Good morning! Apologies for being a little late today, as I was watching the election coverage on television until the wee small hours. Also I had a very interesting afternoon at the London Value Investor Conference yesterday, and have got copious notes that will turn into an article or two here in the coming week or so. Private Equity guru Jon Moulton was the stand out speaker for me - his talk was full of wit & wisdom, which I shall report back on at a later date.

Blur (LON:BLUR)

This would make a great case study of a typical over-hyped growth stock. It's been an absolute car crash for investors in recent months, because four factors converged;

1. Aggressive revenue recognition which has (presumably) been challenged by the auditors, and has resulted in accounts being late (always bad) and reported revenue falling way below forecasts.

2. Being heavily loss-making.

3. Running out of cash.

4. The above coinciding with a sudden and considerable loss of market appetite for risk.

Blur's business is basically a website where suppliers can tender for work in many areas such as marketing, design, app development, etc. So it's an online marketplace for services. Blur seem to take a remarkably high 20% commission, which as several people have commented to me is probably too high to be sustainable long-term for volume work.

Results for the year ended 31 Dec 2013 have been published today, and look pretty awful to me. Revenue was $4.8m, but bear in mind this is the gross project value on Blur's website, plus listing fees. So really I would suggest that the gross profit line of $1.16m is closer to what I would regard as proper revenue - i.e. revenue attributable to Blur.

The company generated a $6.5m pre tax loss for the year, and that's a proper trading loss, there are no exceptionals. Put another way, the company would have to grow turnover by a factor of 5.6 times, with no increase in overheads, just to reach breakeven.

Bulls will no doubt say that early stage growth companies are nearly always loss-making to begin with, and that it's the growth which matters. That's a fair point, but you cannot afford to have any bumps in the road along the way. So management here have massively screwed up, by adopting imprudent revenue recognition policies, and then having to restate turnover downwards by a considerable amount. That coinciding with needing more cash, has caused this disaster for investors;

With 29.6m shares in issue, the peak market cap was about £234m. What on earth were people thinking, to put such a ridiculous valuation on this company? It just shows what a bonkers bull market we've been in over the last year or more. It's reassuring to see valuations come down to more sensible levels.

The company lives to fight another day, as in a separate announcement today there are details of a fundraising being organised by N+1 Singer, to raise $20m in a Placing, which sounds as if it's been agreed (subject to sign off at an EGM, which should be a formality). They have tacked on a token Open Offer for another $2m. That's the wrong proportion in my view - to be fair to existing shareholders, an Open Offer should be the same size as the Placing, not just 10% of the size of the Placing. That said, this is a distressed fundraising, so shoring it up with a firm Placing is more important that being a hostage to fortune with an Open Offer.

The fundraising is at just 75p, so the share price has now fallen to 82.5p at the time of writing. A complete disaster for shareholders, but that's the risk you take when chasing a story stock up to a daft over-valuation.

The possible upside here comes from an outlook that sounds as if they have at least got something here. Whether they will be able to turn it into a profitable business eventually, who knows? Personally this is exactly the type of stock that I avoid like the plague, and am jolly glad I did.

The continued increase in bookings in 2013 and into 2014 illustrates our first mover advantage in the emerging services-commerce market, and underpins a stronger financial position in the long term. With 45,000 businesses on our Global Services Exchange, from 145 countries worldwide, we believe we have the foundation from which to build a world leading global technology company, addressing a significant market opportunity. We look to the future with confidence.

Moss Bros (LON:MOSB)

There's a trading update from this High Street menswear fashion & hire business. Menswear is very difficult to retail profitably, because the sales per square foot are so low. Collectively, men just spend a lot less money on clothes than women do, which is why the High Street is dominated by womens fashion chains, and hardly any menswear chains. It also explains why menswear is tucked away in the cheaper space such as basements or mezzanine floors in mixed shops such as Next, M&S, etc, with the more lucrative ladieswear always on the ground floor, and at the front.

Today's IMS from Moss Bros is impressive - retail sales were up 6.3% on an LFL basis for the 16 week period from 26 Jan to 17 May 2014. That rises to +8.5% if online sales are included - even more impressive! I like that they mention LFL gross profit, which is the best measure of performance, as it reflects both sales and margin changes. That was up 6%, which is good, and should be well ahead of rises in overheads. Ecommerce sales are up 115%, which is very impressive, but only constitute 6.5% of total sales.

About a third of the stores have been refitted to a more modern design, which no doubt is helping drive performance. A good refit should add about 10% to sales, in my experience, as it will draw in more customers, although the impact wanes to about 5% after the novelty has worn off.

Hire sales are down 3.8%, "reflecting a subdued wedding market", but this is a relatively small part (16%) of their business, so doesn't matter that much.

Overall then, it's a nice clear trading statement, and the business is performing well, with the outlook sounding good;

The business continues to make good progress on its key strategic objectives and the Board remains confident the business will meet market expectations for the year.

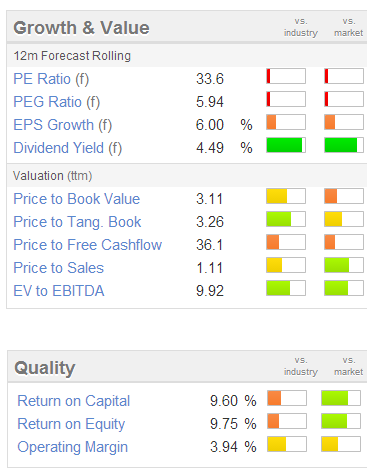

My main problem with this share is that it's too expensive. The business is doing well, but it's a low margin operation. A fashion retailer really should be making 10%+ operating profit margins, but Moss Bros is much lower than that. This year & next year it is forecast to make profits of £4-5m, on turnover of £115-120m. That's not very good.

