Good morning!

Today there will be one report. I'm (Paul) writing most of it, but Graham is likely to add a couple more sections later this afternoon. We often add more sections in the afternoon & evenings, so it's worth checking the previous day's report to see if there's anything that you've missed. The quickest way to do that is to bookmark the SCVR landing page, then glance down at the tickers, in the blue boxes, to see if any are of interest.

There's been more fun & games with forex over the weekend. I see that sterling briefly dipped below $1.20 first thing. Now that the uncertainty is out of the way over hard Brexit, it wouldn't surprise me to see sterling rally somewhat. Once people have certainty, they can plan accordingly. It's uncertainty that markets dislike the most.

Anyway, we're used to the drill by now. Weak sterling is good for the FTSE100, good for exporters & UK companies with overseas earnings. It's bad for importers. So as long as our portfolios reflect this, then we should be doing well. Also of course all the UK indices are at or near new highs, so everyone should be doing well. How long that will carry on for, who knows? It does all feel a bit toppy to me, but as long as companies are reporting positive trading updates, then I'm happy to run with them.

WANdisco (LON:WAND)

Share price: 269p (up 20% today)

No. shares: 35.1m

Market cap: £94.4m

(at the time of writing, I hold a long position in this share)

Trading update - this former glamour tech stock has had a rough couple of years. That's because top line growth stalled, and heavy losses made it look as if the writing was on the wall. However, perhaps surprisingly, investors continued to pour money into it, in several fundraisings. Overheads were cut considerably last year.

So, as I mentioned in my last report (Oct 2016), the key to survival is to start generating some decent top line growth. Today's update delivers strong growth. It's the first genuinely positive statement I can remember from this company. Hence why I've dipped my toe in, with a smallish very speculative purchase this morning. If the facts change, I change my mind. Mind you, I can never really be sure with this company what are facts, and what is spin!

Given the false dawns in the past, I can understand most people being highly sceptical, and wanting more confirmation that things really have turned a corner.

There's lots of detail in today's announcement, but it all seems to read positively, with meaningful growth, and reduced cash burn;

A couple of comments on the above;

Sales bookings were up 36% in H1, so the rise to +109% in H2 is a big sequential improvement in growth.

Revenue seems to lag behind bookings, so that's important to factor into forecasts.

Cash burn - it seems to have burned about $4m cash in H2, by my calculations (net debt of $2.8m at 30 Jun 2016, plus $14.3m new equity funding net of fees, less closing net cash of $7.6m at 31 Dec 2016 = $3.9m cash burn). I hope that's right - it's not clear from today's RNS if the $7.6m is net or gross cash.

Q4 was close to cash breakeven, but I am told this is the best quarter for cash collection, so may not be typical of future cash burn.

Outlook comments - as follows;

Strong order book and sales pipeline continues to underpin medium term growth expectations...

We have begun 2017 with a strong new business pipeline and a significantly reduced cost base, which together, will further our progress towards profitability.

So it's still loss-making, albeit at a reduced level. I'm usually wary of companies that refer to the medium term being positive, as it hints that the short term isn't so good!

My opinion - historic performance has been lamentable, and I was convinced this company was heading for the knackers yard. However, deep cost-cutting last year, and very strong top line growth in H2 2016 have dramatically improved the outlook, in my view.

I imagine another fundraising will be needed at some point, but that's not a problem once the share price is roaring up, and good news is flowing.

This share has been a big tech favourite in the past, and I suspect it might become so again, if the positive newsflow keeps coming.

It's clearly only of interest to growth investors. Value investors will understandably shudder in horror that a serial under-performer, and cash burner like this is valued at nearly £100m.

However, the big name contract wins & positive sales momentum developing now are exactly what tech growth investors look for. They can chase up valuations to eye-watering levels in this kind of market. That's why it's starting to look interesting, in my view.

Obviously if the sales momentum konks out, then the share price would crash back down again. So it all hinges on whether that decent growth reported today can be maintained, or not. So a high risk, but potentially interesting situation, in my view.

