Good morning!

Alongside today's updates, I'm also planning to add a few comments on Dart (LON:DTG), to continue the conversation in Friday's comments thread.

Cheers,

Graham

Carillion (LON:CLLN)

- Share price: 59.65p (+6%)

- No. of shares: 430.3 million

- Market Cap: £257 million

Carillion appoints EY to support Strategic Review

This was at 117p when I covered it a week ago, and near 200p the week before that, so today's 6% bounce is likely to be of little comfort to shareholders.

This building support services group is, as we've discussed, the UK's most shorted stock. 21% of shares outstanding are currently reported short: that's a reduction compared to the last time I checked, implying there has been a decent amount of short covering over the past week.

A large amount of short interest can be a helpful bonus when you go long of a stock, because it means there is a lot of pent-up demand from the shorters who have no choice but to eventually buy it back. In extreme cases, you can get a gigantic short squeeze as what happened with Volkswagen shares in 2008!

Long-term success still depends on being right about the company fundamentals, of course, and in particular on the company in question not going bust or diluting shareholders to oblivion while you are in it.

In the case of Carillion, an equity raise looks like it could be on the cards, although who knows how big it might be?

With unpopular decisions on the cards and on interim CEO in the hot seat, some awkward tasks are being outsourced:

Carillion, the integrated support services group, announces that it has appointed the professional services firm, EY, with immediate effect to support its strategic review with a particular focus upon cost reduction and cash collection.

Working capital and recoveries are also mentioned in a later paragraph as strategies to assist in reducing net borrowing.

CEO comment:

We are moving forward quickly with the actions outlined last week. Alongside our own efforts, EY will provide support across the business and bring an external perspective to our cost reduction and cash collection challenge. My priorities are to reduce the Group's net debt and create a balance sheet that will support Carillion going forward.

My opinion: I completely agree with using outsourced expertise when it comes to skills which aren't core to a company's business model, but I hate to see consultants used in relation to core activities which a company should be able to do itself.

I also think that strong managers should be able to take unpopular decisions themselves, rather than saying that the consultants made them do it.

So I'd hope to see the strategic review finished quickly and for the company to move on, having made the necessary hires it needs to take care of these matters itself in the future.

I obviously wouldn't consider making a new investment in Carillion right now. If I was still holding the shares, having bought them some time ago, maybe I'd keep holding them, if I could satisfy myself that the equity raise might not be very big.

But with c. £700 million in net debt forecast, the enterprise value at the current share price is still close to £1 billion on a pro forma basis. I'm not sure that's low enough yet, given the doubt which one might now reasonably have in relation to the reported results from prior years.

Stockopedia classifies it as a Speculative Small-Cap which is also a Value Trap.

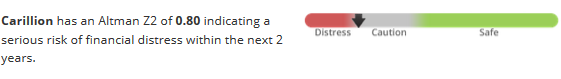

The Altman Z-Score is as follows:

Edit: Thanks to timarr for pointing out there was also a HS2 announcement by Carillion today, along with the strategic review. It's £1.4 billion in contracts for the London to Birmingham section of the route. This is a joint venture with Eiffage and Kier Group. Carillion shares are now up 22% so far today - lots of fun for traders!

Parity (LON:PTY)

- Share price: 10.25p (+12%)

- No. of shares: 102 million

- Market cap: £10.5 million

This creeps over our £10 million market cap limit with the help of today's trading statement, and has been requested by FREng.

It's a recruitment and consultancy business with an emphasis on technology.

This update says trading is merely consistent with full year expectations, but has an upbeat tone

Further to our AGM statement on 25th May 2017, when we stated that the Group had had a satisfactory start to the year, we are pleased to report that there is clear evidence that we are maintaining momentum. The Board expects Group operating profit for the half year to show double digit growth versus H1 2016, and to be consistent with the market's full year expectations.

Consultancy revenues are ahead of expectations but recruitment divisions are down compared to last year.

We also read that net debt reduced from £4.4 million to £2.3 million, although a working capital swing has apparently caused this.

I like positive swings in working capital, but it's important to note they are generally "one-time" bonuses, and can easily reverse.

My opinion: The company appears eager to grow the consultancy side of the business, rather than recruitment. While the consultancy division may indeed be higher-margin, I find recruitment businesses much easier to understand and to analyse as an investment proposition.

Buying into people businesses is very difficult, especially when you're not on the inside. I would need to do a lot more work on this and see a lot of value to consider it.

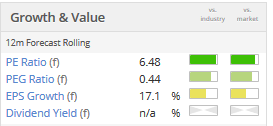

For what it's worth, Stockopedia gives it a Value Rank of 96, which says to me that the market agrees it needs to be priced in a modest way. The forecast PE ratio is merely 6.5x, and it also has a very low PEG ratio.

