Good morning! Plenty of trading updates today, so I'll rattle through as many as possible before my head turns to mush, which usually happens by about lunchtime!

Dialight (LON:DIA)

Share price: 789p

No. shares: 32.5m

Market Cap: £256.4m

I've looked at this industrial LED lighting company before, and generally considered it too expensive. Although checking back, my article of 24 Feb 2014 gave a useful recap, and flagged that the company seemed to be stabilising after a period of missing growth forecasts.

The company is a maker of industrial LED lighting, so the picture on the right from their website gives a flavour for the products (click to go through to their website).

It's obvious that the potential markets for these industrial lighting products are vast, and global. Although no doubt there will be many competitors attacking the same markets.

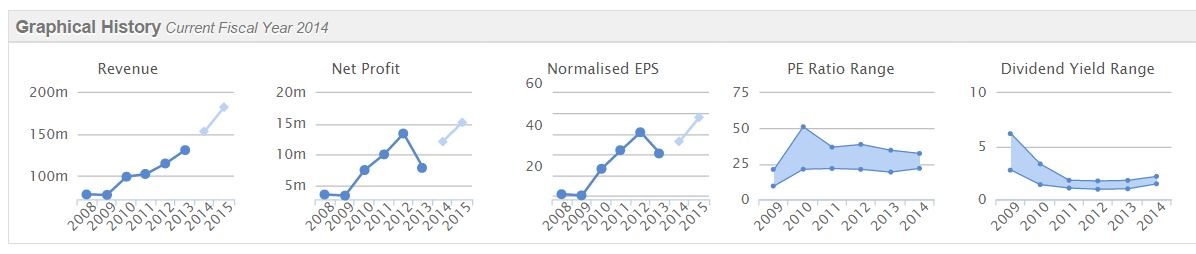

The shares did very well in the rapid growth phase, although (as is so often the case) the moment growth faltered, the shares fell sharply, roughly halving in price from the peak. This is the double whammy of a growth company not meeting forecasts - not only are forecasts lowered, but the market also de-rates the shares onto a lower PER. Combine the two, and you can easily see a 50% drop in share price in a day or two.

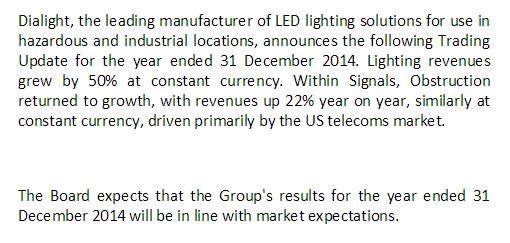

Trading update - the growth rates given in today's trading update have certainly made me sit up and take notice;

Lighting is the biggest division, so achieving 50% growth there is really very good. Presumably that growth rate will reduce a bit once converted into sterling, but even so. No mention is made of margins. I note from the last interims that profit growth was slower than sales growth, which implies that gross margins fell - so no doubt there are competitive pressures involved, but even so these growth rates are very impressive.

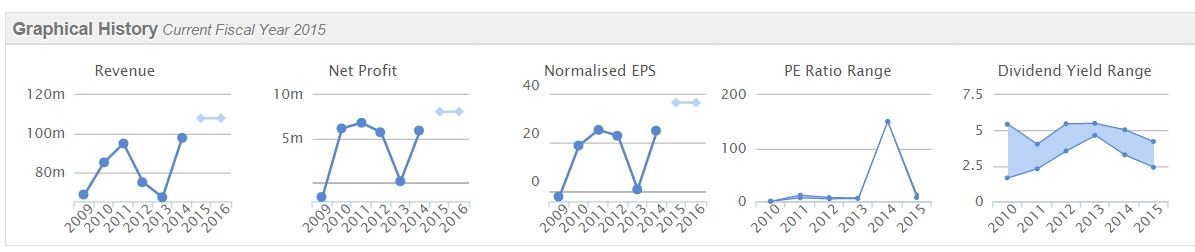

Valuation - you can see from the Stockopedia graphical history that the company has been growing very well, but with a bump in the road on profitability in 2013, which harmed the share price at the time.

Broker consensus is for 36.6p EPS for calendar 2014, and we know from today's statement that this has been achieved. So attention now turns to 2015, and broker consensus there is for 48.1p, a strong increase of about 31%. Will that be achieved? We don't know, but the rapid growth in 2014 suggests that the company has the wind in its sails. There isn't any outlook statement in today's update, but that will come with the 2014 results, which are expected to be published on 2 Mar 2015.

