Good morning!

It's strikingly quiet this morning - very low trading volumes on the basket of shares which I follow in real time. Independence Day weekend in the USA, Greek Referendum, Wimbledon - take your pick for what to blame!

I like this time of year, as thin volumes can create some interesting short term buying opportunities, if someone tries to offload some illiquid stock when there's hardly anyone watching! So I usually pick up one or two bargains over the summer and similarly over Xmas/NY.

Staffline (LON:STAF)

Share price: 1340p (up 1.5%)

No. shares: 27.7m

Market cap: £371.2m

Trading update - this staffing group reiterates its AGM update on 21 May 2015, saying that H1 "trading has been strong and in line with market expectations".

Further comments are that the staffing division has "an excellent new business pipeline".

Its other division, now called PeoplePlus (which operates Government Work Programme contracts) "is making good progress" in the 9 regions where it is the prime contractor.

So this all sounds good.

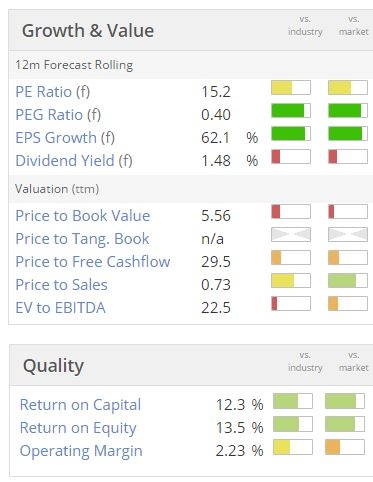

Valuation - despite the huge increase in share price in the last few years, the valuation (on a forward PER basis) is not outragrous by any means - at 15.2 times forward earnings, as you can see from the usual graphics below.

Look at how strong EPS growth has been. Without wishing to pour cold water over things, as there's no doubt this company has been a big success story so far, I should point out that a lot of the increased earnings has been achieved by gearing up the balance sheet, and making acquisitions funded partly by debt.

Balance Sheet - the last reported figures show net tangible assets are negative, at -£15.8m. Gross bank debt is fairly considerable, at £35.8m, although that is mitigated on the balance sheet date by cash of £18.4m, so net debt was £17.4m.

I think it's more important to look at gross debt, because the year end cash figure is often window-dressed to a level which is atypically high, at many companies.

This level of debt is not alarming, but it's getting towards the top end of what I would say is comfortable.

Share based payments - these look excessive to me, so I am flagging it up.

In 2014 the company made an adjusted operating profit of £19.4m, but then awarded £3.7m in shares to management. That's nearly 19% of profits given away as bonuses effectively. In 2013 the figure was nearly 17%. I think that is too much.

My opinion - I'd like to see Staffline do a big equity fundraising (say £35-70m), to shore up the balance sheet. That would obviously dilute existing holders, and reduce EPS. So the PER would then rise from about 15 to perhaps 17-18, which I think it looking a bit toppy.

With a divi yield of only 1.5%, that's nothing to write home about.

There are also issues with the toxicity & potential political risk from supplying low wage temporary staff. Public opinion is hardening towards this issue, with income inequality now so grotesquely unfair, that companies like Staffline could come under fire again, as it has done in the past - although previous concerns were batted away, and would have actually been a very good buying opportunity! I'm only mentioning this issue because its a risk factor for shareholders, that people need to consider.

Maybe the valuation is up with events for the time being, and with the weak balance sheet too, it doesn't appeal to me any more. Although it has to be recognised that management have done a great job so far in creating shareholder value - the shares have six-bagged since I first flagged up the value here on my mothballed blog in 2012.

A further point to note from the chart below, is the huge jump recently as earnings expectations have risen considerably from acquisitions. This makes me ponder whether the market's method of applying a PER to earnings is actually correct? Or maybe the PER being used is too high? If a company can just bolt on relatively cheap acquisitions, and instantly create hugely more value than the price being paid for the acquisitions, then it suggests that perhaps the stock market is over-valuing things? Just a thought.

