Good afternoon!

My apologies for being unable to file reports on Thu & Fri this week. We don't want gaps in the sequence, so I've set aside some time today (Sun afternoon) to catch up.

Mothercare (LON:MTC)

Share price: 254p

No. shares: 170.8m

Market cap: £433.8m

Q2 trading update - this covers the 13 weeks to 10 Oct 2015.

I like it when trading updates start with a brief summary, which makes it much easier to quickly absorb things. In this case it says;

Trading remains in line with our full year expectations. The UK is continuing to benefit from our digital and full price trading strategy while International has returned to underlying growth, although continues to face significant foreign currency headwinds.

I'm surprised that the share price has reacted so positively to what is, after all, just an in line with expectations update. Perhaps people were fearing something worse? Or perhaps investors are anticipating continued strength in trading?

The 6.5% increase in LFL sales (UK) for Q2 is excellent, especially as it's been achieved at higher gross margins too. It seems odd this has not translated through to out-performance against expectations. Perhaps the forex headwinds which the company refers to mean International has offset improvements in UK?

My opinion - I've discussed this one with Richard Crow in our audioboom chats, and he likes the turnaround potential here. I recall buying a few at about 230p, but don't seem to have them any more, so must have changed my mind at some point.

The balance sheet is much improved after a Rights Issue in late 2014, although note that there's quite a hefty pension deficit shown - £81.2m at 28 Mar 2015 - which needs to be taken into account when valuing the shares. Note 29 to the last Annual Report shows how the scheme liabilities shot up from £303.0m to £364.6m mainly due to changes in the actuarial assumptions. The discount rate fell from 4.5% to 3.5%, which seems to be the culprit, as that will expand the present value of future scheme liabilities by quite a lot, as they're being discounted at a lower rate. Maybe the pension deficit will disappear again in due course when interest rates normalise, but how many years have I been saying this, and interest rates remain artificially low. Is this the new normal? If it is, then pension deficits won't melt away, they will have to be cash funded.

Overall, I can't make my mind up on Mothercare. It does look like an early-stage turnaround, but the valuation is perhaps a tad too high for where they've currently got to?

Sepura (LON:SEPU)

Share price: 172p

No. shares: 184.7m

Market cap: £317.7m

H1 trading update - everything looks on track here, with the following highlights;

· Record H1 revenues of €93 million driven by strong organic growth and the contribution from Teltronic

· Teltronic integration on track and all forecast cost synergies secured

· Trading in line with market expectations for the full year

So it's an in line update, which is the main thing. The acquisition of Teltronic looks a major acquisition, as forecasts are for considerable growth. That's a good thing, because in the past Sepura (which supplies special radios for the emergency services, etc) has been vulnerable to gaps in the order book when large projects complete. For that reason I tend to be rather wary about this share, having seen it plummet before.

Net debt of E80m looks too high to me, relative to the expected level of profitability. Although for now anyway, the outlook sounds positive;

The solid start to the year and continuing demand give us confidence that we will deliver on market expectations for the full year."

Looking at the last balance sheet, and adjusting for the Teltronic acquisition (E127.m purchase price, funded by a £56.9m equity fundraising, and the balance from additional debt, I am concerned that the balance sheet will be very top heavy with goodwill. That limits the amount they can pay in divis, and makes them vulnerable to a slowdown in orders.

As a reader very wisely pointed out last week, Directors often latch onto a debt:EBITDA covenant, thinking that they have plenty of headroom, but they fail to stress test it by working out how things would look if earnings (say) halved due to the onset of the next recession (recessions are inevitable, after all! It's only the timing that is uncertain).

I have a general concern that too many companies are using cheap debt to boost their earnings, and hence share prices, and hence value of Director share options. However, this in some cases will be creating the seeds of serious future problems when earnings collapse, and there's no balance sheet strength to fall back on. Maybe I'm years too early with these warnings, but it's something to keep in the back of one's mind, so we're prepared when the economic tide does go out again.

Dividend yield - looks like someone at Thomson Reuters had fat fingers when inputting the dividend forecasts, as the yield I am sure is not 46%! So I've raised a green ticket, and that should be corrected shortly.

Foxtons (LON:FOXT)

Share price: 204p

No. shares: 282.2m

Market cap: £575.7m

Q3 trading update - this is quite an interesting share to monitor, as it gives an idea of what's going on in the crazy world of London property. A lot of detail is given, with the closing remarks being a mild profit warning;

"We are in a strong position to capitalise on market growth currently being seen in outer London areas through the organic expansion of our branch network. Although we expect any recovery of the property sales market to be slow due to low current levels of stock, we enter the fourth quarter with a £1bn sales pipeline which is well above the same point last year and based on current market conditions, we remain broadly on track to meet full year expectations".

