Welcome back after the long weekend!

Paul is also writing a Part 2 article, wherein he is covering:

- Plastics Capital (LON:PLA)

- Premier Veterinary (LON:PVG)

- Digital Barriers (LON:DGB)

Regards,

Graham

Just Eat (LON:JE.)

Share price: 560.25p (-3%)

No. shares: 678.9m

Market cap: £3,804m

A reader took issue with me last week describing this as having a "nosebleed valuation"!

I accept that description may have been a little harsh, as today's 40% like-for-like growth numbers reinforce the case for a premium rating.

It's also quite pleasing to see revenue growth outstripping customer order growth - to me, that suggests increasing comfort/trust with the service, as customers make higher-value orders.

Reported revenues were up 46% to £118.9 million (Q1 2016: £81.5 million).

On a currency neutral, like for like1 basis, revenues grew by 40%...

Total orders of 39.0 million (Q1 2016: 31.5 million), up 25% on a like for like1 basis.

The interim CEO, who is also the CFO, reiterates guidance for the full year.

I still think some nerves would be justified here until the management/Board decisions have been finalised, as it doesn't strike me as a company which would be able to run itself on auto-pilot.

Earnings estimates for 2017 have been stable and if it does achieve estimates through to 2018, then the PE ratio would fall to 25x. So it doesn't need to maintain momentum for all that long to grow into the current market cap.

PPHE Hotel (LON:PPH)

Share price: 783p (+2%)

No. shares: 42.2m

Market cap: £330m

This is a mid-range hotel group with interests in the UK, Netherlands, Germany and Croatia.

The interesting thing about the Park Plaza brand is that it's actually owned by the Carlson Rezidor group, which also owns the Radisson chain. But PPHE has the exclusive territorial license in various countries to develop and operate the hotels.

The latest quarter has gone really well, with help from a hotel expansion, exchange rates and also from a general upturn in the sector:

On a like-for-like basis1, revenue increased by 17.0% to £53.3 million (three months ended 31 March 2016: £45.6 million), driven by a marked recovery in the leisure segment in London, the opening of the extension of Park Plaza London Riverbank, improved trading in Germany and a currency exchange rate benefit.

Likewise, reported total revenue increased by 28.9% to £57.7 million (three months ended 31 March 2016: £44.7 million)...

Drilling down into the per-available-room numbers, like-for-like RevPAR jumped by over 20%. Both occupancy and the average room rate substantially increased over the period, combining to produce a very large increase in the revenue per available room (see table at bottom of the statement).

Trading and outlook are all in line with expectations.

My opinion

An interesting hotel investment with shareholder-friendly management. It paid a large (100p) special dividend last year.

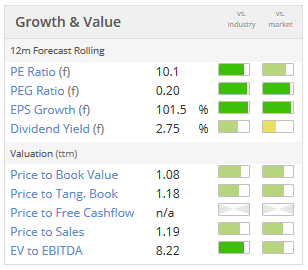

It tends to trade at a modest valuation, approximately reflecting its book value (assets less borrowings) and probably also discounting for the lack of ownership over the Park Plaza brand.

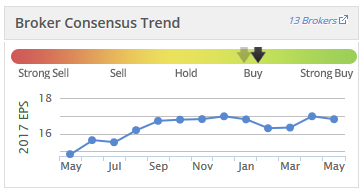

Perhaps it deserves a bit more attention from the investment community:

Access Intelligence (LON:ACC)

Share price: 4.25p (+3%)

No. shares: 287.6m

Market cap: £12m

My first time looking at this stock, in response to a request from DGW in the comments.

It's just over our £10 million market cap rule-of-thumb, but sadly still has a horrific official bid/ask spread (4p/4.5p).

After wholesale restructuring, its key asset now is a platform called "Vuelio" (homepage), which describes itself as "Europe's leading provider of software for communications, public affairs and stakeholder engagement". It says it has the largest UK database of journalists, editors, and bloggers. It has tools for distributing press releases, monitoring media influence, etc.

The Chairman comment is as follows:

We have effectively built a new Vuelio business, in part through the integration of assets acquired in 2015, but also through an accelerated programme of development and product upgrades for longstanding Vuelio customers. Having completed the all-encompassing migration project, the first four months of 2017 trading have seen improved new business sales and renewal rates and we are confident that we have the makings of a good business.

So it's asking us to treat it as a new company, based on the change which has occurred.

Net debt sits at £2.1 million.

My opinion

A healthy dose of scepticism appears justified, given the historic losses (unprofitable since 2009). I'm open to arguments as to why it might break through to profitability going forward, but I just haven't seen strong evidence for this yet, based on my initial reading of these results.

For example: the 2016 performance from continuing operations was loss-making at the EBITDA level and even after excluding one-off expenses. So it probably needs to keep restructuring to get to break-even, and indeed has pledged to continue restructuring during the course of this year.

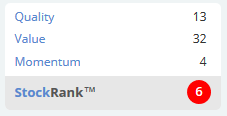

The StockRank is not terribly surprising:

That's it for me today. Don't forget there are more stocks being covered by Paul at this link.

Also, there are some really high-quality user contributions on these forums, so I just thought I'd highlight the second item in this article's comment thread, by Paraic (link here, or just scroll below this article). He's describing the situation at Palace Capital (LON:PCA), which appears worth looking into.

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.