Good evening. Sorry for my absence yesterday & earlier today, I've been unwell, so spent 3 days in bed. Anyway, let's get this show back on the road! I'll do a report for today, and then circle back to yesterday's later this week, as I definitely want to comment on results from Spaceandpeople (LON:SAL) as it's not clear to me why the market marked the shares down 20% yesterday, as they reported in line with revised expectations.

Accumuli (LON:ACM)

Trading update - this IT security group reports that group EBITDA is line with management expectations for the year ending 31 Mar 2015. The detail sounds positive too. However, Accumuli inexplicably fails to mention the elephant in the room, which is that they've sold the company!!

Recommended acquisition - a separate announcement is today issued by NCC (LON:NCC), saying that it has agreed with the Board of Accumuli to buy Accumuli for mainly shares, but some cash. Normally when you look at takeover deals, you think to yourself, this is a done deal. However, in this case I think this deal looks a bit wobbly.

Firstly, the premium to the market price is not enough. They are only offering a 19.1% premium, at 32.8p. Takeover deals really should be at least a 30% premium to tempt shareholders to bank the profit now, rather than going it alone.

Secondly, the deal is only 5.97p in cash, and the balance of 26.83p in 0.1218 new NCC shares. Trouble is, NCC shares have already dropped sharply, down by 7.7% today to 203p. So that now values the takeover at 5.97p cash + (0.1218 * 203p) = 30.7p. That's now only an 11.6% premium to the share price last night. It's not enough, so I think NCC will have to dig a bit deeper to get this deal done.

However, the big shareholders have agreed the deal, and the company has 57.3% irrevocable undertakings to support the deal.

My opinion - this doesn't look a particularly good deal for Accumuli shareholders, but maybe the big shareholders prefer the idea of holding more liquid shares in a much bigger group (NCC is about 10 times the size of ACM in market cap). I would be pushing for NCC to sweeten the deal with a higher price, so for me (if I held the shares), I would be voting no.

It's also not great for NCC shareholders, who have seen their share price drop sharply on the news, so the board of NCC are probably already getting complaints from their shareholders. Doing a mainly paper deal, means that the NCC share price is likely to remain weak, as Accumuli shareholders take advantage of the increased liquidity to exit.

This type of situation is sometimes quite amusing, as Directors who have spent years telling everyone how brilliant their company is, now have to suddenly start telling everyone the complete opposite - how limited its potential is as an independent company, and being part of a bigger group would be much better!

T Clarke (LON:CTO)

Share price: 70p

No. shares: 41.8m

Market Cap: £29.3m

(at the time of writing, I hold a long position in this share)

Final results - for the year ended 31 Dec 2014.

I flagged up the turnaround potential of this company in my report here of 13 Nov 2014, when the shares were 50.75p, indeed I bought some personally shortly afterwards, having mulled it over a bit more. So far so good, as they're up almost 40%.

If you don't have the time or inclination to recap on my previous report, then the summary version is that this company now appears to be in a cyclical sweet spot, where the order book is filling up, and margins & cashflow are improving. The company does complex electrical fit-outs of office blocks, especially in London. So it lags behind the building cycle by 1-2 years, as obviously the building has to be built before it can be fitted out.

This company has a strategy of accepting low margin work in a downturn, to keep its workforce busy. However, they then have the workforce with the right skills & experience, to take on complex projects when the economy improves, as is happening now.

Profitability - at first this looks poor, with "underlying operating profit" down from £3.2m in 2013 to only £1.4m in 2014. Underlying profit before tax of £0.7m is £200k above broker consensus. which is shown on Stockopedia as £0.5m net profit expected by brokers for 2014.

These are very small numbers though, for the £227.5m turnover, so clearly this share would not be of interest if that level of low profit was likely to be ongoing. We saw recently with ISG (LON:ISG) what happens when a low margin contractor runs into contract problems - they had to do a rescue fundraising, and the shares lost half their value (as well as the dilution from new shares).

One-off contract issues - this is crux of the matter, so I am reading the narrative now to find some more detail on this, i.e. what went wrong in 2014, and how much that affected profitability? It doesn't seem to be that significant after all, and I am left wondering why underlying profit fell, since it adjusts out these one-off factors?

Order book - has risen strongly, and is now over £300m, including some high profile contract wins;

Dividends - it's pleasing to see that the company has restored the divi, which was cut in Aug 2014 as the company was dealing with contract issues (which have now been resolved). At 2.6p the final divi is generous, being up nearly 24% on last year's final divi. The total divis for 2014 are 3.1p, flat against last year. That gives a good divi yield of 4.4%, and I suspect the divis will now be on an upward trajectory over the next few years, as business improves.