My main problem with this share is that it's too expensive. The business is doing well, but it's a low margin operation. A fashion retailer really should be making 10%+ operating profit margins, but Moss Bros is much lower than that. This year & next year it is forecast to make profits of £4-5m, on turnover of £115-120m. That's not very good.

So the market cap of about £120m, or circa 1 times sales, looks much too high to me, given that they make low operating margins. This is partly excused by the strong Balance Sheet, which has a lot of cash on it, I seem to recall.

Also the dividend was hugely jacked up last year, and the forecast yield is 4.4%, which is obviously good. However, that is not covered by earnings, which are forecast at 3.4p for this year.

So these shares would only make sense at this valuation if you think that they can greatly increase profit margins. I'm not sure that is likely, although the strength of sterling against the dollar is helping clothing retailers, as they import goods usually priced in dollars from the Far East.

So for me, I'd only be interested at about half the current share price. Based on existing forecasts, this stock is far too expensive in my opinion, given that it's lowish margin, and has limited growth potential. That's just my opinion, so as usual please DYOR.

Solid State (LON:SSP)

There's a reasonable trading statement from this supplier of ruggedised computers, batteries, and other electronics, which says;

Group revenue will be slightly ahead of market expectations and profit is expected to be in line with market expectations.

I'm not interested in turnover, it's profit that matters.

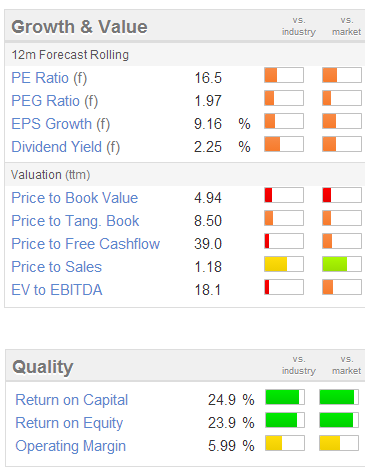

It's not a madly exciting business, so to my mind the valuation at 400p has now got well ahead of itself, on a forward PER of 16.5 times. Although it depends on the outlook for future profitability. If you think they can grow organically a lot, then it might be worth considering. Although personally I think there are much better quality companies out there for a PER of 16.5.

CityFibre Infrastructure Holdings (LON:CFHL)

I am interested in this company, having seen them present at a FinnCap event a few months ago. It's a recently floated infrastructure company that builds city centre fibre communications networks. Access to the networks is then sold on long term contracts to businesses and internet service providers, if my understanding is correct.

My main problem with it, is that I have no idea how to value it. Today's results for calendar 2013 are pro forma figures for the business that is now owned by CFHL, and does not reflect the benefit of the funds raised on flotation.

It's quite heavily loss-making at the moment, and presumably at some point revenue will build, and the company will become profitable. So the historic figures don't really matter, I would need to see detailed projections about how revenue and profitability will build. I can't find any broker forecasts, so at present find it impossible to come to a view on whether the shares are worth buying or not. The concept sounds very interesting though.

In a separate announcement there is a £30m Placing at 70p per share, to expand their network of fibre.

It's the type of thing that I might take a small punt on, if the market gets back into bull mentality for small caps, but for the moment I'll keep it on my watchlist. They are in negotiations to raise debt funding, so think I'll wait to see what amount is raised, and on what terms.

This company has a very flamboyant American CEO, who tells a great story, with fanatical zeal. However that style makes me uneasy, as it can get investors too excited, leading to people perhaps not doing as much Due Diligence as they should.

Essenden (LON:ESS)

I last looked at this ten-pin bowling club operator in quite a bit of detail in my report here of 19 Mar 2014, which also looked at the debt for equity deal which extinguished the previous shareholder loans. My conclusion then was that the shares had got ahead of themselves at 100p, but they've since fallen back considerably to 63p at the time of writing. With 49.9m shares in issue, that makes the market cap about £31.4m.

I did some back of the envelope workings last time which suggested that an EPS figure of around 6.4p for calendar 2014, so it's therefore possibly on a PER of about 10. In my opinion that's probably about right, maybe even leaning towards being moderately cheap? (assuming that my estimate is accurate - I can't find any broker notes to compare it with).

Today's trading update sounds good;

Trading, since we last reported to the market in March 2014, remains slightly ahead of our expectations. Like for like sales for the 20 week period to 18thMay 2014 are up 6.1% across the estate, continuing the encouraging trend that commenced in the final quarter of last year. Considering the challenge of warmer weather during April, due in part to Easter being later this year than last year, trading has remained solid and despite the hot temperatures at peak times in May, sales for the first two weeks of the month are up 4.9% on a like for like basis.

The like for like sales growth is being converted into improved site performance, more than compensating for the reduction in the number of sites compared with this period last year (following the closure of those on short term leases).

Whilst the next few weeks may be impacted by the World Cup, we are encouraged by the sales growth that we have delivered. We anticipate that 2014 will be a year of further financial progress.

That's it for today, and the week.

I hope you enjoy the long weekend, so shall be back on Tuesday morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.