Good morning!

For anyone interested, I had a second wind yesterday evening, and added two more sections into yesterday's report - on APC Technology (LON:APC) and John Menzies (LON:MNZS) .

Also, on discussing H & T (LON:HAT) in more detail with readers here, in yesterday's comments section, I'm becoming a bit more relaxed about the ethics of pawnbroking, which seems less bad than some of the alternative lending sources. I read somewhere today that 80% of H&T's customers do actually redeem their loan & get their stuff back, so there does seem a valid place for emergency lending where people are stuck. Incidentally, I've always enjoyed the TV show, Posh Pawn, where people pawn some amazing items of jewellery, Ferraris, helicopters, even a mini submarine! So HAT has crept on to my possible purchases list at 199p per share.

I spotted an interesting article yesterday, but annoyingly can't now find the link, it might have been on Seeking Alpha, Zero Hedge, or MarketWatch websites, which said that 23 countries were currently already experiencing stock market crashes! It then provided links to the charts of each country's main stock market index. Suitably alarmed, I then discovered that these were all emerging market countries, and their markets were giving back some or all of the gains which had been made in the previous six to twelve months. So in most cases, the recent falls look a fairly normal reversal of a previous exaggerated move upwards. Apparently this is at least partly caused by the dollar's strength, so that people who borrowed dollars to speculate in emerging markets are now forced sellers, as their dollar loans have swollen in local currency terms.

So does any of this matter to me? I don't think so. Emerging market wobbles, and carry trades unwinding, are fairly normal events. I can't see why that would affect the value of Spaceandpeople (LON:SAL) or affect the amount of clothes bought by Boohoo.Com (LON:BOO) customers. In fact, the strong pound will be good for BooHoo's gross margins.

There are always macro worries. The main thing for me, is that the key UK and US economies now appear to be in a good, self-sustaining growth, inflation is low (good), consumers & companies are getting a tax cut from cheaper oil, so for me, and the sort of things I invest in, the macro picture looks absolutely fine.

Memo to self: stop reading alarmist articles on the internet. There's always someone predicting a stock market crash, and once in a blue moon, they are correct, like the proverbial stopped clock.

It's very quiet for company news again today, but I note the diary for next week is getting busy with large & mid cap interim results, so small cap 30 Jun interim results should mostly follow on. The reporting cycle in the UK is far too slow in my view. A company with good financial controls really should be able to issue interim results 3 or 4 weeks after a half year end.

Robinson (LON:RBN)

Share price: 191p (down 3.5% today)

No. shares: 16.4m

Market cap: £31.3m

Interims to 30 Jun 2015 - the company has merged three statements into one - its interim results, a Director change (a new NED has been appointed, with relevant experience at Unilever), and it is changing adviser to FinnCap. I think it would have been better to do the conventional thing, by putting out three separate RNSs, because that makes it easier to refer back to specific announcements in future.

Madrox - this was a large acquisition, relative to the size of existing Robinson, which was bought in H2 of 2014. So today's H1 figures for 2015 include Madrox, but the comparative figures don't. So turnover and operating profit should be strongly up, which they are;

Turnover is up 25% to £13.6m (for six months only remember)

Operating profit is £1,235k, up from £495k (before amortisation & exceptionals)

Interim divi up 11% to 2.5p, so it looks like the full year divi might be slightly higher than forecast (currently 5.3p). It looks to me as if they might be heading for a 5.5p full year payout, which would give a handy yield of 2.9% - not to be sniffed at, in this low interest rate environment.

Commentary - the following points are noted;

- Earn-out for Madrox has risen by £0.9m to £3.4m, due to it performing well (treated as an exceptional cost) - can be paid from existing cash/bank facilities, they say

- Reduced turnover of £0.8m in H1 from contract loss at their other Polish business, but this has previously been flagged, so is not a new problem (see my report of 15 May 2015)

- Negative impact from 9% weakening of Polish Zloty vs Sterling

- Lower resin prices reduced turnover (but presumably not profit, as it's a pass-through cost)

- Cashflow strong, reducing net debt to £2.3m

Outlook comments very brief, but sound positive;

During the second half of 2015 new business gains are expected to lift revenues and lead to a significant recovery in Lodz, especially in 2016.

Balance sheet - not as good as it was, due to taking on some debt to part-fund the acquisition. Overall looks OK to me, but the payment of the £3.4m earn-out due in the next 12 months will replace "other payables" with more bank debt, which I'm not terribly comfortable with. I'd say bank debt is getting towards the top end of comfortable, and I'd like to see them pay it down more quickly, rather than increasing dividends.

Actually, forget that, as I've just remembered they have freehold property assets. On checking the 2014 Annual Report, there is £7.2m in net book value of freehold property, and a note says that surplus properties have a market value estimated at £4.6m.

Therefore, I'm fine with the bank debt, given that it is supported by property assets.

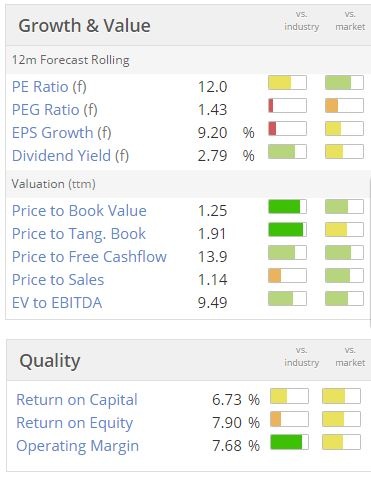

Valuation - assuming that forecasts remain unchanged, this share looks priced about right to me;

My opinion - as Robinson will be permanently under severe margin pressure from its customers (who sell food & personal products into supermarkets mainly), then I think expectations for this share should stay grounded. A PER of 12 looks about right.

