Note: Paul updated Tuesday's report to include Topps Tiles (LON:TPT), Epwin (LON:EPWN) and eg Solutions (LON:EGS) (in addition to accesso Technology (LON:ACSO), Indigovision (LON:IND) and £CALL). You can read it here.

First section - by Paul Scott.

Thanks to Graham for taking the strain today. I should be getting the keys to my new flat today, then the removal men are shifting all my stuff on Friday. Therefore I’m being considerably distracted from the markets this week.

It’s a fairly modest place on the south coast. These days I like to keep living costs low, as experience has taught me that relying on the markets for income is too precarious. It’s best to build up some other forms of income, to cover all household outgoings. That takes the pressure off, allowing an investor to even sit on the sidelines in cash, if a bear market starts.

I tend to look at portfolio gains as being a bonus. Obviously the last 2 years have been remarkably good, but it won’t be like that forever. So it’s always best to plan for a downturn.

Anyway, on to today’s news. Here are a few very brief comments;

Spaceandpeople (LON:SAL) – contract win announced. I see that, as usual, the share price moved the day before the announcement. So our insider dealer at SAL is alive & well. Whilst I had a historic attachment to this business, I now think it lacks the potential to really scale up. Therefore the upside is probably quite limited. As the CEO always points out, contract wins are a matter of “snakes & ladders”. So the company tends to RNS contract wins, but is less keen to announce contract losses! That’s true of many companies. It’s got momentum for now, so that might provide some liquidity for long-suffering shareholders to exit, if they wish to.

Trakm8 Holdings (LON:TRAK) (in which I hold a long position) – has also announced a contract win, which sounds potentially significant. “Additional visibility for our expectations for this financial year & beyond”. The company seems to be gradually recovering from previous mishaps. Although we’ll have to wait and see what the next set of numbers look like.

Keywords Studios (LON:KWS) – Note that Directors have taken advantage of the stellar share price gains to bank £37m from selling a sizeable chunk of their holdings. Make of that what you will, I’m just flagging it up.

Lombard Risk Management (LON:LRM) – results for the year ended 31 Mar 2017 are out today. This share has been heavily promoted recently, on the back on contract wins. Revenues are up strongly – a 45% increase to £34.3m. However, if you take a closer look at the cashflow statement in particular, things are far from rosy. The company capitalised a staggering £7.5m into intangibles. That must be a hefty chunk of its total payroll. Stripping out capitalisation, the company made a £5.6m loss for the year.

Based on results to date, I seriously question whether this is a viable business. From the numbers to date, I think not. It’s always jam tomorrow. Also, bear in mind that a lot of its impressive-sounding contracts are actually quite small. I don’t rate this share at all.

Hogg Robinson (LON:HRG) – good results are out today. However, the elephant in the room is the £265m pension deficit. This is up £6.9m. However, there’s been some clever accounting involved in massaging the pension deficit down. Liabilities rose by a staggering £96.7m, due to the impact of lower interest rates. However, the company then agreed with the trustees, to jiggle around the demographic assumptions, in order to bring the deficit down again.

Note from the cashflow statement that the company is making £7.3m p.a. over-payments into the pension fund. That is similar to the amount paid to shareholders in divis, of £8.3m (giving a yield of 4%). So this is a good example of how pension deficits consume real cash, and restrict the divis that can be paid.

It looks quite a nice business, but I wouldn’t be interested in a company with such a problem pension deficit, and therefore overall a car crash balance sheet.

Actual Experience (LON:ACT) – interim results from this jam tomorrow tech company. £135m market cap. Revenues fell by more than half to £193k in H1. So practically nothing, basically. It incurred a loss in the 6m of £3.8m. The cash position is healthy, at £22.6m. A shrewd friend tells me that this company is the business, in terms of its services (which help diagnose problems in IT systems, or websites, something like that). However, there is absolutely no financial performance to back that up, yet.

I steer clear of jam tomorrow shares, as they nearly all go wrong in one way or another. So why take the risk that you can find the needle in the haystack?

Second section - by Graham Neary

Paul's prodigious output continues, even when he's moving house!