Vislink (LON:VLK)

Share price: 16p (down 7.9% today)

No. shares: 124.6m

Market cap: £19.9m

Update on proposed disposal - this is a very concerning announcement, which would make the share an instant sell for me, if I held any.

It looks to me as if the buyer of Vislink's legacy business hasn't got enough cash to complete the deal. Instead of paying $16m in one go, it has now renegotiated terms to pay $6.5m up-front, and the $9.5m balance 45 days later.

The buyer, called xG, is issuing secured loan notes to Vislink, which are secured on the business being disposed of. So I suppose if xG were to default, then Vislink could recover the disposed of business, and presumably keep the $6.5m initial payment?

I've done a bit of digging on xG, and it turns out to be a tiny (only $16m mkt cap) NASDAQ listed company. It raised $10m to part-fund the Vislink acquisition recently. I've had a look at xG's financials, and they're diabolical. It's been heavily loss-making, and seems to be a blue sky type of company, with negligible sales.

Overall then, I would not be confident that this deal will actually complete. Vislink has been reassured that the initial $6.5m is in transit, but who knows?

It all looks pretty dodgy to me, and I would treat Vislink as a bargepole job, as if this deal doesn't complete, then Vislink is in a dire position itself due to excessive bank debt run up by the idiot in charge (Hawkins), who has run this company into the ground.

Very high risk. This looks potentially very bad to me. Why take the risk, when you don't have to? My main question is, where does xG expect to get the rest of the dosh from? It doesn't seem to have the cash on hand to redeem the loan notes. It might all turn out fine, but serious questions need to be asked about what's going on, and how likely this deal is to actually complete.

Mello Beckenham

Due to issues with trains, etc, the monthly investor evening in Beckenham tonight has been cancelled. I know a lot of regulars read this report, so just wanted to make sure that everyone got the message & don't have a wasted journey.

Tax Systems (LON:TAX)

Share price: 67p (down 5.0% today)

No. shares: 76.0m

Market cap: £50.9m

Trading update - for the year ended 31 Dec 2016. Funnily enough, this company cropped up yesterday, when I was doing some research to familiarise myself with new issues. This share joined AIM in July 2016, reversing into a shell which you might remember - the failed Eco City Vehicles business.

MXC Capital were behind this deal, and still hold 20%. Given their actions at Redcentric (selling out just before accounting misstatements were announced), I would watch very carefully indeed for any RNSs showing them selling their TAX shares!

There are some interesting shrewdies on the shareholder list, namely Nigel Wray at 7.1%, Henderson at 16.8%, Harwood Capital (Christopher Mills's outfit), and Hargreave Hale at 5.8%. Those (and other) concentrated holdings could make the share illiquid.

The new business is a profitable software company - providing corporation tax software to accountants. I am told by a friend who is a tax professional, that the software is excellent, and that revenues are likely to be very sticky.

Today's trading update is in line;

The Company has performed as budgeted at the time of re-admission to AIM in July 2016 ("Admission") and trading and net debt for the year ended 31 December 2016 are in line with market expectations.

Since Admission, the Company has strengthened its management team with a number of new appointments to drive organic and acquisitive growth while supporting the Company's valued existing customer base.

Interim results to 30 Jun 2016 are no use, as that pre-dates the acquisition & fundraising.

There's a more useful announcement here, issued on 1 July 2016, which explains the acquisition of Tax Computer Systems Ltd, which is the business which was reversed into the cash shell.

My main concern is that a considerable amount of debt was used to part-fund the acquisition. £45m was raised in an equity fundraising, but another £30m in debt has been used to fund the £73m enterprise value of the acquisition (the £2m balance probably being fees).

New debt facilities of £30 million comprising £9 million term loan and £11 million revolving credit facility with HSBC Bank plc in addition to £10 million unsecured loan notes issued to the Business Growth Fund plc

So the danger is that investors might buy this share on the basis of an apparently reasonable forward PER, without realising that there's also a big pile of debt that, at some point, will have to be repaid.