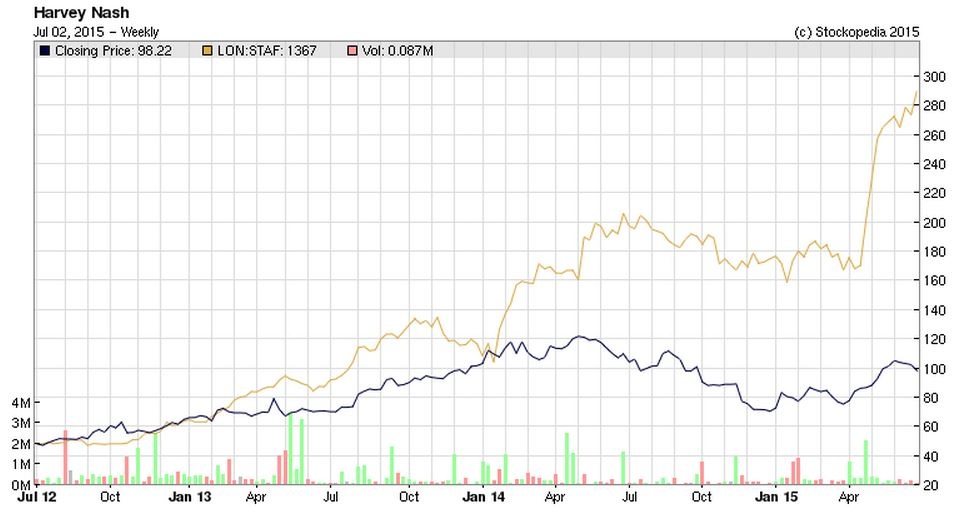

Harvey Nash (LON:HVN)

Share price: 98.2p (down 3.7% today)

No. shares: 73.5m

Market cap: £72.2m

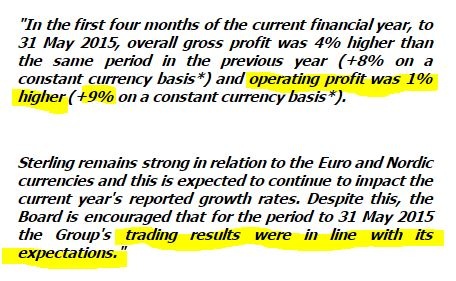

AGM trading update - this sounds alright - the company has successfully absorbed adverse forex movements, and says that it's in line with expectations for H1 (6m to 31 May 2015):

(I haven't quite got the hang of my new vertical mouse, as you can see above, but am getting there slowly!)

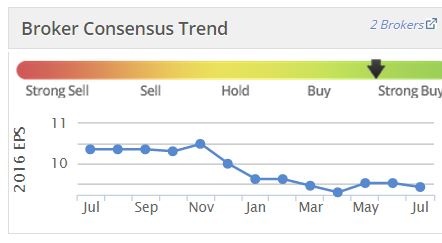

It looks like the company has managed broker expectations gradually down in the last year, which is far preferable to a profit warning:

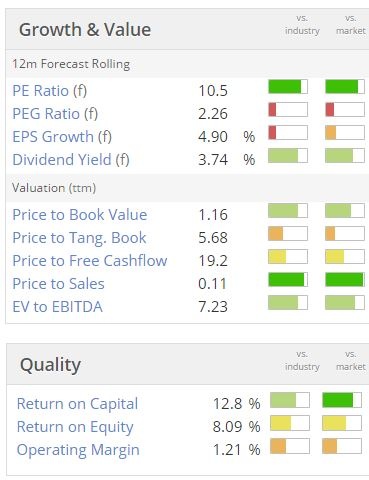

Valuation - it looks reasonably good value, with a lowish PER, and a reasonable dividend yield. It also scores a very high StockRank of 98.

My opinion - it looks reasonably good value, but the reason for that is probably that the market perceives this company as rather dull - there's no growth to speak of, and profits have been more-or-less flat for the past five years. Therefore a modest valuation multiple looks appropriate.

This flat performance is in striking contrast to the turbocharged growth delivered by Staffline. I've overlaid the STAF chart onto the HVN chart below, and clearly there's a bit of a difference!

It's quick & easy to do a comparison between several (up to 4) stocks on Stockopedia. This is a handy tool, and often gives food for thought. In this case (see below), it very much demonstrates how HVN is a fairly boring value share, whereas STAF is a more racy growth share.

