Good morning!

I'm running a bit late today, as there was nothing much of interest when I did my usual iPad review of the RNS in bed at 7:30 this morning. So I tend to have a lie-in on Fridays, if there's no news which is particularly stimulating.

Update to yesterday's report - I had a second wind last night, probably brought on by the surge in blood pressure from listening to Dianne Abbott (again!) on Question Time! Anyway, I reported on 3 more companies - Molins (LON:MLIN), Ceres Power Holdings (LON:CWR), and Idox (LON:IDOX) - with 2 out of those 3 going onto the Bargepole List! Click here to see yesterday's updated report.

Looking at today's announcements, one that did make me chuckle, was the latest debacle from Sports Direct (SPD). Founder & controlling shareholder Mike Ashley just seems to create chaos whatever he does - the Donald Trump of the investing world?!

Stung by criticism of numerous aspects of how he runs the company, he's thrown his toys out of the pram;

Since May 2014, Sports Direct International plc ("the Group") has financed its capital requirements through a revolving credit facility ("RCF") with a number of banks. The RCF recently has been increased to a capacity of £788 million. Under the terms of the RCF, the interest rate payable by the Group increases if it is more than one third drawn (i.e. more than £263 million). Previously, when the Group has required borrowing in excess of this amount, it has utilised its £250 million loan facility ("MALF") with Mike Ashley/Mash Holdings Limited. The rate of interest payable on this facility is c.50% lower than that payable on the RCF, and does not attract arrangement fees or commitment fees. Accordingly, although an unusual arrangement for a public company, using this facility in this way has been of significant benefit to the Group, over time giving rise to a saving of over £1 million.

In the coming months, the Group expects that its borrowing requirements will be consistently in excess of the £263 million level. The Group, however, has been subject to unjustified criticism over related party transactions, including incorrect press coverage of the benefits of the MALF. It has been decided that it is in the best interests of the Group and its shareholders to avoid further criticism at this time. Accordingly, the Group will not draw down from the MALF in the foreseeable future, which will lead to an increase in the overall cost of borrowing.

So there! With brass knobs on!

A company is either a listed company, or a private company. It can't be both. SPD is a good example of where a dominant founder wants the best of both worlds. It doesn't work. If he wants to run it like a private fiefdom, then he should take it private.

(at the time of writing, I hold a long position in this share)

Tristel (LON:TSTL)

Share price: 108.75p (up 4.6% today)

No. shares: 42.2m

Market cap: £45.9m

(at the time of writing, I hold a long position in this share)

Director purchases - I'm really not a fan of orchestrated Director share purchases after bad news, but as mentioned recently for another company, it does seem to work in some situations anyway, in helping to reassure investors. Perhaps it works in marginal situations, where confidence is beginning to return anyway, which is how I see Tristel?

I reported here on 24 Feb 2016 on Tristel's interim results, and the various factors which triggered a sharp correction in the share price. My view, when the shares were at 125p at the time of writing that report, was that the price looked "a bit too high", but that the "longer term upside still looks good".

The share price subsequently dropped considerably more, and went as low as the low-mid 90p's yesterday morning. At around that level, I think it was a reasonably good purchase, so I picked up a few, more of a dabble than a conviction buy.

Management webinar - I was also really impressed with the webinar that TSTL management did with Equity Development yesterday lunchtime. I watched/listened, and felt that management were open in addressing the criticisms of the slowing sales growth, and the share options charge. There's no doubt they have dropped a big clanger with a badly designed share options scheme, but I think they recognise that, and were emphatic that there would be no repetition in the next 3-5 years.

Various other factors mitigate my concerns over the slowing growth rate (now 8%), such as 4% being due to currency effects, and also that low margin products have been dropped - hitting turnover, but having little to no impact on profit.

Overall, I take my hat off to TSTL management for being so open with private investors, and not only holding a webinar, but also a meeting in London, open to private investors. Feedback from this has also been positive. This is outstanding stuff - if only all companies were so willing to engage with their PI shareholder base - especially when contentious issues arise.

TSTL is already being rewarded with a rebound in the share price. I think the glass is slowly turning from half empty, to half full again. The upside from potential US FDA approvals is something that I'd like to stick around for, as that could be a significant catalyst for future growth. I'm not sure there is necessarily much short term upside from here, but who knows? I would have thought it might recover to say 120-130p after a while.

Volex (LON:VLX)

Share price: 39p (down 13.3% today)

No. shares: 90.3m

Market cap: £35.2m

Trading update - this looks like a mild profit warning;

As stated at the time of our half year results announcement in November 2015, demand was slow in the first half and key customer new product launches were deferred into the second half of the year. Expected demand for both existing and new products from our largest customer was less than expected in the second half of the year, and we now anticipate that sales for the full year will be in the range of $360 to $370 million. Elsewhere we are seeing competition and reduced demand in our Asian power cord business partially offset by positive trends in our North American healthcare business.