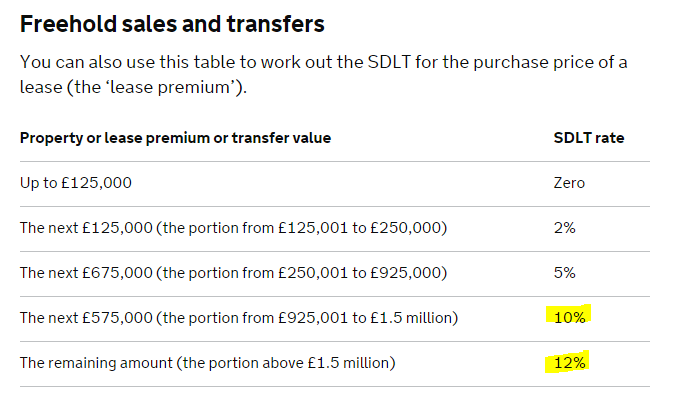

The recent large hike in Stamp Duty seems to have killed the market stone dead, by some accounts, with buyers seeking discounts to compensate them for the large stamp duty bill. Here are the current rates (I've highlighted the ones that in practice will apply largely to London only);

Memo to Govt & Civil Service - punitive tax grabs will simply change peoples' behaviour, and very often result in a lower overall tax take, as activity slows - especially when you take into account all the renovation work that now won't happen because high-end properties are not changing hands so much. You stimulate the economy (and the tax take) overall by lowering transaction taxes such as Stamp Duty, not jacking them up!

My opinion - Foxtons shares are worth a look I think, as there's a nice dividend yield, and it has a steady flow of income from the lettings side of the business, hence is not entirely dependent on property sales. There's also the boom in new build property going on in London that should give scope for Foxtons to earn fees.

Although on the other hand, do I really want any exposure to an estate agent serving a madly inflated market such as London property? Probably not - it's an accident waiting to happen, we just don't know when.

Lombard Risk Management (LON:LRM)

Share price: 10.6p

No. shares: 304.3m

Market cap: £32.3m

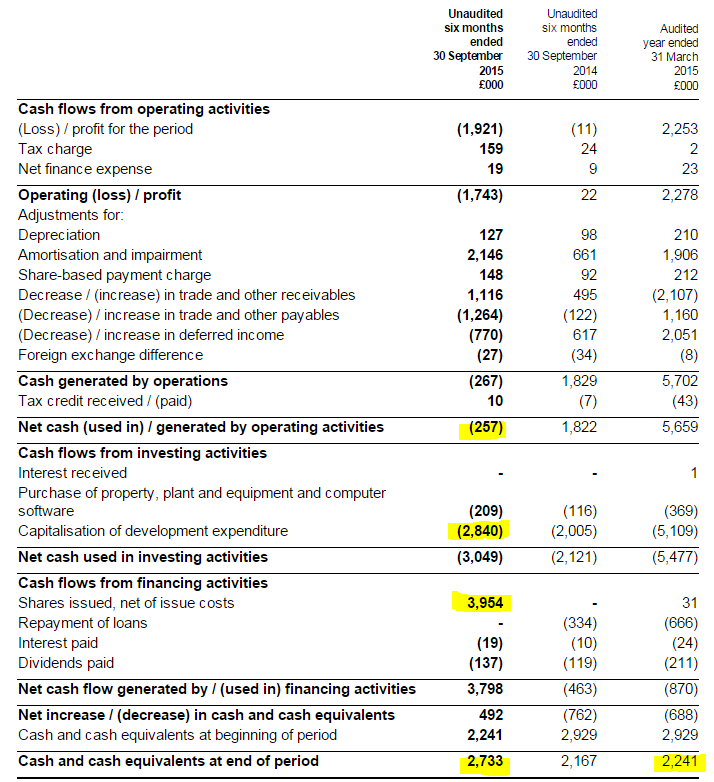

Interim results to 30 Sep 2015 - these figures look awful to me. The main issue with this company is that it capitalises a huge amount of costs, to create a positive EBITDA, but the reality is that it's loss-making if you expense the payroll costs in the same way that the company admits it internally budgets for.

With this type of company, the cashflow statement is more revealing than the P&L. Consider the numbers I've highlighted below;

The company raised £3.95m from a new share issue, yet nearly all of that disappeared in the six months, on development spending - which are internal, cash costs - payroll basically.

So it ended the period with £2.7m cash, having had £2.2m six months earlier, despite having raised £3.95m in fresh equity! So the reality is, this is a heavily cash-burning company which will only be able to survive by either (a) dramatically improving its performance through increased sales or reduced costs, or (b) further, repeated fundraisings.

My opinion - this share looks extremely high risk to me, so I've put it on my bargepole list today.

The company says it is optimistic about H2 performance - well let's hope they're right, as another performance like H1 would probably mean the company would go bust by running out of cash - which means having to return to the market for more cash. What price will the next Placing be at? 5p? 2p? As we've seen with shares like Cloudbuy (LON:CBUY) the market tires of jam tomorrow promises after hearing the same story a few times, with no tangible progress.

Alumasc (LON:ALU)

Share price: 167.5p (down 50p in 2 days)

No. shares: 35.6m

Market cap: £59.6m

AGM trading update - the market has decided to sell first, and ask questions later, by the looks of it, with a fairly brutal 50p drop in share price from 217.5p to 167.5p on Thu & Fri this week. Although putting that into perspective, it means the shares have simply given back the gains made last month, so we're back to where we were in the summer - hardly a disaster.