Dart (LON:DTG)

- Share price: 534p (down 20% since last Wednesday)

- No. of shares: 148.3 million

- Market cap: £791 million

Another one above our market cap limit but it was widely discussed last week (e.g. on the comment thread here) so I thought I should get something written down for future records.

Dart manages Jet2 and Jet2holidays, and also owns a distribution business.

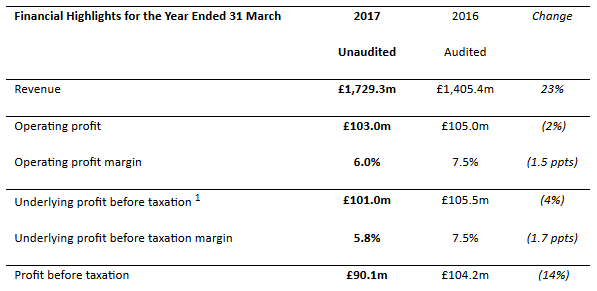

Final results released last week had the following highlights:

Results slightly worse then but the final dividend was raised 26%.

The 14% reduction in PBT (pre-tax profit) is explained as follows:

This result includes considerable investment to launch our two new Jet2 operating bases at Birmingham and London Stansted Airports and also includes a £10.9m charge for foreign exchange revaluation losses (2016: £1.3m). Before accounting for these revaluation losses, underlying profit before taxation reduced by 4% to £101.0m (2016: £105.5m).

So if you trust that the "investment" made into Birmingham and Stansted is indeed just that, then the underlying result is not so bad.

The outlook statement is reassuring:

Given visibility on current forward bookings and the recent successful launch of our new operating bases at Birmingham and London Stansted Airports, the Board expects to meet current market expectations of underlying profit before taxation for the year ending 31 March 2018.

My opinion

These results don't look too bad to me.

Number of passengers is up 17%. Average airline tickets were down 5% to £86.65 and the average load factor was 91.5%, down by 100 bps.

That could be the cause of concern which has sparked the sell-off, if Jet2 is considered to be failing to compete with the larger budget airlines. Its load factor isn't at the level of Ryanair, for example, which increased load factor to 96% in June (admittedly a seasonal high, but it has consistently been around 95%).

Jet2 is different to Ryanair with its focus on package holidays, but I reckon that the 91.5% result is still a bit short of being satisfactory. And it coincided with weaker pricing too, so overall demand must have been quite a lot weaker.

The Distribution side also appears to be a little disappointing, and the announcement describes it as facing very competitive market conditions.

Further down, I can see that this line may have spooked investors:

Looking further ahead, there remains considerable uncertainty around "Brexit" negotiations and the effect these could have, both on our freedom to fly and on our customers' ability to travel to our leisure destinations. This is unsettling; however, we believe that the UK Government recognises the importance of aviation services, and similarly, European countries appreciate the value that British tourists bring to their respective economies.

Personally, I'd be optimistic of arrangements being made so that tourism continues without great disruption. I understand that this is a serious macro fear in the industry. Michael O'Leary (Ryanair CEO) has also been making some dire warnings about it over the past week.

Airlines are well-known for destroying capital in the long-run but I wouldn't be too upset about owning some Dart shares in these circumstances: a large, vague, macro-oriented threat combined with a company that is still performing in a reasonable way, has a decent net cash position, is increasing its dividend, and has a super StockRank. Doesn't sound too bad at all!

Taptica International (LON:TAP)

- Share price: 385p (+4%)

- No. of shares: 60.6 million

- Market cap: £233 million

This mobile advertising platform announces a small-ish acquisition. It's buying 57% of a Japanese company in the same space, Adinnovation, for up to $5.7 million in cash.

Rationale:

Following the establishment of Taptica's office in Seoul in 2016, and together with an already strong China-based presence, the Acquisition forms part of Taptica's stated strategy to increase its presence in the Asia-Pacific region. The management of Taptica anticipates Japan will be the next key growth market for mobile advertising due to its developed mobile networks and strong proliferation of smartphones.

This is a fairly interesting stock, which I have not examined in detail before. It's only been listed since 2014 and is based in Israel.

The financial metrics all look fantastic (high ROCE, good operating margin, strong growth), and perhaps the market hasn't quite managed to suspend its disbelief yet (a bit like £PLUS).

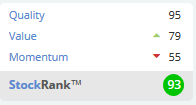

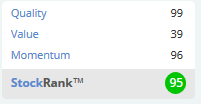

As such, the Quality Rank is excellent but the Value Rank is also not bad, so that the overall StockRank is an excellent 95.

My only previous foray into mobile advertising was with the ill-fated Zamano (LON:ZMNO), whose business model was regulated out of existence.

Taptica International (LON:TAP) looks an awful lot more interesting than that one, so I would be glad to read more and learn more about it. The international discount is not always justified on AIM.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.