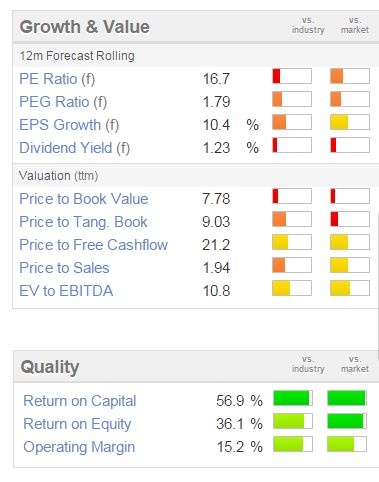

The usual Stockopedia valuation graphics are showing a red bar for PER at 16.7, although to my mind a PER of 16.7 is not excessive at all for a company showing such strong growth rates.

Indeed, look at the PEG which is only 0.7 (where under 1.0 is generally considered good value).

Quality measures are middling to good, although these have fallen quite a lot. If you check back to my report a year ago, the quality scores were much higher, and all bright green. This reflects the disappointing year in 2013, but the company is now recovering, so we can probably anticipate an improvement in the quality scores in future.

After all, getting one step ahead of the data is the way to make money! One of my favourite investing quotes reinforces this crucial element of looking forwards in investing - not just on fundamentals, but also on market sentiment;

There's an OK dividend yield of 2.38%, and the company's Balance Sheet is strong, with negligible net debt.

Development spend - the cashflow statement reveals that profits benefit significantly from capitalising development spending. In 2013 such capex was £4.4m, versus an amortisation charge of £1.1m, so a net boost to profits of £3.3m, a material amount.

Having said that, in a competitive sector, R&D spending is key to keeping ahead of the pack, so I generally see hefty R&D spending as a positive. You just have to hope that management are spending the budget wisely.

My opinion - overall, I like it. A PER of 16.7 strikes me as reasonable for the growth being achieved, providing that growth is sustainable (maybe not at such a high rate, but anything over 20% growth in sales would underpin a higher share price in my view).

I can see market confidence in this company returning possibly, if they carry on meeting forecasts, and hence to my mind there could be possible upside to (at a guess) £10-12 if things continue going well for the company.

Subjectively, it looks a good point on the chart to be considering a purchase too, in my opinion, so I shall do a bit more work on this, and possibly start building a position in it. As usual though, if there is another disappointment, then it could be an early morning 20-30% loss, that's the risk you take.

It's not exactly a value share, but it seems to qualify quite well as a GARP share, in my opinion.

Character (LON:CCT)

Share price: 311p

No. shares: 21.5m

Market Cap: 66.9m

Please permit me to uncharacteristically (!!) blow my own trumpet! Regulars here will know that toys company Character Group was not only trading well, but that the shares were cheap too - I flagged up that the shares were cheap in my report of 8 Sep 2014, when they were 214p, and again, more emphatically on 3 Dec 2014 when the price was 245p. I hope some readers benefited from the surge in price, which in this case was really obviously on the cards, as the figures were yelling at us that the share was cheap.

Trading update - this looks very good to me. 28% growth in the first 4 months of the current financial year.

Checking back to last year's interims, they were strong. So this is not a case where the company is up against soft comparatives, quite the opposite. Turnover was £46.9m in H1 last year, so being up 28% this year in H1 (assuming that growth continues into Jan & Feb 2015) means that H1 turnover could be as high as £60.0m.

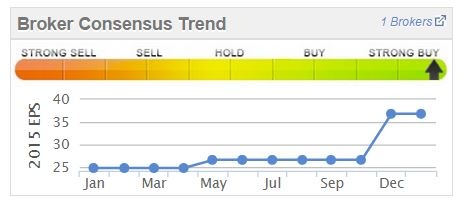

Valuation - my guess is that broker forecasts are likely to be upgraded again. There has already been one quite big upgrade with the strong trading update in Dec 2014, as you can see from the Stockopedia graphic on EPS forecasts below.

Sticking my neck out here, I could imagine brokers upgrading to c.40p EPS for this year. Therefore with the shares at 316p at the time of writing (they are volatile today) that would give a PER still only at 7.9 - still very cheap.

For the time being though, the company says;

However, that is assuming such high earnings are sustainable. The company has disappointed before, but as you can see from the graphs below, it has generally been pretty good at turning a decent profit, apart from a glitch in 2013. As for 2009 - well that was in the middle of the financial crisis, so you would expect that to have been a tough year, but unrepresentative of normal conditions.

My opinion - given the track record, and the changing fashions of toys, it's not one to go crazy over, in my opinion. As an existing holder though, I'm not even considering top slicing yet. On the basis of today's announcement, a price of 400-500p looks possible in my view, if the positive trading momentum continues throughout 2015.

