Good morning!

I'm kicking things off today, but Paul will probably be along later with a few thoughts of his own.

I am looking at Burberry (LON:BRBY), Tribal (LON:TRB), Midwich (LON:MIDW) and Premier Foods (LON:PFD), while Paul is looking at Best Of The Best (LON:BOTB).

Also, please note that yesterday's report now covers 10 stocks, thank to a huge contribution by Paul, including late updates. The report now includes:

Brady (LON:BRY), Craneware (LON:CRW), Distil (LON:DIS), dotDigital (LON:DOTD) Elegant Hotels (LON:EHG), Games Workshop (LON:GAW), Greggs (LON:GRG), Hotel Chocolat (LON:HOTC), Johnston Press (LON:JPR), Miton (LON:MGR).

Click here for yesterday's report.

Regards

Graham

Burberry (LON:BRBY)

Share price: 1616p (+1.4%)

No. shares: 440m

Market cap: £7,000m

(At the time of writing, I holding a long position in BRBY.)

Though it is not a small-cap, I think it would be remiss of me not to mention Burberry. This is a stock I've previously owned and purchased on behalf of clients, and is currently a substantial (nearly 20%) part of my portfolio. (I don't recommend that others run such a concentrated portfolio as this.)

I had a poor year in 2016, partly due to some heavy GBP exposure in my companies, but it would have been much worse without Burberry, which produced a total return of 45%.

Look at the Q3 result: revenue is up 4% underlying, but 22% at reported FX.

I really think it's a shame that currency issues have to wreak such havoc on the international financial system, but it's not a problem I'm going to be able to fix. I just need to be more careful with it.

Anyway, I'm pretty happy with these results. China, a country with which I have some familiarity and understanding, and which is crucial for Burberry, has seen an "acceleration":

· Low single-digit percentage growth in Asia Pacific

- Acceleration in Mainland China, with high single-digit percentage comparable sales growth, despite the impact of the elevation of the store portfolio in Beijing

- Hong Kong improved to a low single-digit percentage comparable sales decline, with positive conversion offsetting the majority of the footfall decline

Elsewhere, the UK has surged by a incredible 40%, with growth in tourist and domestic spending. However, the US saw a small decline.

Outlook: In line with current market expectations.

My opinion: I think Chris Bailey can be proud of the progress made at Burberry while he juggled the Chief Creative Officer and Chief Executive Officer roles.

The incoming CEO, formerly at Céline, will be joining as Exec Chairman of APAC/Middle East later this month, before ascending to CEO in July.

I'd like to see him continue with the cost reduction and digital themes, which are working well, and hopefully the brand will benefit from Bailey's opportunity to again focus purely on design.

Tribal (LON:TRB)

Share price: 69p (+6.4%)

No. shares: 195m

Market cap: £135m

This is a successful turnaround story with the shares recovering from c. 17p earlier this year when the company had a rights issue, disposals and a management shakeup.

Things are back on track:

Tribal Group PLC is pleased to announce that, following a good second half, the Board anticipates that Group revenues will be in line with its expectations for the year to 31 December 2016 and the performance of the Group will be materially ahead.

Huge (versus the mkt cap) cost saving of £8.5 million "have been delivered", and "further efficiency savings are expected in 2017".

For me, this means that prior results are virtually irrelevant - new management have turned this into a very different proposition. I expect that this stock's Value Rank (currently just 12) will improve when full year results are announced.

Midwich (LON:MIDW)

Share price: 261p (+17%)

No. shares: 79m

Market cap: £206m

This international group of tech distributors has published a fantastic slice of news:

"...the Board now expects to report revenue for 2016 of approximately £370 million, representing growth of around 18 per cent over prior year. Movements in exchange rates account for approximately 3 per cent of this growth. The Group has delivered this revenue growth and continued to improve gross margins in line with the Board's expectations.

As a result of this strong performance, the Board now anticipates reporting adjusted profit before tax for 2016 comfortably ahead of its previous expectations."

The anticipated profit and the previous expectations are not quantified.

In September, the company made an acquisition of a business with £20 million annual turnover, and I wonder if this is included in the above growth percentages? Even if it has been included, the revenue growth rate would still have been very strong.

Midwich has only been listed since May, and has not appeared on the SCVR before. I'm sure we'll get to know it better, over time.

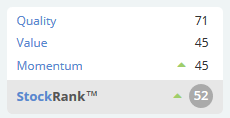

For now, the StockRank is average and the dividend yield is c. 4.7%, which may be of interest to some investors.

