Good morning! Fairly quiet again today for news.

Surgical Innovations (LON:SUN)

Share priceL 1.75p

No. shares: 404.7m

Market Cap: £7.1m

Profit warning - this is not good at all. The company has 'fessed up to a number of items that will require £1.6m in exceptional charges in the current year (ending 31 Dec 2014). These include;

- Reversing out previously booked sales of £0.6m

- Write-down in trade receivables relating to anticipated rebates from distributors, and

- Redundancy costs

.

In situations like this, I always go back to the double-entry bookkeeping. To generate a profit, any company has to credit the P&L with a sale, and then the debit has to go somewhere on the Balance Sheet - usually into either Debtors or Cash. That's where profit comes from.

So, when a company starts writing down debtor values on its Balance Sheet, this means that it has previously booked profits incorrectly. Therefore in this case, it looks as if the reported profit in 2013 (and maybe earlier) was not real. It's unusual to see debtors within long term assets, as normally debtors are all in current assets. I believe that any debtor item in long term assets is inherently suspect, and this has been confirmed here.

Note how long term debtors rose from £1,367k to £2,124k between Jun to Dec 2013. So that looks as if it provided a false £757k boost to profits in H2 of 2013. That wipes out almost all of the £885k operating profit reported in 2013, thus the company was probably trading at breakeven in 2013.

This type of stuff should make cautious investors run for the hills. If you can't rely on some items in the accounts, then in my view you can't rely on the accounts at all. The final sentence just reinforces my negative view here, clearly indicating the company is now under cashflow pressure;

As previously notified, the Board expects that the Company will report a significant loss before tax for the full year. Against this backdrop, short-term working capital funding and cash generation remains the Board's key priority and further updates will be provided to shareholders as appropriate.

I note it had a £3.0m bank loan reported at the last Bal Sheet date of 30 Jun 2014), so that could be at risk now. If the bank pull the facility, then the only option for survival is a hurried & probably deeply discounted Placing.

If I held shares here, I'd have dumped them this morning. As usual, that's not advice, it's just my personal opinion. It's gone on my bargepole list, for shares that are too risky to consider investing in.

Pressfit Holdings (LON:PFIT)

Share price: 5.25p

No. shares: 50.9m

Market Cap: £2.7m

Profit warning - I mentioned this company because it's the biggest faller of the day, down 42% to 5.25p. This is due to an announcement last night, after the market had closed, warning of delays to orders from the company's major customer, AMCO Group.

My opinion - this company only listed on 1 Aug 2014, but already had two of the worst possible red flags on it - it is Chinese, and the broker is Daniel Stewart.

It's a ridiculously small company, was far too early stage to be listed, and putting out a profit warning within 3 months of listing is unforgivable. I don't suppose any investors will mourn the eventual disappearance of Daniel Stewart, it can't come a day too soon in my view - this broker is making a mockery of an already dysfunctional market, by floating rubbish like this.

Shoe Zone (LON:SHOE)

Share price: 210p

No. shares: 50.0m

Market Cap: £105.0m

I've mentioned this discount shoe retailer before in a positive light. In my opinion it was one of the better IPOs earlier this year. It's family-controlled, which some investors don't like, but others (notably Lord John Lee and David Stredder) actively seek out companies with a dominant family shareholder base, as they often prove to be long-term out-performers, and can have more prudent management than companies with hired hands trying to empire build & screw shareholders with excessive remuneration packages & share options.

I'm leaning more towards viewing a dominant family shareholding as a positive, as a fragmented shareholder base will usually mean that the owners are effectively absent, hence management will do whatever they please, including feathering their own nests. Although you have to be careful to ensure that the family shareholders are not themselves abusing minority shareholders (e.g. things like stopping the dividends in order to drive down the share price, and then tabling a lowball offer for the whole company).

Trading update - as expected, everything is fine for the 52 week period ending 4 Oct 2014, being reported on today;

Revenues for the year are expected to be approximately £172.5 million (2013: £193.9 million), in line with previous guidance, reflecting 17 new openings and the planned closures of a number of temporary stores. The Board expects pre-tax profit for the period to be in line with market expectations, however the net cash position will be significantly ahead of market expectations at approximately £8.5 million.

