Good morning!

No time for a preamble today, as I have to rattle through this report as quickly as possible, due to an urgent dentist appointment at 11:45 this morning - half a molar sheared off last week, but thankfully it's not (yet!) exposed the nerve, but I need to get it fixed pronto, and this was the only time they could fit me in.

Johnston Press (LON:JPR)

Share price: 119p (down 16% today)

No. shares: 105.9m

Market cap: £126.0m

Trading update - as regular readers here will know, I've been bearish on this newspaper group for years - because not only is the obvious structural decline of newspapers likely to be terminal within (say) ten years, but also because (unlike Trinity Mirror (LON:TNI) which has cleared its historic debt) JPR is still saddled with possibly insurmountable debts.

True, it refinanced in mid-2014, but the way I look at it, the investors who poured fresh equity into it were mugs, who hadn't done their sums correctly. Even after the fundraising, the last reported balance sheet (at 3 Jan 2015) shows net tangible asset value which is heavily negative, at -£314.3m if you just write off the £514.3m intangible assets, although it's possible that the £81.4m deferred tax liability might relate to intangibles, so if we write that off too, then NTAV is still negative, at -£230.8m. There could be some upside on the freehold property values, but I doubt if the fixed assets' book value of £53.3m is understated enough to close the shortfall.

The pension deficit requires recovery payments in cash of £10m in 2016, rising 3% thereafter until the final payment of £12.7m in 2024, so that's a significant drain on cashflow. Plus the considerable debt has been a large drain on cashflow, just to service the interest, let alone repay the capital.

The latest bonds were issued in May 2014, and are senior secured notes, with a coupon of 8.625%, so that's an annual interest bill of £19.4m for those, which mature in 2019 I believe. Will the company be able to cover the interest costs, the pension fund overpayments, and build up a war chest of £225m above that to repay the capital by 2019? I very much doubt it, because the core business is in terminal decline.

Today's update confirms the continued structural decline of newspapers, which is similar to a recent statement from Trinity Mirror (LON:TNI) which suggested that advertising revenues are permanently deserting newspapers and instead going online. The efforts by newspapers to generate their own online revenues always sound good in trading updates, but are not very material when you look at the annual results - so perhaps just a fig leaf to temporarily obscure the reality that TNI and JPR are dying businesses?

JPR says today that Q2 worsened compared with Q1, which it blames on the General Election. On a more positive note, they say that indications for July show an improvement. Both advertising and circulation revenues are down about 5% for H1, compared with last year. Cost reductions mitigated much of the profit impact, and they're saying that "first half profits are likely to be marginally below last year".

Strong cashflow is noted, with "reduced net debt, in line with expectations".

Outlook - "at this stage we anticipate full year profit will be slightly below market expectations".

My opinion - this share is a straightforward punt on whether the business can generate enough cash in its dying years to repay the debt, sort out the pension fund deficit, and still have anything left over for shareholders.

It's important to remember that shareholders rank behind all creditors in a winding up, and newspaper groups are effectively in a very slow, orderly winding up process. Unless they can pull something out of the hat, in terms of digital advertising, which is possible - the newspaper groups do after all have massive databases of current and previous advertising clients.

Overall it seems to me that JPR's debt & pension deficit are probably too great a burden to leave much (if anything for shareholders). Given that JPR doesn't pay divis, then any shareholder return is going to be 2019 or later, so discount that to today's value, and it is not likely to be very worthwhie leaving money tied up here for 5+ years, in the hope that you might get something back eventually. I note that a tiny dividend is forecast for 2016.

I reckon advertising revenues for newspapers could collapse quite quickly at some tipping point, maybe in the not-too-distant future, but that's just a hunch. So again, why would you want to expose your portfolio to that risk? I'm sure there are much better investments out there than this. The apparently low PER is a value trap, in my view - as when you factor in the declining revenues & ultimately profits (they can't keep cost cutting forever), and add back all the debt & pension deficit, then the adjusted PER isn't cheap after all.

EDIT: Since the JPR 8.625% Senior Bonds are traded, I've checked the price, to see what the bond market thinks of them. The original price at issue was 98, and they are still around the same price today. So the bond market seems to have maintained a fairly static level of confidence, whilst the equity is slipping backwards in value. Although of course if the bond market had a lot of confidence in the JPR bonds, then the yield would have fallen, and the price risen, which it hasn't done.

Taking risk:reward into account, I reckon the bonds look a vastly more attractive punt than the equity, as you get a decent return (nearly 9% yield), and you rank ahead of shareholders in terms of claims over the group's assets. I can see quite a good case for buying the bonds, but absolutely zero appeal to owning the shares.