Premier Foods (LON:PFD)

Share price: 40p (-16%)

No. shares: 832m

Market cap: £332m

This has been a rollercoaster for investors, and not a terribly happy one at the moment.

Instead of cashing out last year, at 65p per share, to a bid from US-based MCormick, the company chose to go into partnership with Japanese company Nissin (which owns 20% of Premier).

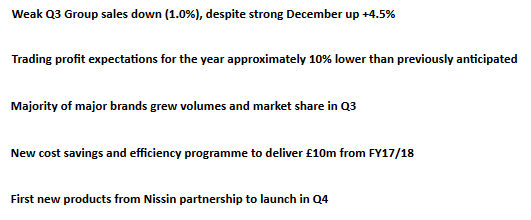

Today, the company reports as follows:

So it's not all doom and gloom, but it's still a serious profit warning.

The company says that its categories were "generally softer due to changes in retailer promotion strategies," to include "a reduction in multi-buy promotions which has the effect of reducing category volumes".

International sales are much more positive, up by 15%.

Input costs

The Group is experiencing material input cost

inflation, notably in commodities such as sugar, chocolate, dairy, wheat

and palm oil. Input costs have also been driven up by currency

devaluation.

Outlook

The Group's expectations for Sales and Trading profit

in FY16/17 are lower than previously anticipated, with Trading profit

expected to be 10% lower. Net debt as of 1 April 2017 is expected to be

around £525 million.

My opinion

The balance sheet is obviously unbalanced and puts the company on an enterprise value of c. £850 million as of April. The debt-adjusted P/E multiple prior to today's warning was c. 12x, according to my calculations.

This is certainly not a stock where I would put a large chunk of my portfolio - underlying financial leverage is not ok, when you are concentrated.

Which is a shame, because I'd like to think that Premier's brands still have a bit of pricing power. Obviously, something has come unstuck in the most recent quarter due to the pricing strategies at the supermarkets, but surely their value could be salvaged with the correct strategy.

But I'm glad this has never tempted me and I'm still not tempted, due to the capital structure.

Contribution by Paul Scott:

Best Of The Best (LON:BOTB)

Share price: 315p (up 7% today)

No. shares: 10.1m

Market cap: £31.8m

(at the time of writing, I [PS] hold a long position in this share)

Interim results – for the 6 months to 31 Oct 2016.

This company is the long-standing operator of supercar competitions in airports. However, that’s just the shop window now, and the method by which the brand & reputation was built. Online ticket sales is the main area of activity now. This is what makes this share so interesting to me. Online sales provides an opportunity to scale up dramatically, with little increase in operating costs (apart from marketing spend of course, which is what drives growth). Key points;

Revenues are up 10.9% overall, to £5.5m. The key number is online sales, up 24.6% to £4.16m for the half year. So you can see that online is the bulk of sales, at 75% of the total.

Profit before tax has almost doubled, from £0.48m in H1 last year, to £0.92m H1 this year.

Note the high profit margin, of 16.7%. So this is a small, but high quality business.

Balance sheet – is strong, and contains the freehold office premises, plus £2.28m in cash.

Dividends – BOTB has a history of being generous with divis – paying out surplus cash in a series of special divis. A 10p special divi was paid in Dec 2016, on top of the 1.3p regular divi. I’m expecting more of the same in future.

New website – is due to be launched imminently. Management decided to start with a blank sheet of paper and redesign the website from scratch. This is because the old version had reached its limit, in terms of functionality. Improved loyalty schemes & other features will be interesting to check out shortly, when the new site launches.

Capitalised development spending is modest – only £109k in H1. The accounting is conservative, with no funnies in the figures. Management are trustworthy, in my view, based on an excellent track record.

Marketing spending is being increased. I’m delighted to hear this, as I think management has arguably been too cautious to date. I think the business is capable of much faster growth, so a more aggressive marketing approach is to be welcomed.

My opinion – this share is a firm favourite of mine, and has been in my personal and fantasy portfolio for some time. I regard this as a core long-term holding. To me, the bigger picture is that I’m hoping for an eventual trade sale, at multiples of the current price. Therefore, it’s missing the point to agonise over what the PER is at the moment. Long term, that won’t really matter very much.

Also, in the short term, profit is a moveable feast at this company. Marketing spend can be dialled up or down to whatever management want. So personally I would prefer if the company would actually run at breakeven, and spend more on marketing. Providing that marketing spend is producing measurable positive results, in terms of new player recruitment & retention.

International growth is another area of interest. Both driving overseas players to the UK website, and setting up overseas franchises, such as the one in India.

Lots of potential here, thinking longer term, in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.