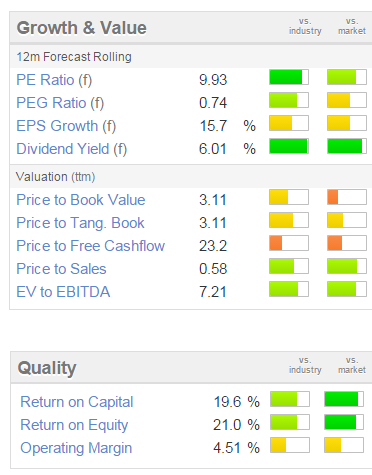

Valuation - broker consensus seems to be for 17.8p EPS this year, and I'm seeing a range from £8.9m to £11.4m for pre-tax profit, so I'm not entirely sure which figure the company is referring to. Although 17.8p EPS seems to be shown on several websites as consensus for EPS, so I'll go with that.

At 210p that puts the shares on a PER of 11.8 for the year just ended. That seems a reasonable valuation to me, especially considering the company also has a sound Balance Sheet with net cash of £8.5m.

Note that the Stockopedia formulae take the forecast PER & dividend yield, and show excellent results on that front, in particular note the 6.0% forecast dividend yield! That alone should push the shares up about 20% in my view, to get the yield down to about 5%.

Outlook - this sounds OK;

We are delighted to report our profit will be in line with expectations having had the best August in the Group's history followed by a slow September, with a late start to the boot season. I am pleased to report that the boot season is now in full swing and the first two weeks of the new financial year have been good.

It's interesting to note that this retailer has also mentioned the extremely mild weather conditions having depressed sales in Sept, but that's nothing to worry about in my experience - it just happens sometimes, and you often pick up the lost sales in a busier than expected Oct-Dec period.

My opinion - the only drawback is that turnover dropped quite a lot in the year just reported - from £193.9m to £172.5m, due to the closure of temporary shops. Normally temporary shops are a minor element to turnover, so it looks as if there were a considerable number closed, to make turnover fall 11%.

Overall though, this company gets a firm thumbs up from me at the current valuation - it seems a decent, entrepreneurial company, at a relatively modest valuation. Growth is expected from new stores being opened in Poland and Spain. The forecast dividend yield is excellent.

Shoe Zone operates at the value end of the market (average selling price is only about £11 a pair), and seems to be doing a good job. I like it because it's a newer company, beating old established competition, and with a good online operation too (I bought some work shoes from their website, and it was quick, easy & cheap).

Xeros Technology (LON:XSG)

Share price: 124p

No. shares: 65.2m

Market Cap: £80.8m

I recall looking at this company a few months ago, to see if it was of any interest. It's a blue sky company that raised a lot of cash, and is developing a new type of washing machine, which uses a lot less water & detergent, using polymer beads to remove stains & smells from clothing.

Final results - for the year ended 31 Jul 2014 are published today. As expected, the company had negligible turnover, and a hefty loss before tax of £6.7m. However, it has £29.5m net cash in the bank, so is well financed for the loss-making part of its growth (assuming it ever reaches profit).

Outlook - the company is targeting commercial laundries in the USA as their main focus. Interestingly, the company says that several US utility companies have offered "substantial financial incentives" for customers to invest in Xeros machines. The company today says;

In summary, we have made significant progress in Commercial Laundry with the majority of the organisation fully focused on this first key market and proving ground for the technology generally. All our early adopter customers are extremely enthusiastic about the benefits they see in their laundries. This, together with the quality of the pipeline we have developed, particularly in hotels, provides a good foundation from which to build. The number of machines installed and committed to install in the USA stood at 37 on 31 July 14 (Europe 7) and we believe the combined total will exceed 80 by the end of the calendar year.

My opinion - I don't feel qualified to assess the technology. However, I have a general resistance to any blue sky investments, because the vast majority of such shares turn out to be terrible investments! Usually projects take far longer than expected to work, and cost a lot more money. So that means repeated fundraising rounds at lower & lower prices.

This one however looks fully funded for the next few years, which is somewhat reassuring.

Is their technology enough of a leap forward to displace existing equipment? I suspect there will be a lot of intertia to overcome in the commercial laundry sector. So overall I feel that it's possibly not enough of a breakthrough to make it a commercial success in the sort of timeframes that would appeal to me. But it's certainly an interesting one to keep on my watch list.

Generally I like investing in this type of blue sky company after the original business plan has failed, it's raised loads more money, everyone thinks it's terrible, management have been replaced, the valuation is at or below net cash, but the first sign of strong sales growth is beginning to emerge. That's not the case here, so I'll move on.

The chart suggests that investors are warming to the story here;

Right, got to dash, I have a long lunch with a friend this afternoon, so will be out of contact this afternoon.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.