But I'll add a few more comments now:

Hollywood Bowl (LON:BOWL)

- Share price: 175p (+5%)

- No. shares: 150 million

- Market cap: £262 million

A reader has previously suggested I covered this, and today is the perfect opportunity with the H1 results.

Hollywood Bowl is a bowling operator with 56 venues, claiming to be the larger ten-pin bowling operator in the UK.

This announcement strikes a very upbeat tone: revenues are up 8%, operating profit up 18.5%, and there is a pledge to review shareholder returns given the strong balance sheet and cash generation.

Two new openings are due each year for the next three years, all six "legally committed" with their respective landlords. The O2 in London is among the venues set to open later this year.

Like-for-like

LfL sales were up by a much more modest 1.2% over the period, although the company claims 2% of growth was lost due to missing out on this Easter break (so H2 should logically benefit by a similar amount).

The operating margin increases from 20% to 22%, implying some operating leverage from opening new stores, even if LfL growth was unspectacular.

I note that the company refers to "challenging weather" in H1, due to "unprecedented record dry months" - the exact opposite situation for most public-facing companies!

But that being the case, perhaps there is a case to be made that LfL sales were held back, and next winter could see a much stronger result.

Cash flow

Hollywood Bowl provides an incredibly useful breakdown: it gives both maintenance and expansionary capex! It would be great if many more companies did this. This way, we can see how much capex was unavoidable to stand still, and how much of it should lead to future growth.

It's still worth taking the time to verify this as much as possible, but the company reckons that adjusted operating cash flow was £14.6 million, which was then reduced by expansionary capex of £3.3 million, exceptionals of £3.2 million, and interest and dividends.

Expansionary capex includes refurbishment costs, so a sceptic might wonder if some of that was really expansionary, or if it was necessary to stand still.

Some of the exceptionals might be questionable, too, in terms of how exceptional they really are.

So I'm glad the company has made an effort to show us what the underlying operational cash flow is, but of course I'd still want to put it under the microscope!

My opinion

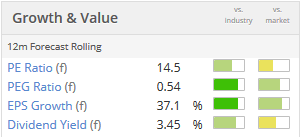

Overall, looks an interesting proposition to me, and perhaps not too expensive.

It has only been listed since September, so might still be flying under the radar for some private investors.

The StockRank only gives it a score of 40, so nothing spectacular on that front.

It has a decent dividend yield which usually doesn't hurt, and management are strongly hinting that it could increase, or rewards could be improved in some other way:

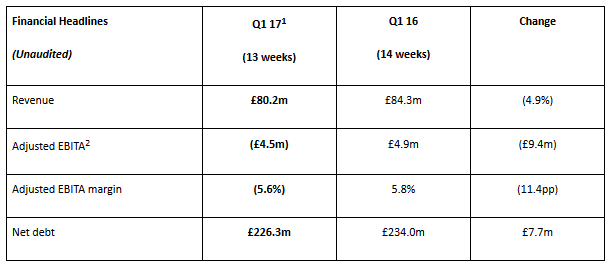

HSS Hire (LON:HSS)

- Share price: 61.5p (-1%)

- No. shares: 170 million

- Market cap: £105 million

Not a lot to shout about from this equipment hire group, where I am probably not alone in continuing to sound the alarm bells:

The company points out that there was one less trading week this quarter, and many branches were closed in a restructuring program over the last six months. So a reduction in revenue should have been expected - and so underlying revenue is reported as "flat" year-on-year.

Cash headroom is £30 million taking into account the current facilities.

A new CEO has been appointed, joining in a week, taking over the freshly restructured business. So it's tempting to think that trading could improve.

As a reminder, however, HSS had £136 million of 6.75% Senior Secured Notes outstanding at December. The rest of the debt is in the form of an RCF charging 2.25% over LIBOR. The bonds mature in 2019, which is also when the existing RCF matures.

At a 5.3% weighted average interest rate, you get a £12 million annual interest bill.

Reached that kind of EBIT on a consistent basis looks challenging, and with the note maturity date gradually approaching, I think the equity holders are in a precarious position

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.