We pick up a 2.7% divi while we wait too, which is the sort of return that is apparently enough to send the elderly into a buying frenzy, judging from the evening news last night, but doesn't particularly excite me. It's better than nothing though.

Impellam (LON:IPEL)

Share price: 540p

No. shares: 48.8m

Market Cap: £263.5m

This is an international staffing group, which I've reported on in considerable detail, several times in these reports, click here to view the archive. I started turning positive on the company on 30 Jul 2014 when the company reported interim results. The problem division appears to be getting fixed, leaving these shares looking good value on a low PER. The shares have been gradually rising since then.

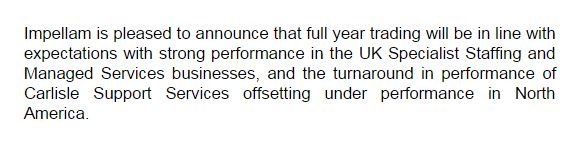

Trading update - for calendar 2014 is good - in line with expectations;

I'm a bit surprised that USA under-performed, as that's supposed to be the strongly recovering, and biggest economy.

Net debt - is reported at £15m. That doesn't seem a lot for the size of company.

Valuation - it looks strikingly cheap on a PER basis. Stockopedia shows broker consensus of 66.8p for 2014, and 75.0p for 2015. So it's not really clear why the shares are only at 540p. That's a PER of 8.1 and 7.2 for 2014 and 2015 respectively.

My opinion - it's not often these days that you find a business that's performing alright, and on a current year PER just above 7. The ownership structure might put off some investors - a trust for Lord Ashcroft's children owns 52.7% of the equity (lucky children!), thus making it illiquid, and meaning that the trust controls the company.

I follow him on Twitter, and have come to the conclusion that Lord Ashcroft seems far too busy with political polling to have much time worrying about recruitment. The most recent Placing diluted this big shareholder from 59% down to 52.7%, so hopefully over time there might be more Placings, or a secondary Placing of some or all of the trust's shares, to improve liquidity, and create a more balanced shareholder structure.

A controlling family shareholding is not necessarily a bad thing. Lord Lee actively seeks out such companies, as he believes the stewardship of a controlling family will deliver better long term rewards for all shareholders. Although there is always the risk that minority shareholders could be disadvantaged by an opportunistic low-priced buyout - as some have complained is happening at Prezzo (LON:PRZ) for example.

I'm intrigued by the last sentence in the Directorspeak bit of today's announcement. Wonder what they mean by "strategic options"? Maybe a deal is on the cards - i.e. selling out to a larger competitor perhaps? Or more acquisitions maybe - Impellam has been quite acquisitive in 2014 after all. Although I am not keen on them issuing more shares whilst the existing ones are valued on such a low rating.

Brainjuicer (LON:BJU)

Trading update - can't say I'm particularly excited by this announcement. The company says pre-tax profits for 2014 are expected to be up from £3.6m last time to "at least £4m" this time, in line with market expectations. However, the shine is taken off this by them admitting that overheads control, including a lower bonus pool for staff, drove this, rather than sales growth.

Looking at the Stockopedia valuation graphics on the left, it doesn't look cheap. However, the quality scores are very high.

The company has grown nicely in the last 7 years, and it's interesting to note this has been achieved without issuing any new shares at all, so no dilution.

This company has intrigued me before, but I don't know enough about it to form an informed view. They do market research in an innovative way, I believe.

A people business, so the talent walks out of the door every night. Divi yield is a rather miserable 1.2%.

Overall, I can't get excited about it at the moment, but would like to find out more about the company, and meet management at some point. I see the CEO owns just over 30% of the shares, so very much a skin in the game type of management, which is a good thing.

It's going on my watch list anyway, as there looks to be some potential here.

Goals Soccer Centres (LON:GOAL) - has issued an in line with expectations report for calendar 2014 today.

One point interested me - that its Los Angeles site is doing well, so they are now looking at opening more USA sites. That could make the roll-out altogether more interesting, as it has been very slow so far.

The valuation of this share got ahead of events a while back in my view, but it's starting to look a bit more sensible now, on a fwd PER of 13.3. There is a fair bit of debt remaining I believe, but it was reduced to a more sensible level from earlier excessive levels, I seem to recall.

Will review the 2014 accounts with interest when they are published.

John Menzies (LON:MNZS) - has put out an in line with expectations statement. Although bear in mind that expectations have recently been lowered, after their profit warning, which I reported on 5 Nov 2014 here. I'm sceptical whether the very high dividends can be maintained.

We'll end the week there. Thanks for reading & especially for people who add useful extra factual points in the comments section, which is much appreciated. Enjoy the weekend!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in DIA, CCT, and IPEL, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.