Good morning!

Business as usual today, after the appalling weekend terrorist attacks in Paris. The best thing we can all do is just carry on as normal, and not let the scum concerned have the slightest impact on financial markets. After all, panic selling after a terrorist attack is helping to do their job for them.

Mello Beckenham

A quick reminder that this excellent, and very friendly monthly investor event is happening tonight. The company presenting is micro cap Creightons (LON:CRL) - a minnow cosmetics company. Unusually, for a £5m market cap company, it is consistently profitable, although I note there isn't a dividend.

Unless there is multibagger potential upside, then personally I don't tend to take an interest in stocks this small, as I've been caught out too many times with liquidity problems - you can't sell if something goes wrong, and the spread can be eye-wateringly bad if you want to trade in any decent size. Also the price can spike up or down, if there is a sudden surge in investor interest, or everyone rushing to exit at the same time on bad news. So care needed here I think.

That said, it's always interesting to meet potentially up & coming small companies, and management made a reasonably good impression when they presented at Mello Peterborough some time ago.

Details for those wishing to attend are here. I understand that the prospect of free samples is already attracting a more gender-balanced crowd than usual!

Majestic Wine (LON:MJW)

Share price: 299p (down 3.5% today)

No. shares: 70.7m

Market cap: £211.4m

I hadn't realised that the share price of this wine retailer had fallen back so much, after a big, apparently speculative, surge in price starting in Apr 2015, on a change of strategy & CEO. A big acquisition was made, of an internet business called Naked Wines, and unusually, the acquired company's CEO became the overall group CEO, if my memory serves me correctly. The acquisition seemed a bold move, given that Naked Wines was loss-making at the time.

I wrote an article here on 15 Jun 2015, reporting on the company's rather lacklustre full year results to 30 Mar 2015, and was unconvinced by the strategy change. Note that, at the time, the company said that short term profitability would be suppressed by investments needed to reinvigorate the existing Majestic Wine business.

Interim results - 26 wks to 28 Sep 2015 - these are not the easiest of figures to interpret, because there are quite a few moving parts - the acquisition of Naked Wines, a £4.8m profit on property disposal, and various other items classified as one-off.

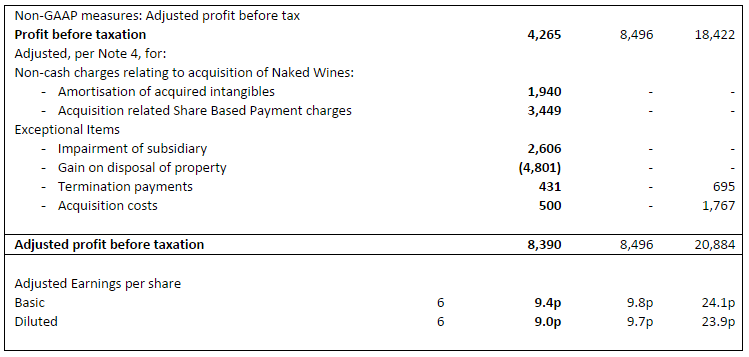

The table below is quite useful;

If you're happy to accept the adjusted profit figure, then it shows profit almost flat, at £8.39m, not a bad result at all, for a half year, of a company valued at £211.4m market cap.

Net debt has risen, as expected, due to the acquisition, but doesn't look a particular problem at £25.2m - especially as capex will reduce greatly, due to the new store opening programme being reduced from 16 to 2-3 new shops per year in future. They seem to be saying that the market is almost saturated, so they want to squeeze more out of the existing shops, rather than open lots of new ones. That's better for cashflow too, so makes sense to me.

Retail sales showed a decent +2.3% rise in LFL sales in H1. Commercial sales were also good, up 8%.

Naked Wines - I'm not entirely convinced by this, it's a crowd-funding platform for wine production, but it seems to be growing strongly, and is said to have reached breakeven six months ahead of target - although in theory it would be very easy to adjust that, by moving costs around within the group.

