Good morning!

For anyone interested, I recorded a 17-minute video last night, to run through 5 company results or trading updates, mainly Begbies Traynor (LON:BEG) but also some comments on Manx Telecom (LON:MANX) , ISG (LON:ISG) , Next Fifteen Communications (LON:NFC) , and very briefly NetDimensions Holdings (LON:NETD) . When there's a backlog, and I'm too tired to type up a great spiel, it's sometimes easier to catch up by talking it through on a video, illustrated with the Stockopedia figures on each company. Hence why they are only occasional.

I'm pleased to see that the Greek Parliament has approved the latest bail-out deal, so that removes a significant political & economic uncertainty that has been hanging over the markets. For now. I imagine that what Greece has been through in recent months might well make other Eurozone countries think twice before electing so-called anti-austerity Governments. Arguably the Eurozone had to be harsh with Greece, to prevent more serious contagion from e.g. Spain, Portugal, or Italy.

I hope a mini Marshall Plan is agreed for Greece, to get its economy back on its feet, and repair some of the damage there. A Telegraph article today shows how many Greeks are now seeking work abroad, which of course will only make the demographics in Greece even worse (ageing population, but not enough tax revenues to support them). I will definitely be holidaying in Greece next year, to do my bit to help boost production at the Mythos factory!

Lots of trading updates today, so let's crack on.

Dart (LON:DTG)

Share price: 435p (up 4.5% today)

No. shares: 147.1m

Market cap: £639.9m

Results y/e 31 Mar 2015 - it's well above my usual market cap level, but it's a share that I've followed (and intermittently owned) for quite a few years. The market has reacted positively today to what seem to be good results, and positive outlook comments.

Underlying profit before tax is up 36% to £57.2m, with underlying EPS up 29% to 31.72p, so that's a PER of 13.7, which sounds reasonable.

Dividends - are very poor, with only 3p total divis for the year, yielding a paltry 0.7%, so it's certainly not a share for income seekers at the moment - although divis are likely to rise at some point in the future as the business matures.

Outlook - most noteworthy is that the company says, "We are optimistic that the Group's financial performance for the year to 31 March 2016 will exceed current market expectations".

Considering that they are only in the fourth month of the current financial year, to be putting out an above expectations comment is excellent. Although looking at market expectations, the broker forecast looks too low, at only 28.2p EPS. Also bear in mind that Dart should have good visibility, since customers book and pay up-front. So these factors possibly explain why the share price has not risen more than 4.5% today.

Another restraining factor is the warning about increased capacity from competitors:

Looking further ahead, we note the considerable increase in capacity planned by several low cost airlines over the next few years. We believe the continued expansion of our package holiday product, together with the development of our directly contracted sun and city hotel portfolio differentiates our Leisure Travel business, giving us confidence for our continued profitable growth.

So that's another reason not to get too carried away here.

Balance sheet - net tangible assets are £150.4m.

The current ratio is rather weak, at only 0.87, however travel companies have an unusual working capital profile, in that customers pay up-front in large amounts. So customer advance payments actually fund most of the business, in common with many other companies in the sector.

So it's important not to get carried away with the £293.8m net cash shown on Dart's balance sheet. Remember all this money actually belongs to customers (and then some). The deferred revenue creditor is gigantic, at £579.6m, which is the figure that records how much customers have paid up-front.

This is not necessarily a problem, but I'm flagging it because the whole concept of Enterprise Value doesn't work with travel companies, as they sit on so much cash belonging to customers. The big (albeit remote) risk is if all flights are grounded for an extended period (e.g. a major earthquake nearby), then there is the risk that airlines would have to return customer funds, and potentially go bust.

I suppose another risk is if a future Government required all customer deposits to be held separately in escrow. That would then leave a huge hole in the balance sheet for many travel companies, including Dart. It's always worth thinking about potential risks, even if they seem very unlikely to happen.

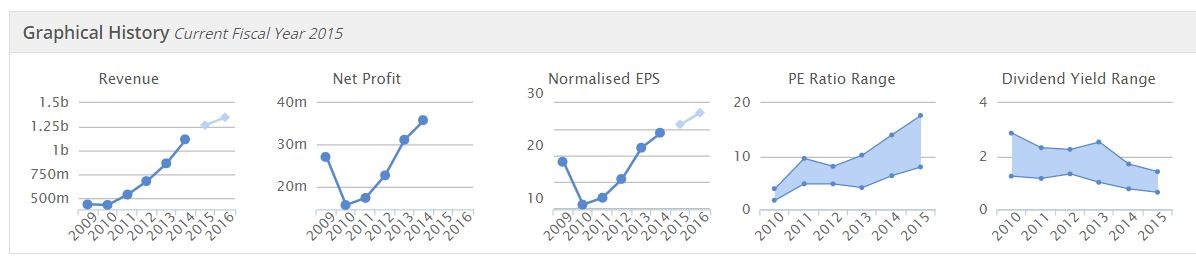

My opinion - Dart has been a fantastic share over the years, and the company's track record is shown well in the Stockopedia graphs below:

Although it's also worth pointing out that there are so many moving parts with the business model of airlines, that they're highly susceptible to things going wrong - e.g. in the spring/summer of 2014 DTG shares plunged from a peak of about 300p to as low as 180p on the issue of back-dated compensation to customers for late flights.

As I flagged to readers here on 26 Jun 2014, when the shares were 187p;

"in my view this could be a good buying opportunity to get into a fundamentally sound business, which is having a blip in trading, at an attractive price."

So are the shares still good value? Not really, in my view. I'd say they're fully priced for now, given the competitive pressures in the sector. Personally I'm more inclined to look at easyJet (LON:EZJ) as it's on a lower PER of 11.9, and pays a much more generous divi yield of 3.6%.

Although note that the StockRank is still exceptionally high, at 98. So there is a strong case for just running with the momentum (and hoping that nothing subsequently goes wrong). Personally I often like to top-slice positions which have done very well, and are looking priced fully. At least that way one can bank some of the gains, but still benefit from any further momentum. Also, top-slicing frees up some cash to buy on any subsequent dips, so it's a nice strategy in my view, but each to their own.

Safestyle UK (LON:SFE)

Share price: 236p (up 2% today)

No. shares: 77.8m

Market cap: £183.6m

Trading update - covering H1 to 30 Jun 2015, from this UK manufacturer & retailer of uPVC replacement windows & doors.

The key section says:

The Company has continued to trade well, with revenue for the first half of the year expected to be £74.0 million, an increase of 6.8% on the previous year (H1 2014: £69.2 million). This is pleasing progress against a particularly strong Q1 2014, reflecting further growth in market share and the price increases introduced in January 2015. We expect a continuing strong sales performance in the second half of the year and remain confident of achieving full year results in line with board expectations.

That all reads very well, and the key last sentence confirms full year expectations.

Order intake - has been "encouraging" recently, which they say is contrary to industry statistics saying the market had contracted by 10%.

Net cash - is reported at £14.9m on 30 Jun 2015.

Outlook comments are all positive too.

Valuation - this type of business is obviously cyclical, and benefiting from ultra-low interest rates, and improving consumer sentiment & disposable incomes. So the company should be trading well, and it's important not to get too carried away with the valuation. I would say a PER of 10-12 times earnings is ample.

It's rated at just under 13 times forecast earnings (although there's always the chance it might beat forecasts, given the positive noises made today), and the yield is pretty good at about 4.4%.

Note that the StockRank is a very strong 96.

My opinion - there's a lot to like here. Although in my view, the price is probably about right for now, personally I'm not interested in chasing a cyclical stock higher. Although it is worth considering that other buyers of the shares might just ignore the economic cycle altogether, and wrongly assume that profits will keep rising forever. So who's to say that there couldn't be more upside on the shares?

I'm wondering if there is any read-across here for Entu (UK) (LON:ENTU) (which I hold), whose shares have been in freefall in the last few days? It will be interesting to see what Entu say next week, when they report.

Finsbury Food (LON:FIF)

Share price: 92.4p (up 6.2% today)

No. shares: 126.8m

Market cap: £117.2m

Trading update - which relates to the full year ended 27 Jun 2015, for this speciality bakery group. It sounds good, the key part saying;

The Board is pleased to report that, following the positive half year trading performance, strong trading has continued in the second half and the Group will outperform its current EBITDA and profit expectations. Total Company sales revenues grew to £256.2m, an increase of 45.8% on prior year. This includes organic growth of £10.7m, an increase of 6.1% versus prior year, primarily within Cake.

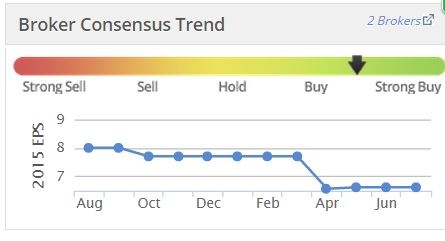

Although it's worth noting that the bar was lowered in Apr 2015, with a reduced broker consensus:

This group has grown significantly in the last year, with two acquisitions, which will feed through into bigger numbers next year too.

