Good morning!

Charity challenge

It's been a while since I've done anything for charity, so this one caught my imagination - it's called "Live below the line" - and is a 5-day challenge, starting today, to see if you can live on just £1 per day for all food & drink. The idea is to raise sponsorship for charities helping some of the poorest people in the world.

It's always difficult to choose which charities to support, so I picked 3, and the donations are split 3 ways on my fundraising page, here was my rationale for picking each charity;

- VSO - has a very good reputation, and the people going abroad to help are volunteers.

- Syria Relief - the scale of destruction in war-torn Syria is just appalling, and we must help.

- Action Aid - particularly relevant, as they're fundraising to help the earthquake victims in Nepal.

I've posted a starting video blog, created the other night, and have stocked up on Asda smart price provisions for this week. Breakfast this morning was porridge made with water only (so, gruel basically!) which was OK. I really missed my morning coffee today though, but there was no room in the £1 per day budget for any coffee, tea, or milk.

Anything you can donate (any amount is welcome, however large or small) would be great, and it's fine to wait until the end of the week, if you want to be sure that I've actually completed the challenge. Hopefully I might lose a couple of pounds too, as I am apparently a "pompous, pie-eating, salad-dodging windbag", according to a charming fellow called "Stud-Muffin" on advfn bulletin boards!

Redde (LON:REDD)

Share price: 122.5p

No. shares: 294.1m

Market Cap: £360.3m

Trading update - it's more good news from this legal services, accident management group. The group has undergone a remarkable transformation in the last couple of years, coming back from almost going bust, to being strongly profitable and cash-generative - unlike most other players in this sector. It has also been paying out generous dividends.

As the company has a 30 June year end, today's update covers Q3, which has seen "strong trading volumes ... operating profits exceeding the Board's expectations". Excellent stuff!

Cash collection - "a new record low" for debtor days, down to only 104 days, "and further reductions are expected". Compare this with the chronic inability to collect in cash which plagued, and ultimately destroyed Quindell.

Redde seem to have adopted a far better business model of doing work which pays out quickly, rather than high margin work where you can still be waiting to be paid two years later (such as Quindell's ill-fated industrial deafness venture).

Cash - gross cash is down £0.4m in the quarter to £62.8m, but a dividend of £11.3m was paid during that period, so the business has been very cash generative.

Valuation - the shares have been an excellent performer, but are now beginning to look as if they are up with events, in my view.

Broker consensus is for 7.9p EPS this year and next year. So assuming they might exceed this a little, say 8.5p for this year? Then at 122.5p per share the PER is 14.4. That's probably enough for this sector, which is vulnerable to regulatory changes, and where there is increasing competition.

Dividends - Redde pays out almost all its earnings in divis, and can afford to, given its strong balance sheet. The current year yield is 6.1%, so attractive to income seekers, providing the earnings & hence divis are sustainable. That can't be taken for granted, as regulatory changes have thrown this sector into turmoil before, and could do again, who knows?

My opinion - it's not a sector I like investing in, but Redde has been my favourite share in this sector for some time now, and the shares have done very well. The valuation looks to be up with events now though, so personally I've sold up & moved on.

Brady (LON:BRY)

Share price: 100p (down 1.5% today)

No. shares: 82.0m

Market Cap: £82.0m

Trading update - this sounds fine to me;

Valuation - broker consensus is for 5.77p this year, and 6.4p next year, so assuming those are correct then the PER is 17.3, falling to 15.6. That looks to be about the right price in my opinion.

Dividends - the yield is about 2.0%, better than nothing, but not madly exciting.

My opinion - I looked into Brady in more detail in my report on 16 Mar 2015, on publication of their calendar 2014 results. Nothing much has changed, so as before, I think it looks alright, but the valuation is probably about right.

I only have a fairly superficial look at companies in these reports, so readers would need to do their own due diligence, to ascertain what the future prospects of the company might be - that's what will drive the share price up or down, after all. As things stand now though, the shares don't look especially good value.

