Good morning,

Paul is away today, so I'm holding the fort here!

Share price: 42.5p (-10%)

No. shares: 39.7m

Market cap: £18.7m

Interim Results (for the six months to 30 September 2016)

Comparisons with last year are somewhat pointless, since Bilby has been transformed by two acquisitions for aggregate consideration of £12.7 million.

There are positive noises on this front:

Both acquired businesses have been successfully

integrated, met their initial earn-out performance conditions and, along

with Purdy, have continued to trade ahead of expectations.

The shares are still down by about 70% year-to-date, however, as investor confidence was knocked by the loss of a local authority customer.

As previously announced, a long-standing and major public sector

customer of the Group changed the processes by which it manages its

outsourced building services work. This has resulted in significant work

being taken in house by the customer. This situation has not changed

and, combined with commencement delays to other contracts and slower

than anticipated revenues from the SEC and Fusion frameworks, will

further impact revenues and profitability for the full year.

That major customer loss resulted in a reduction in EBITDA forecasts for this year of c. 25%, and the above paragraph doesn't suggest that there is going to be any form of consolation in terms of this year's performance.

As a service provider to the public sector housing market (gas heating, electrical and general building services), Bilby has obvious similarities to Lakehouse (LON:LAKE), another recent flotation which has perplexed investors!

Restatement: I am finding Bilby quite perplexing, too.

The 2016 accounts have been restated to show PBT of £0.7 million rather than £1.4 million, caused by a disputed invoice and also:

£556,000 understatement of

subcontractor costs due to changes in the terms of trade with

subcontractors and a delay in subcontractor costs. The adjustment was

made to cost of sales and trade and other payables.

Material restatements are one of those things which tend to have a disproportionate impact on valuation, and combined with the company's apparent vulnerability to the loss of a single customer, I am not surprised to see investor sentiment so low here.

The balance sheet is in negative tangible net equity. £16.7 million of current assets are offset by nearly £23 million of total liabilities.

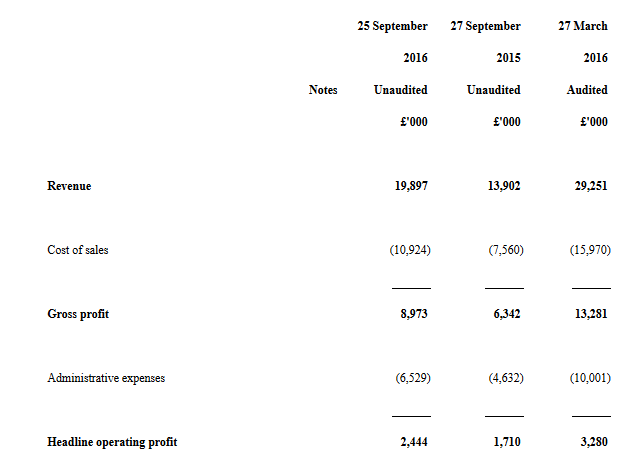

My opinion: Overall, I see little attraction here. The company claims to have earned £1.2 million in operating profit during the half-year, before non-underlying items, but it continues to review possible acquisitions - which would ensure that non-underlying items continue to weigh on results.

In general, I am increasingly sceptical of acquisitive growth strategies, as the costs and complexity rarely seem to make it worthwhile. I'd much rather buy into companies which accepted that they don't have much organic growth, instead of trying to manufacture growth out of thin air!

Share price: 87.4p (+4%)

No. shares: 281m

Market cap: £246m

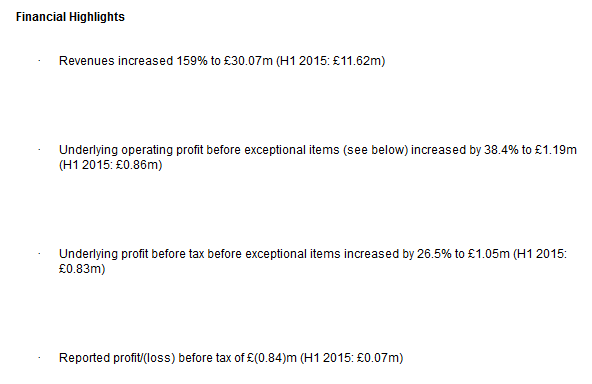

Nice update from this indebted newspaper group:

The Board is confident that performance*

for the year will be marginally ahead of expectations, with net debt

falling to around £35 million by the year end, significantly better than

expectations.

That's great news, but don't forget there's a £426 million (last seen) pension scheme accounting deficit to be reckoned with here.

The downward revenue trend is about the same, a marginal improvement perhaps:

Group revenue** on a like for like basis is expected to fall by below 8% in the fourth quarter compared to a decline of 9% in the third quarter and a decline of 8% in the first half. Publishing revenue is expected to fall by 8% in the final quarter with print declining by 10% and digital growing by 8%.

Elsewhere, the provision for dealing with phone hacking claims is increased by £11.5 million.

My opinion: As far as a potential investment is concerned, this goes into the "too difficult" basket for me.

However, if I was inclined to gamble, I'd be inclined to go long of this share. At the interims, the company reckoned that a mere 0.5% change to its assumed discount rate would reduce its pension deficit by £155 million, i.e. by more than a third.

RPI/CPI and life expectancy changes could go the wrong way, of course, but a few small central bank-driven interest rate changes in 2017 could produce a dramatic change to how the market views this company's financial position. There's a lot of potential change in store when we are talking about £1.6 billion of pension assets and £2.0 billion of liabilities! It could make for an interesting trade, as it did in 2012/2013.