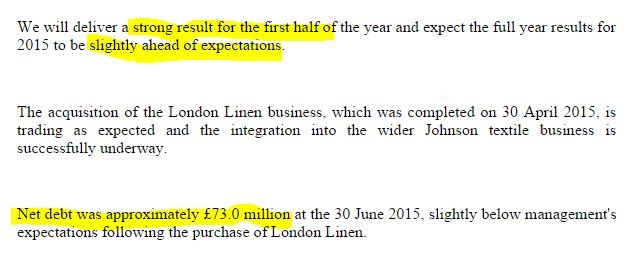

Johnson Service (LON:JSG)

Share price: 89.3p (up 3.5%)

No. shares: 330.5m

Market cap: £295.1m

Trading update - this reads positively:

My opinion - given that the company has quite a lot of debt now, I would say the forward PER of 14.3 looks about right. The company needs to be careful not to gear up too much, and get into a mess with its finances again, as it did in the last economic cycle. Net debt of £73m sounds a lot to me, given that net profit is expected to be £18.5m this year. So it's definitely not a share to be holding when the next banking crisis, and recession comes along. For the time being though, things look alright. Hopefully they will use some cashflow to reduce debt over the next couple of years?

Low & Bonar (LON:LWB)

Share price: 68p (down 1% today)

No. shares: 328.4m

Market cap: £223.3m

Interim results - for the six months to 31 May 2015.

This is a manufacturer of coated fabrics, flooring, construction materials, and other similar products. So I imagine it would be a cyclical business that should be improving at the moment.

Sales were up 0.9% in constant currency, but down 5.2% to £186m as reported in sterling, so a familiar theme here at the moment of sterling strength working against them. Although important to remember that currency movements are swings & roundabouts, so I prefer to focus on the underlying performance. Also one year's loss could be another year's gain.

The adjusted operating margin rose from 5.9% to 6.8%, giving £9.7m profit (before tax, amortisation, and non-recurring items). Remember these figures are only for H1, so need to be roughly doubled for a full year (assuming no significant seasonality to trading).

Adjusted EPS is 2.04p (up 9.7%). The company says it's on track to meet the Board's expectations for the full year, which shows as 5.7p on Stockopedia. So it looks as if there is a significant H2 weighting to the year. That's easy enough to check by comparing the prior year H1 and FY figures, and sure enough there was a heavy H2 bias last year, with H1 only being 36.6% of FY profits.

So using the same ratio of 37:63 on the 2.04p EPS achieved in H1 arrives at a full year estimate of 5.5p, which is near enough to the broker forecast of 5.7p to mean that I'm happy that I've reasonableness tested the broker forecast.

Valuation - going with this year's 5.7p EPS estimate gives a PER of 11.9, which looks good value. However, there's a lot of debt, so the PER should be low, to reflect that.

Balance Sheet - as usual, my tests are as follows:

1. Net tangible assets needs to be positive - passed. Net assets are £175m, but subtracting intangibles of £94m brings NTAV down to £81m, which looks OK.

2. Current ratio needs to be above 1.2, preferably over 1.5 - passed. The current ratio here is very good at 2.4. However, note that the big improvement in current ratio is because the bank debt has mostly now moved down into long term liabilities - so the facilities must have been extended.

3. Debt needs to be reasonable (also considering the pension deficit too) - this is a fail for me. The long-term debt of £127.6m, plus the £10.1m pension deficit, make this company look too highly geared for my liking. Although having said that, it is a capital-intensive company, with £118.5m in fixed assets, so financing that through debt is perhaps justified.

Also bear in mind that on 31 May 2015 the group also held £25.2m in cash, so net debt was £102.4. I think that's still too high - net debt is about 46% of the market cap, so if you were to put the company to a cash/debt neutral position, then it would valued on a PER of about 15 or 16, which doesn't look such good value now, in fact it's probably about the right price.

Although I note from the narrative that the company says net debt is seasonally higher at the half year end.

Dividends - the yield is a generous 4.1%, but bear in mind the debt situation - is it really wise to be paying out so much in divis when the company is burdened with a lot of debt?

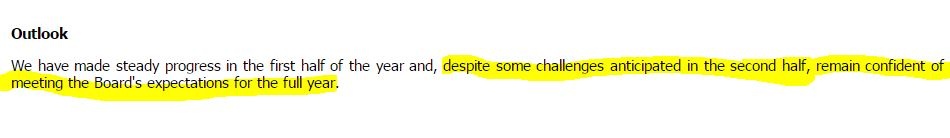

Outlook - this doesn't entirely fill me with confidence:

I'd want to know what they mean by challenges in H2. That sounds potentially ominous!

My opinion - I can't see anything to get excited about here. The valuation is probably about right for now, in my view.

That's me done for the day!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only. They are NOT financial advice, nor share recommendations. It's your job to decide how to manage your own portfolio!)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.