Balance Sheet - not great, but not a disaster. It fails my NTAV must be positive rule. So taking off intangibles of £23.2m, net assets of £18.9m become modestly negative at -£4.3m.

The current ratio is 1.15, which although it's below my (arbitrary) lower limit of 1.2, it should be pointed out that T.Clarke has hardly any inventories. So it can operate safely with a lower current ratio - I normally go down to 1.0 for companies with little to no inventories.

The net cash position has greatly improved, from £1.0m a year ago, to £5.3m at 31 Dec 2014. That helps support the idea that they are gaining new work on more attractive terms than the old (i.e. customers can be persuaded to pay more up-front).

Note there is a pension deficit, which stood at £16.3m at 31 Dec 2014, quite a material amount, so investors will have to decide for yourself whether you can tolerate that risk or not.

Outlook - they sound confident about the future;

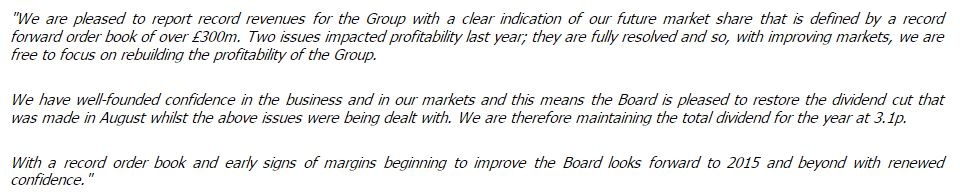

My opinion - I like it, as a very straightforward cyclical turnaround situation. The market cap is only £29.3m, so if the company gets anywhere near the 5% operating margins that it made at the height of the cycle last time, then a share price of 200-300p could be justified - which indeed is where the shares did trade before the financial crisis in 2008.

Note that T.Clarke has got through the depressed 7 years since without issuing any major number of new shares. So no adjustment to share price target is needed there, and it gives me confidence that they have the expertise to handle difficult conditions.

On the downside, I don't like low margin contracting businesses, as something always ends up going wrong with some contracts sooner or later - indeed that jumps out of the page today reading the 2014 results.

Here is the 10-year share price chart. I suspect that, providing there aren't any major problems along the way, it might continue gradually recovering from here, and shareholders are being paid decent divis whilst we wait - always nice!

Getech (LON:GTC)

Share price: 47.5p

No. shares: 30.3m

Market Cap: £14.4m

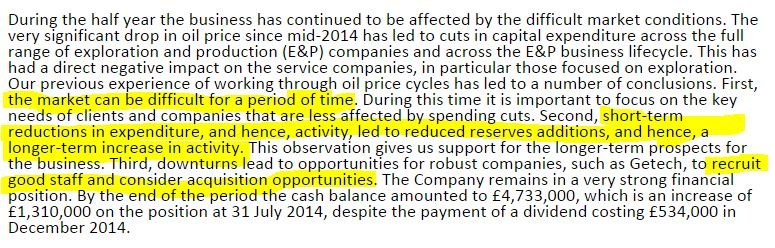

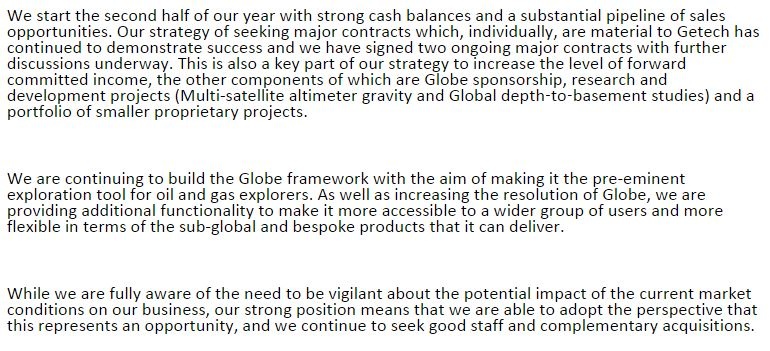

Interim results - for the half year to 31 Jan 2015 - look surprisingly resilient, considering the sector that Getech operates in (providing seismic services for oil exploration). The company makes some very interesting comments about current market conditions;

Strong cash balances are key, in my view, in the oil & oil services sector. That's certainly the type of share that I'm looking at in these sectors. Let the hot money chase the more highly geared stories, I'd rather have sleep at night safety. You only have to look at Afren (LON:AFR) to see what happens when a highly geared balance sheet implodes.

Balance sheet - this is strong, with £7.0m in NTAV. The current ratio is healthy, at 1.74, and there is no debt. Net cash is £4.7m, about a third of the market cap, so all good there.

Profitability - this rose from £233k last H1 to £707k this H1, so a big increase there, surprisingly. Although this was only on £3.6m turnover, reinforcing that this is a very small company.