Betting on it would be pure

speculation, but maybe the risk:reward on offer is not too bad?

Share price: 10.25p (unch.)

No. shares: 81.4m

Market cap: £8m

Please note that I currently own shares in United Carpets (LON:UCG).

Interim results (for the 6 month period ended 30 September 2016)

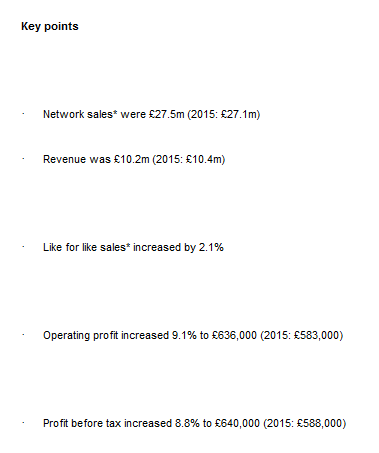

I'll try to keep this brief, as the small market cap and lack of liquidity would make this a difficult one for many people to buy into. It is likely to be of interest to those following Carpetright (LON:CPR).

Operating from a much smaller store network of 59 outlets, most of them franchised, United has succeeded in grinding out 2.1% like-for-like sales growth, which the chairman describes as a "satisfactory" performance.

This is in contrast to Carpetright (LON:CPR), whose latest six-month figures showed a 2.9% decline in like-for-like UK sales.

Dividend: The shares provide a useful yield, and the company has previously paid a special dividend from surplus cash. For now, the interim dividend is maintained at 0.13p.

Outlook: No immediate cause for concern in the outlook statement.

Like for like sales for the 10 weeks since the period end to 8 December 2016 have continued to be positive.

Despite the challenging political and economic background, the outlook for the financial year is positive having completed a successful first half. Our markets are driven to a large extent by consumer confidence and while we have ongoing political uncertainty over Brexit, the underlying base case is satisfactory, supported by a low interest rate environment combined with a housing market that continues to function reasonably well.

My opinion: The accounts are nice and clean. United don't bother with "adjusted" or "underlying" metrics, even though there are some costs they could strip out to give an adjusted figure.

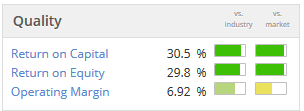

Overall, I am content with these results. Industry veteran P Eyre, founder of the company and Chief Executive, holds 47%, and I am happy to continue backing his judgement. And I like the franchise business model, as it tends to generate excellent returns on capital.

Fulham Shore (LON:FUL)

No. shares: 571m

Market cap: £104m

Interim Results for the six months ended 25 September 2016

These results include a confident overview from the chairman of this expanding restaurant group:

We have slowly increased the number of openings per year we can manage. Our progress so far was 9 for the year ended 27 March 2016 and 13 year to date for the year ending 26 March 2017. We expect to increase this number in London and across the country in the next financial year.

Sites are available, our restaurants are busy and popular, our prices are good value and our staff are well motivated.

The current portfolio is 42 restaurants: 12 "The Real Greek", 29 "Franco Manca" (pizza), 1 "Bukoswski Grill".

The results look good to me, good enough to justify the expansion plans:

I understand that restaurants tend to have very weak pre-tax profit margins, so this 12% "headline" result is excellent.

The three main adjustments to the headline numbers are share-based payments (investors should include these, in my opinion), pre-opening costs (arguably ok to exclude these), and amortisation of brand (probably ok to exclude these).

If we include the share-based payments only, then we get a fairer "headline" profit figure for the latest period of £2.1 million - still an excellent result for the industry, I think.

Including the other expenses too, reported operating profit falls to £855k.

My opinion:

I can see this potentially growing into its valuation, for investors who are willing to look through the initial opening costs of new restaurants and at the underlying operational cash flow.

Another 13+ restaurants in the next financial year (ending March 2018) would increase the portfolio by more than 30%. Today's statement emphasises a need to invest in the company's central functions, but even still, you'd think there might be some beneficial operational leverage with that kind of growth!

I don't know enough about these specific restaurant brands to say whether this company could turn out to be the next Restaurant (LON:RTN). Overall, though, it appears to be worthy of further research.

Sepura (LON:SEPU)

Share price: 19.4p (-18%)No. shares: 370m

Market cap: £72m

Under the terms of the Acquisition, each Sepura Shareholder will be entitled to receive: 20 pence in cash per Sepura Share

The Acquisition values the entire issued and to be issued ordinary share capital of Sepura at approximately £74 million.

These shares were trading at 195p as recently as March. That's an incredible amount of value destruction in 9 months!

Shareholders representing 38% of Sepura have undertaken to vote for the deal (or written a letter of intent to vote for the deal), so presumably it will go through.

The rationale for the deal is that there was little other choice:

"...Sepura continues to face significant headwinds in a highly competitive environment and that it is likely to require further cooperation from its lending banks, in addition to alternative sources of funding. Consequently, success in achieving this strategy will be influenced by the significant future risks and uncertainties.

Previous bank cooperation included the deferral of payments, and covenants were set to be breached in March.

Amazingly, Sepura raised €73.7 million from shareholders in July of this year, but has still been forced into a fire sale. This all follows the €127.5 million acquisition of "Teltronic" in 2015, which failed to produced the necessary financial results and synergies.

It's easy for me to summarise what has happened: Sepura is another casualty of the desire to pursue growth through acquisition, combined with the failure to adequately finance this strategy.

If investors stopped buying shares in companies which did this, management teams would quickly learn to stop doing it!

It's been an eventful Friday, and I hope these updates were of interest.

Have a great weekend,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.