Broker consensus is currently for $396.1m revenue, for the year ending 3 Apr 2016. So that's a revenue miss of about 8%, if we take $365 as the mid-point in the given range.

Cost-cutting - clearly this is the main priority for a business which has been struggling for a while, in a low margin sector, so this makes sense;

Our central cost base has been significantly reduced to better align the business with current revenue performance, and further savings have been identified at the factory level.

Note that cost-cutting was already underway, with $9+ in savings noted in a previous announcement on 21 Dec 2015.

Profitability - whilst a profit warning, at least it's still making profits;

In the short term, operational gearing in our business has resulted in a fall in our gross profit margin, and the Board expect to announce full year operating profits (before exceptional costs and share-based payments) in the range of $4 to $5 million.

The trouble is, exceptional costs seem to be never-ending with Volex, as it's been restructuring for several years now.

Bank debt - whilst the net debt was last reported at only $5.4m (at 4 Oct 2015), I suspect the figures are probably window-dressed for balance sheet dates, since cash was $30.0m, and bank debt was $35.4m. If that was the typical position, then clearly the cash would be used to repay debt, in order to make substantial savings on interest charges.

Mention is made today of the bank covenants, at least the current level is given, but not how this compares with what the limits are which would trigger a default. So it's vital to check back, to find out this information.

I've looked at the last Annual Report (note 19), and the covenants seem to be based on EBITDA, which seems fair standard these days;

The terms of the facility require the Group to perform quarterly financial covenant calculations with respect to leverage (adjusted net debt to adjusted rolling 12-month EBITDA) and interest cover (adjusted rolling 12-month EBITDA to adjusted rolling 12-month interest). Breach of these covenants could result in cancellation of the facility. The amendment to the facility in the year adjusted these covenants to be aligned with the forecast future trading of the Group.

Also note that fees of $875k were incurred when the covenants had to be relaxed, including a $300k payment which the lenders extracted from the company.

Today the company says;

As at the end of the third quarter our leverage ratio (as defined in our $45million revolving credit facility) was 1.9x and our interest cover ratio was 7.7x.

Since I haven't been able to find out what the maximum ratios are, then I don't know whether this is good or bad. Since the company did not include a comment today, saying that they are comfortably within the covenants (which is what companies usually say, if they are), then I can only presume that the headroom on the bank covenants might be getting tight again - potentially bad, or very bad news.

So I'm nervous about the bank debt situation.

My opinion - it looks too high risk to me. Deteriorating trading, low margins, and being forced to cut costs to stay in the black, is not a good place to be.

Moreover, I think the chances of Volex returning to its old, glory days of high margins & big profits, are basically close to nil. Competitors and customers have obviously eradicated the previously super-normal profits that Volex made, and it's now just a very low margin, maker of fairly generic products.

Combined with a heavy burden of bank debt, to fund its working capital, I can't see any attractions here for investors. There are no divis either - they were stopped about 2-3 years ago.

The trouble is that electrical cords can be made in sweatshops in very low wage countries, and hence it's very difficult to see how Volex will be able to differentiate itself, and earn better margins. It's just not an attractive sector to invest in, the way I see it. Why put your capital at risk? Things don't look bad enough for it to go on the Bargepole List, but it was a close call.

Alternative Networks (LON:AN.)

Share price: 309p (up 9.6% today)

No. shares: 48.4m

Market cap: £149.6m

I was hoping to avoid having to comment on this one, as I've never really understood their business, but several readers have asked me to review it, after yesterday's profit warning, so let's take a look.

