remember that I never, ever give recommendations, only my personal opinions. As always, constructive comments from readers are very welcome in the comments section below.

Edit: One point I forgot to mention, is that NWKI has had a cloud over it concerning a class action in the USA. However this now appears to have been settled, with a £0.55m exceptional provision made (although I note that a £1m provision was made the previous year for the same issue).

I've created a chart below showing the relative share price performance of some smaller recruiters over the last two years. The two stand-out performers are Staffline (LON:STAF) and Matchtech (LON:MTEC), with Empresaria (LON:EMR) and Harvey Nash (LON:HVN) middle performing, and the laggards being Networkers International (LON:NWKI), Hydrogen (LON:HYDG), and Impellam (LON:IPEL). So you can either pay up for quality, or go for the bargains and hope that they re-rate in a recovering economy.

Northacre (LON:NTA)

This property developer is 69% owned by its majority shareholder, Abu Dhabi Capital Mgt, so should really be seen as a private company that happens to have a Listing.

A trading statement today says that revenues for the year ended 28 Feb 2014 was just £3m, with administrative expenses of £5.3m, so however you look at that, it's going to be a loss for the year, it's just not clear how big a loss (since there might be other costs involved?).

Details of more projects underway are given, and it sounds like high-end London stuff. So very dependent on that sector remaining in bubble territory by the sounds of it.

I've no idea how to value this company, and with a 69% major shareholder, regard it as uninvestable for me personally, but each to their own.

That's pretty much it for today. There are some contract win type announcements, but I don't tend to report on those unless they look material in size, and likely to affect forecast performance significantly. Here are some quick look type comments:

H & T (LON:HAT) reports that its talks to acquire some of the assets of fellow pawnbroker Albermarle & Bond, have terminated. No reason is given.

Micro cap Pentagon Protection (LON:PPR) is down sharply (25% to 5p at the time of writing) today on a business update. It says that the "relatively healthy" sales pipeline, it has run into cashflow problems, and is seeking funding. Sounds scary. It's too small to be Listed, with a market cap of only about £0.5m now! So a de-Listing must be a serious possibility now? I note that the 29% shareholder resigned as Chairman 5 days ago - precursor to a refinancing perhaps? Looks precarious.

Finally, I see that ISDX Listed Sprue Aegis (OFEX:SPRP) has finally decided to move to AIM, which is good news. It's a terrific growth company in my view, and the results look good. Probably fairly priced for now though, after a very good run in the last year or so.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in FCCN, NWKI, and SPRP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.