Valuation - they don't say by how much expectations will be beaten, so it's finger in the air time, or get hold of an updated broker note. I imagine the 7-8p range is probably where EPS is likely to be for y/e 28 Jun 2015.

With more growth in the current new year, estimates are 8.85p at the moment, but maybe 9-10p is possible for y/e 28 Jun 2016? So at 92p the shares look reasonably priced, subject to the balance sheet not being laden with debt.

My opinion - in my report here of 19 Jan 2015, I pointed out that at 63p the valuation looked "very reasonable", and that "...there might be scope for this to go somewhat higher perhaps?", which turned out to be correct, as the price is now up 47% in the six months since then.

I'd like to see the full year results before commenting further, but the acquisitions seem to have gone well, and the valuation isn't looking stretched yet.

Brainjuicer (LON:BJU)

Share price: 403p (down 3% today)

No. shares: 12.7m

Market cap: £51.2m

Trading update - I'm surprised this update for H1 to 30 Jun 2015, has only hit the share price by 3%, as on a glass half-empty day I think the sell-off could have been a lot bigger. I've never properly understood this company, but it seems to be a fancy market research consultancy.

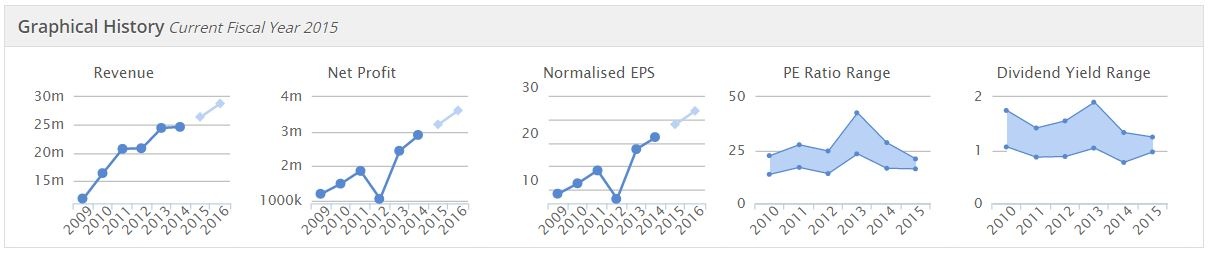

It's a proper company though, with net cash, paying (modest) divis, and a very good track record of growth in both revenues and profits (apart from a bad year in 2012 - which happens a lot with small caps - I think it's best to assume that all small caps will have at least one bad year in every five. That way you're prepared for profit warnings):

H1 profit is expected to be about 25% lower than H1 of 2014. Sounds pretty bad, but the explanation given seems plausible - that revenue was up 4%, but overheads grew faster, including some one-off costs, such as relocating their HQ in London. Plus headcount was increased 10%, to "invest for future growth".

Last year the company made an operating profit of £1.5m on turnover of £11.2m. So it looks as if profit will be about £1.15m in H1 2015.

I've checked back to 2013 and 2014, and there does seem to be an approximately 1:2 profit split for H1:H2, i.e. H2 is roughly twice as profitable as H1, which is alluded to in the final paragraph of today's announcement;

The Company has enjoyed good growth in its core quantitative products in the first half, and it does not anticipate incurring further material one-off costs in the second half. The Company generates the majority of its profit in the second half, and whilst revenue visibility remains typically limited the Board believes the Company is in a position to meet profit expectations for the full year.

That's quite cleverly worded, but being "in a position to meet" something is quite different from being confident that you will meet it! So the way I read it, the company hopes to make up the shortfall in H2, but might not. Therefore I view this as being potentially a deferred full year profit warning.

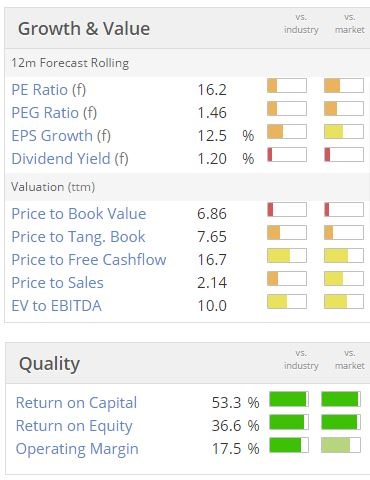

Given that this share doesn't exactly look a bargain, on a fwd PER of 16.2, personally I wouldn't be prepared to pay that sort of rating unless I had a more rock solid current trading statement & outlook.

This one looks potentially wobbly, so why take the risk of buying now? It's not for me at the moment. However, it is an interesting company, and I'd like to learn more about it over time.

Note that the quality scores are excellent on Stockopedia, and it has a very good stockRank of 88. So it looks a nice company.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.