My opinion - it's a nicely profitable niche, but I don't see much room for growth. Personally I prefer companies with a very big potential market, giving scope for considerable growth. Sure, this company could diversify, and also move into complementary areas, but that often ends in disaster.

I think it would make sense to wait for the full 2016 results, to get a proper handle on the figures. The other issue is how much development spend is being capitalised? I note the company likes to talk about EBITDA, as many software companies do, but of course that is a meaningless number because it ignores development spending (both cash cost, and amortisation).

The high level of debt might limit the dividend yield. This type of business would only interest me if it were largely debt-free, and paying a c.5% dividend yield. So it's not for me, but I'll review the 2016 figures anyway when they're published. As always, I reserve the right to change my mind, if the figures subsequently appeal to me.

As a general point, it's good to see some better quality companies floating on AIM. Maybe the broker community is finally grasping that many investors actually want profitable, dividend paying companies to invest in, not speculative trash. That is particularly true of AIM IHT portfolios, which are blossoming due to the excellent tax relief available.

Michelmersh Brick Holdings (LON:MBH)

Share price: 50p (up 1% today)

No. shares: 81.5m

Market cap: £40.8m

Trading update & property disposal - there's no change in the guidance for this brick maker, and property owner;

In October 2016, the Group announced that it expected its financial performance for 2016 to be at or around a similar level to that reported for the full year 2015 and the Board confirms that expectation.

Cash generation was particularly pleasing with year-end cash balances exceeding forecast.

There's also more cash in the pipeline, since a surplus property is being disposed of for £2.68m. That will generate a surplus over book value (after all costs) of over £1m. Whilst that's not a huge amount, it's a nice bonus. I wonder if there are other property assets in the books at below market value?

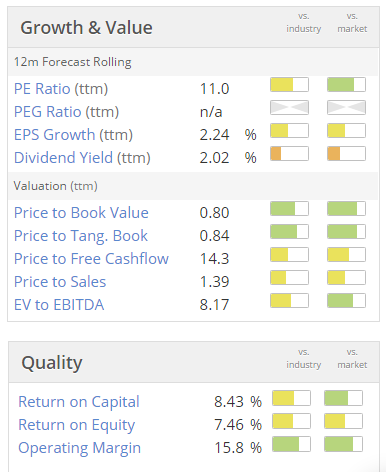

Valuation - looks probably about right to me:

Redstoneconnect (LON:REDS)

Share price: 1.65p (up 15.8% today)

No. shares: 1,633.2 (taken from RNS dated 29 Apr 2016)

Market cap: £26.9m

(at the time of writing, I hold a long position in this share)

Contract to deliver in-building cellular - I don't normally comment on contract wins, as so many of this type of announcement is spurious. However, this looks quite interesting.

Reading between the lines, it sounds as if the client might be Google's new London HQ, a campus being built near King's Cross station. You can't really get a better reference site than that. Therefore, this contract could be a catalyst to enable REDS to win much more business.

As everyone is using smartphones these days, having top notch In-building mobile phone signals is becoming increasingly important. So I can clearly see how this could become a big market. So I like the potential for this.

Regular readers here will know that I visited this company late last year, and was impressed with new management. I try not to buy immediately after meetings, because it's too easy to get swept up in the moment. It's usually better to have a cooling off period, and consider it more carefully, taking one's time.

The strategy seems much more clear, and they have already got some high quality relationships with blue chip clients. So cross-selling is a real possibility. The company also has some potentially interesting in-house developed software for managing hot-desking.

All in all, I think this share is potentially interesting, and hence have dipped my toe in with a small opening long position. I'll wait to see what the next set of results are like before deciding whether to fully commit to it, or not.

A couple of quickies to round off.

SQS Software Quality Systems AG (LON:SQS) - trading update for Dec 2016 year end. Profit is in line with expectations.

Outlook comments sound encouraging though, with news of some big new orders.

Year end net debt looks reasonable, at E12m.