There again, the market loves internet growth stories, so I could see market sentiment suddenly turn bullish on this stock, if some strong KPIs are forthcoming in future from Naked Wines. So a nice potential catalyst there for upside on the shares, possibly? Internet-savvy management are also more likely to succeed with the general internet strategy for the existing retail business.

Outlook - more details are given on strategy, and the company reiterates that profits are likely to be subdued in the short term;

We are excited and confident about the future, but I must emphasise that these plans will take time and require investment which means that we expect profits to fall before they return to growth from a low point in FY16. We anticipate that our strong cash flow will enable us to invest as needed while continuing to deleverage and restoring the dividend in full by 2018.

Balance sheet - it's not too bad actually, if you can live with the £39.3m bank loan in long term creditors. Although note that this is partially offset by £19.1m cash, although I think one has to work on the basis that cash is usually at or near a short term peak on balance sheet dates, at most companies.

NTAV is £43.7m, which seems reasonable.

Working capital looks alright, with a current ratio of 1.26 - remember that because retailers sell for cash, then they can operate with a much lower current ratio than other businesses which have to wait typically 60 days to get paid by customers. Although Majestic is not a pure retailer any more.

Given the cash generative nature of the business, reduced capex plans, and a stated desire to pay down debt from the substantial cashflows, then I can live with the bank debt.

My opinion - given that the hype has come out of the share price, I reckon this could actually be potentially, quite a good time to buy. The core business appears to be trading reasonably well, although margins will probably remain under pressure from supermarkets.

Removing the 6 bottle minimum purchase is a good idea too.

Upside from the market getting excited about the internet strategy and Naked Wines, could put some fizz into the share price, as we saw happen earlier in 2015.

A reasonable balance sheet, and debt levels that look under control, and set to reduce, overall mean that to my mind this share looks potentially interesting.

More research is needed, but it's certainly going on my watch list. I wonder if the share price is depressed as previous holders who liked the dividends are selling out? Although the company has said today that it intends restoring the divis in full, by 2018.

The downside risk is mainly that the internet stuff goes flat, but that doesn't seem to be the case so far. I think there are some wine-related unintended puns creeping in here, so I'll put a cork in it!

Gateley Holdings (LON:GTLY)

Share price: 103p (flat on the day)

No. shares: 105.3m

Market cap: £108.5m

Trading update - covering the 6m ending 31 Oct 2015, sounds reassuring;

The Group has made a solid start to the financial year and is trading in-line with management expectations. Revenues for the first six months are expected to be not less than £29.5 million, being not less than 10 per cent ahead of the corresponding pro-forma period last year.

Stockopedia doesn't show any broker forecasts, so I can't really form a view on valuation, and the shares have only been listed a few months - it listed on 8 Jun 2015, so there's no track record yet as a listed company.

My opinion - small cap IPOs have generally been dismal in this cycle, with so much junk floated. Even the good companies have often warned on profits fairly soon after listing, probably because they were dressed up for listing, with unsustainable profits, and overly optimistic forecasts.

Therefore I'm really not particularly interesting in looking at recent IPOs any more - it's like searching for a needle in a haystack. If the majority are over-priced, and/or flawed in some way, then why bother looking?

That said, having had a quick look at the last set of results here, Gateley is a decently profitable company, and paying divis, so it might be worth a look.

NB. Note that the historic figures shown on Stockopedia look to be for when it was a partnership. This is important because profits were artificially high, due to remuneration for senior staff (partners) being paid out of retained profits. So note the pro forma profit adjustments reduced 2014/15 profit from £23.6m to £9.8m, by reclassifying partners' profit share as salaries. This point is clearly very material to how you value the shares.

Nothing much else caught my eye today as being of interest, so I'll sign off here.

Regards, Paul.

(of the companies mentioned today, I have no long or short positions. A fund management company with which I am associated may hold positions in companies mentioned.

NB. These reports are just my personal opinions only, which are subject to change without notice. Nothing in these reports is intended as, nor should be misconstrued as being financial advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.