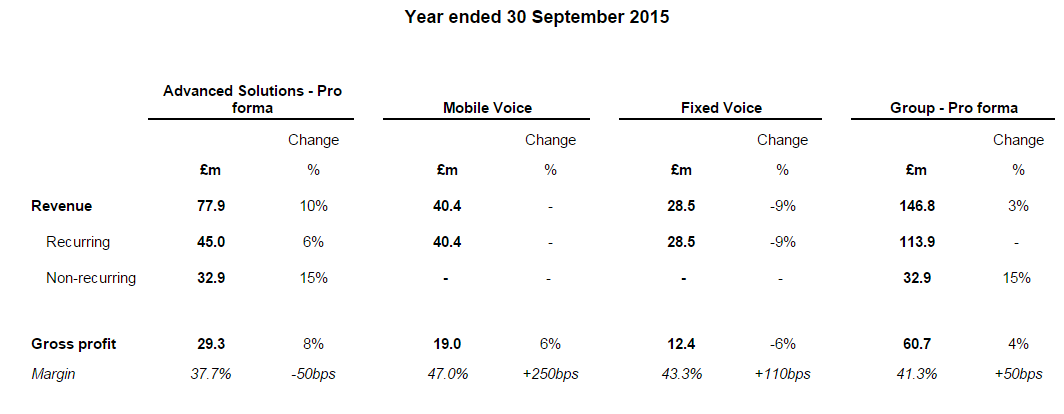

Reviewing the last full year accounts, I'm starting to get a handle on what the group actually does - which seems to be a mixture of mobile & fixed line telephony, and IT services. This table gives the split;

Noteworthy is high level of recurring revenue, at 77.6% of total revenue.

Also note that, whilst Advanced Solutions is the largest division, it's also the lowest gross margin %, at 37.7%.

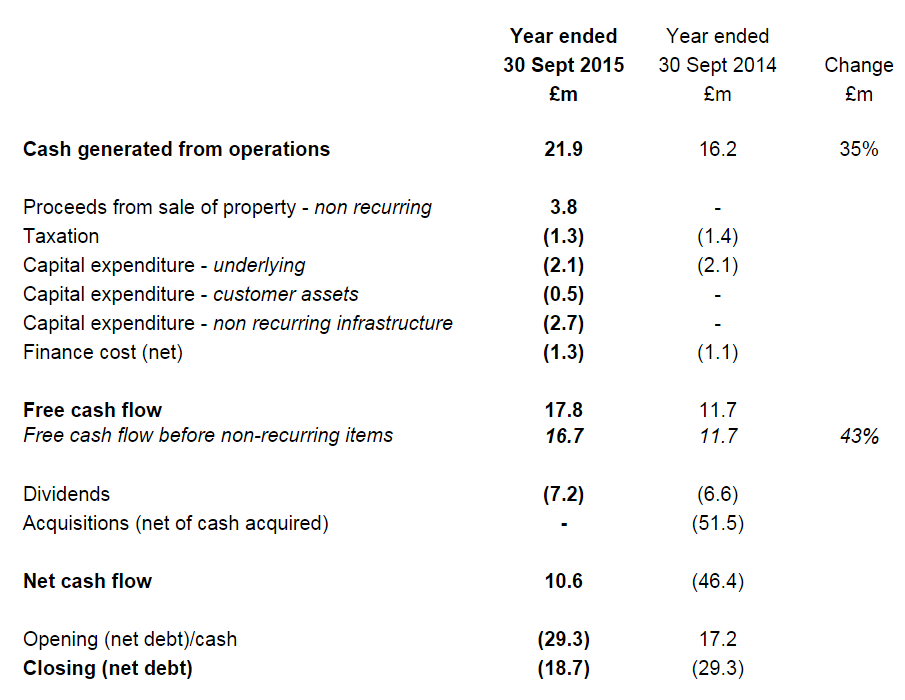

Cash generation - a key feature of this company seems to be its cash generation, which is highlighted in a table in the last results. This enables it to pay generous divis;

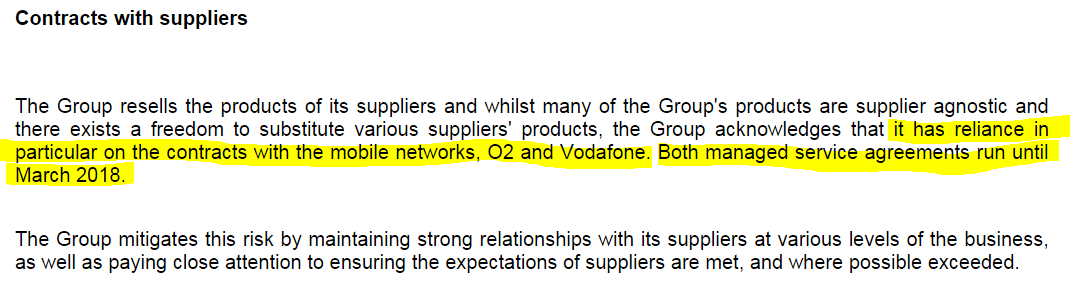

My concern is that, as a reseller of telephone services, the current good margins may not be sustainable. This is alluded to within the "Principal risks and uncertainties" section, as follows;

Balance Sheet - surprisingly weak, but not necessarily a problem if cashflow remains strong.

NAV is £42.7m, but once you deduct intangibles of £73.2m, that becomes -£30.5m, not good. Bit given the strong cash generation, probably not a problem (providing cash generation continues to be good). It would however become a big problem, if profitability collapsed for any reason.