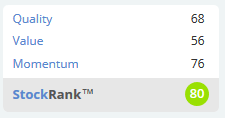

I don't understand this company, but a quick review of the numbers on Stockopedia suggests to me that this may well be worth a closer look. The company seems to have a good track record of earnings growth. The valuation looks reasonable too, and it pays a divi. Not bad at all, given the upbeat outlook comments today. Have any readers looked at this company?

That's me done for the day.

I will now hand over to Graham, who may want to add some additional sections below.

Regards, Paul.

Graham here with two quick comments:

Ashmore (LON:ASHM)

Share price: 302p (+6.6%)

No. shares: 713m

Market cap: £2,010m

This is a lot bigger than we usually cover in SCVR, but I'm covering it for two reasons:

1) Financials are a sector I'm particularly comfortable with;

2) Trends at the fund management companies can tell us a lot about broader financial and economic trends.

With that out of the way, here is today's RNS:

Trading Statement - Second Quarter Assets under Management

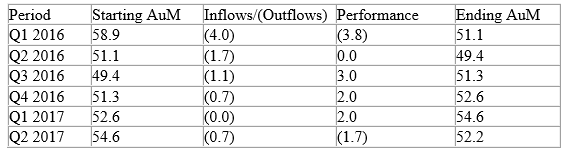

I'll tag today's numbers onto a table I previously created to show the recent trend here:

Despite lower market levels, Ashmore's investment performance relative to benchmarks remained very strong throughout the quarter across all fixed income and equities investment themes.

During these times of increased indexing, outperforming benchmarks has never been so important.

And then, after mentioning various problems during Q2 (strong dollar, US election, steepening yield curve):

While these factors interrupted the improvement in sentiment towards Emerging Markets, the effect proved to be short-lived with asset prices strengthening in December and continuing into the new year. The combination of attractive absolute and relative returns, accelerating GDP growth, and low allocations all support the expectation of further strong performance in 2017 and a return to the improving flow trend seen for most of 2016.

So it sounds like the CEO thinks we could get another 5%+ growth in AuM during this calendar year, up again from the low reached 12 months ago.

They aren't "exciting", but I like fund management companies as a sector because a) they generate a lot of cash (and the Ashmore dividend yield is currently about 5.9%); b) their customers can be surprisingly "sticky", and c) they are capital-light.

Counter-balancing that, they can be cyclical, and subject to macro trends beyond their control.

Ashmore is a prime example of this - it cannot do anything to determine overall emerging market and currency performance, but these factors will have a big impact on its results. The only thing Ashmore can do is try to beat its benchmarks (at the last results, it was disclosed that 73% of funds under management were beating benchmark over 5 years).

So I remain interested in Ashmore. This is the sort of stock I might put in a sleepy retirement portfolio, for income (though I don't currently have a position).

Stockopedia Stockranks are fairly positive on it at the moment, too. It could be worth researching in greater detail.

Orosur Mining Inc (LON:OMI)

Share price: 16.75p (+9%)

No. shares: 100m

Market cap: £17m

From the very large to the rather small, this South American gold miner had an update I'll briefly mention:

I very rarely look at this sector these days. The original reason I noticed Orosur was due to an extraordinary cash flow multiple.

My impression has been that this company is extraordinarily well run, relative to the sector. It has tightly controlled costs, decent margins (cash operating costs of $914/oz) and very clear forward guidance from management, which is usually achieved.

Multiples remain attractive today with $8 million in net cash generated from operations.

I have not had a position here for some time, however, since I came to the conclusion that the company would not fulfill the pledge made several years ago to commence the payment of dividends.

While the company's operational performance has been very good, I remain secure in my belief that significant dividends will not be forthcoming for the foreseeable future. $7 million of cash was used in investing activities during the latest quarter, as it explores and begins work on new mines, and extends the life of old mines, where resources will not last forever. Unfortunately, it does not keep investors up-to-date with total resources, which for me is the most important number.

So it's an interesting speculative share and a decent company against its peers in the sector, but I think there is a risk that the mine life is not long enough, and so therefore a very strong risk that dividends will not be sufficient to make this a successful investment (for buy-and-hold investors).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.