Sprue Aegis (LON:SPRP)

Share price: 300p (down 12.4% today)

No. shares: 45.5m

Market Cap: £136.5m

Final results - for calendar 2014 are issued by this smoke alarms company. The figures look excellent to me. Turnover is up 36% to £65.6m, and pre-exceptional profit rose from £5.5m to £10.4m. As far as EPS is concerned, diluted pre-exceptional EPS rose from 11.2p in 2013, to 18.8p in 2014.

Whilst these are excellent figures, they seem to be a bit below broker forecast, which is for 20.2p EPS. This is what caused the sharp drop in share price today (which partially recovered).

Exchange rates - the group's biggest market is Europe, and it reports in sterling, so this has a £1.7m adverse impact on 2014 results. Personally I see exchange movements as swings & roundabouts, but it does seem odd that the market, and analyst forecasts, don't seem to have anticipated this known factor.

Valuation - at 300p the shares are on a PER of 16.0, which seems reasonable, given the excellent growth.

Balance sheet - net assets are £27.6m, less intangibles of £4.5m intangible assets, gives us £23.1m net tangible assets, so that looks solid.

As regards working capital, the current ratio is excellent at 2.19, so a big tick there. This includes net cash of £15.9m which is 11.6% of the market cap. So that means at 300p per share, you're paying 265p for the business, and 35p for the cash pile. In my simplistic way of looking at things, that brings the PER down from 16.0 to 14.1, so quite an important factor to take into account.

There is one red flag on the balance sheet which jumps out at me - debtors looks very high at £20.2m (up from £10.3m last year), so that would need enquiring about, to find out why the debtors figure has shot up by 96%, when turnover is only up 36%.

Trade payables is also up a similar amount, so might be connected?

Cashflow statement - note that £1.6m of intangible assets were capitalised, which is a lot higher than the £294k amortisation for the year, so the P&L has benefited by a net £1.3m of costs deferred into subsequent periods. Not a big concern, but worth noting.

Dividends - the full year divi is 6p, on top of a 2p interim divi, gives 8p, for a yield of 2.7% - whilst not a madly exciting figure, it is well covered (over 2 times), and divis have been growing strongly (up 33% on last year). As I mentioned at one of my Mello talks, I prefer a medium, but strongly growing & well covered divi, to a very high, but static & possibly unsustainable divi.

Outlook - this section is self-explanatory;

My opinion - I like this company a lot, and am impressed with the numbers. My only reservations are the potential for future problems with the distribution agreement with BRK, although that was renewed for three years from 1 April 2015, so it's nothing to worry about for the time being.

A second concern is that legislation in France, mandating fitting of smoke alarms, is driving the strong growth at the moment. Is this sustainable I wonder? Although note that there are new products coming on stream, e.g. wirelessly connected products for remote monitoring (e.g. for landlords), due out later in 2015.

I don't know the company well enough to judge the outlook, although it's a share I've held before, and did very well on, holding from about 92p to 200p. Sold too early though. I was toying with the idea of buying the dip today - if it had got down to 250p, then I would have pushed the button, but it got to 270p and then rebounded to 300p, so I missed the moment.

Overall, it looks a good solid company, on a reasonable rating of 14.1 times, when valued on a cash/debt neutral basis. I don't see massive immediate upside, but could see the shares possibly rising further over time, if the performance figures continue to be strong.

StockRank - I'm surprised the StockRank is only 64, and suspect that might rise once the Stockopedia computers do some whirring, and assimilate the latest results. As mentioned before, I'm a great believer in the power of man & machine combined (so I use StockRanks to provide me with a shortlist of shares to then manually assess), rather than Ed's preference for relying on the machine only! (which makes sense for people who are too busy to do the research, or who don't enjoy researching, or who are just not very good at it!!)

So it's interesting to note that as in this case, man can anticipate what the machine is likely to do - i.e. upgrade the StockRank once it has crunched these latest, strong results numbers. You and I can anticipate that, and hence potentially gain an advantage.

Staffline (LON:STAF)

Share price: 955p (up 19% today)

No. shares: 27.7m

Market Cap: £264.5m

Trading update - the company reports on trading so far this financial year (ending 31 Dec 2015) as follows;

It doesn't say anything about performance relative to market expectations, which is a bit annoying. However, one assumes they must be at least in line, given that they refer to the year starting strongly.