Regenersis (LON:RGS)

Share price: 162p (down 19% today)

No. shares: 79.0m

Market cap: £128.0m

Trading update - this is another share that I've come to increasingly distrust, the more I've looked at it. Perhaps it's the overly complex presentation of the results, with their own definition of profit ("HOP"), or the overly enthusiastic FD giving repeated rampy-sounding investor presentations, or the killer factor was Matthew Peacock cashing in £17.5m selling 5.8m shares at 300p in Jan 2014. Whatever the explanations given, always follow the money, is my motto - so if Directors sell huge amounts of shares, it's time to follow them promptly out of the exit.

Today's update says that results for y/e 30 Jun 2015 will be "in line with market consensus". This is despite an adverse currency headwind. Fine so far.

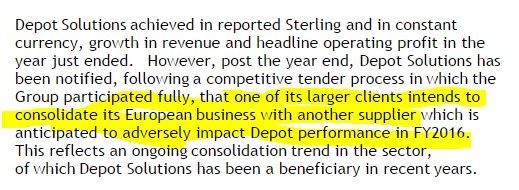

Profit warning - this relates to the current, new financial year (ending 30 Jun 2016):

Trouble is, the impact is not quantified, so we're left in the dark somewhat, over how significant this is. Personally, I don't rate the Depot Solutions business - it's low margin, and they've had to seek out business in developing countries, because it's too low margin in developed countries. That just doesn't sound an attractive space to be operating in, to my mind.

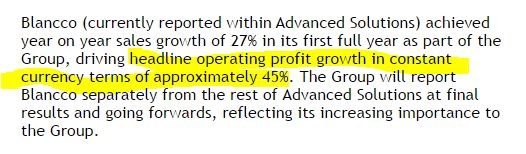

Blancco - this was a major acquisition, of a specialist company which deletes sensitive data from hard drives, if my understanding is correct. Things seem to be going well here:

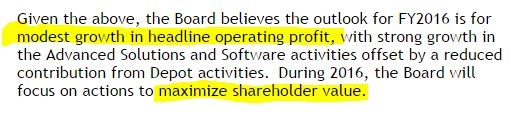

Summary - overall this sounds not too bad actually. Maybe the market has over-reacted with the sharp share price fall today?

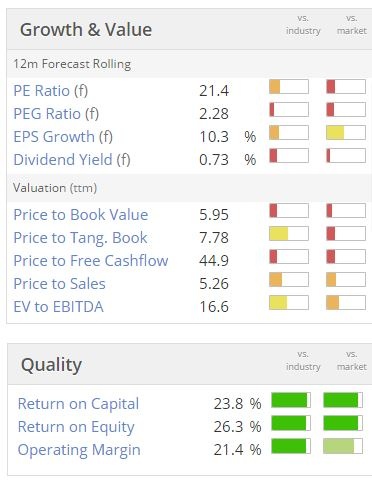

My opinion - I don't particularly trust the numbers with this company, but despite that I'm wondering if today's share price fall has possibly been a bit harsh? Checking the last interims, the balance sheet is alright, with net cash of £12.1m, so it looks financially secure.

I wonder what they mean by maximising shareholder value? Maybe that means restructuring to increase profits, or possibly disposals of poorly performing bits of the business? I don't see a coherent reason for this group to bundle together low margin electronics repair businesses with a higher margin software business (Blancco). Perhaps management need to do a re-think on why the group exists, and what the future strategy is?

From an investment perspective, it doesn't yet scream value to me, and the dividend yield of about 3% is useful, but not exceptional. Overall I'd say it's potentially starting to look interesting at 162p, but I might wait to see what happens over the next few months, rather than diving in and trying to catch the falling knife, which usually goes wrong.

dotDigital (LON:DOTD)

(I hold shares in this company)

Trading update - There's only time for a very quick comment here. There's a lot of detail in today's update, which reads very positively to me, so I'm surprised that the share price has barely moved.

This is a software company which provides an email marketing platform, on a SaaS revenue model. It's demonstrated strong growth, and decent profitability, and holds net cash of £12.3m.

The company is now expanding overseas, and whilst early days, seems to be gaining traction, with international sales up 106% to £3.1m. There are obviously up-front costs to establishing sales operations overseas, so expect this to be a short term drag on profits, for a potentially big long-term pay-off - which was how Mark Slater described this company recently at an investor event.

Today it says that "EBITDA will be slightly ahead of market guidance". I'm not keen on them benchmarking on EBITDA, as it's a nonsense number with software companies, due to costs being capitalised into intangibles. I'd much rather look at conventional profits.

I note that broker consensus EPS has been creeping down over the last 12 months, which could explain why the shares have traded sideways for a year.

My opinion - I really like this company as a long term investment. It's not cheap on fundamentals, at the moment, due to investment in growth (i.e. costs up-front, benefit later). However, we're in a bull market for this type of company, and such strong organic growth is hard to find, and often commands a very high rating. Strip out the net cash here, and the PER is about 19, which in the current market I think is actually quite reasonable for a business which has grown revenues by over 30% p.a. for the last consecutive 10 years - a very impressive statistic.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.