Current ratio - is very poor, at only 0.64. Again, not a problem when the sun is shining, so let's hope it continues to shine.

Net debt - looks reasonable, at £18.7m (and is down sharply, from £29.3m a year ago)

All the above figures are from the accounts dated 30 Sep 2015.

OK, that's brought me up to speed on the historic numbers, so let's look at the profit warning this week;

Profit warning - the mobile division is facing problems;

The Group's Advanced Solutions business continues to make good progress following the completion of the integration of the acquisitions made in 2014. This has recently been offset by significant ongoing pressures in our mobile business particularly on roaming revenue and profitability arising from a combination of increased network competition and the regulatory headwinds carriers currently face.A rather confusing estimate is given, which I'm struggling to follow, but it sounds quite bad to me - revenue flat, and gross margin down by more than 10%. If overheads remain the same, then there could be a large, operationally geared impact on the bottom line;

It is too early to determine the impact on the results for the full year ending 30 September 2016, however, the Board currently estimate that for the six months ending 31 March 2016, aggregate revenue across the Group is expected to be broadly in line with the same period in the prior year; gross profit is expected to be, in percentage terms, low double digits below the level seen in the same period in the prior year resulting in Adjusted EBITDA also below the first half of FY2015. The Group has taken measures to improve profit margins and is considering further mitigating actions that should alleviate some of this impact over the rest of the current financial year and beyond.

By "considering further mitigating actions", I imagine that means cutting overheads?

More colour is given on what's gone wrong in the mobile division;

Mobile revenue and profitability reductions are being driven by significantly reduced roaming revenues as a result of new global tariffs launched by the carriers. This impact is being seen across the UK mobile market but Alternative has been particularly impacted due to its comparatively larger roaming base. Historically, the Group has generated a large proportion of mobile profits from roaming in both voice and data, particularly from outside of the EU as demonstrated by the comparatively high ARPU.

Alternative's approach has been to match competitive tariffs to retain customers and the Group will continue to invest in the mobile proposition to attract new customers and provide existing customers with a market leading experience.

This really isn't good. It's not a transitory problem, it looks to me as if a chunk of the group's profits has just vanished, due to competitive pressures. That makes me nervous about the sustainability of other profits, since a lot of it seems to be based on reselling.

The rest of the group is doing alright though, and the divis look safe;

The balance of the Group's portfolio - Advanced Solutions and Fixed Voice - continue to trade in line with the Board's expectations. The Group's cash generation remains strong and in line with current guidance the Board currently intends to propose a full year dividend at least 10% above the prior year level moving to 15% in the medium term.

Broker forecasts - FinnCap has reduced its forecast EPS for this year (ending 30 Sep 2016) considerably, so this is a big deal. Adj EPS has been reduced from 35.3p to 28.2p.

Dividend per share forecast is unchanged, at 18.9p.

Valuation - so at the current share price of 309p, that gives a PER of 11.0, and a dividend yield of 6.1%.

My opinion - a PER of 11.0, and divi yield of 6.1% look rather good on the face of it. However, bear in mind that a significant chunk of this group's profit has just vanished. That makes me very uncomfortable.

It raises questions about how sustainable remaining earnings are? Resellers of other people's goods or services are always vulnerable to being squeezed from both sides, and hence this type of business should in my view be on a low PER, as its profits may not be sustainable.

To my mind then, the profitability here looks too vulnerable to further setbacks, therefore it's not something that I would consider buying.

If however, you think that existing profits can be maintained, or increased, then the shares would clearly have some attraction, especially for the generous divis.

A few quickies before I down tools for the weekend;

Fyffes (LON:FFY) - headline figures for 2015, announced today, look good. I quite like this company, as a fairly boring, reasonably-priced stock. Worth a look. (I don't currently hold, but have done in the past).

Snoozebox Holdings (LON:ZZZ) - has lost 2 Directors today. I think the signs here are looking pretty bad. Not one that I'm going to revisit, as as currently structured I don't think it's a workable business model.

Zytronic (LON:ZYT) - an "in line with management's expectations" update was issued yesterday to coincide with the AGM. Also note that the company has updated its website. Note that the shares went ex-divi yesterday, for the 8.87p final divi, which would explain why the share price dipped. There is an AGM Report here on the ShareSoc website, with thanks to the author, Christopher Down. (I hold a long position in this share)

Right, that's me done for the week! I'm off to visit family in Bournemouth this evening, and spending the whole weekend there. Will take my laptop in case I stay over Sunday night & need to write Monday's SCVR from there.

Enjoy the weekend!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.