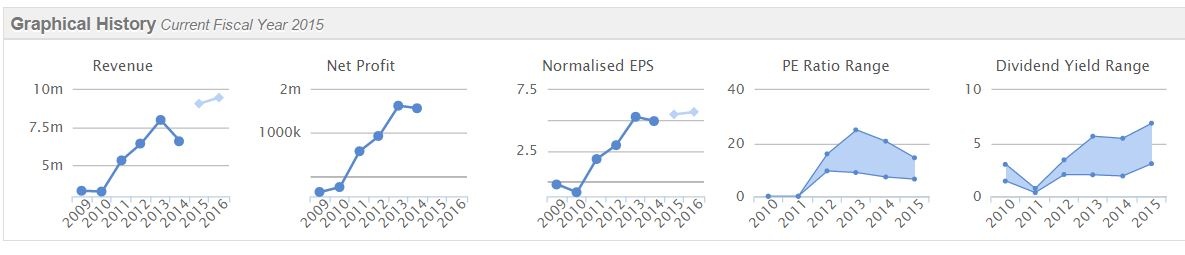

As you can see from the usual Stockopedia graphics below, the company has a good track record of profitability, but of course that was when the oil price was much higher. So is that sustainable, once the current order book has washed through, I wonder? There must be a high risk of another profit warning here, in my estimation. Also, will it hit full year forecasts?

Outlook - sounds pretty buoyant, but sounds as if (as before) major contract wins provide the potential for a profit warning, if they don't close on the right side of the year end;

My opinion - Getech seems to be weathering the downturn in the oil sector remarkably well so far. On balance I think it's too small a company for me to want to get involved again (I've held before).

Vislink (LON:VLK)

Share price: 48.75p

No. shares: 122.6m

Market Cap: £59.8m

(at the time of writing, I hold shares in this company)

Final results - for the year ended 31 Dec 2014 are out today. The headline figures look very good, with adjusted operating profit up 66.1% to £7.2m, but on digging into the detail, it transpires that a strong performance from the Pebble Beach Systems software company acquired, has considerably more than offset a relatively poor performance from the existing hardware business (specialist cameras for broadcasting, and security systems).

The Executive Chairman here is a serial acquirer of other companies, and so far, from what I can tell, he seems to be getting it right.

Thinks I like;

- Pebble Beach already contributing over a third of profits

- Dividend hiked by 20% to 1.5p (yield = 3.1%). Note there is no interim divi.

- Balance sheet is still solid overall (but see point 3 below)

- Profits do look real - operating cashflow rose from £4.2m to £7.7m

- Reduction in capitalised development spend, from £4.5m to £3.6m

- Some promising new products in the pipeline - e.g. wearable cameras for sportpeople

Things I dislike;

- Core business saw turnover down 10.4%, and profit down 12.9%

- Debtor days & stock days both high, due to phasing of big orders

- Intangibles now £43.7m of £56.8m net assets

Outlook - I tend to put more emphasis on the "markets continue to be challenging" comment, than the "renewed confidence" comment!

My opinion - overall, it looks quite promising. The valuation is modest (about 11 times EPS forecast for 2015), and the balance sheet is alright. There's a reasonable divi to keep us amused whilst we wait. The software company acquisition seems to have saved their bacon!

It will now be a question of waiting to see how the new products are received. Even though most sports bore me to tears, even I can see that watching sport from helmet cams of the players, would be a remarkable experience - e.g. this video gives a flavour - GoPro is the company that Vislink has partnered with.

SkyePharma (LON:SKP)

(at the time of writing, I hold a long position in this share)

Final results - for calendar 2014 are out, and look impressive to me. I rarely touch pharmaceuticals companies, as you really need sector knowledge to get it right. However, I've held this one for a while because it came up on a GARP screen that I ran.

There was a bit of a wobble in Jan 2015 when the market sold off the shares on a statement about possible deferral of some milestone receipts, but the price has since recovered well - another example of how buying on minor bad news can be a very good thing - a theme I'll be talking about more this year.

Revenues rose 18% to £73.8m, and pre-exceptional operating profit shot up 67% to £22.7m. Impressive stuff. Moreover, the growth seems to be coming from recently launched products, and on outlook they say;

Sounds good to me.

Balance sheet - the historic issues have been dealt with, and the company now passes all my balance sheet tests comfortably. It had net cash of £15.0m as at 31 Dec 2014.

My opinion - broker forecast for 2015 is about 20p EPS, and note that has been creeping up over the last year, usually a good sign. Therefore at 321p the fwd PER is about 16, which doesn't seem expensive for a growth company. There's also potential for a takeover bid with this type of company.

Right off to bed, I've got another report to start writing in 8 hours' time!

Regards, Paul.

(Paul has long positions in SAL, VLK, CTO, SKP and has a short position in AFR. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.