Although this announcement does add to a sense of unease I am getting about the strength of the building sector in the UK. There have been a number of company announcements which sound hesitant about current conditions.

The first part of Alumasc's update sounds reasonably OK;

Alumasc has made a satisfactory start to the new financial year and demand from the group's core UK construction market remains encouraging. The order book continues to rise and year to date revenues from continuing operations are marginally ahead of the prior year. Encouragingly, the contribution from smaller projects continues to grow within this.

The next paragraph sounds more worrying;

We have seen some evidence that capacity constraints within the construction industry generally have caused delay to some projects. While this may have an impact on timing, we continue to believe that management's expectations for the group's full year financial performance will be achieved.

So it looks like the market has interpreted this as a possible future profit warning - i.e. doubt has been introduced as to whether this year really will meet expectations after all. The company operates on a 30 June year end.

Pension deficit - this is a very material issue at Alumasc. As I reported here on 30 Oct 2014, payments into the pension fund where at that time consuming three-quarters of post-tax profit! So this is a vital issue to investigate fully before buying the shares.

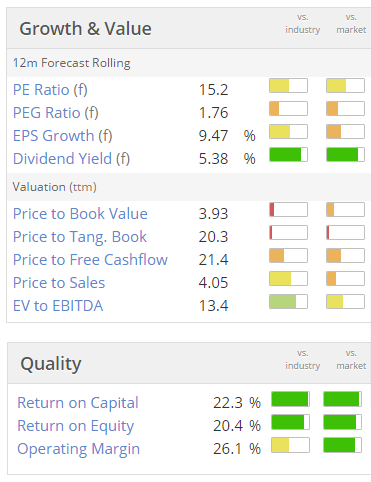

My opinion - I see that the shares are rated very highly by Stockopedia, with a StockRank of 99, but I have a feeling the algorithms do not adjust for pension fund deficits, and the market seems to be largely ignoring them at the moment too (so won't necessarily be reflected in the share price).

I might look at the company again once the shares have stopped falling, but for the time being it looks a bit wobbly - too many mixed messages in the trading update, for me to be comfortable getting involved in the shares at the moment.

You also have to consider liquidity with small caps like this one - I was talking to someone in the City last week about this. Institutions are essentially locked in, once they buy shares in companies this small. So if one of them decides they want out, the share price can be absolutely crushed - because the market can see the overhang from the RNS, as each 1% reduction has to be announced, for holders over 3%. If there are no big buyers, then the share price has only one way to go, down, until it gets so cheap that bargain hunters move in, but they can pick their moment, knowing that the shares will probably be cheaper still in a few weeks or months.

Someone else I talked to in the City the other day told me that Institutional buyers in small caps are very thin on the ground right now. If they want to get a decent-sized new issue away, they basically have to make 5 phone calls to key Institutions. If they're not interested, then it's a waste of time making any other calls apparently.

So it's well worth checking back over the last, say 2 years, for any small cap - and seeing what the disclosable shareholders are doing. If one or more is dripping out stock into the market, that could be a serious headwind for the share price. Especially if current trading is starting to sound potentially wobbly.

Servoca (LON:SVCA)

Share price: 30.5p

No. shares: 124.8m

Market cap: £38.1m

Trading update - I've not been able to understand why the share price here was so strong, as it wasn't justified on the historic, nor forecast figures. All has become clear now - the reason is because the company has been trading its socks off!

The Company is pleased to report that results for the year ended 30 September 2015 will be significantly ahead of market expectations.

The reasons seem to be buoyant trading in Servoca's education recruitment business. Healthcare recruitment has also been strong.

Valuation - broker consensus is currently 1.5p EPS for y/e 30 Sep 2015. Significantly ahead sounds like we may be looking at say between 1.6p to 2.0p at a guess? If we take an average, of 1.8p, then that puts the shares on a PER of 16.9 - that looks high at first sight, but bearing in mind that Servoca is saying it expects more growth this year, then maybe it's justified?

Broker consensus is for 2.1p this year, and that have scope to be raised further, which gets us to a more normal PER for this type of business (which are usually on a PER of about 8-12, depending on how much debt they have).

My opinion - the key question to ask, for any company that you want to value on a PER basis, is whether profits are sustainable? My worry here is that the company might be doing well from short term problems caused by Govt policy. Sooner or later the golden goose stops being so generous with its eggs - so I would want to find out how much public sector reliance Servoca has (sounds like a lot), and then factor in the possibility of a Govt policy change (say restricting amounts permissible to be paid to agencies).

So far, so good though, for this company & its shares. We saw management at a Mello or ShareSoc events a while back, and there was no inkling that the shares would multi-bag. It struck me as a rather ordinary business. Perhaps I should have paid closer attention, as clearly I missed a good opportunity here!

Apologies again for this report being 3 days late, but I hope you have found it interesting.

Regards, Paul.

(of the companies mentioned in this report, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies referred to.

NB. These reports are purely Paul's personal opinions. They are NOT recommendations or advice!)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.