I think it would need some good earnings upgrades to drive the share price much higher, so for the moment the price looks up with events in my view.

With hindsight, it would have made a cracking buy on uncertainty a little while ago, but the re-rating looks to have already happened, so I can't see any reason to buy now it's higher.

Inspired Energy (LON:INSE)

Share price: 12p (up 1.1% today)

No. shares: 433.4m

Market cap: £52.0m

Interims to 30 Jun 2015 - a reader has asked me to take a look at this company. I always ignore any company with "energy" in the name, as I don't report on the resources sector. However, in this case this company seems to be an energy procurement consultancy (based near Blackpool) for corporate customers & SMEs, so it sounds very much like Utilitywise (LON:UTW) at a first glance (note: I hold a long position in UTW).

Revenue rose 32% to £6.5m for the six months, so with a market cap of £52m it's valued on a rich multiple of sales - 4 times, if we annualise the interim figure by doubling it. So the company must be highly profitable.

Profit - EBITDA was strong, at £2.5m, then a selection of costs are listed, so take your pick which ones you want to include as recurring costs, and which you don't!

I've highlighted below which items I consider to be of a recurring nature, so would use to calculate an underlying adjusted profit figure, which for me drops out at £2.15m, so a chunky profit figure for six months, and a strong profit margin on just £6.5m sales.

Investor presentation - click on this link to view the investor/analyst presentation of the calendar 2014 results.

I'm also having a look through their 2014 Annual Report, and it seems essentially the same business model as Utilitywise (LON:UTW) - receiving commissions from the energy companies for introducing customers. This has always struck me as an odd way to do things - why do the energy companies pay such fat commissions to intermediaries, instead of just competing in the open market, direct?

Revenue recognition - I don't have time to go into this in detail now, but am flagging it up as an issue that needs further work. From what I can gather, Inspired Energy seems to adopt a much more conservative revenue recognition policy than Utilitywise.

For example, consider the following extracts from their respective interim accounts;

Utilitywise (6 months to 31 Jan 2015)- Turnover £29.9m

- Debtors (in non-current assets) £18.4m

- Debtors (in current assets) £16.7m

- Total debtors £35.1m (117% of six month's turnover)

- Trade & other payables £15.2m (in current liabilities only) - 51% of turnover

- Turnover £6.5m

- Debtors (in non-current assets) £nil

- Debtors (in current assets) £6.6m

- Total debtors £6.6m (102% of six month's turnover)

- Trade & other payables £1.0m (in current liabilities only) - 15% of turnover

So the key difference seems to be that Utilitywise appears to book sales (and therefore increased profits) more aggressively, since it's very unusual to have debtors in both current assets and non-current assets, i.e. sales have been booked through the P&L where the customer won't pay within the next 12 months, which strikes me as very odd.

However, the auditors have agreed it all, and Neil Woodford has also been through it all with a fine toothcomb, and was emphatic about the accounting treatment being acceptable.

Having said that, Inspired Energy also has substantial Debtors, which are equivalent to 102% of the previous six months' turnover, still very high, although not as high as Utilitywise at 117% of turnover.

I'm generally uncomfortable with the accounting in this sector, for both companies, but Utilitywise appears to be the more aggressive in booking revenues & hence profits.

Note also that Utilitywise seems to have much larger trade payables, although I'm not sure if that has much significance or not. Looking back at their 2014 Annual Report, this was mostly accrued taxes, other accruals, and deferred income (to reflect cash that customers have advance paid).

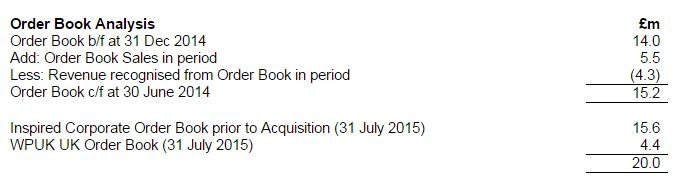

Inspired Energy talks about its Order Book, and gives the following table;

I am wondering whether this is stuff that Utilitywise would have booked as revenue, but Inspired Energy has not yet done so? This needs more work to dig into, but there looks to be an issue here, in that the two companies do not seem to have comparable accounts. Therefore it's difficult to form any conclusions about their respective valuations.

Cashflow - I note that Inspired is not generating anywhere near as much free cashflow as its reported profits, due to the increasing debtor balance. That is a concern, but no doubt people will say it's because of the growth rate. High debtors always worry me, as it's nearly always a sign of future problems, in my experience. Although this sector is a bit different, where customers are often billed retrospectively by the consultancy company, based on the money they have theoretically saved from switching tariffs.

Dividends - both companies pay divis, which in encouraging, as it reassures that profits are real. Inspired has a forward yield of 2.5%, whilst Utilitywise has a yield of 4.2%.

My opinion - this is the first time I've looked at Inspired Energy, and it strikes me as being rather expensive for the size of business, and in a sector that I don't like (although I bought some Utilitywise on the recent plunge to 180p, as the fall looks overdone).

For the time being though, these energy consultancies seem to be generating bumper profits, and are paying divis too, so whilst their accounting policies might raise question marks, it seems a lucrative area (for now).

All done for today. See you in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in UTW, and no short positions.A fund management company with which Paul is associated may also hold positions in companies mentioned.NB. These reports are just Paul's personal opinions, they are NEVER share recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.