Acquisition of A4e - Staffline is acquiring A4e, a welfare to work, and skills training company, for an enterprise value of £34.5m. I'm scratching my head a bit on this, as the price seems extremely cheap, too cheap in fact. The EBITDA multiple is only 2.5 times - why on earth would the vendor sell for such a low price? It beats me. That is not explained in the announcement today.

Although it is noted, at the end of today's announcement, that A4e had several employees convicted in Mar 2015 for fraud, relating to allegations made in 2011. Staffline say, "The company has been audited numerous times since 2011 and has demonstrated that there has been no other instances of fraud". Hmmmm. The A4e Directors are stepping down, either immediately or after a transition period.

Broker forecasts - have been raised considerably today. FinnCap have increased 2015 forecast EPS to 91.7p, and 2016 to 108.5p, so that should support a share price well above 1000p, providing nothing goes wrong.

My opinion - I've got moral reservations about the activities of Staffline. The company basically helps companies get round their obligations to employees, and instead replace them with lower cost agency workers, on little more than minimum wage. That is clearly a very bad thing for the country as a whole, as the taxpayer then has to subsidise low paid agency workers with housing benefit, tax credits, etc.

I think it's only a matter of time before politicians (either in the UK and/or in Europe) latch on to this issue, and changes are made. So the business model could come under attack at some point.

On a more positive note, the welfare to work programmes operated by Staffline seem to be genuinely successful in getting the unemployed back into work. I can't quite understand why they were able to buy A4e so cheaply - perhaps the Govt indicated that it wouldn't receive any more work under the old management, tainted with previous issues there? I'm guessing there, but there has to be a fundamental reason why someone is prepared to sell a profitable business for just 2.5 times EBITDA.

The other possibility is that A4e got into trouble with its bank? It already had debt of £11m, which Staffline is assuming as part of the purchase price, and the welfare to work contracts are quite cash hungry - costs are incurred up-front, and then payment by results received over a protracted subsequent period.

Red24 (LON:REDT)

Share price: 18.75p (up 17% today)

No. shares: 49.0m

Market Cap: £9.2m

Trading update - the key part says as follows;

This is impressive, considering the company lost a major client, as mentioned above.

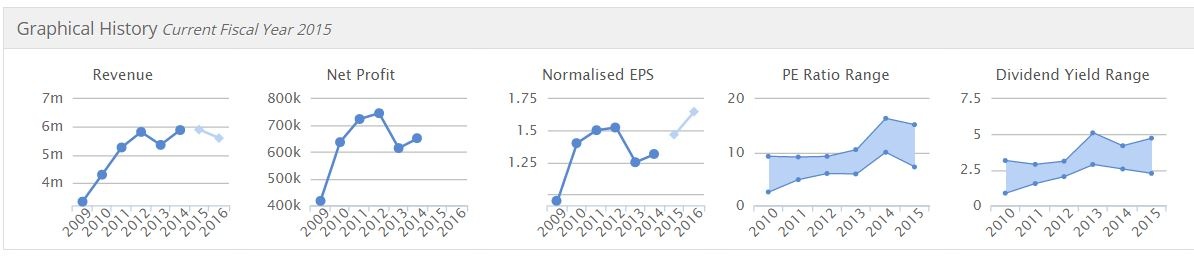

Valuation - you have to be careful using the PER as a valuation measure on very small companies, as their profits can be volatile. However in this case the company has a good track record of making £600-800k profit each year since 2010, and it also pays out about a 3% divi yield.

Outlook - this sounds quite positive;

My opinion - I'm generally not a fan of very small companies like this, unless there is a good prospect of rapid growth. The problem is that they're very difficult to trade in any meaningful size, and can be all but impossible to sell, if something goes wrong.

However, the newsflow here looks good, the valuation is reasonable. Also it has net cash of £3.2m. The StockRank of 99 is almost as high as you can get. I just question whether there is much further upside, from what seems to be, so far, quite a pedestrian growth sort of company, as you can see from the graphs below;

The share price has had a great run, so if I still held, I would definitely be taking some or all of the profit now.

All done, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.