Good morning,

Paul added many sections to yesterday's report which now includes comments on all of the following:

- Servoca (LON:SVCA)

- Richoux (LON:RIC)

- Air Partner (LON:AIR)

- Styles and Wood (LON:STY)

- Synectics (LON:SNX)

- Harvey Nash (LON:HVN)

- Character (LON:CCT)

- IMImobile (LON:IMO)

Regards,

Graham

Kromek (LON:KMK)

Share price: 30.375p (+8.5%)

No. shares: 259m

Market cap: £79m

It's a short update from this radiation detection business for the financial year ending this month.

The Group is making good progress on the delivery of new orders won over the past two years and, as a result, the Company is trading in line with market expectations.

Such a statement wouldn't normally send shares higher by almost 10%, but it also reiterates that it expects a "step change in revenue growth" in the new financial year.

Though I have expressed scepticism in relation to this company before, the market clearly likes it as the shares are 50% higher compared to when I last covered it in January.

It's targeting EBITDA breakeven this financial year (ending April 2018).

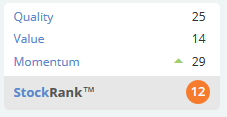

With more than 200 patents it might be worth a look, though from a statistical point of view, not too many companies with these characteristics turn out to be winners:

Just Eat (LON:JE.)

Share price: 575.25p (-1.8%)

No. shares: 678.9m

Market cap: £3,905m

Not a small-cap but of interest to many of us here, the Just Eat Exec Chairman is taking a leave of absence for medical treatment.

He will doubtless receive best wishes from everyone connected to the company.

It's more than a bit unlucky for Just Eat, which lost its CEO in February to "urgent family matters".

Now the CFO is stepping up to be interim CEO, and a senior NED will complete the search for a permanent CEO.

Surely the argument for a nosebleed valuation is all that much harder to make when senior management is in the midst of so much involuntary change?

Beximco Pharmaceuticals (LON:BXP)

Share price: 69p (+3%)

No. shares: 405.6m

Market cap: £280m

Financial Results for the Third Quarter of 2016-2017

This is a rare beast - a successful Bangladeshi pharmaceutical manufacturer, dual-listed in Dhaka and London!

There has been a long-standing arbitrage possibility here, since the prices on each exchange have borne very little relation to each other. Even today, the price of a Beximco share in Bangladesh is priced at 112 BDT (Bangladeshi Taka), or about 103p, nearly a 50% premium against the shares listed on AIM.

There is an apparent lack of fungibility between the two share classes, however, so nobody has managed to correct this discrepancy yet.

Indeed, I have just googled "Beximco fungibility" (perhaps the first time anybody has used this search term?), and received the following explanation on the company website:

The GDRs and the underlying shares are not fungible, therefore it is not possible for these shares to be traded in Dhaka Stock Exchange and Chittagong Stock Exchange... The Company approached Bangladesh SEC for fungibility in June 2005 but the request was refused. Subsequently, the Company again approached the SEC in January 2006 but again the request was turned down.

So this is why we can buy cheaper Beximco shares in London. And it doesn't look as if it's going to change soon.

The first nine months of the year show it continuing to make good progress, sales up 13% and the operating margin up by 100bps to 22.6%.

By my calculation (since the company doesn't provide its own GBP conversion), operating profit is £15 million for the nine-month period.

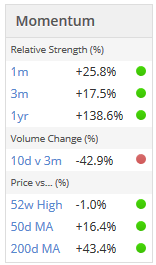

Beximco's Momentum Rank is stunning (99) but it looks ok in terms of Value too, and remember that all of this is taking place at a big discount to the local share price!

Trakm8 Holdings (LON:TRAK)

Share price: 79p (+2%)

No. shares: 35.7m

Market cap: £28m

Another trading update from Trakm8 for the financial year ending in March (it already updated in February, with a profit warning).

On that day, it warned that revenues would be "only modestly ahead of FY2016 with adjusted operating profit significantly below FY2016".

Now that the market has digested so much of the bad news, and investors have given the company an extra £2.1 million cash, it is looking a much more reasonable proposition. Today's update tell us:

- Revenues up 6% year on year, up 7% like for like

- Recurring revenue up 18% to £9.8m (2016: £8.3m)

- New orders booked up 37% year on year, benefitting FY18 and beyond:

And the number of telematic units is up 26%.

So while growth and cash flow performance have badly missed prior expectations, it arguably deserves to retain a growth stock rating (albeit at a lower level than that which was previously achieved).

The year-end net debt level is £3.9 million, after the £2.1 million placing.

Outlook is fine:

The Board is confident in the Group's future prospects and an update on trading for the current financial year commencing 1 April 2017 will be provided in conjunction with the 2016/17 final results.

(Those final results to be announced in July.)

My opinion

It appears to have a lot of promise, but can't afford any more slip-ups. Another placing would suggest that it's not capable of budgeting properly, even if the products and the fundamental business are fantastic.

Adjusted operating profit came in at £3.9 million in 2016, versus £3.1 million in statutory operating profit.

On the basis that the company should recover to at least those levels very quickly, given the large increase in sales and active units, risk:reward now looks pretty favourable to me.

Mincon (LON:MCON)

Share price: 87.5p (+5%)

No. shares: 210.5m

Market cap: £184m

This is an Irish engineering group making hard rock drilling tools for customers globally.

Today's statement is written in an understated, plain-speaking manner which is always refreshing.

For example, the company offers a note of calm in relation to the Q1 revenue growth rate of 34% (25% at constant currency):

We would, in general, caution against taking this first quarter as a new run rate, even though the growth has been spread across most of our markets. A sector recovery, and to a degree we depend on this for growth in revenue and margin, can be fitful at the early part of the cycle and may not follow a straight line recovery profile by any means. However we believe we are working towards an improving position in products, people, customers and resource for the next few years, to build growth and resilience in our business.

Net cash sits on the balance sheet, €37 million at Q1 2017.

Third party products grew at a much faster rate than own-manufactured products, and there is a sensible attitude to this:

We sell products complementary to our own manufactured ranges, upon which we receive a distributor margin. While these products may make a meaningful contribution to addressing the sales and administration overhead, they do not add a great deal to the bottom line. We make a better margin on Mincon manufactured product and we actively consider the product ranges we make and buy to see what adds value and what, over the longer term, may not.

My opinion

Worth investigating in further detail. It has been listed since December 2013 and still seems to be flying under the radar of most investors.

Prior to this morning, brokers were forecasting net income of €9.4 million for 2017, rising to €10.1 million in 2018, based on 6% revenue growth, which now looks on the conservative side given the Q1 result.

UP Global Sourcing Holdings (LON:UPGS)

Share price: 178p (+5%)

No. shares: 82m

Market cap: £146m

Mentioning this in passing in response to reader request, this branding/sourcing/distribution business, focused on consumer goods, issues its first interim results as a listed entity:

- Total revenue increased 62.2% to £68.1m (H1 2016: £42.0m);

- Underlying1 EBITDA increased 75.1% to £8.8 million (H1 2016: £5.0m);

- Underlying1 profit before tax increased 77.9% to £8.4m (H1 2016: £4.7m);

Statutory PBT, after the cost of director bonuses, was £7.0 million.

Based on my initial inspection of the company, I concluded that its earning power was a function almost entirely of its supply chain expertise, of its ability to source product.

That's not a criticism, just a view on how the company works. And it seems to be very good at what it does. So I'll try to keep an eye on this one, and invite further comments from readers who may have a deeper insight into how it operates.

That's all I've got for today, have a fantastic long weekend and I'll see you in May!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.